In the ever-evolving landscape of federal taxation, understanding the nuanced responsibilities can be a monumental task for entities navigating the IRS's requirements. Among the myriad of forms and regulations, Form 945-A stands out as a crucial document for those engaging with nonpayroll income tax withholdings. As revised in October 1995 by the Department of the Treasury, this form serves as an annual record of federal tax liability, specifically designed to be filed alongside Forms 945 or CT-1. It meticulously records tax liabilities on a day-to-day basis, catering to semimonthly schedule depositors and enveloping nonpayroll transactions such as backup withholdings, pensions, annuities, IRAs, Indian gaming profits, and gambling winnings. Crucially, Form 945-A also plays a pivotal role for entities reporting on Form CT-1, related to railroad retirement tax returns, guiding through additional reporting mandates. Beyond its primary function, the form acts as a linchpin for the IRS to synchronize an entity's reported tax liabilities with deposits made, ensuring timely and accurate tax collection. Detailed within its structure are provisions for adjustments, allowing rectification of administrative errors, highlighting the form’s role beyond mere reporting but as a tool for maintaining fiscal accuracy and compliance. In essence, adherence to accurately completing and submitting Form 945-A is not only a statutory obligation but a testament to an entity's commitment to upholding the integrity of its financial duties under United States tax law.

| Question | Answer |

|---|---|

| Form Name | 10 95 Form |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | CT-1, subtotals, 10 95 tax form, Semiweekly |

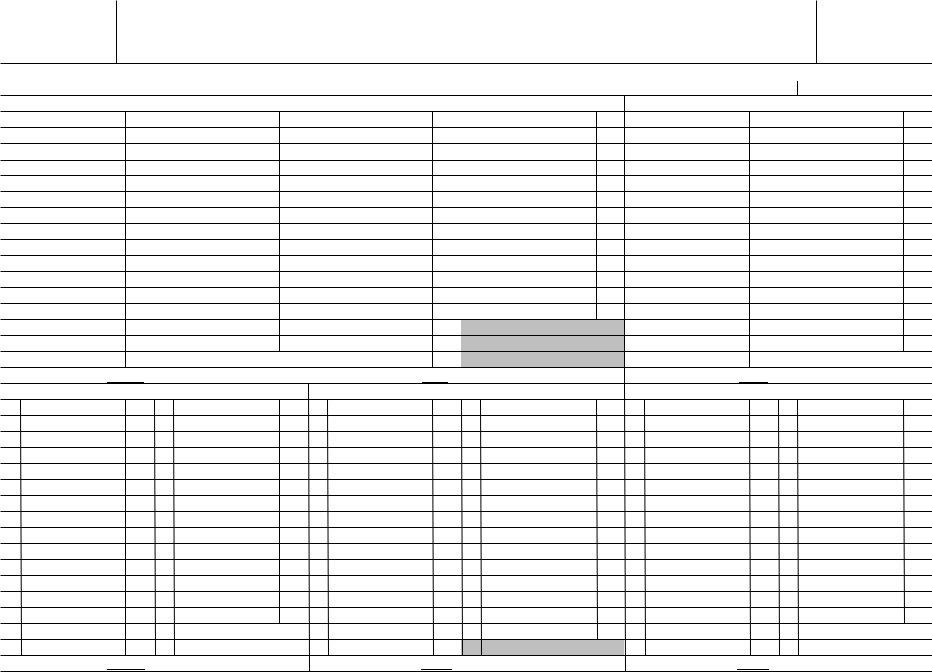

Form

(Rev. October 1995)

Department of the Treasury Internal Revenue Service

Annual Record of Federal Tax Liability

▶ File with Forms 945 or

5555

OMB No.

Name as shown on Form 945 or

|

January tax liability |

|||

1 |

|

|

17 |

|

2 |

|

|

18 |

|

3 |

|

|

19 |

|

4 |

|

|

20 |

|

5 |

|

|

21 |

|

6 |

|

|

22 |

|

7 |

|

|

23 |

|

8 |

|

|

24 |

|

9 |

|

|

25 |

|

10 |

|

|

26 |

|

11 |

|

|

27 |

|

12 |

|

|

28 |

|

13 |

|

|

29 |

|

14 |

|

|

30 |

|

15 |

|

|

31 |

|

16 |

|

|

|

|

(A) Total for month |

▶ |

|||

|

|

April tax liability |

||

1 |

|

17 |

|

|

2 |

|

18 |

|

|

3 |

|

19 |

|

|

4 |

|

20 |

|

|

5 |

|

21 |

|

|

6 |

|

22 |

|

|

7 |

|

23 |

|

|

8 |

|

24 |

|

|

9 |

|

25 |

|

|

10 |

|

26 |

|

|

11 |

|

27 |

|

|

12 |

|

28 |

|

|

13 |

|

29 |

|

|

14 |

|

30 |

|

|

15 |

|

|

|

|

16 |

|

|

|

|

(D) Total for month |

▶ |

|||

|

February tax liability |

|||

1 |

|

|

17 |

|

2 |

|

|

18 |

|

3 |

|

|

19 |

|

4 |

|

|

20 |

|

5 |

|

|

21 |

|

6 |

|

|

22 |

|

7 |

|

|

23 |

|

8 |

|

|

24 |

|

9 |

|

|

25 |

|

10 |

|

|

26 |

|

11 |

|

|

27 |

|

12 |

|

|

28 |

|

13 |

|

|

29 |

|

14 |

|

|

|

|

15 |

|

|

|

|

16 |

|

|

|

|

(B) Total for month |

▶ |

|||

|

|

May tax liability |

||

1 |

|

17 |

|

|

2 |

|

18 |

|

|

3 |

|

19 |

|

|

4 |

|

20 |

|

|

5 |

|

21 |

|

|

6 |

|

22 |

|

|

7 |

|

23 |

|

|

8 |

|

24 |

|

|

9 |

|

25 |

|

|

10 |

|

26 |

|

|

11 |

|

27 |

|

|

12 |

|

28 |

|

|

13 |

|

29 |

|

|

14 |

|

30 |

|

|

15 |

|

31 |

|

|

16 |

|

|

|

|

(E) Total for month |

▶ |

|||

|

|

Employer identification number |

||

|

|

|

||

|

March tax liability |

|||

1 |

|

|

17 |

|

2 |

|

|

18 |

|

3 |

|

|

19 |

|

4 |

|

|

20 |

|

5 |

|

|

21 |

|

6 |

|

|

22 |

|

7 |

|

|

23 |

|

8 |

|

|

24 |

|

9 |

|

|

25 |

|

10 |

|

|

26 |

|

11 |

|

|

27 |

|

12 |

|

|

28 |

|

13 |

|

|

29 |

|

14 |

|

|

30 |

|

15 |

|

|

31 |

|

16 |

|

|

|

|

(C) Total for month |

▶ |

|||

|

June tax liability |

|||

1 |

|

17 |

|

|

2 |

|

18 |

|

|

3 |

|

19 |

|

|

4 |

|

20 |

|

|

5 |

|

21 |

|

|

6 |

|

22 |

|

|

7 |

|

23 |

|

|

8 |

|

24 |

|

|

9 |

|

25 |

|

|

10 |

|

26 |

|

|

11 |

|

27 |

|

|

12 |

|

28 |

|

|

13 |

|

29 |

|

|

14 |

|

30 |

|

|

15 |

|

|

|

|

16 |

|

|

|

|

(F) Total for month |

▶ |

|||

Cat. No. 14733M |

Form |

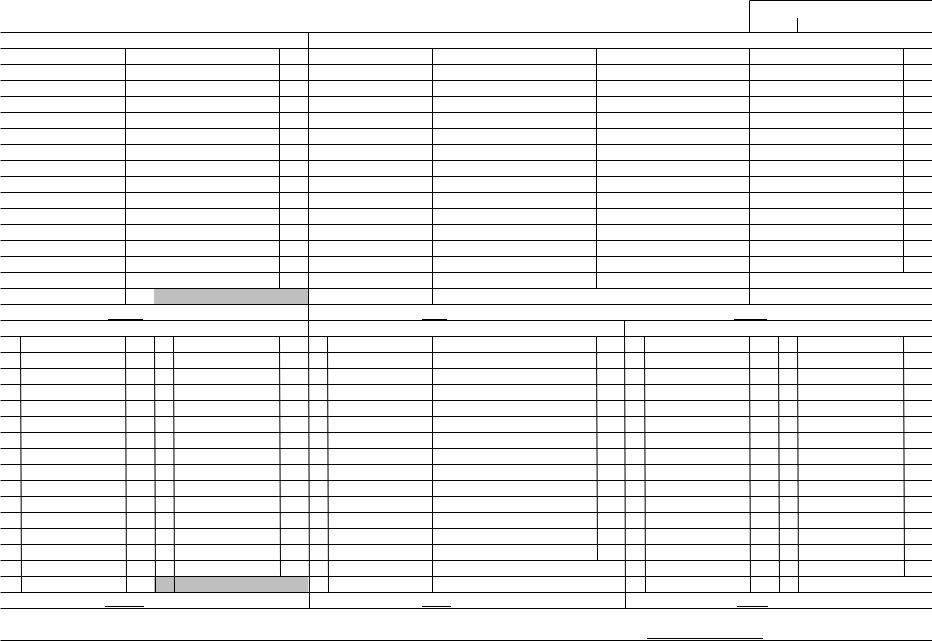

Annual Record of Federal Tax Liability

(continued)

Form

Page 2

Employer identification number

|

|

July tax liability |

||

1 |

|

|

17 |

|

2 |

|

|

18 |

|

3 |

|

|

19 |

|

4 |

|

|

20 |

|

5 |

|

|

21 |

|

6 |

|

|

22 |

|

7 |

|

|

23 |

|

8 |

|

|

24 |

|

9 |

|

|

25 |

|

10 |

|

|

26 |

|

11 |

|

|

27 |

|

12 |

|

|

28 |

|

13 |

|

|

29 |

|

14 |

|

|

30 |

|

15 |

|

|

31 |

|

16 |

|

|

|

|

(G) Total for month |

▶ |

|||

|

October tax liability |

|||

1 |

|

17 |

|

|

2 |

|

18 |

|

|

3 |

|

19 |

|

|

4 |

|

20 |

|

|

5 |

|

21 |

|

|

6 |

|

22 |

|

|

7 |

|

23 |

|

|

8 |

|

24 |

|

|

9 |

|

25 |

|

|

10 |

|

26 |

|

|

11 |

|

27 |

|

|

12 |

|

28 |

|

|

13 |

|

29 |

|

|

14 |

|

30 |

|

|

15 |

|

31 |

|

|

16 |

|

|

|

|

(J) Total for month |

▶ |

|||

|

August tax liability |

|

September tax liability |

|||||||

1 |

|

|

17 |

|

1 |

|

|

17 |

|

|

2 |

|

|

18 |

|

2 |

|

|

18 |

|

|

3 |

|

|

19 |

|

3 |

|

|

19 |

|

|

4 |

|

|

20 |

|

4 |

|

|

20 |

|

|

5 |

|

|

21 |

|

5 |

|

|

21 |

|

|

6 |

|

|

22 |

|

6 |

|

|

22 |

|

|

7 |

|

|

23 |

|

7 |

|

|

23 |

|

|

8 |

|

|

24 |

|

8 |

|

|

24 |

|

|

9 |

|

|

25 |

|

9 |

|

|

25 |

|

|

10 |

|

|

26 |

|

10 |

|

|

26 |

|

|

11 |

|

|

27 |

|

11 |

|

|

27 |

|

|

12 |

|

|

28 |

|

12 |

|

|

28 |

|

|

13 |

|

|

29 |

|

13 |

|

|

29 |

|

|

14 |

|

|

30 |

|

14 |

|

|

30 |

|

|

15 |

|

|

31 |

|

15 |

|

|

|

|

|

16 |

|

|

|

|

16 |

|

|

|

|

|

(H) Total for month |

▶ |

(I) Total for month |

▶ |

|||||||

|

November tax liability |

|

December tax liability |

|||||||

1 |

|

|

17 |

|

1 |

|

17 |

|

|

|

2 |

|

|

18 |

|

2 |

|

18 |

|

|

|

3 |

|

|

19 |

|

3 |

|

19 |

|

|

|

4 |

|

|

20 |

|

4 |

|

20 |

|

|

|

5 |

|

|

21 |

|

5 |

|

21 |

|

|

|

6 |

|

|

22 |

|

6 |

|

22 |

|

|

|

7 |

|

|

23 |

|

7 |

|

23 |

|

|

|

8 |

|

|

24 |

|

8 |

|

24 |

|

|

|

9 |

|

|

25 |

|

9 |

|

25 |

|

|

|

10 |

|

|

26 |

|

10 |

|

26 |

|

|

|

11 |

|

|

27 |

|

11 |

|

27 |

|

|

|

12 |

|

|

28 |

|

12 |

|

28 |

|

|

|

13 |

|

|

29 |

|

13 |

|

29 |

|

|

|

14 |

|

|

30 |

|

14 |

|

30 |

|

|

|

15 |

|

|

|

|

15 |

|

31 |

|

|

|

16 |

|

|

|

|

16 |

|

|

|

|

|

(K) Total for month |

▶ |

(L) Total for month |

▶ |

|||||||

(M) Total tax liability for year (add lines (A) through (L)). This should equal line 4 on Form 945 (or line 18 on Form |

▶ |

Form |

Page 3 |

Paperwork Reduction Act

The time needed to complete and file this form will vary depending on individual circumstances. The estimated average time is:

Recordkeeping |

8 hr., 37 min. |

Preparing and sending |

|

the form to the IRS |

8 min. |

If you have comments concerning the accuracy of these time estimates or suggestions for making this form simpler, we would be happy to hear from you. You can write to the IRS at the address listed in the instructions of the tax return with which this form is filed.

General Instructions

Purpose of

Note: Form

Who must

Deposit withheld income tax (including backup withholding) with an authorized financial institution or the Federal Reserve bank or branch that serves your area. Include Form 8109, Federal Tax Deposit Coupon, with each deposit. Please see the instructions in the front of the coupon book for more information.

Specific Instructions

If you are required to report your tax liabilities on Form

Each numbered space on Form

Example A. Company A, which has a semiweekly deposit schedule, makes periodic payments on gambling winnings on the 15th day of each month. On December 20, 1995, in addition to its periodic payments, it withheld from a payment on gambling winnings under the backup withholding rules. Since Company A is a semiweekly schedule depositor, it must record these nonpayroll withholding liabilities on Form

Example B. Company B is a semiweekly schedule depositor. During January, it withheld income tax on pension distributions as follows: $52,000 on January 13; $35,000 on January 27. Since Company B is a semiweekly schedule depositor, it must record its income tax withholding liabilities on Form

Example C. Because Company C is a new business, it is a monthly schedule depositor for 1995. During January, it withheld income tax on nonpayroll payments as follows: $2,000 on January 13; $99,000 on January 27. The deposit rules require that a monthly schedule depositor begin depositing on a semiweekly deposit schedule when a $100,000 or more tax liability is accumulated on any day within a deposit period (see section 11 of Circular E for details). Since Company C accumulated $101,000 ($2,000 + $99,000) on January 27, 1995, it became a semiweekly schedule depositor. Company C must complete Form

If the adjustment decreases your current liability, use the adjustment amount as a credit to offset subsequent liabilities until it is used up. For example, on January 10, 1995, Company D discovered that a mathematical error was made on a prior period return, resulting in a $10,000 overstatement of nonpayroll income tax withholding. Since the correct amounts were withheld and reported on Forms

Printed on recycled paper