By using the online editor for PDFs by FormsPal, you can fill out or modify 2019 schedule c fillable form here and now. We at FormsPal are committed to providing you with the ideal experience with our tool by regularly adding new capabilities and improvements. Our tool has become much more useful thanks to the most recent updates! So now, filling out PDF files is simpler and faster than ever before. With just several basic steps, you'll be able to begin your PDF editing:

Step 1: Hit the "Get Form" button above. It will open up our pdf tool so you can start filling out your form.

Step 2: The tool offers you the ability to modify your PDF file in various ways. Improve it by writing personalized text, adjust existing content, and place in a signature - all manageable in minutes!

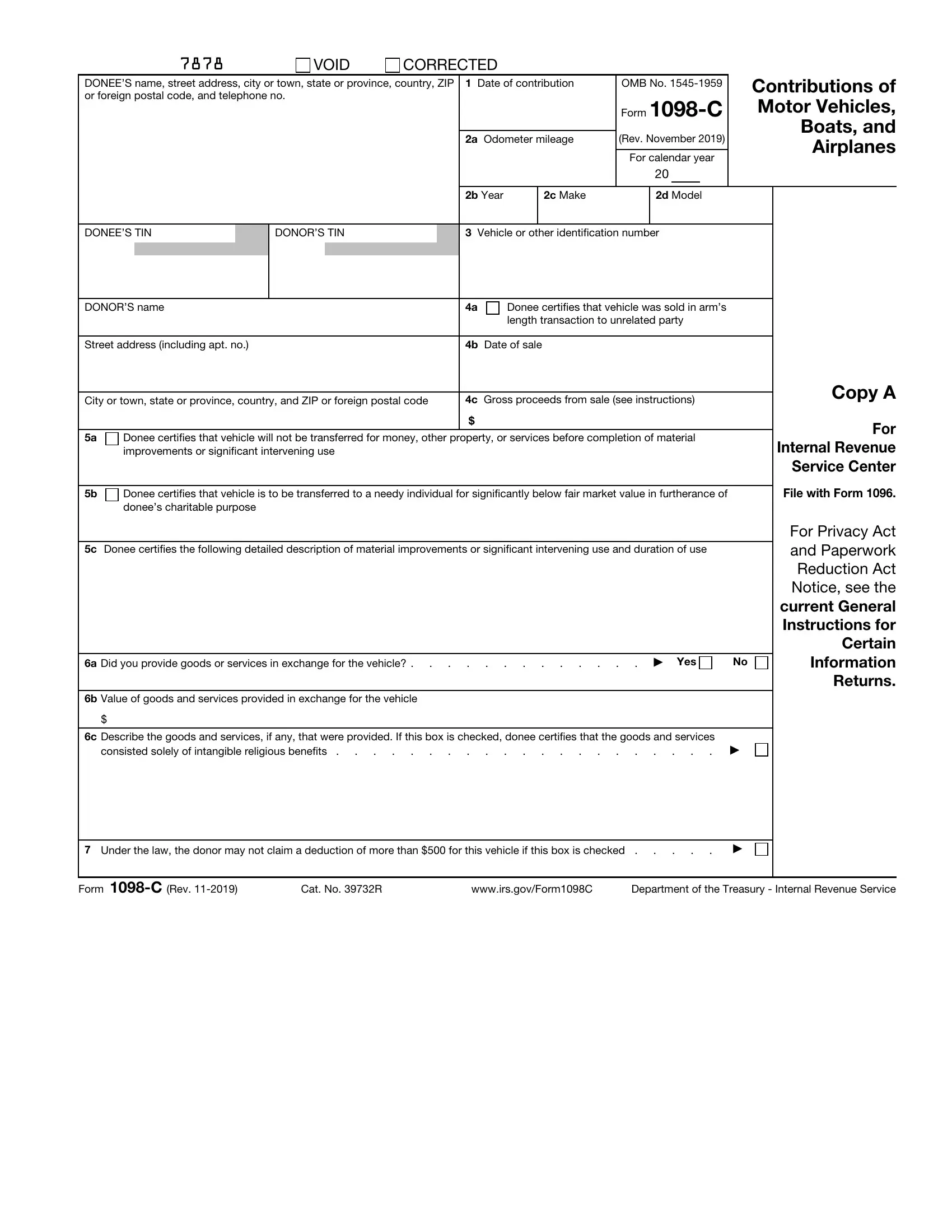

As for the fields of this particular document, here is what you should do:

1. First of all, while filling in the 2019 schedule c fillable form, beging with the section with the following blank fields:

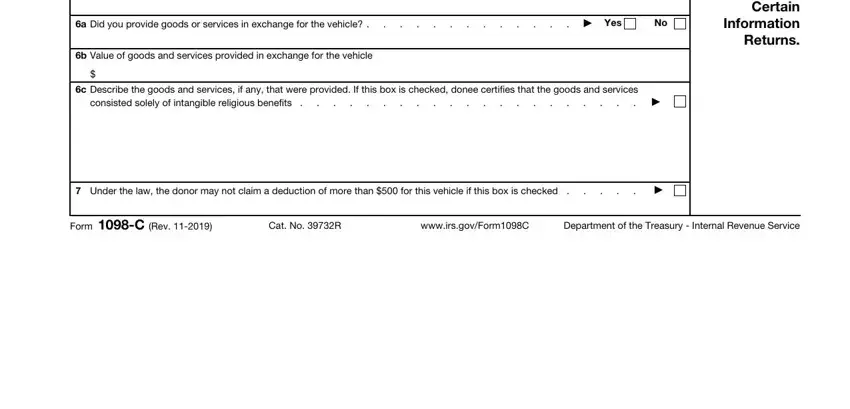

2. Once your current task is complete, take the next step – fill out all of these fields - a Did you provide goods or, Yes, b Value of goods and services, c Describe the goods and services, consisted solely of intangible, For Privacy Act and Paperwork, Under the law the donor may not, Form C Rev , Cat No R, wwwirsgovFormC, and Department of the Treasury with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

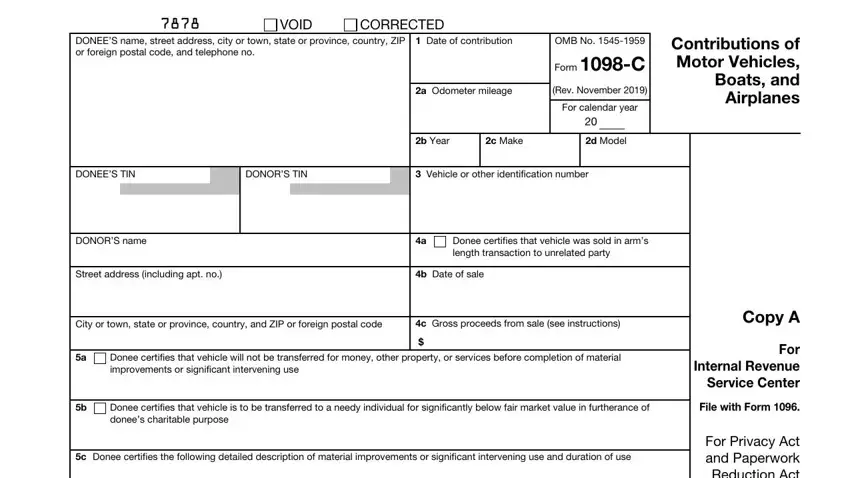

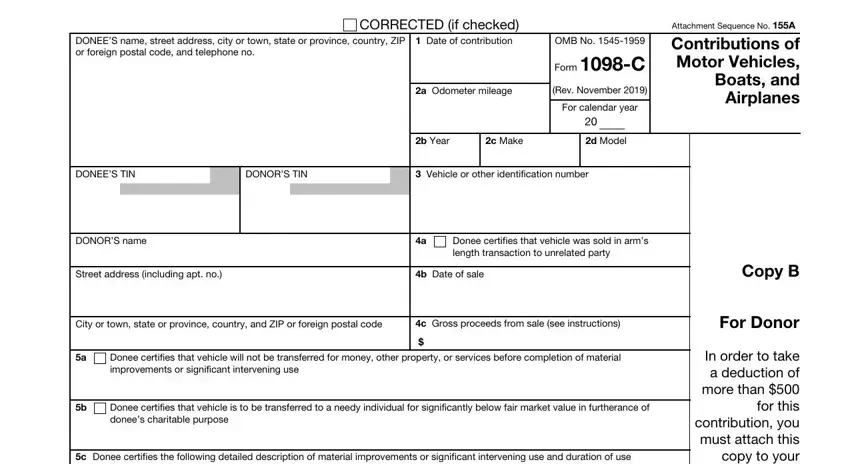

3. This subsequent part is considered relatively easy, DONEES name street address city or, CORRECTED if checked Date of, OMB No Form C, a Odometer mileage, Rev November , For calendar year, b Year, c Make, d Model, DONEES TIN, DONORS TIN, Vehicle or other identification, DONORS name, Donee certifies that vehicle was, and Street address including apt no - each one of these form fields will need to be filled out here.

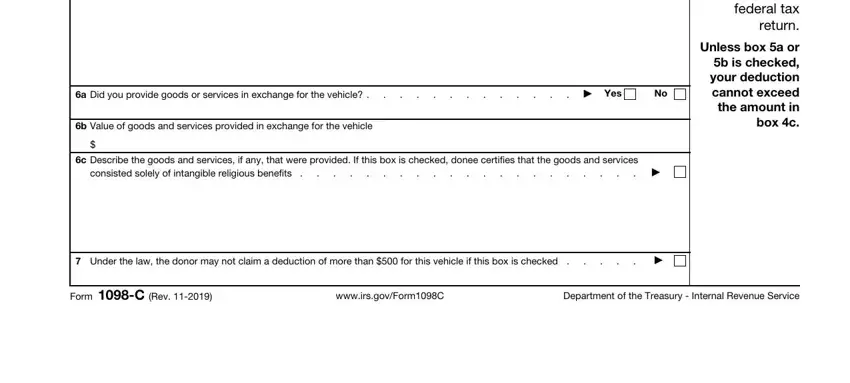

4. It is time to fill in this next section! In this case you have all these a Did you provide goods or, Yes, b Value of goods and services, c Describe the goods and services, consisted solely of intangible, In order to take a deduction of, Unless box a or b is checked your, Under the law the donor may not, Form C Rev , wwwirsgovFormC, and Department of the Treasury blank fields to complete.

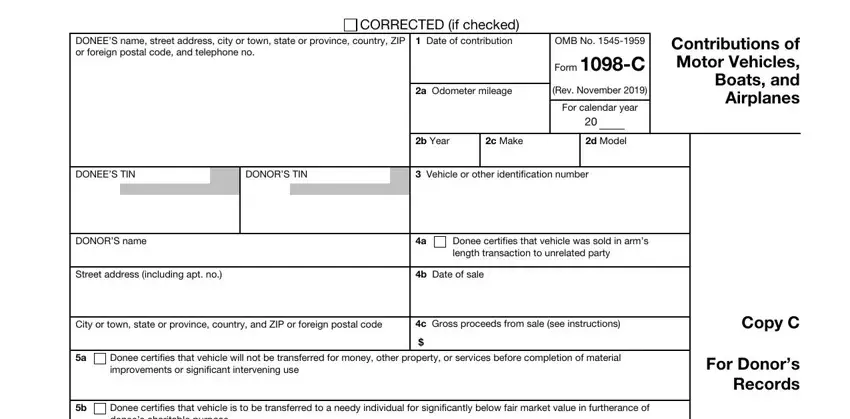

5. To finish your form, this final segment features a number of additional fields. Entering DONEES name street address city or, CORRECTED if checked Date of, OMB No Form C, a Odometer mileage, Rev November , For calendar year, b Year, c Make, d Model, DONEES TIN, DONORS TIN, Vehicle or other identification, DONORS name, Donee certifies that vehicle was, and Street address including apt no should conclude the process and you will be done before you know it!

Those who work with this document often make mistakes when completing Donee certifies that vehicle was in this area. Be sure you re-examine everything you enter here.

Step 3: When you've glanced through the details you filled in, simply click "Done" to complete your form at FormsPal. Grab your 2019 schedule c fillable form once you sign up at FormsPal for a free trial. Readily view the form within your FormsPal account, along with any edits and changes all saved! FormsPal offers secure form completion without personal data recording or distributing. Rest assured that your information is in good hands here!