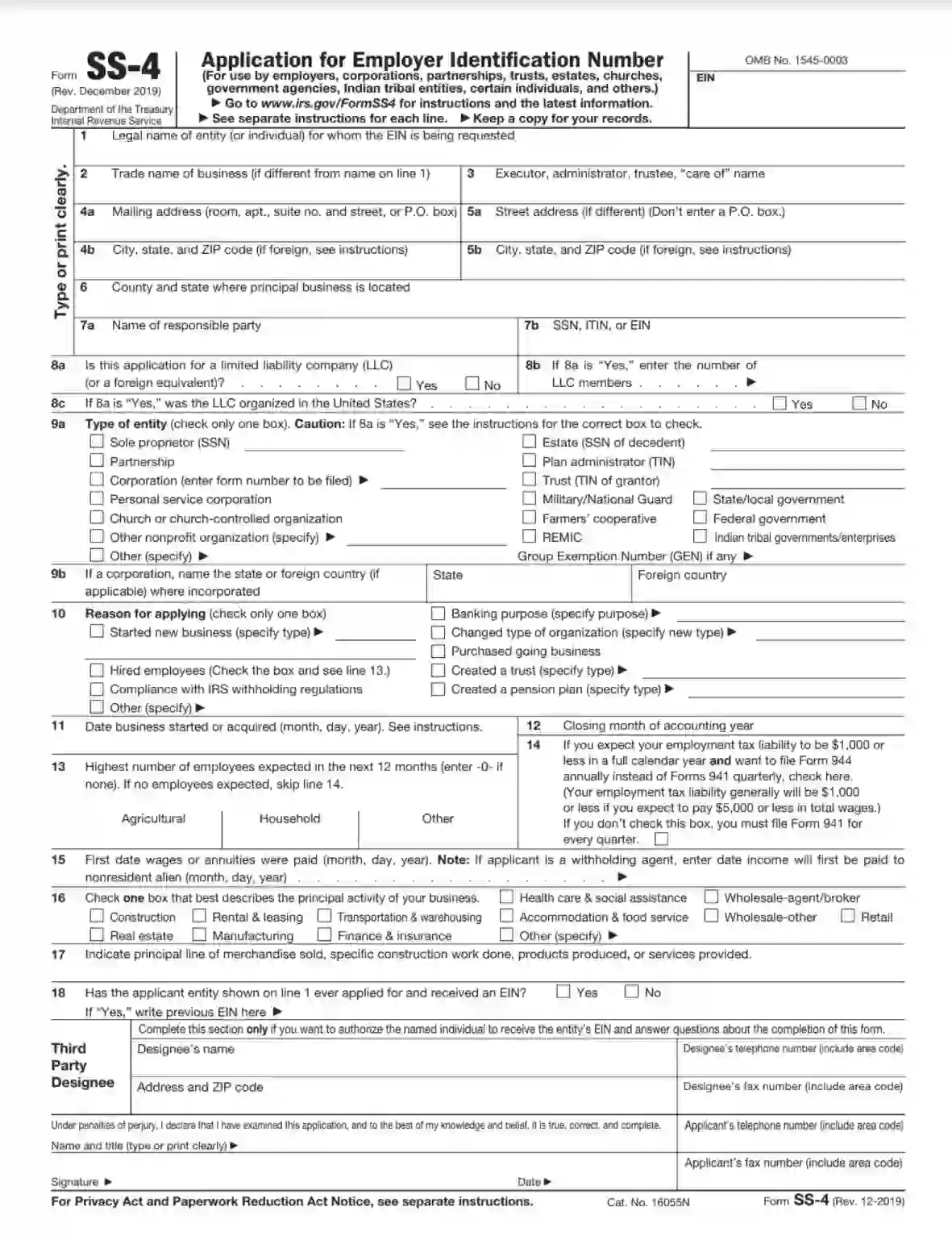

Form SS-4, titled “Application for Employer Identification Number (EIN),” is used by business entities to apply for an EIN, a unique nine-digit number assigned by the IRS. This number is used to identify a business entity and is necessary for a business to pay employees, open business bank accounts, and file tax returns.

The purpose of Form SS-4 is to streamline the process of obtaining an EIN, which is essential for handling many aspects of a business’s operations and compliance with federal tax laws. Entities that need an EIN include corporations, partnerships, sole proprietors, trusts, estates, and non-profit organizations. The form can be submitted online, by fax, or by mail, making it accessible for all business owners needing to register their new business with the IRS.

Other IRS Forms for Trusts and Estates

In order to lawfully operate in the US, businesses have to file a certain set of legal forms with the IRS. Learn what other IRS forms might be necessary for those who conduct business in the United States.

How to Fill out IRS Form SS-4

To apply for a tax identification number, the claimant needs to generate and download the latest Form SS-4. You are empowered to visit the IRS official online center or make use of our PDF template-building software. Our forms are thoroughly prepared by specialists and comply with the renewed demands. Feel free to follow the illustrated guide below and prepare the needed document with a minimum effort.

The data must be inserted in a typed or printed manner. Also, ensure to leave the EIN box at the top right corner empty for the IRS officer to fill it in.

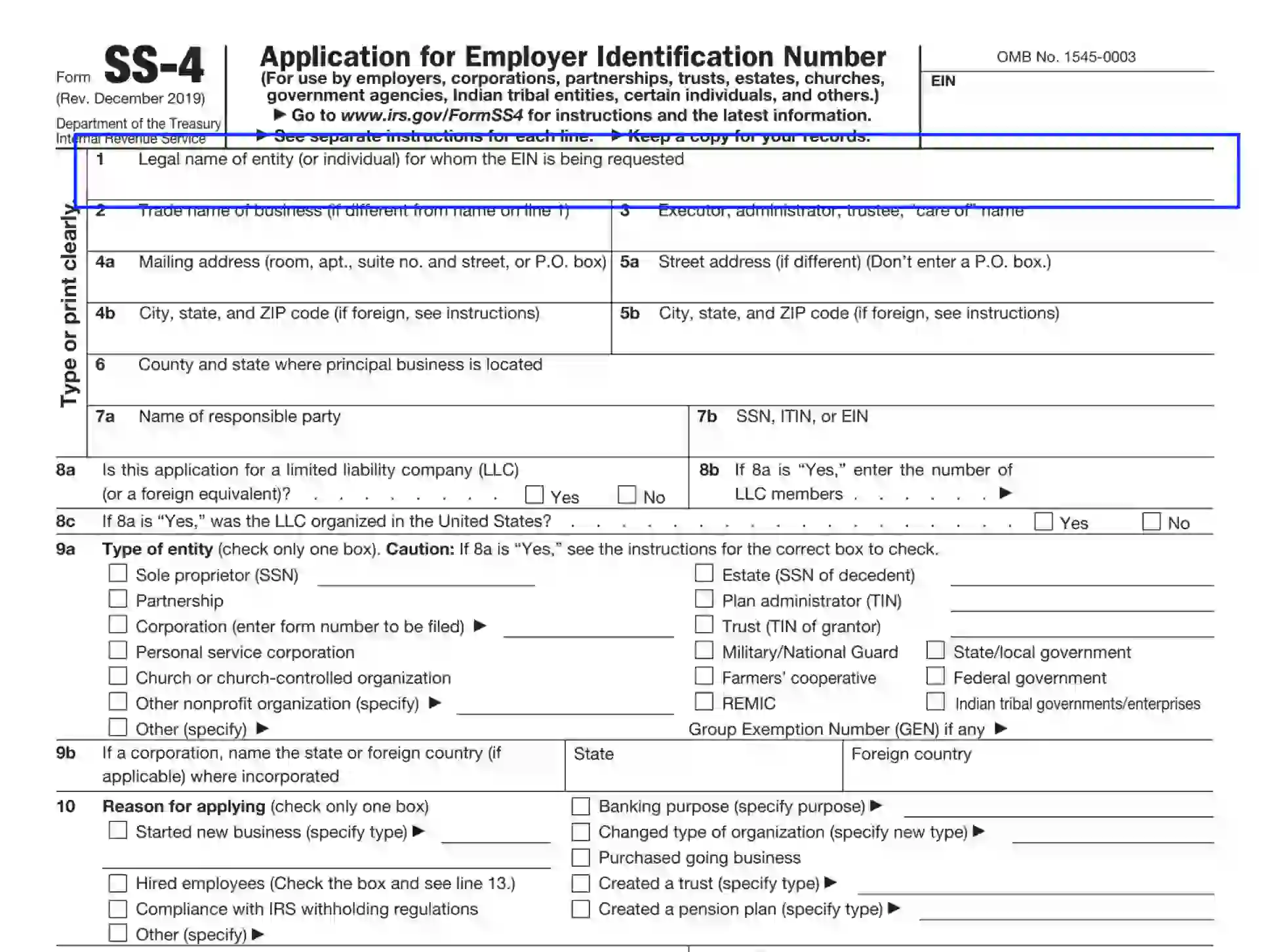

Identify the Applicant

In Unit 1, the preparer should enter the applicant’s legal name if the EIN requester is an individual. For entities, trusts, corporations, estates of the decedent, and other types of qualifying organizations, fill in the name as it is defined in the legal documentation like the trust instrument, partnership agreement, incorporation papers, and other lawfully empowered papers.

Specify the Applicant’s Business Name

In Unit 2, the preparer should define the EIN applicant’s business name if it doesn’t coincide with the info disclosed in Unit one.

Define the Executer

Section 3 requires entering the name of the individual appointed or authorized to conduct the business on behalf of the entity, trust, or individual. Therefore, enter the appropriate position for each type of EIN applicants:

- The full legal name, including the middle initials for individuals

- Trustee for the trust

- Representative or other fiduciary for estates

- The name of the “care of” specialist for business entities and corporations

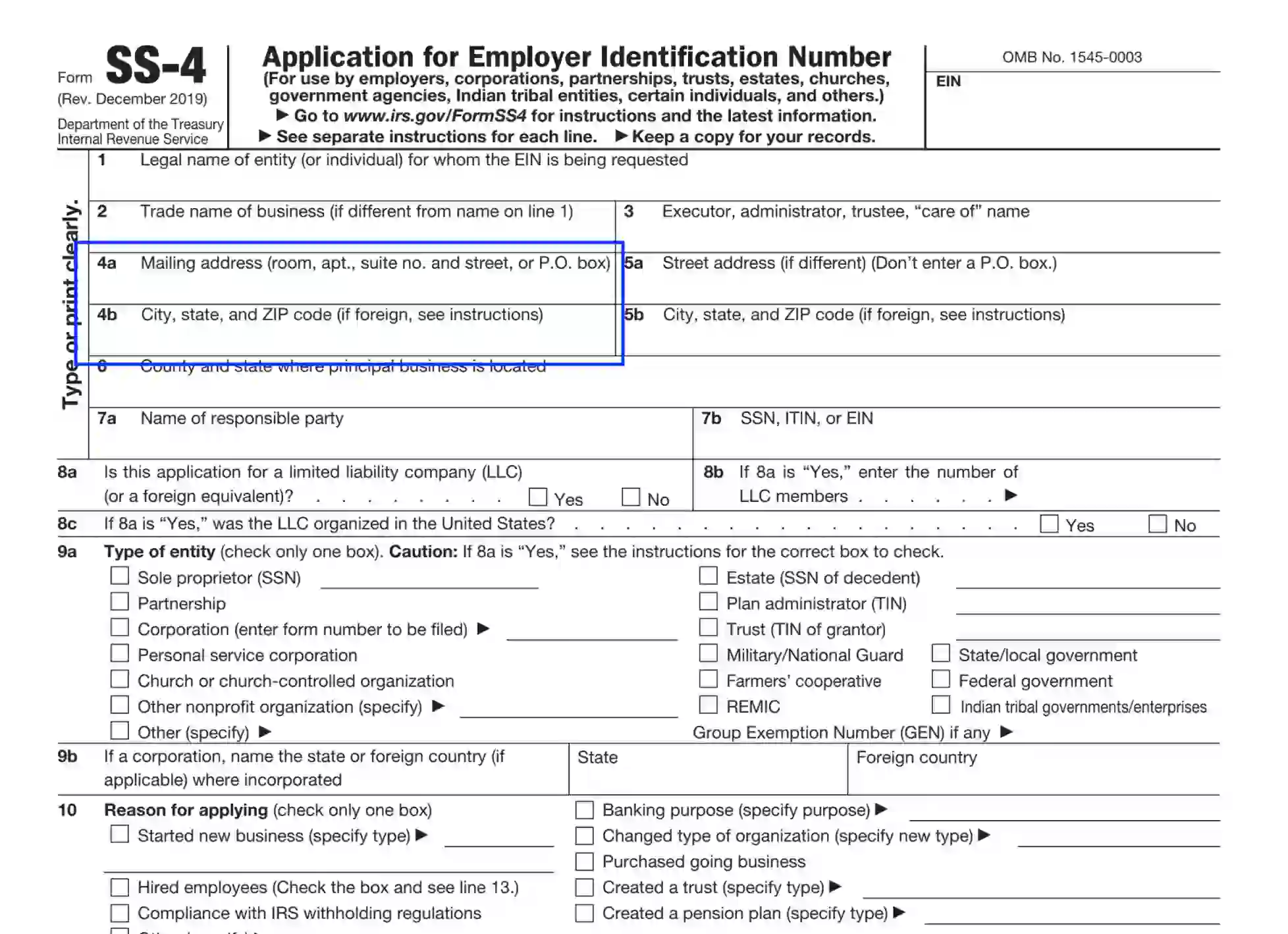

Submit the Organization’s (Proprietor’s) Mailing Address

In Units 4 (a, b), the applicant should insert the business correspondence delivery address. Disclose the room (apartment or suite) number, street, city, state, and ZIP details. If the entity uses the P. O. Box for receiving letters, provide the corresponding info.

If the business organization is located outside the US territories, also indicate the country name, province or region, and postal code. Ensure to avoid abbreviations.

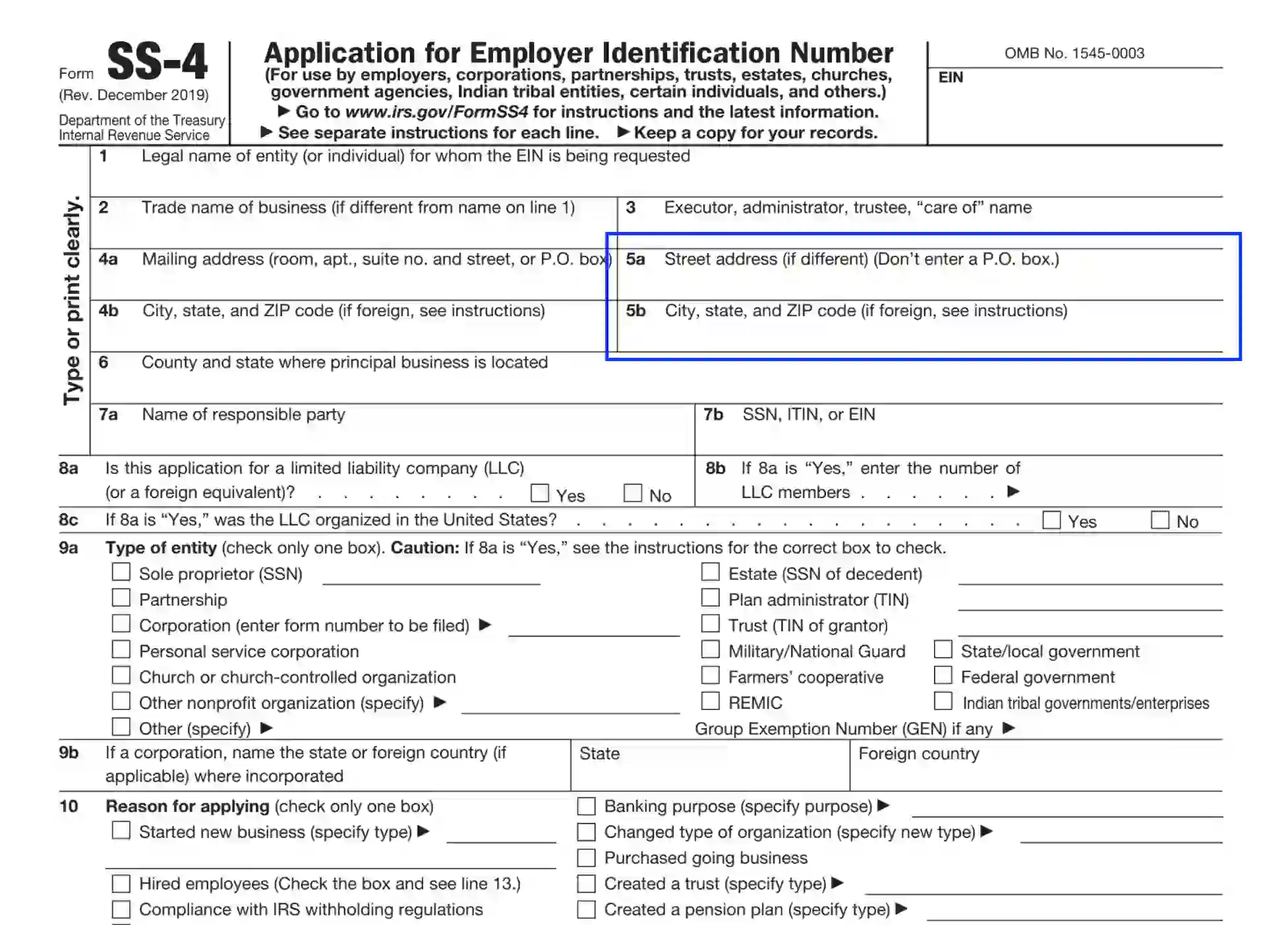

Disclose the Entity’s Physical Location

If the business has a physical address that is different from the mailing one, the preparer needs to point to the location details in Units 5 (a, b). You need to specify the street, city, state, and ZIP details. If the applicant or their business is located in a foreign territory, also include the country’s full name, region (province), and postal code.

This unit is completed if the 4 (a, b) answer differs from the physical location. Also, you are not allowed to use P. O. Box data for the physical location.

Submit the Principal Company Address

In Unit 6, the applicant should enter their principal business physical location, defining the state and the country.

Identify the Responsible Party

In Unit 7 (a, b), the preparer discloses the full legal name and tax data (SSN, EIN, or ITIN) of the responsible party who has the legitimacy to conduct and manage the entity’s assets and funds. The responsible party has a sufficient level of control to run and lead the business.

As the applicants can vary by type, each category is represented by a particular position. Here are the guidelines:

- The entity’s owner or the designated individual to control the business and direct the business property

- Principal officers for corporations

- The general partner for partnerships

- The grantor (owner or trustor) for trusts

- The executor or other fiduciary for a deceased’s estate

- Organizations that have tax exemption privileges appoint the principal offices as required by form 990.

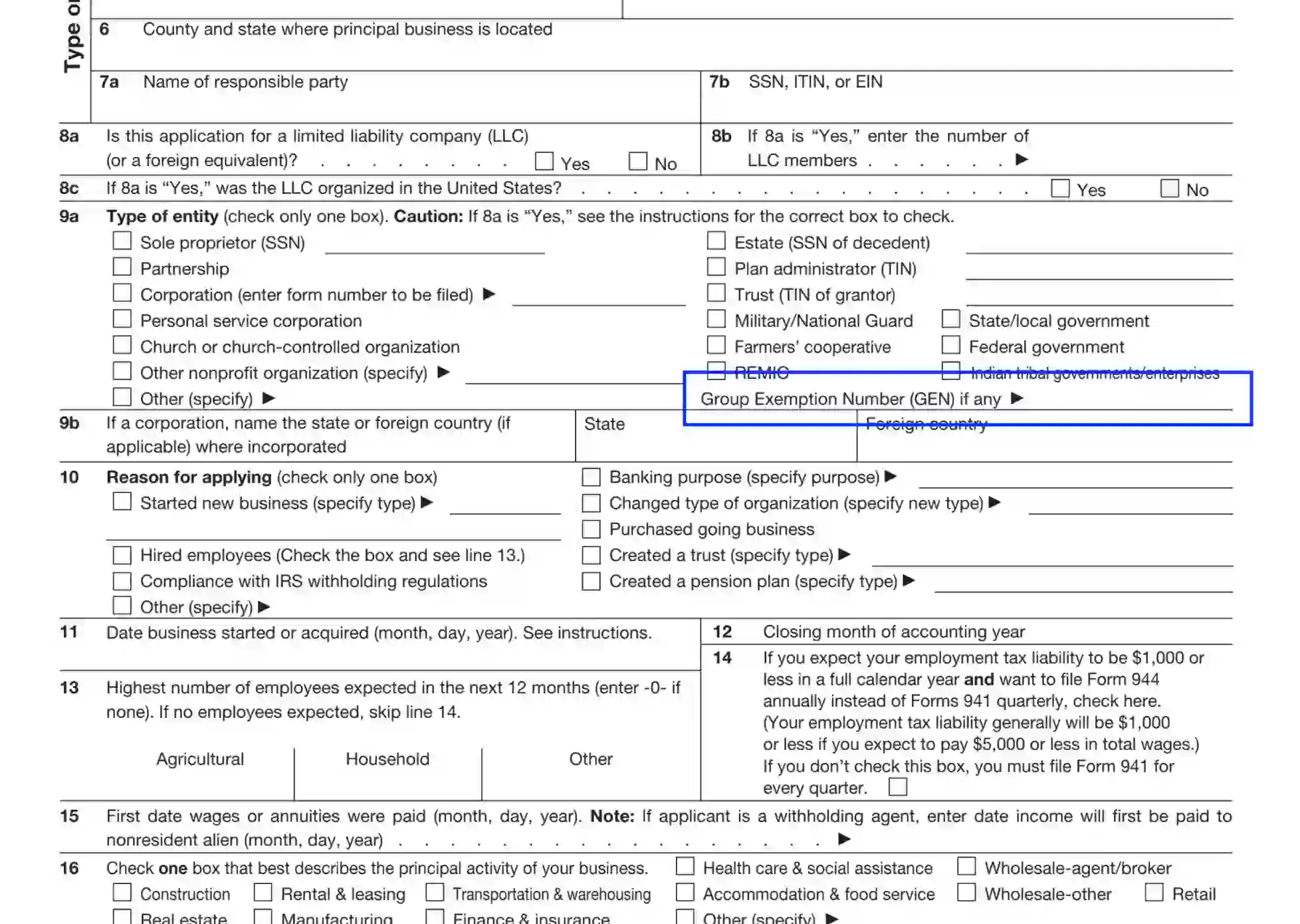

Clarify If the EIN Request Is for an LLC

In Units 8 (a, b, c), the applicant should specify if the EIN request is prepared for the LLC organization. Select between the “Yes-No” alternatives, and provide details about the number of the LLC members if answered “Yes.” Also, the claimant needs to specify the territory of the LLC’s location.

This info is important for tax purposes to understand the LLC legal status, as one-member companies are expected to disclose the revenue and losses on the owner’s tax return. Two and more-member LLCs are, on the other hand, considered partnerships that should report other types of balance forms.

Define the Business Category

In Unit 9 (a, b), the applicant should specify the type of the business. Select one box from the list provided in the section. Some alternatives require entering additional info, like SSN or TIN.

If you choose the “corporation” box, ensure to include the state or country detail where the organization was initially formed and registered.

If your business possesses a group exemption number, submit the details on the line shown below:

If you have problems identifying your entity’s type, it is recommended to visit the official IRS website for thorough instructions and assistance.

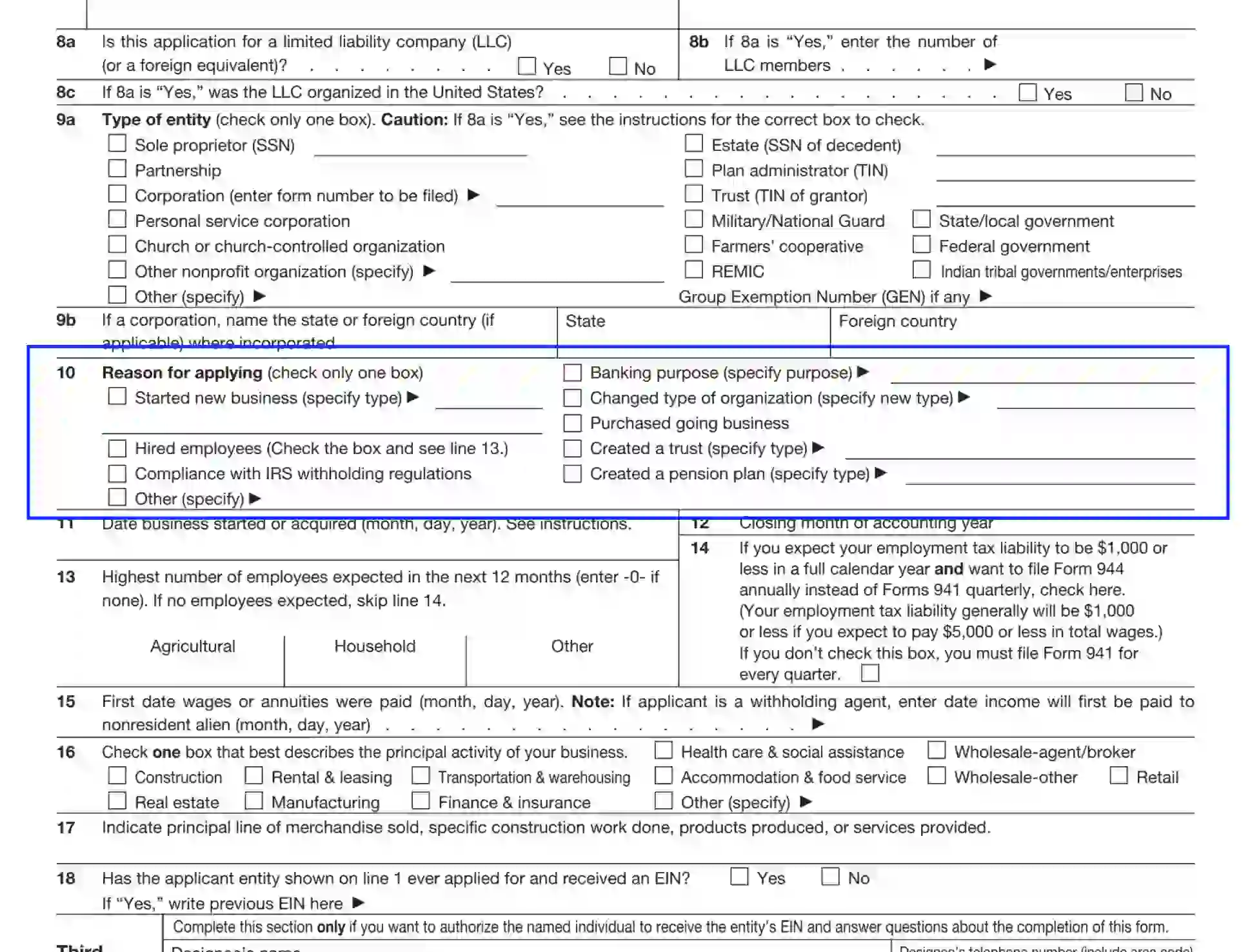

Clarify the Purposes of the Application

In Unit 10, the preparer needs to define the reasons for claiming the EIN. You are empowered to choose only one alternative from the variants given and provide additional details (where applicable) to clarify your preference.

If you select the “Hired employees” box, ensure to complete Unit 13 regarding the number and category of specialists you invite.

If you have a different reason, select the “Other” slot and clarify the purpose in an accessible format.

Define the Date of the Business Founding

In Unit 11, the applicant is expected to fill in the date in a month-day-year format when they founded the entity or trust. If the applicant bought an existing business, they need to enter the date when the company was acquired and any inherent data related to the ownership transfer or change.

For decedent estates, the applicant is empowered to enter the deceased’s date of death.

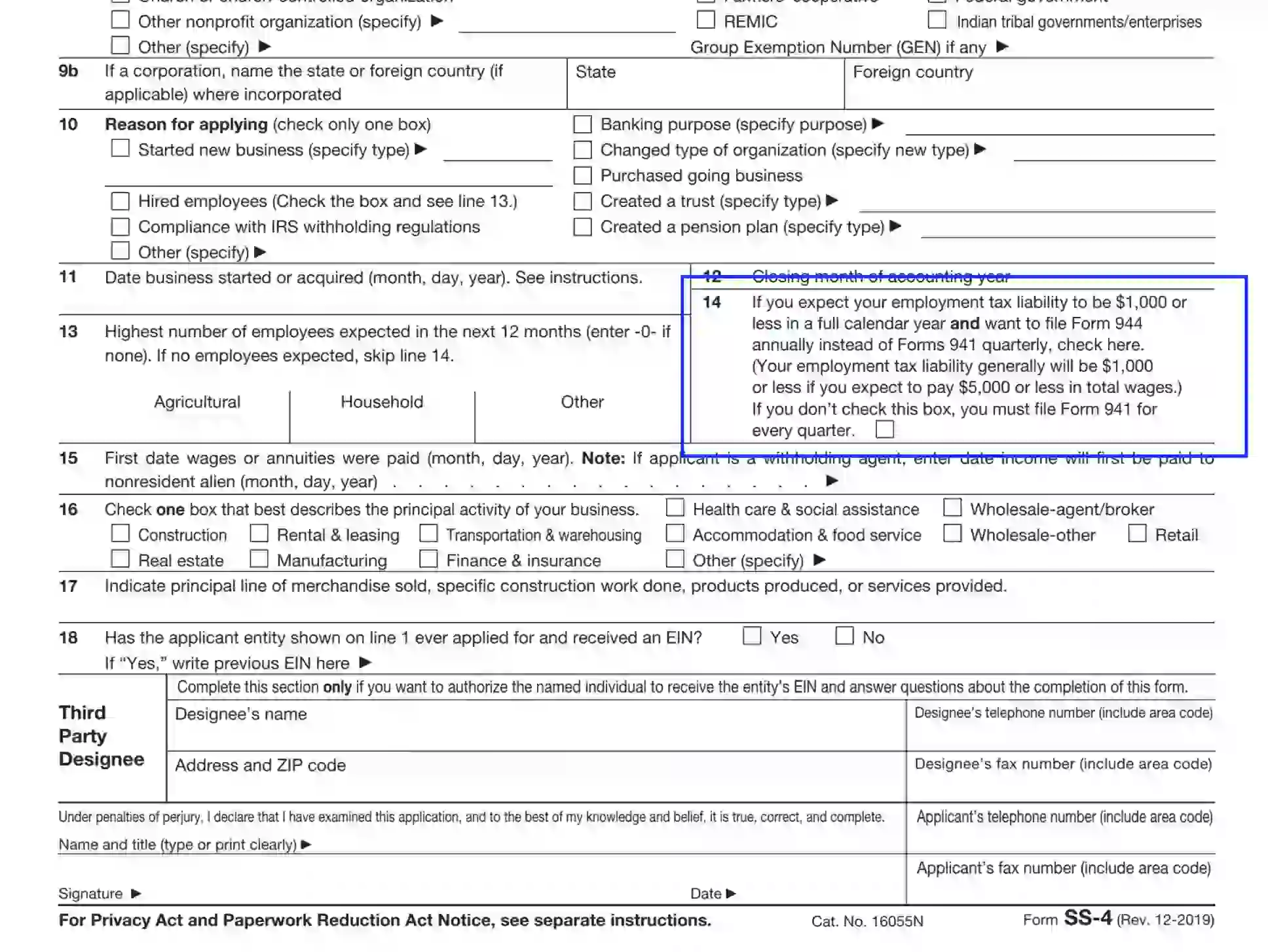

Determine the Last Month of the Entity’s Accounting Period

Use Unit 12 to provide details regarding the month when the entity’s accounting period ends annually. Traditionally, the business can select from two alternatives: a calendar year or fiscal period. The accounting year consists of 12 months following straightly. Calendar periods close on the 31 of December, while fiscal tax periods contain 12 consequent months closing on other than 31 of December.

Specify the Plans Regarding the Number of Employees

In Unit 13, the applicant is required to enter the number of potential employees they are going to hire during the upcoming year. Enter the approximate number and specify the sphere of activities.

If the business owner doesn’t plan to hire workers and other specialists, fill in “0” (zero) and leave Unit 14 blank.

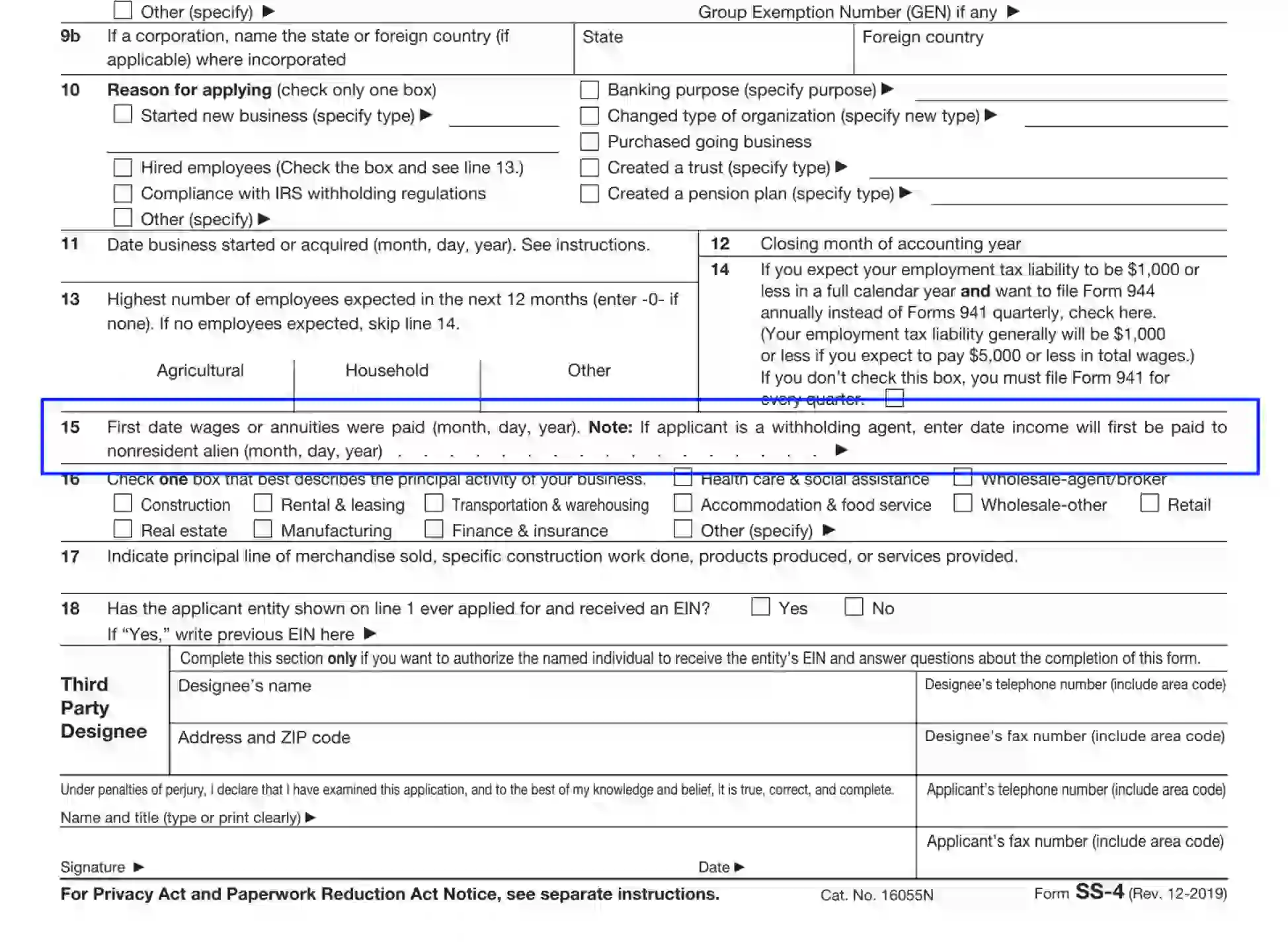

Clarify If You Plan to Prepare Form 944

Unit 14 contains info related to filing form 944. If you expect to comply with the requirements and prefer to report form 944 annually instead of the quarterly form 941, you must check the box in this section. Otherwise, the applicant will file quarterly reports by default.

Enter the Operating Date of Payments and Annuities

Complete Unit 15 to disclose the date when the first salaries, payments, and annuities were provided to the entity’s employees.

In case the business company has no workers and employees, insert “Not Applicable” on the line. Foreign employers should submit the date when they started to refund the employees within the US.

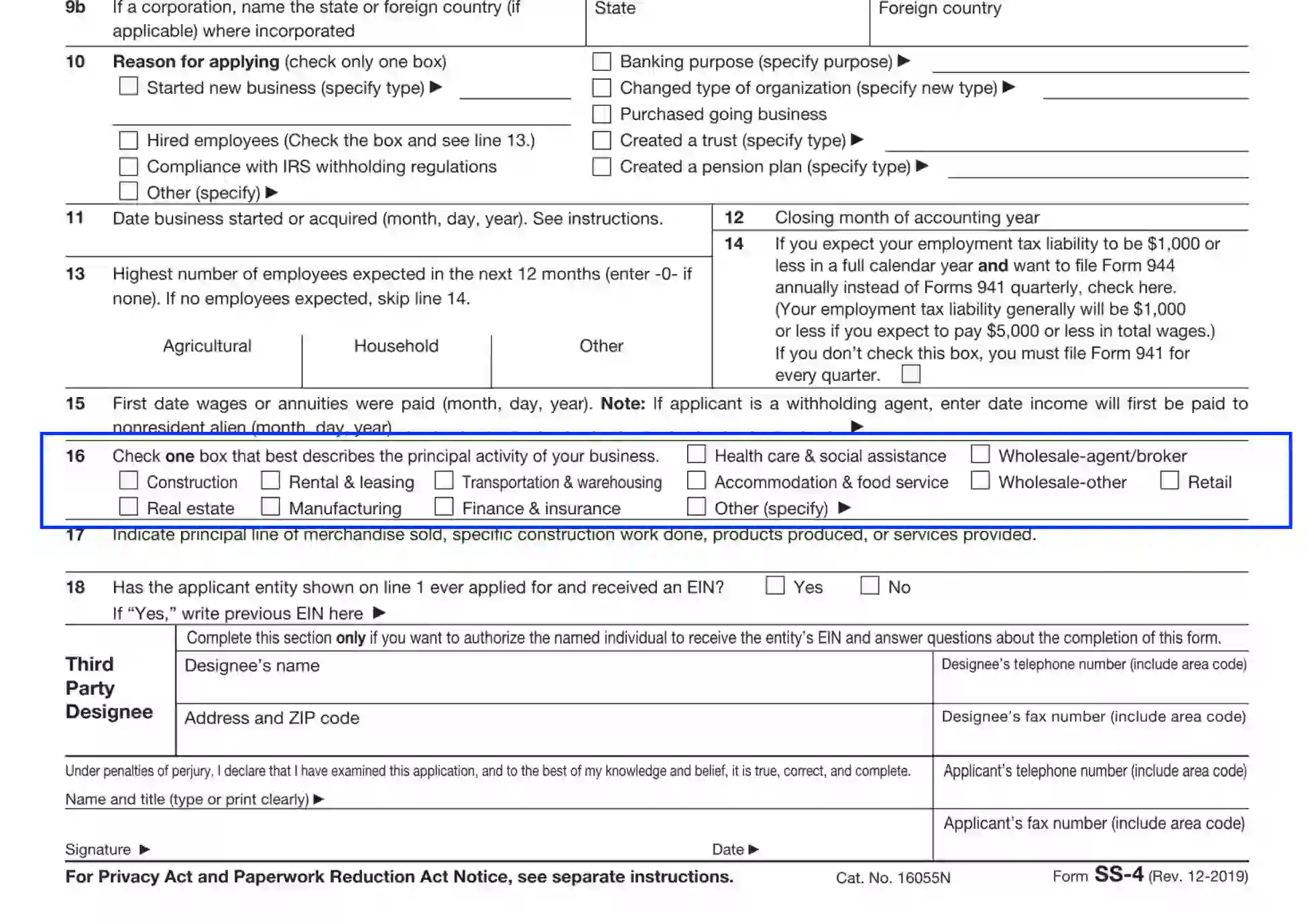

Describe the Focal Activity of the Company

In Unit 16, the applicant is empowered to define the business principal activity by choosing one alternative from the variants provided. If none is applicable, check the “Other” box and give an inherent explanation.

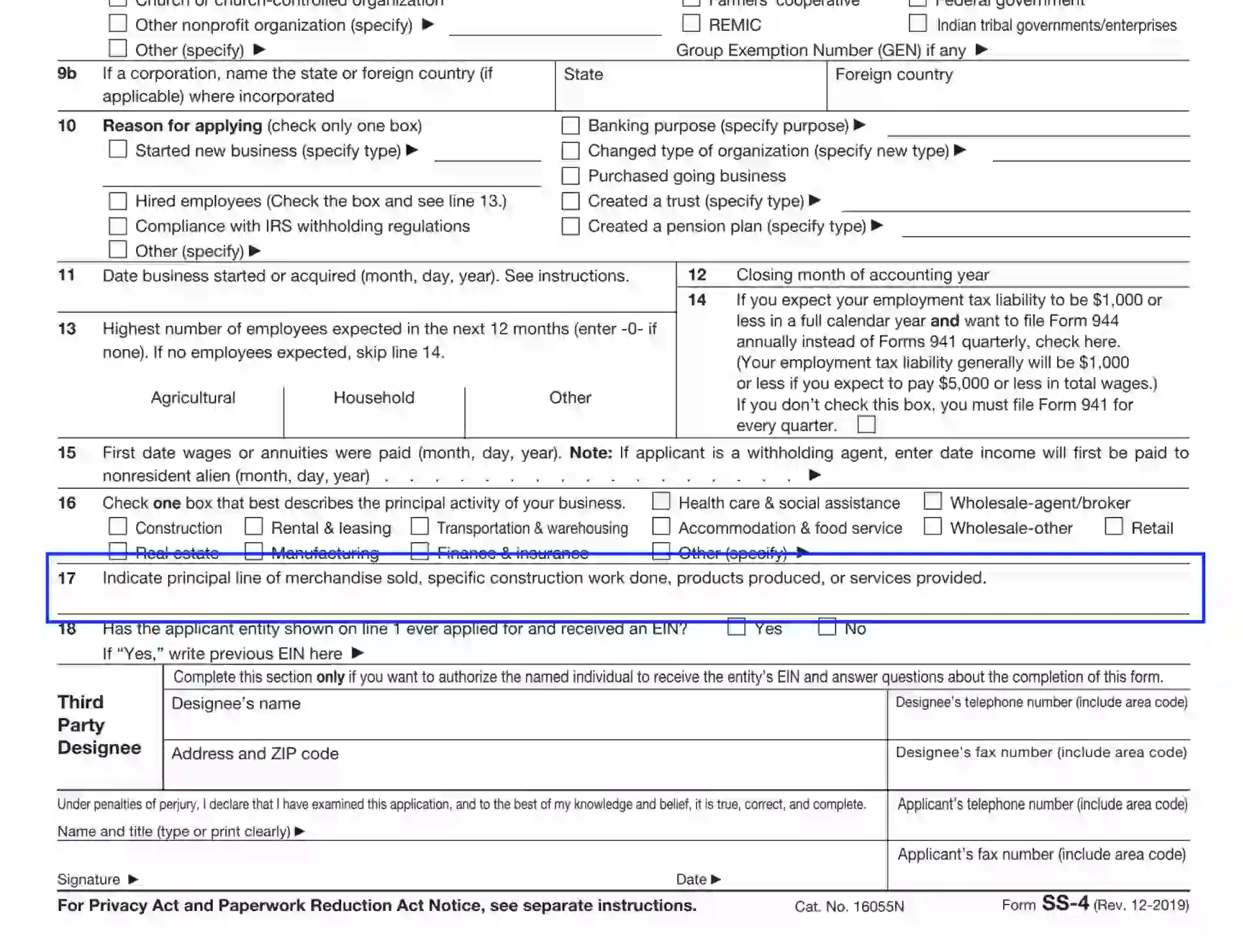

Provide More Details about the Business Activity Selected in Unit 16

Use Unit 17 to give specifications about your choice of the business activity. Enter a short description following the request.

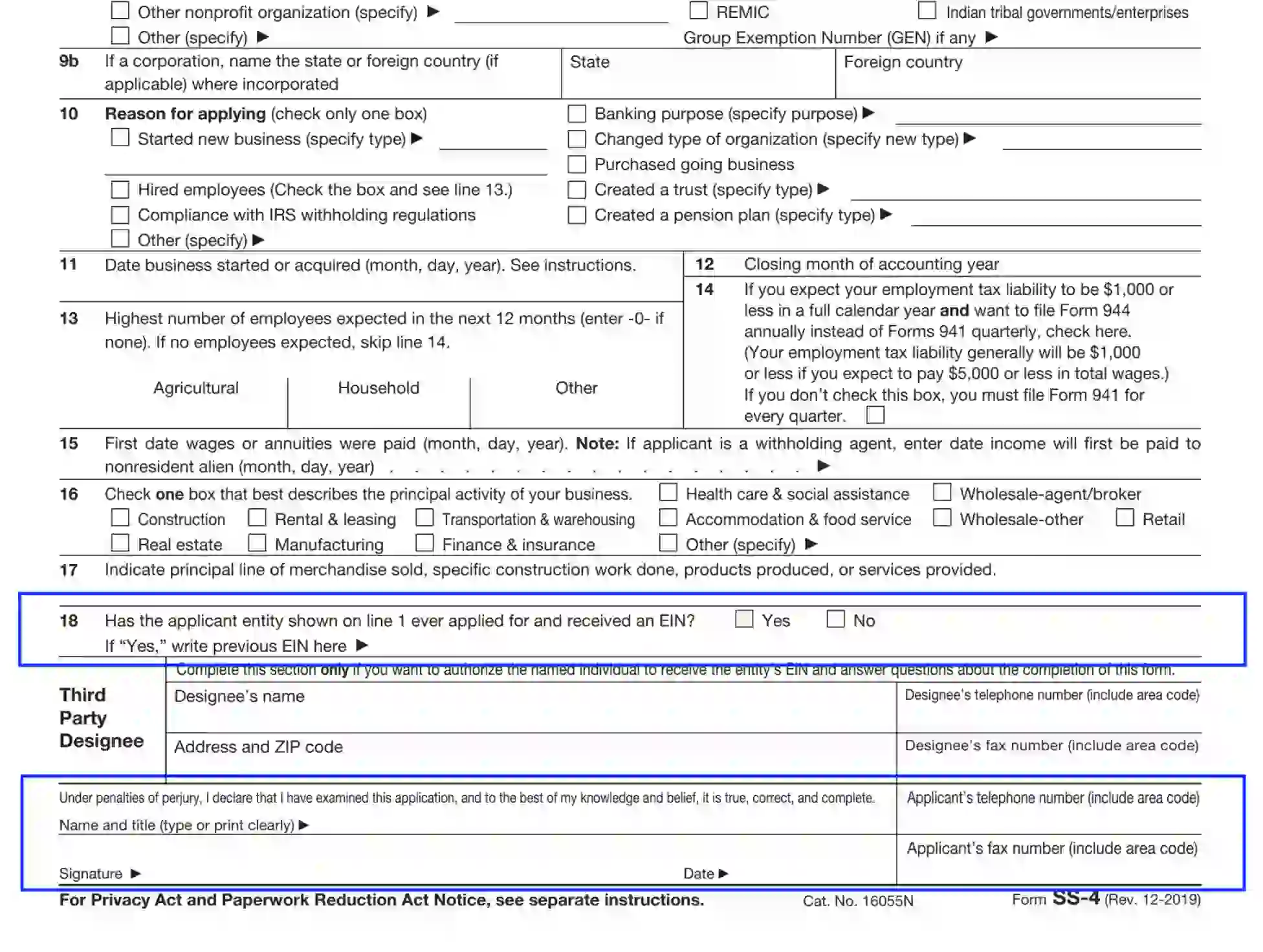

Authorize the Application

In the final Unit 18, the applicant needs to submit their consent to the data submitted and disclose the following authorization aspects:

- Legal name

- Title

- Phone and fax numbers, including the area code info

- Applicant’s signature

- Current calendar date

If the applicant or the business entity has ever applied for an employer ID number and has been assigned the EIN, check the “Yes” box and submit the details of the previous reference.

Designate an Agent (If Any)

If the applicant wishes to appoint a third party person to negotiate the SS-4 details and receive the business company’s EIN, complete the section by providing the following details:

- Appointed representative’s legal name

- Designee’s address, including the apartment, street, city, state, and ZIP

- Phone and fax details, including the area code