H.R.5175 – DISCLOSE Act

A project of the Participatory Politics Foundation and the Sunlight Foundation

A non-profit, non-partisan public resource

Everyone can be an insider. Learn how.

- Bills

- Senators

- Representatives

- Votes

- Issues

- Committees

- The Money Trail

- Blog

- Groups

- Start a New Group

- Resources

- Wiki

- Vote Comparison

- Site Widgets

- States

- How-to Use OpenCongress

- Follow Our Twitter

- All Resources

To amend the Federal Election Campaign Act of 1971 to prohibit foreign influence in Federal elections, to prohibit government contractors from making expenditures with respect to such elections, and to establish additional disclosure requirements with respect to spending in such elections, and for other purposes.

Non-Congressional Legal Templates and PDFs

At OpenCongress and FormsPal.com, we are committed to providing free and accessible information to educate and support communities and individuals.

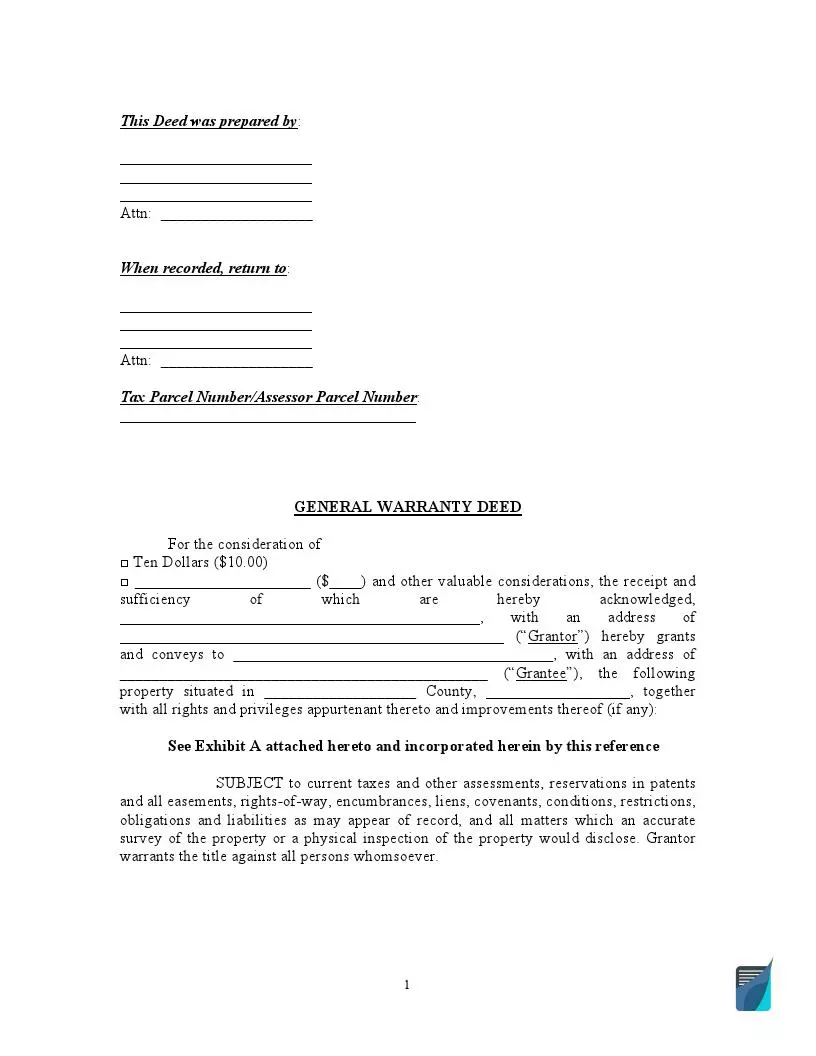

Find Fillable Deed Forms

Deed forms facilitate the transfer of real estate between two entities: the grantor, who conveys the property, and the grantee, who receives the title. These forms must contain the names of the involved parties, the date of the transaction, a description of the property, and a precise legal description of the premises. Typically, only the grantor signs the deed form, although some jurisdictions also mandate the grantee’s signature.

The Most Widely Used Deed Forms

A quitclaim deed form is a common method for transferring property ownership from one individual to another. This type of deed, however, does not assure that the transferor has exclusive ownership rights to the property. Therefore, it is important to approach the preparation of this form with caution. Quitclaim deeds are typically used among individuals with a trusting relationship, such as family members or close friends.

Residents of California can use California Quit Claim Deed Forms to draft their documents. Under California regulations, additional forms must accompany a quitclaim deed for recording. Specifically, you must submit Form BOE-502-A (Preliminary Change of Ownership Report) with your deed. A California quitclaim deed requires notarization and must be filed at the recorder’s office in the county where the property is situated.

Another frequently used deed is the Lady Bird Deed Form, also recognized as an enhanced life estate deed. It offers a time-efficient approach to real estate planning by enabling your heirs to inherit your property without undergoing the probate process upon death. However, using a Lady Bird deed is limited to only a few states: Florida, Michigan, Texas, Vermont, and West Virginia.

A General Warranty Deed Form offers the highest level of legal security in real estate transactions. This document assumes that the transferor holds clear property ownership, free from liens or mortgages. Contrary to a quitclaim deed, a warranty deed is typically utilized when the grantee acquires the real estate in return for monetary compensation.

A Texas Warranty Deed transfers property ownership within Texas, commonly during a real estate purchase. The grantor must sign the deed in the presence of either two witnesses or a notary public. Additionally, it must be recorded at the county recorder’s office where the property is located.

Deed Types

Regardless of the type employed, all deeds must be recorded and linked to the real property to show ownership history over time. Different deeds provide varying levels of guarantees, so selecting the appropriate document is crucial. Additionally, certain types of deeds may necessitate specific components and attachments. For instance, recording a transfer-on-death form typically requires including a copy of the deceased person’s death certificate.

- Deed Forms

- Bargain and Sale Deed Form

- Correction Deed Form

- Trust Deed Form

- Fiduciary Deed Form

- Gift Deed Forms

- Deed in Lieu Form

- Limited Warranty Deed Form

- Transfer On Death Form

Sample General Warranty Deed:

Deed Forms by State

The signing requirements for deed forms differ across states. Some states only require the signature of a notary public, while others mandate one or two witnesses. Once properly written and signed, your deed form must be filed with the recorder’s office. To transfer property using deeds, it’s essential to use the state-specific form where the property is situated. Refer to the list below for a deed template applicable to your state.

- Deed of Trust Form California

- Texas Deed of Trust

- Florida Warranty Deed

- Georgia Warranty Deed

- North Carolina General Warranty Deed Forms

- Lady Bird Deed in Florida

- Michigan Lady Bird Deed

- Lady Bird Deed TX

- Florida Quit Claim Deed

- Georgia Quit Claim Deed Form

- Illinois Quit Claim Deed

- Michigan Quit Claim Deed

- Quit Claim Deed Form NY

- North Carolina Quitclaim Deed

- Quit Claim Deed Ohio

- Pennsylvania Quit Claim Deed

- Quit Claim Deed Texas

- Special Warranty Deed FL

- Special Warranty Deed TX

- Transfer On Death Deed CA

- IN Transfer On Death Deed

- Texas Transfer On Death Deed

Fillable PDF Forms

Choose from our extensive collection of PDF forms, conveniently categorized for your ease. These documents are customizable and can be created in just a few minutes. Simply select the relevant category, complete the form, and use your PDF document anywhere.

Internal Revenue Service (IRS) PDF Forms

IRS Schedule A Form 1040 or 1040-SR

IRS Schedule A Form 990 or 990-EZ

IRS Schedule B Form 1040

IRS Schedule B Form 941

IRS Schedule C Form 1040

IRS Schedule D Form 1040 or 1040-SR

IRS Schedule E Form 1040

IRS Schedule J Form 1040

IRS Schedule K-1 Form 1041

IRS Schedule K-1 Form 1065

IRS Schedule K-1 Form 1120-S

IRS Schedule M-3 Form 1120

IRS Schedule O Form 990 or 990-EZ

IRS Schedule SE Form 1040

Other Fillable and Editable PDF Forms and Templates

MyAcuvue Rewards Submission Form

Obituary Template

Online Graph Paper

Prenuptial Agreement

Prescription Label Template

Pre Trip Inspection Checklist

PS Form 3575

Temporary Custody Form

T-Shirt Order Form

Utility Bill Template

Wedding Ceremony Script

Welp Hatchery

Willie Lynch Letter: The Making of a Slave

YMCA Member Cancellation Letter

Applications

AAA International Driving Permit Application

Application for Divorce

Autozone Credit Card Application

Boyfriend Application Form

Business Credit Application Template

Chick Fil a Job Application

Colleges Application Form

Cuddle Buddy Application

Dekalb County Water Application

DHSR/HCPEC-4515

Eagle Scout Rank Application

Employment Application Form

Girlfriend Application Form

International Driving Permit Application

Leap Application IML-4

Rochdale Village Application

Shark Tank Application

Tanzania Visa Application

Tennessee DHS Family Assistance Application

Trader Joe’s Application

Business

AIA A305 1986

AQHA Transfer Form

Construction Proposal Form

Gift Letter

HUD-1 Settlement Statement

SBA Form 413

All Bill Titles

Official: To amend the Federal Election Campaign Act of 1971 to prohibit foreign influence in Federal elections, to prohibit government contractors from making expenditures with respect to such elections, and to establish additional disclosure requirements with respect to spending in such elections, and for other purposes. as introduced.

Popular: Democracy is Strengthened by Casting Light on Spending in Elections Act as introduced.

Popular: DISCLOSE Act as introduced.

Short: Democracy is Strengthened by Casting Light on Spending in Elections Act as introduced.

Short: DISCLOSE Act as introduced.

Short: Democracy is Strengthened by Casting Light on Spending in Elections Act as reported to house.

Short: DISCLOSE Act as reported to house.

Short: Democracy is Strengthened by Casting Light on Spending in Elections Act as passed house.

Short: DISCLOSE Act as passed house.

- Overview

- Actions & Votes

- Money Trail

- News (141) & Blogs (1K)

- Comments (51)

Bill’s Views

Today: 238

Past Seven Days: 1,363

All-Time: 156,210

Official Bill Text

Comment on about 110 Pages

| Introduced | House Passed | Senate Passes | President Signs |

| 04/28/10 | 06/24/10 |

Sponsor

Representative

Chris Van Hollen

D-MD

View Co-Sponsors (114)

Committees

House Administration

House Judiciary

Related Issue Areas

Government operations and politics

Business records

Civil actions and liability

Congressional elections

Constitution and constitutional amendments

Corporate finance and management

Elections, voting, political campaign regulation

Financial crises and stabilization

Foreign and international corporations

Government information and archives

Internet and video services

Judicial review and appeals

Labor-management relations

Members of Congress

Political advertising

Public contracts and procurement

Public participation and lobbying

Social work, volunteer service, charitable organizations

Tax-exempt organizations

Telecommunication rates and fees

Data via Congressional Research Service

Hide Issues

Latest Vote

Result: Passed – June 24, 2010

Roll call number 391 in the House

Question: On Passage: H R 5175 Democracy is Strengthened by Casting Light on Spending in Elections Act or the DISCLOSE Act

Required percentage of ‘Aye’ votes: 1/2 (50%)

Percentage of ‘aye’ votes: 50%

OpenCongress Summary

This is the Democrats’ response to the Supreme Courts’ recent Citizens United v. FEC ruling. It seeks to increase transparency of corporate and special-interest money in national political campaigns. It would require organizations involved in political campaigning to disclose the identity of the large donors, and to reveal their identities in any political ads they fund. It would also bar foreign corporations, government contractors and TARP recipients from making political expenditures. Notably, the bill would exempt all long-standing, non-profit organizations with more than 500,000 members from having to disclose their donor lists.

OpenCongress bill summaries are written by OpenCongress editors and are entirely independent of Congress and the federal government. For the summary provided by Congress itself, via the Congressional Research Service, see the “Official Summary” below.

Official Summary

6/24/2010–Passed House amended. Democracy is Strengthened by Casting Light on Spending in Elections Act or DISCLOSE Act – Title I: Regulation of Certain Political Spending –

(Sec. 101)

Amends the Federal Election Campaign Act of 1971 (FECA) to prohibit:

(1) independent expenditures and payments for electioneering communications by government contractors if the value of the contract is at least $10 million;

(2) recipients of assistance under the Troubled Asset Relief Program (TARP) of the Emergency Economic Stabilization Act of 2008 (EESA) from making any contribution to any political party, committee, or candidate for public office, or to any person for any political purpose or use, or from making any independent expenditure or disbursing any funds for an electioneering communication; and

(3) persons who enter into negotiations for an oil or gas exploration, development, or production lease under the Outer Continental Shelf Lands Act from making any contribution to any political party, committee, or candidate for public office or to any person for any political purpose or use, or from making any independent expenditure or disbursing any funds for an electioneering communication.

(Sec. 102)

Applies the ban on contributions and expenditures by foreign nationals to foreign-controlled domestic corporations. Requires the highest ranking official of a corporation, before making any contribution, donation, expenditure, independent expenditure, or disbursement for an electioneering communication in connection with a federal election, to file a certification with the Federal Election Commission (FEC), if this has not been done already, that the corporation is not prohibited from carrying out such activity. Declares that nothing prohibits any domestic corporation from establishing, administering, and soliciting contributions to a separate segregated fund, so long as:

(1) none of the amounts in the fund are provided by any prohibited foreign national; and

(2) no such foreign national has the power to direct, dictate, or control the fund. Declares that nothing prohibits any domestic corporation from making a contribution or donation in connection with a state or local election to the extent permitted under state or local law, so long as no foreign national has the power to direct, dictate, or control such contribution or donation. Declares that nothing prohibits any domestic corporation from carrying out certain activities, so long as:

(1) none of the amounts used to carry out such activities are provided by any prohibited foreign national; and

(2) no prohibited foreign national has the power to direct, dictate, or control such activity.

(Sec. 103)

Treats as contributions:

(1) any payments by any person (except a candidate, a candidate’s authorized committee, or a political committee of a political party) for coordinated communications; and

(2) political party communications made on behalf of candidates if made under the control or direction of a candidate or a candidate’s authorized committee. Defines “coordinated communication” as:

(1) a publicly distributed or disseminated communication referring to a candidate or an opponent of such candidate which is made during a specified election period in cooperation, consultation, or concert with, or at the request or suggestion of, a candidate, a candidate’s authorized committee, or a political committee of a political party; or

(2) any communication that republishes, disseminates, or distributes, in whole or in part, any broadcast or any written, graphic, or other form of campaign material prepared by a candidate, a candidate’s authorized committee, or their agents. Excludes from the meaning of “coordinated communication”:

(1) a communication appearing in a news story, commentary, or editorial distributed through the facilities of any broadcasting station, newspaper, magazine, or other periodical publication, unless such facilities are owned or controlled by any political party, political committee, or candidate; or

(2) a communication which constitutes a candidate debate or forum.` Repeals the prohibition against contributions by individuals age 17 or younger.

(Sec. 105)

Prohibits a communication which is disseminated through the Internet from being treated as a form of general public political advertising unless the communication was placed for a fee on another person’s website. Title II: Promoting Effective Disclosure of Campaign-Related Activity – Subtitle A: Treatment of Independent Expenditures and Electioneering Communications Made by All Persons –

(Sec. 201)

Revises the definition of independent expenditure to mean, in part, an expenditure that, when taken as a whole, expressly advocates the election or defeat of a clearly identified candidate, or is the functional equivalent of express advocacy. Requires any person making independent expenditures exceeding $10,000 to:

(1) file a report electronically within 24 hours; and

(2) file a new report electronically each time the person makes or contracts to make independent expenditures in an aggregate amount equal to or greater than $10,000 (or $1,000, if less than 20 days before an election) with respect to the same election.

(Sec. 202)

Increases from 60 days to 120 days the period before a general election during which a communication shall be considered an electioneering communication.

(Sec. 203)

Requires mandatory electronic filing by persons making independent expenditures or electioneering communications exceeding $10,000 at any time. Subtitle B: Expanded Requirements for Corporations and Other Organizations –

(Sec. 211)

Requires corporations, labor organizations, tax-exempt charitable organizations, and political organizations other than political committees (covered organizations) to include specified additional information in reports on independent expenditures of at least $10,000, including certain actual or deemed transfers of money to other persons, but excluding amounts paid from separate segregated funds as well as amounts designated for specified campaign-related activities. Requires certain additional information in electioneering communication reports. Prescribes special rules for transfers aggregating at least $50,000 between covered organizations treated as transfers between affiliates, including transfers to affiliated tax-exempt charitable organizations.

(Sec. 212)

Sets forth special rules for the use of general treasury funds by covered organizations for campaign-related activity, including both designated and unrestricted donor payments to an organization. Authorizes mutually agreed restrictions on the use of donated funds for campaign-related activity between a covered organization and a person who does not want his or her identity disclosed in a significant funder statement or a Top 5 Funders list. Prescribes special rules for transfers aggregating at least $50,000 between covered organizations treated as transfers between affiliates, including transfers to affiliated tax-exempt charitable organizations.

(Sec. 213)

Authorizes covered organizations to make optional use of a separate Campaign-Related Activity Account for making disbursements for campaign-related activity. Requires such an Account to be reduced by the amount of organization revenues attributable to donations or payments from a person other than the covered organization who has an agreement with the organization that it will not use such donations or payments for campaign related activity.

(Sec. 214)

Requires any electioneering communication transmitted through radio or television which is paid for by a political committee (including a political committee of a political party), other than a political committee which receives or accepts contributions or donations which do not comply with the contribution limits or source prohibitions of FECA, to include an audio statement identifying the name of the political committee responsible. Prescribes additional information to be included in certain radio or television electioneering communications by persons (including significant funders of campaign-related communications of a covered organization) other than a candidate, a candidate’s authorized committee, or a political committee of a political party. Prescribes a format for the individual disclosure statement.

(Sec. 215)

Indexes certain amounts under FECA. Subtitle C: Reporting Requirements for Registered Lobbyists –

(Sec. 221)

Amends the Lobbying Disclosure Act of 1995 to require registered lobbyists to report information on independent expenditures or electioneering communications of at least $1,000 to the Secretary of the Senate and the Clerk of the House of Representatives. Title III: Disclosure by Covered Organizations of Information on Campaign Related Activity –

(Sec. 301)

Requires covered organizations to disclose to shareholders, members, or donors information on disbursements for campaign-related activity. Requires a covered organization that maintains an Internet site to post on it a hyperlink from its homepage to the location on the FEC website containing information required to be reported with respect to public independent expenditures, including disbursements for electioneering communications. Title IV: Other Provisions –

(Sec. 401)

Authorizes judicial review of the provisions of this Act by the U.S. District Court for the District of Columbia, and on appeal by the Court of Appeals for the District of Columbia Circuit. Grants Members of Congress the right to:

(1) bring an action to challenge the constitutionality of a provision of this Act; or

(2) intervene in any action challenging the constitutionality of a provision of this Act, either in support of or opposition to the position of a party to the case.

(Sec. 402)

Declares that nothing in this Act shall be construed to affect any provision of law, rule, or regulation which waives a requirement to disclose information relating to any person in any case in which there is a reasonable probability that the information disclosure would subject the person to threats, harassments, or reprisals.

Organizations Supporting H.R.5175

Campaign Legal Center

Democracy 21

Public Citizen

Sunlight Foundation

Public Campaign

Common Cause

…and 2 more. See all.

Organizations Opposing H.R.5175

Center for Competitive Politics

Citizens United

United States Chamber of Commerce

American Petroleum Institute

Sierra Club

National Retail Federation

…and 66 more. See all.

See the money trail behind this bill for more info on how campaign contributions may be influencing senators’ and representatives’ votes.

Latest Letters to Congress

H.R.5175 DISCLOSE Act

basiordio081740 July 16, 2012

I am writing as your constituent in the 3rd Congressional district of Nevada. I am writing as your constituent in the 3rd Congressional district of Nevada. I support H.R.5175 – DISCLOSE Act, and am tracking it using OpenCongress.org, the free public resource website for government transparency and accountability.

Sincerely,

Bobbie A. Siordio

If the voters of this country must show all kinds of I.D. to be able to vote,

even tho they did not have to all these years,,,,Why are the RICH…

H.R.5175 DISCLOSE Act

carolbland July 16, 2012

I am writing as your constituent in the 2nd Congressional district of Arizona. I am writing as your constituent in the 2nd Congressional district of Arizona. I support H.R.5175 – DISCLOSE Act, and am tracking it using OpenCongress.org, the free public resource website for government transparency and accountability.

Sincerely,

Carol Bland

H.R.5175 DISCLOSE Act

EDDOGIEDOG June 03, 2012

I am writing as your constituent in the 41st Congressional district of California. I oppose H.R.5175 – DISCLOSE Act, and am tracking it using OpenCongress.org, the free public resource website for government transparency and accountability.

Sincerely,

EDWARD ROMO

Sincerely,

EDWARD ROMO III

See All Letters (13)

Related Bills

S.3295 DISCLOSE Act

Introduced May 03, 2010

295 views

H.Res.1468 Providing for consideration of the bill (H.R. 5175) to amend …

House Passed Jun 24, 2010

7 views

S.3628 DISCLOSE Act

Introduced Sep 23, 2010

460 views

Vote on This Bill

28% Users Support Bill

219 in favor / 557 opposed

Yes No

Send Your Rep a Letter

about this bill

Support

Oppose

Tracking

Track with MyOC

Subscribe To This Bill

Get Email Alerts

Share This Bill

Share via Email

Save to NotebookMake A Bill WidgetSend us Feedback

Top-Rated Comments

“are private companies mentioned anywhere in the constitution??? no… al…”

nokwisa

“great article, nukeet. i recommend reading it. “…the nra, which previ…”

peacefrog

OC Blog Articles Related To This Bill

This Weekend, Be Your Own Get-Out-The-Vote Machine

Nov 02, 2012

Senators Say DOJ is Lying About the PATRIOT Act

Sep 22, 2011

Go Vote!

Nov 02, 2010

RaceTracker is Up-To-Date for Aug. 24th Primaries

Aug 24, 2010

Primary Results on OC RaceTracker: House, Senate, and Gubernatorial

Aug 11, 2010

Recent OC Blog Articles

Follow #OpenGov Leaders on Micropublishing

Jun 17, 2013

Three #OpenGov Events This Week

Jun 03, 2013

OC at Transparency Camp 2013

May 01, 2013

OpenGovernment.org at National Conference on Media Reform

Apr 04, 2013

Help OpenGovernment.org – Before 5pm ET Today

Mar 21, 2013

OpenCongress

- Search

- About OpenCongress

- Help FAQ

- RSS Feeds

- Widgets

- Developers/API

- Our Staff

- Contact Us

Go to

- Bills

- Senators

- Representatives

- Votes

- Issues

- The Money Trail

Go to

- Wiki

- Blog

- Video

- Resources

My OpenCongress

- Login

OpenCongress is a free and open-source project of the Participatory Politics Foundation, a 501(c)3 non-profit organization with a mission to increase civic engagement. The non-profit Sunlight Foundation is the Founding and Primary Supporter of OpenCongress.