SBA Form 413 is a detailed financial statement required by the Small Business Administration (SBA) for individuals seeking small business loans. The form requires applicants to provide comprehensive financial data, including assets, liabilities, sources of income, and contingent liabilities. This personal financial statement helps the SBA assess loan applicants’ financial health and creditworthiness to ensure they have the financial stability to repay the loan. It includes sections listing real estate owned, personal property, stocks, and debts, among other financial details. The purpose of this form is to provide the SBA with the necessary information to make informed decisions regarding loan approvals and amounts.

Other Business Forms

You will discover even more editable business forms we provide. Following next, we listed a number of the more popular forms found this category. Moreover, do not forget that you are able to upload, fill out, and edit any PDF at FormsPal.

How to Fill Out the SBA Form 413

- Include Identifying Details

As in many financial and legal documents, the first section requires you to state your name, full address, and your personal and work telephone numbers. Include the name of your business.

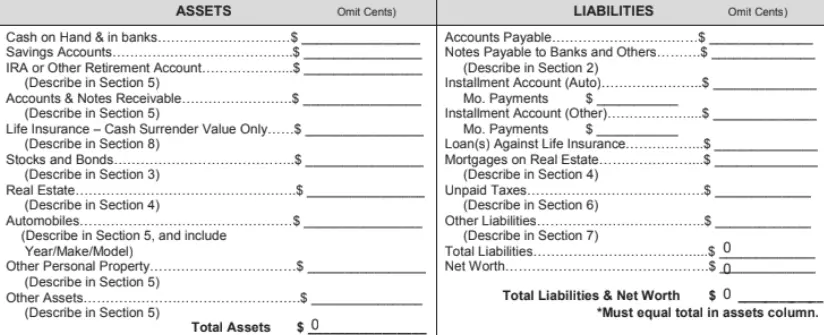

- Describe Your Assets and Liabilities

Here first, include assets stored in your accounts and any relevant property, including real estate. Calculate the total worth of these possessions. In the following sections, you will be asked to describe the assets in great detail.

The second part of the section of Form 413 lists your liabilities. These data are often related to loans or mortgages. Calculate the total and check that you have included every liability. Add any possible liabilities in the “contingent liabilities” box underneath.

- Describe Your Sources of Income

There is a separate section for your income description.

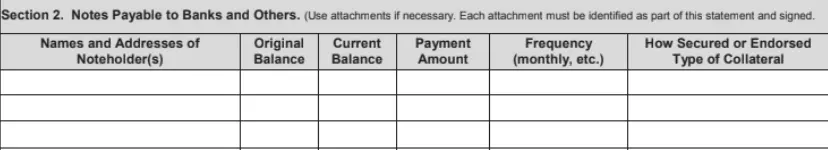

- State If There are Any Notes That Should Be Payable

Here you should also provide the details of the noteholders. Attach documents if necessary, to provide details.

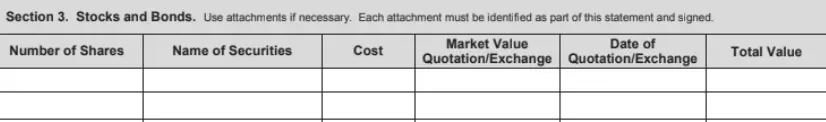

- Describe Your Stocks and Bonds

Here you should also include attachments if needed.

- State What Real Estate You Own

Provide information about the type of real estate you have, including the mortgaged properties.

- Describe Other Properties and Assets

Make sure you provide an accurate and detailed description of your assets, unpaid taxes, and liabilities.

- Provide Detailed Description of Unpaid Taxes and Other Liabilities

Do not omit any information about unpaid taxes or other liabilities.

- State If You Have a Life Insurance

If you do, provide the amount and the name of the insurance company.

- Complete the Form By Signing It

Provide the date and let the applicants sign the form. Also, state their social security numbers. Carefully read the form before signing.