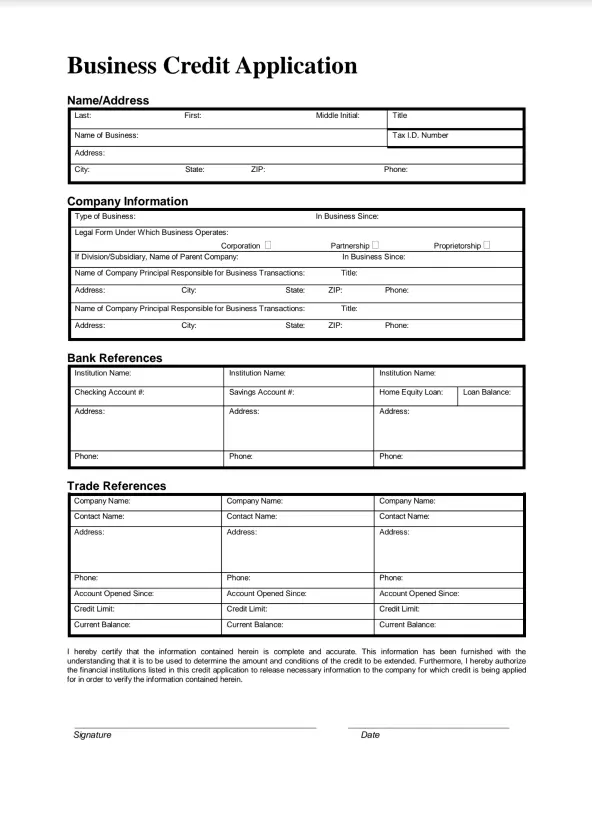

A Business Credit Application Template is a standardized form companies use to collect essential information from businesses wishing to apply for credit terms. This template includes fields for gathering details such as the business name, contact information, business type, ownership details, trade references, and bank references. This form helps streamline the evaluation of potential credit clients, ensuring that the credit grantor has all the necessary data to make informed lending decisions.

The purpose of the Business Credit Application Template is to formalize the process by which a company requests and obtains credit from suppliers or financial institutions. For businesses seeking to establish their credit facilities, submitting a credit application is critical in securing the necessary financial resources to support operations and growth initiatives.

Other Application Forms

There are even more editable application forms we provide. Just below, we selected a number of the more popular forms available in this category. Also, remember that you can actually upload, fill out, and edit any PDF document at FormsPal.

How to Fill Out the Template

The template consists of only one sheet, and this sheet is divided into four blocks a businessperson has to complete. They are a no-brainer: you will not have to provide anything extraordinary, just basic info on yourself, your entity, and your accounts.

However, if you feel unconfident about any of the form’s lines or have any questions and concerns, we strongly recommend asking for the help of your entity’s accountant or any other financial expert. It is much better to ask in advance and avoid mistakes than not to get credit because you have made something wrong.

We not only describe the template but also provide it. Our smart form-building software that generates almost all kinds of legal forms can issue the fillable Business Credit Application to you in seconds. Try it to make the procedure much easier.

Apart from the form itself, we suggest you read our instructions that tell how to complete each block. See the guide below.

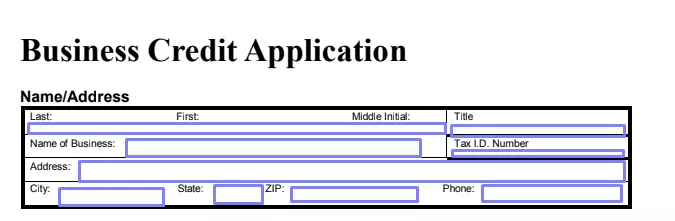

- Insert Info on Yourself

The first block is about you and your basic data. You must enter your full name (last, then first, and middle initial), title, tax ID number. Then, write the details about the business you represent (or own): its name, address (with the city, state, and postal code), and the business’s valid phone number.

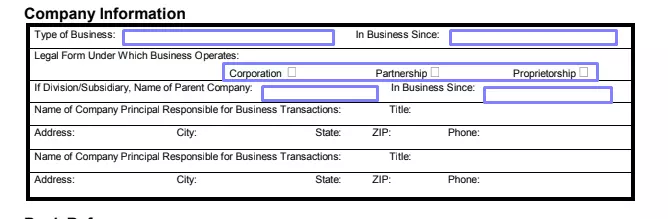

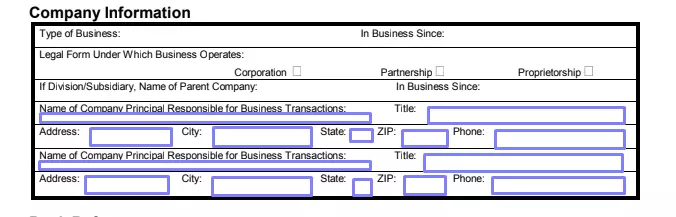

- Add More Details about the Entity

You have to tell more about the business for which you claim the credit. In the second block, you have to provide the business’s type and year when the entity was founded. Below, mark the box describing the business’s legal form (corporation, partnership, and so on).

If you represent a division or a subsidiary company, insert info about its parent company and indicate the foundation year as well.

Introduce the entity principal responsible for business operations and transactions. Add this person’s name, title, full address, and phone number. You can include two such people in this form. Then, move to the following block.

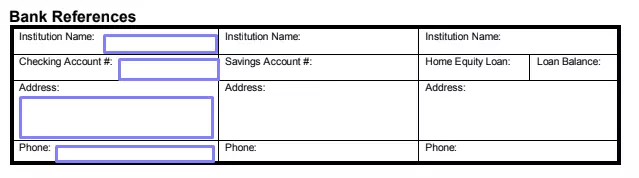

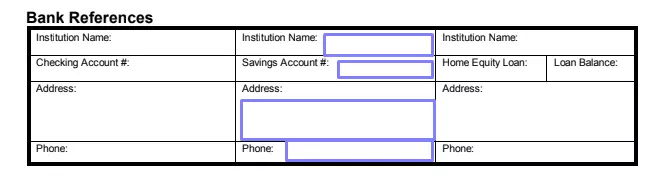

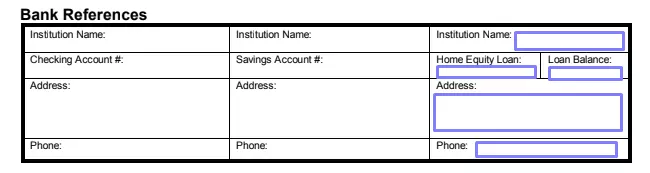

- Indicate Bank References

The next step is to include details about your bank references in the form. You should define the banks (or other financial institutions) responsible for your checking account, savings account, and loans.

Start with the checking account. Enter the bank’s or institution’s name, checking account number, address, and phone number.

In the middle, add the same items for the institution where your entity has a savings account. If it is the same place, duplicate the details you have written in the first column.

On the right, you have to introduce the bank or institution where your entity has the home equity loan (if any). Indicate the loan balance and give the same details about the bank (its name, address, and phone number).

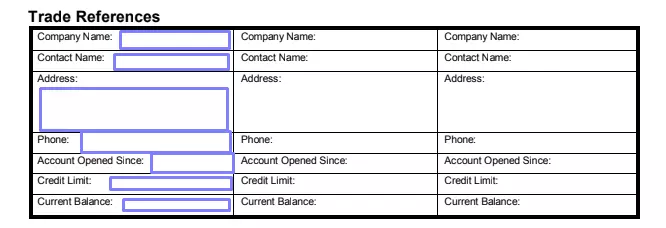

- Add Trade References

The form’s fourth block is for adding your entity’s trade references. These references are other entities from which you purchase items and pay for services that help your business. Such entities can give you a certain credit and prolong it, but only if you are a trustworthy company, of course.

You can add up to three references in the template. Each reference requires providing the company name, contact person’s name, business’s address and phone number, the date when your entity’s account was opened, the credit limit, and current balance.

- Sign the Document

You should confirm that everything inserted in the template is true. You can do it by signing the document below all blocks on the left-hand side and writing the current date on the right.

As you may see, the template we have just described is very brief. Sometimes you will need to provide much more details (your business’s financial results, statistics about your customers, and other things).

You can still use this template to make the basis of your application and complement it with all the demanded details. For instance, you might be asked for an application with more info in case your company is new on the market, or you try lending a significant sum.

Among additional details you can insert to the template are financial results and ratios, profitability proof, cash flow statement, details about your debts, and other informative items. In many cases, the organization where you apply for credit can tell what data you need to provide.