Florida Special Warranty Deed Form

The special warranty deed is used to transfer property rights for movable and immovable estate. Florida inhabitants use this deed when transferring rights to both individuals and legal entities. Here you will find our full article about deed forms.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Florida Warranty Deed Laws and Requirements

As per the title of the document, the person who gives the property away guarantees the purity of the object title. That is, the seller officially and legally assures that they have not done anything with the property that can spoil its status, the object is not pledged or under arrest, and is not tied to an unpaid mortgage.

At the same time, the protection of title does not concern anyone other than the current owner. This means that he property might have been implicated in illegal transactions in the past and was transferred to the current owner with damage in the title. In short, a special warranty deed should be used when the recipient does not doubt the history of the object and the track of its ownership.

Laws

The special warranty deed forms are governed by the Florida Statuses, Title XL, Chapter 689. The section covers the transfer of the real estate to new ownership and dwells on some cases of using this type of deed in detail. To find out the legal justification, you can read § 689.02. The subsection prescribes the warranty deed and highlights its major points.

Signing Requirements

The legal execution of a special warranty deed in Florida must be certified by the signatures of the seller, the buyer, and a notary public in the presence of two witnesses. Sometimes the seller and the buyer can do with one witness with the notary acting as the second witness. All persons must sign the deed in the presence of a notary public for it to be valid.

After notarization, the document is recorded with the Clerk of the Circuit Court. This is the only office that accepts a special warranty deed for further registration in the state administrative structure. Read on to find out instances where the deed is used.

Filing Requirements

Here are the most common cases for a special warranty deed to be relevant:

- Transfer of property rights to trust (for example, to a living trust).

- Transfer of an object to a business owned.

- Sale of commercial real estate.

- Transfer to a new owner who is not concerned about the property’s title (for example, if the new owner purchases title insurance of the property).

- The unwillingness of the current owner to have the property with any encumbrance.

Format Requirements

Florida’s special warranty deed should be primarily distinguished from similar forms, such as General Warranty Deed and Quitclaim Deed. The general warranty deed guarantees the legal purity of the object title throughout the entire track of ownership. In contrast, the special warranty deed applies only to the current owner. Unlike both forms, the quitclaim deed does not guarantee the title at all, which makes it appropriate only in the context of family ties or close acquaintances.

Fees

When submitting an application to the Clerk, remember to pay the tax fee. The amount of the fee is based on the total cost of the transferred object.

How to Fill Out and File a Quitclaim Deed in South Carolina

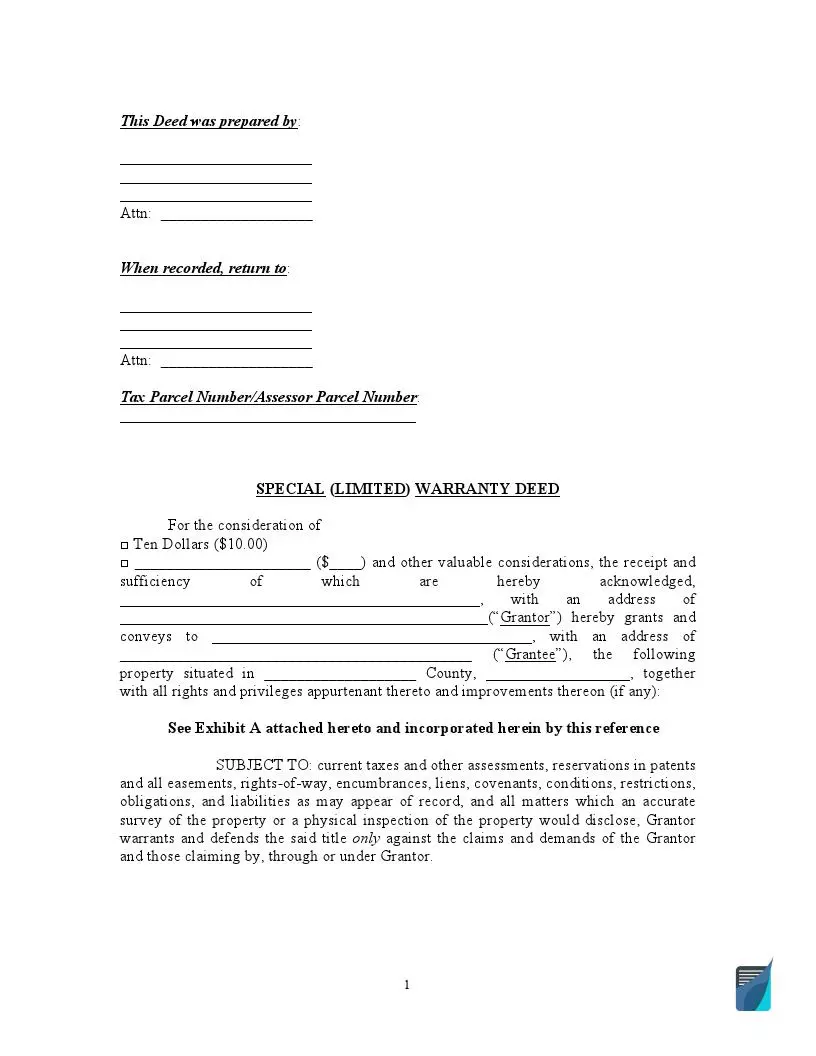

Here is a short and straightforward guide on filling out the paper:

Identify the Claimer

Write the name of the person preparing the deed.

Identify the Grantee

Write the name of the person waiting for a response (usually, it is the grantee or their lawyer).

Specify the Parcel ID

Write down the parcel identification number in the designated line.

Enter the Transfer Date

Specify the date of transfer.

Note the Addresses

Write the name and address of the seller and the buyer.

Name the County

Specify the county where the property is located.

Describe the Object

Fill in the field for the legal description of the object.

Provide the Required Signatures

In the presence of a notary and two witnesses, sign the document and have the grantee sign it.

Provide Additional Documents

Apply the document and the accompanying papers—such as an extended description of the property—to the Clerk.