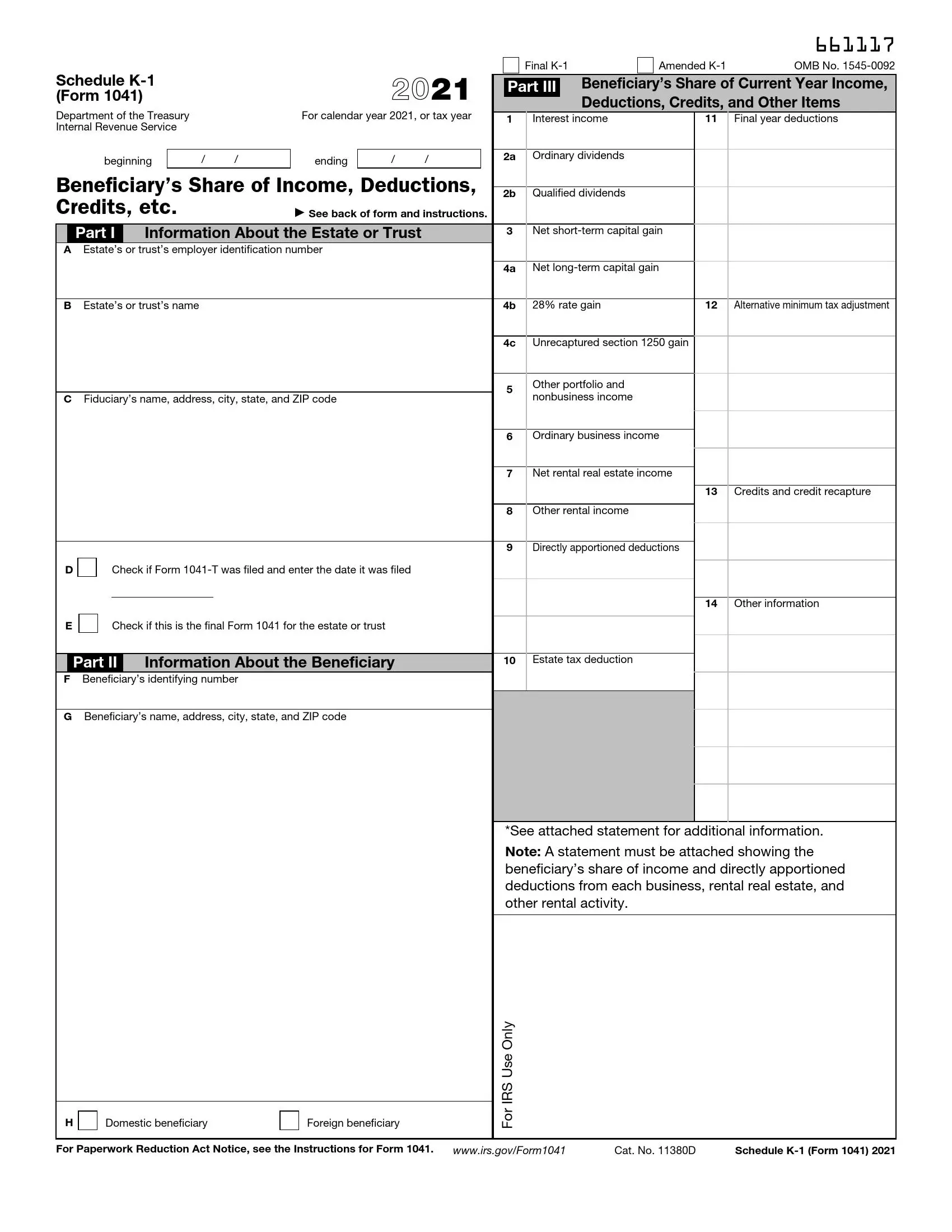

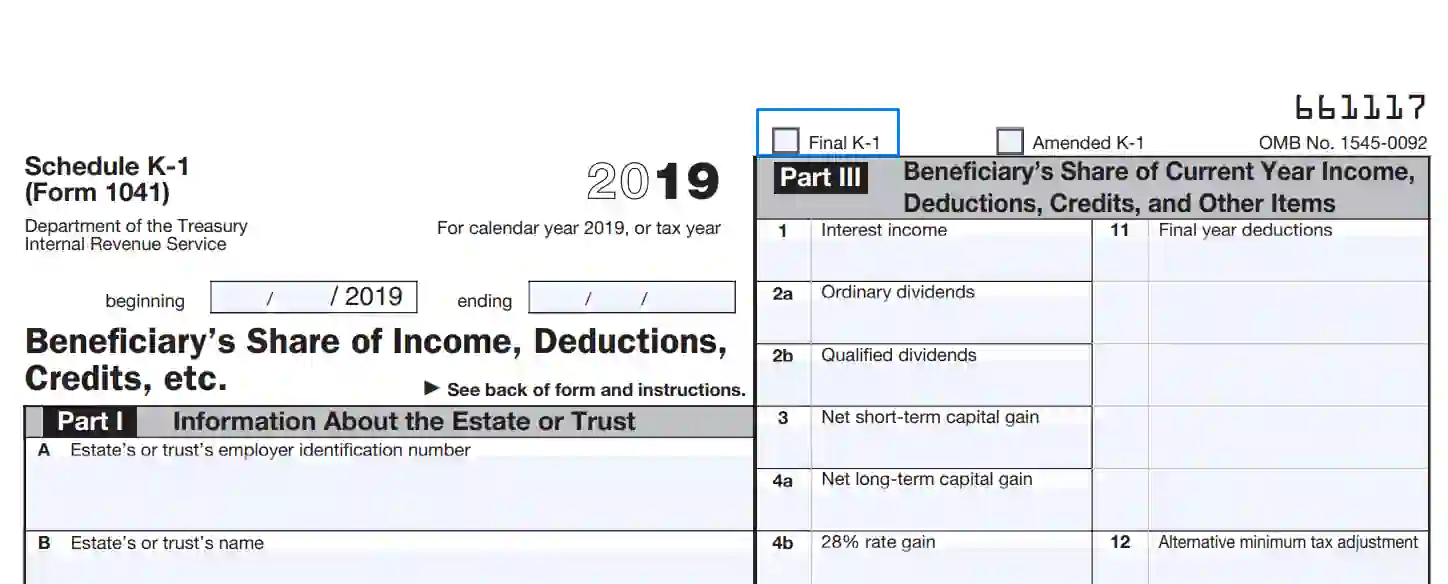

IRS Schedule K-1 (Form 1041) is a document used to report income distributions, deductions, and credits to beneficiaries of estates and trusts. The Schedule K-1 is part of Form 1041, “U.S. Income Tax Return for Estates and Trusts,” which trustees and executors use to report the entity’s income tax liability. Key details included on Schedule K-1 (Form 1041) are:

- The beneficiary’s share of income or loss from the estate or trust,

- Distributions made to the beneficiary during the tax year,

- Specific deductions and credits that the beneficiary is entitled to claim on their personal tax return.

Filing Schedule K-1 for each beneficiary is crucial as it allows them to accurately report their share of the estate or trust’s income and deductions on their tax returns. It ensures proper tax reporting and compliance with IRS requirements, helping beneficiaries understand their tax liabilities related to distributions received from estates and trusts.

Other IRS Forms for Trusts and Estates

Look through some other important IRS forms for beneficiaries.

How To Fill Out Schedule K-1 Form 1041

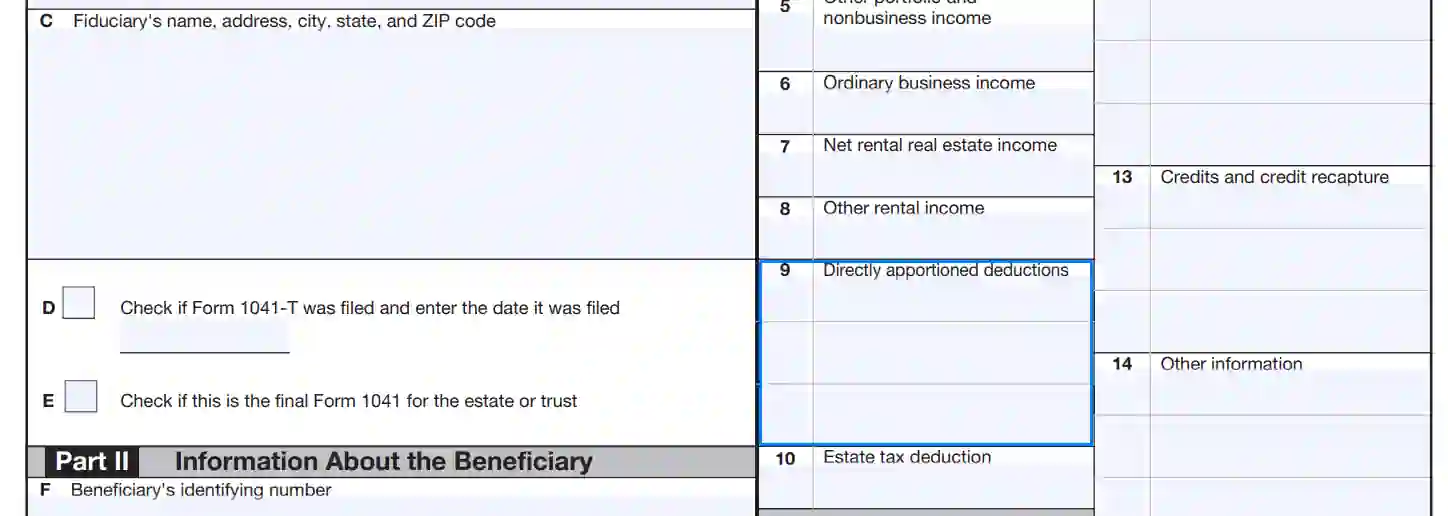

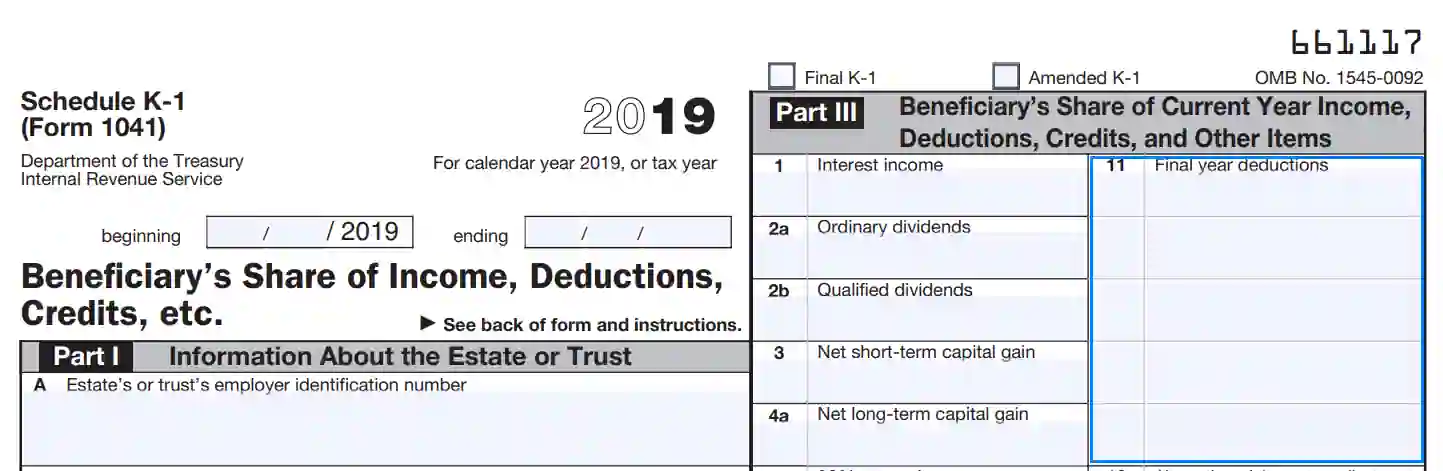

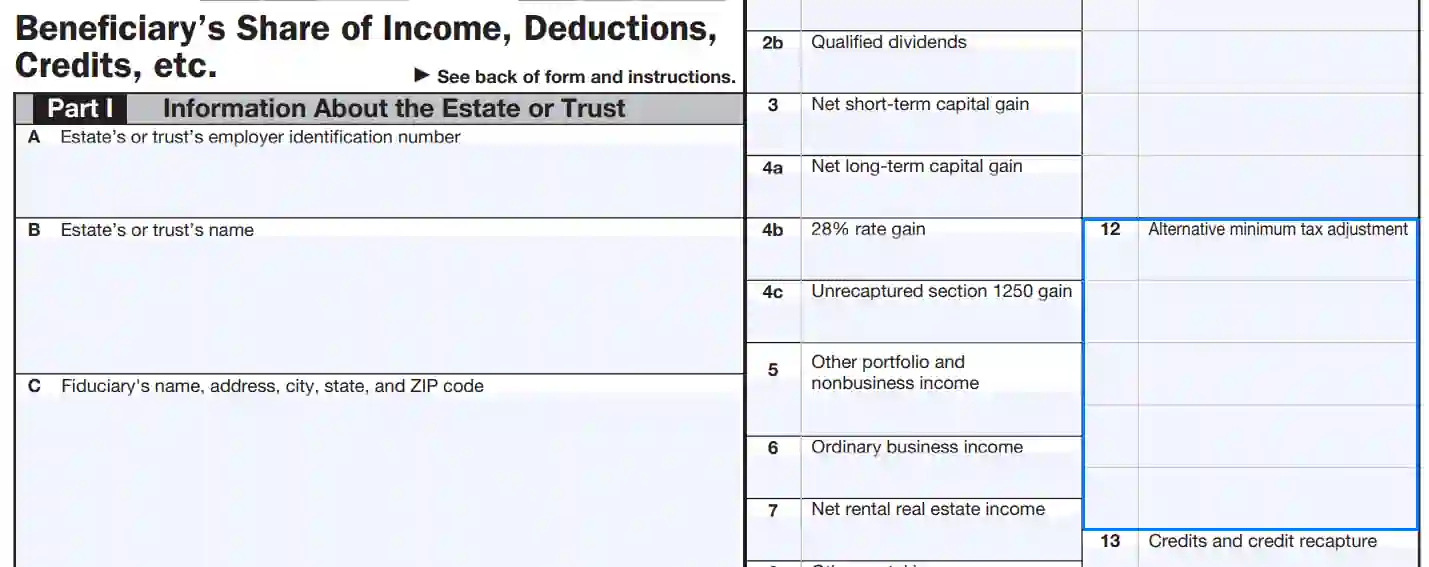

Completion of the Schedule K-1 is quite a complicated task. It consists of one page and 14 boxes. We advise you to use our guidelines to avoid any mistakes in filling out this paper. Ensure you follow the algorithm step-by-step, as there will be conflicts with governmental organizations if you insert something wrong.

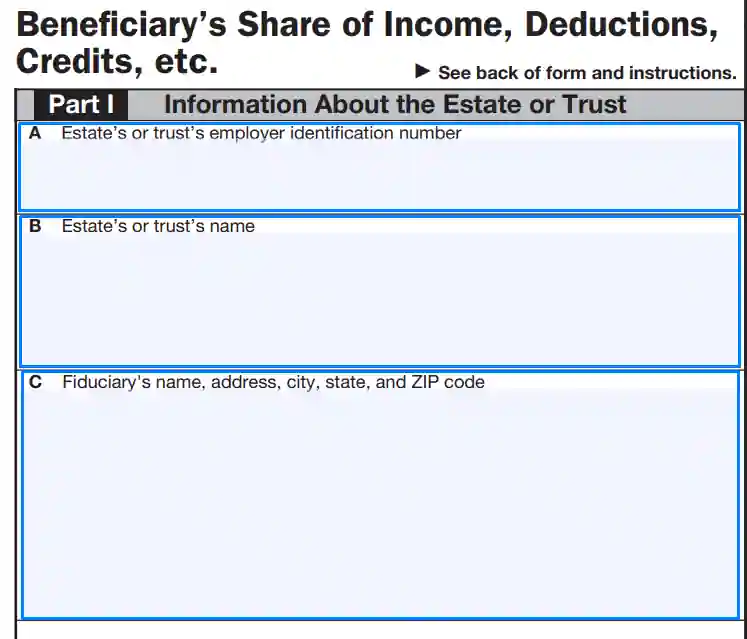

1. Give Basic Info About Your Property

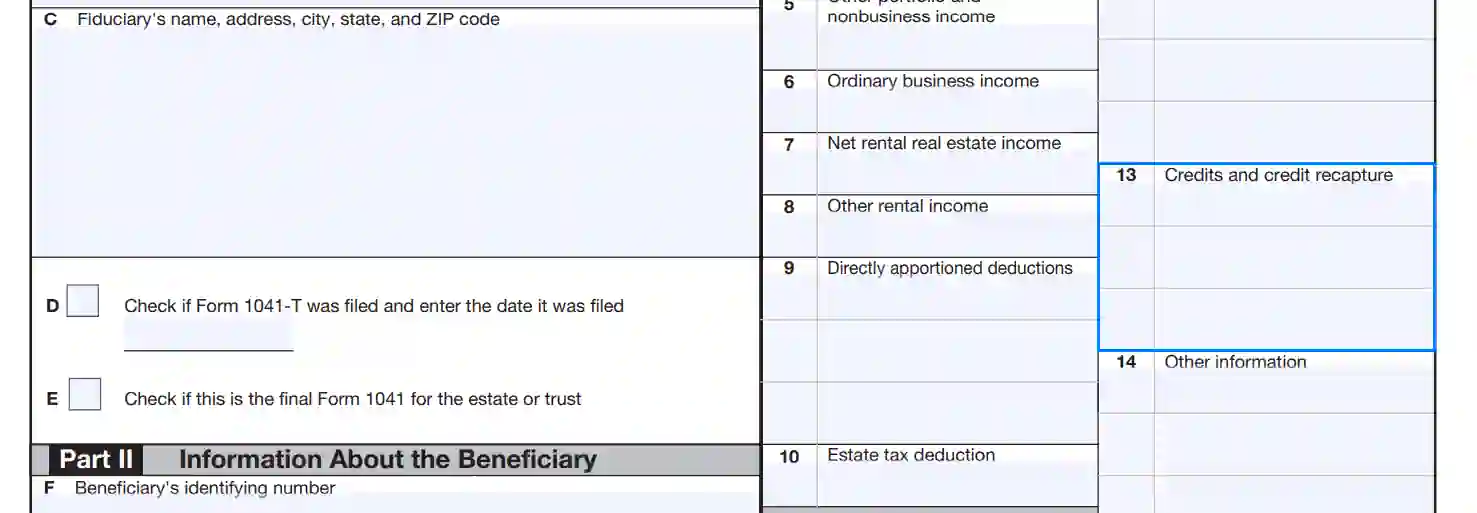

You should write the identification number of an estate in box A. Then introduce your ownership in box B by providing its name. Put the data about the trustee, including name and physical address.

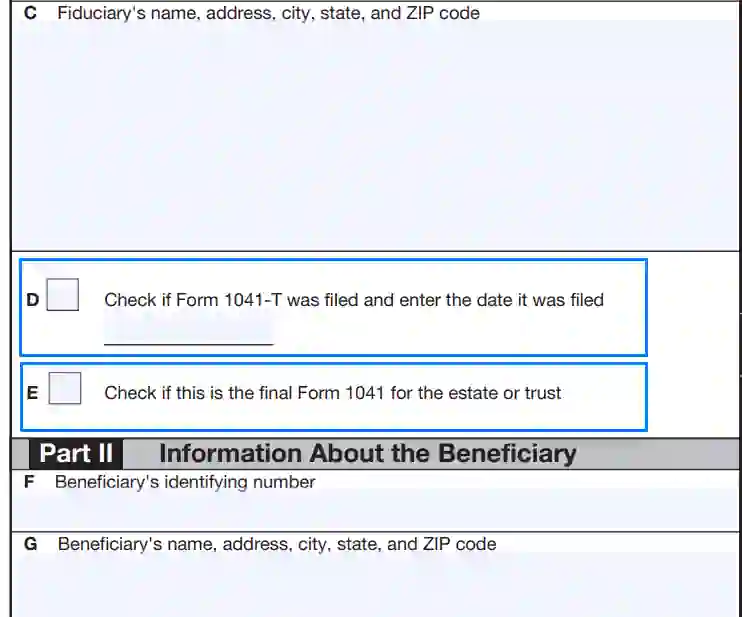

2. Check the Relevant Boxes

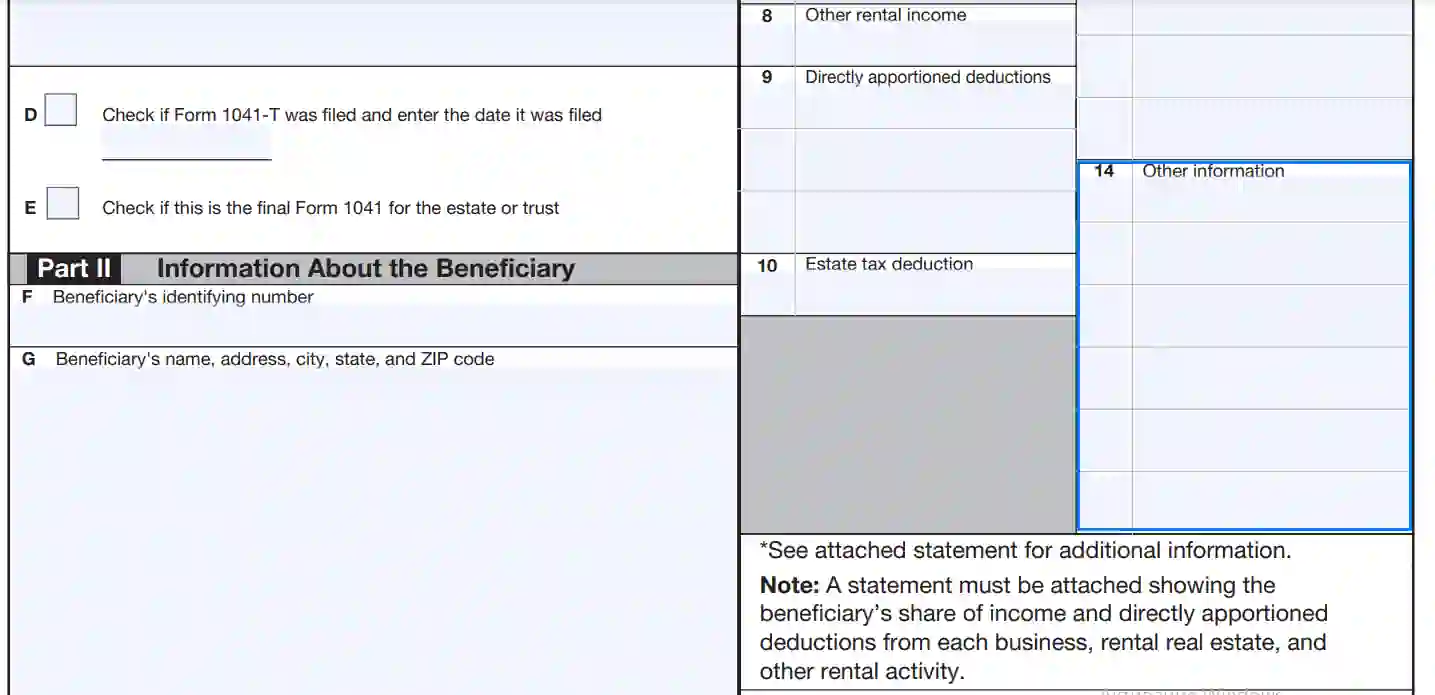

Part one includes boxes D and E, where you should clarify questions about the forms. Put the checkmark in box D if the fiduciary has already sent Form 1041-T, and do not forget to enter the date of filing. Use box E in cases when Form 1041-T was completed for the last time because of the end of ownership. Also, if it is the last year of having the right for the beneficiary, check the box “Final K-1” on the top of the document.

3. Introduce the Beneficiary

Fill in the identification number and name of the assignee and stay the contacts in the boxes F and G of the document. If there is more than one beneficiary, you should use an additional K-1 form. Specify in box H whether this person has a residence in the US or not.

4. Describe Finances Of Beneficiary

You must indicate all peculiarities connected with the assignee’s income in the third part of the form. So, the second page of the form includes instructions on the filling out of this part. Here are tips on the way you should match data in Schedule K-1 and return reports.

The specifications of every line of Part 3 are represented below:

- Line 1 — What share does the beneficiary have, excluding deductions?

- Line 2a — What share does the beneficiary gain from common dividends excluding deductions?

- Line 2b — What part does the beneficiary have from qualified dividends without deductions?

- Line 3 — What share does the beneficiary get from short-term capital profit excluding deductions? You can refer to the first column in line 17 of Form 1041 in this box. Make sure the value is not negative or leave the line empty.

- Lines 4a-4c — What part of the long-term profit does the beneficiary gain without deductions? Form 1041 can be applied here as well. You just need to indicate needed values from the first column of lines 18a-18c and put them right after deduction. The same situation is with negative numbers — do not put them into this form.

- Line 5 — What share does the beneficiary get from remaining activities after deduction?

- Lines 6-8 — What share does the beneficiary own from activities stated in boxes? In these lines, you should provide amounts of profits from business, rent, additional rental activities (as indicated in the form).

5. Continue With Deductions

You should enter the values of three types of deductions in lines 9-11. There are three lines in box 9 for you to report A — depreciation, B — depletion, and C — amortization for all operations you described earlier in lines 5-8.

Next up, you should enter the amount of deduction that was subtracted from the tax on property in line 10.

Five lines in box 11 are for you to clarify different types of deductions. Put A and write the number of excessive deductions that were made because of the end of ownership. Put B in the next line and fill the value for excessive deductions after the dissolution of the contract that are not directly connected to miscellaneous deductions. Put C if you want to describe short-term losses, or put D if you need to clarify long-term losses. Then, you need to put E or F based on the type of net operating losses where E is used for ordinary taxes and F for alternative ones.

Here is the table with the matchings of data in this form with other ones:

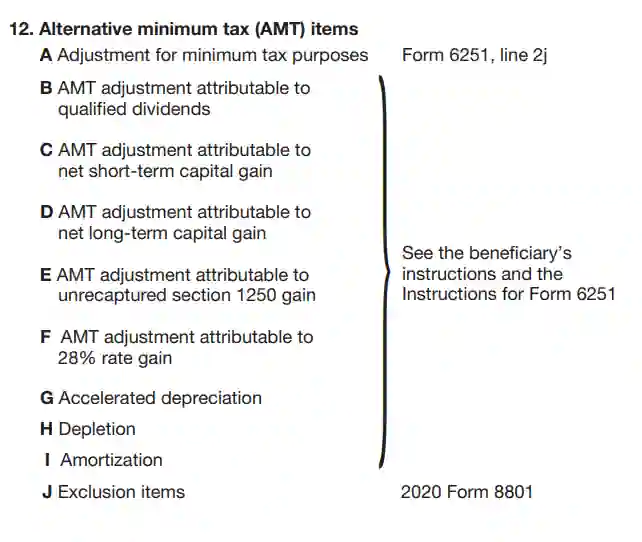

6. Clarify Your Tax Corrections

You need to give info about adjustments using codes from A to I in box 12. A is used for the specification of total adjustments, while others are required for detailed ones.

Apply values from previously completed forms according to the table below:

7. Enter Data About Credits

There are codes from A to Z for box 13 that you can use to specify the various credits you have as a beneficiary.

A detailed description of the codes and sources you can refer to is here:

8. Fill Amount Of Dollars For Other Activities

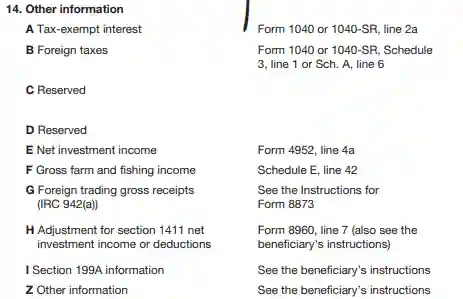

You should again enter codes and sums in box 14 for particular types of financial items listed below:

So, that is all that you need to fill in the Schedule K-1 Form 1041 to complete it. It is not the easiest form from the IRS, and if you have any issues during completion, you can apply our building software to fill it out properly.