Form 433-A (OIC) is a specific version of the IRS form used for submitting an offer in compromise, a program that allows taxpayers to settle their tax debts for less than the full amount owed when they cannot pay their full tax liability. This form, titled “Collection Information Statement for Wage Earners and Self-Employed Individuals (Offer in Compromise),” is essential for providing the IRS with detailed information about the taxpayer’s financial situation. It includes comprehensive sections on income, expenses, assets, and liabilities, all of which the IRS reviews to determine the taxpayer’s ability to pay.

The purpose of Form 433-A (OIC) is to support the offer in the compromise application process. Taxpayers considering an offer in compromise must fill out this form to demonstrate that paying the full amount of taxes owed would be overly burdensome. The IRS uses Form 433-A (OIC) information to assess the reasonable collection potential, the maximum amount they believe the taxpayer can pay. If the offer aligns with this potential, the IRS may accept the compromise, allowing taxpayers to resolve their debt more affordably. This form is a critical component of the negotiation process with the IRS.

Other IRS Forms for Trusts and Estates

Look through some related IRS forms that wage earners and self-employed individuals might find useful.

How to Fill out Form 433-A (OIC)

We encourage you to use our latest software developments to build and customize any legal form you need. With our online PDF editor, you can fill out and amend your form online effortlessly. But if you think you do not have the skill or qualification to fill the form out by yourself, you can always use legal assistance. Once you decide to hire a tax professional to deal with the paperwork for you, ensure to check their license.

Below, you will find a comprehensive guide on how to fill out Form 433-A (OIC).

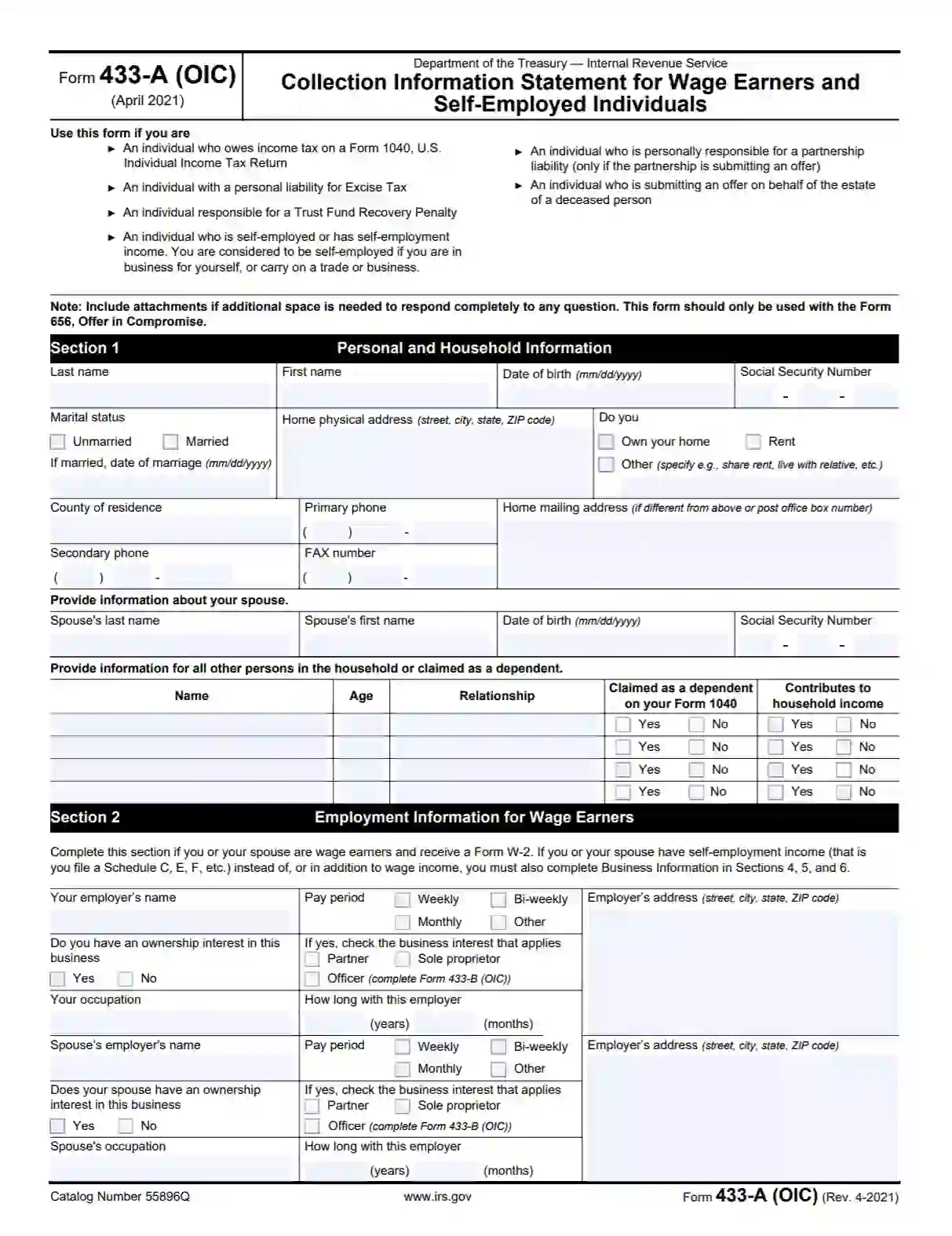

Insert the Required Personal Info

Please read the short instructions and recommendations at the top of the form to find out if you are eligible. Then, you should submit your personal info, including full name, date of birth, physical address, marital status, and contact information.

If you are currently married, please ensure to fill in your spouse’s full name, date of birth, and SSN (as shown below).

If you have any dependent household members, please list them in the table below. Enter their name, age, relationship to the taxpayer, and the amount of contribution made to the household income (if applicable).

Provide Info on Your Employer

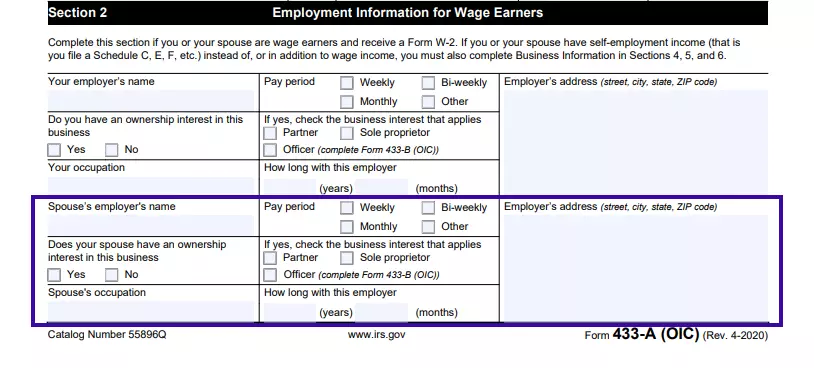

Complete this section only if you or your spouse is officially employed. If you are not a wage earner, you can skip this section and proceed to the next one.

But if you are a wage earner, you need to enter the employer’s name, physical address, occupation, and salary payment period. Please ensure to indicate in this section if you own a proprietorship.

The same set of questions applies to your spouse (if you have one).

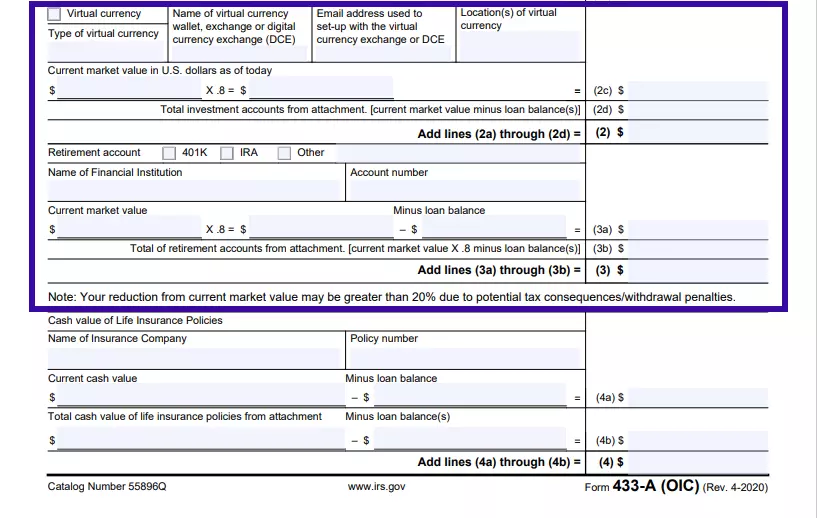

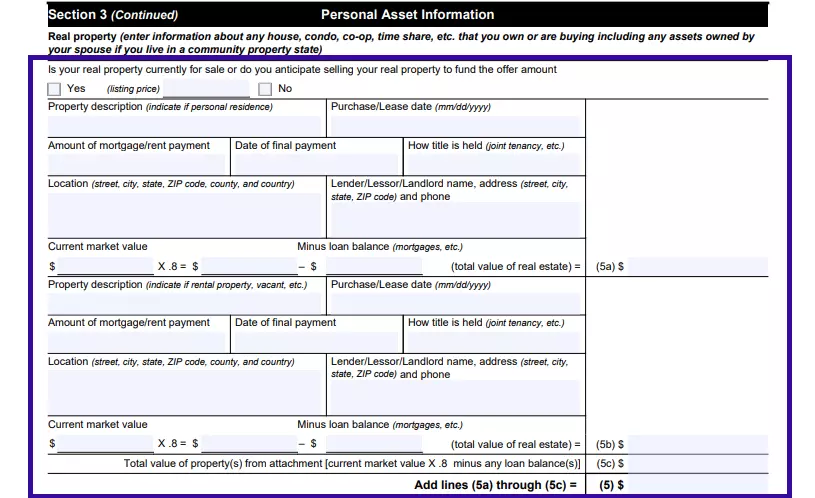

List Your Personal Assets

This next section constitutes a large table which is meant to estimate your fortune and current financial situation in general. Here, you need to list the amounts of both your domestic and foreign cash investments, market and online accounts (if any), bank deposits, savings, and possessions you have in real property, motor vehicles, and other estates. The IRS will need to assess the total value of your assets to make a final decision on your debt deduction.

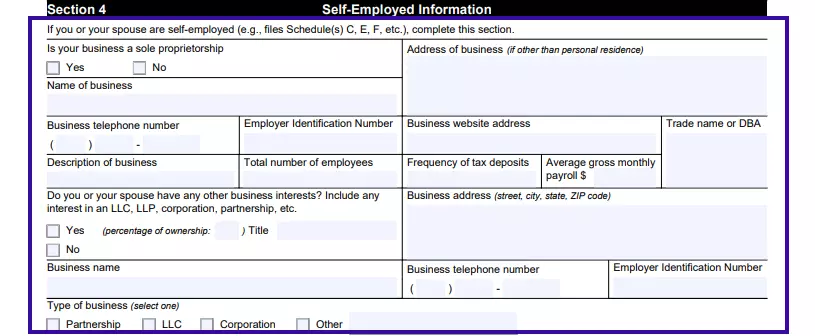

Enter the Required Info on Self-Employment

If you are a self-employed US citizen willing to put an offer in compromise, you should fill out this section. The required information here only concerns your business and includes the company’s name, the physical address of the business office, contact daytime telephone number, EIN, business activity type, and its legal form (LLC, corporation, partnership).

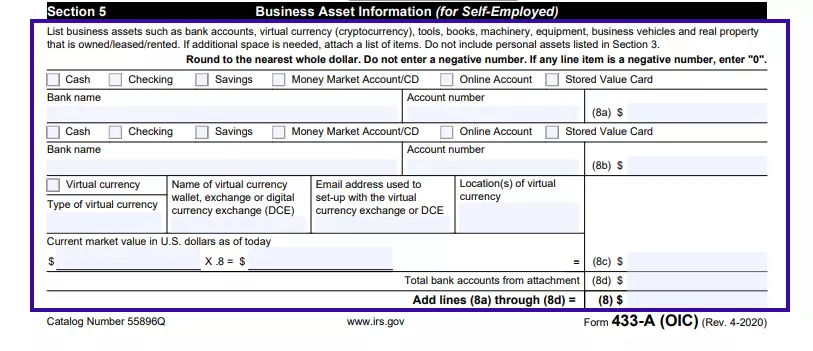

List All Your Business Assets

Here, you should list all the business-related properties that you own and use, lease, or rent. The properties may include equipment and machinery, books, business vehicles, and real estate, as well as cryptocurrency.

Right below the table, you should answer the questions if you have any notes or accounts receivable.

Indicate Actual Monthly Business Income and Expenses

Calculate your gross monthly business income and expenses and insert the respective amounts in the corresponding columns.

If you have already filed a Profit and Loss statement, you should only fill in lines 17 and 29 of this section.

Provide the Household Income and Expenses Info

Here, you should insert exhaustive information on the monthly income of your household, including the wages, unemployment allowances, pensions, interest income, social security, or life insurance payments.

Once you are done with the income rates, please proceed to fill out the gross monthly expenses of your household. The expenses normally include food, accommodation and housing, clothes, vehicles, school expenses for the minors (if applicable), taxes, debt payments, healthcare, insurance, and so on. Depending on your individual situation, fill out the respective boxes.

Insert Your Minimum Offer

Calculate your minimum Offer in Compromise for the IRS to review. Make sure to build your offer on your real paying capacity, but the offer itself should be more than zero US dollars. Otherwise, there is no point in filing this document in the first place.

Provide Other Relevant Information

The IRS might need additional information to decide on giving you the tax indebtedness deduction. If you feel like there are circumstances in your life that can influence the authority’s decision, you should definitely list them in Section 9.

It may be bankruptcy, ongoing litigation, or other legal processes. Fill in the lines that refer to your particular case.

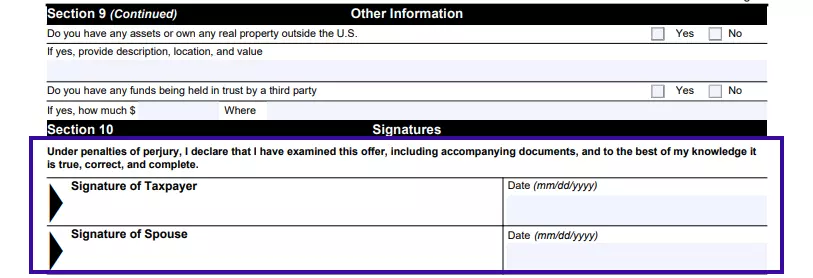

Put the Current Date and Signature

Please remember that you and your spouse have to sign the document as the sign of consent to assure the submitted information is true and accurate. Put the current calendar date next to your signature.