1127a can be filled in without difficulty. Just make use of FormsPal PDF editor to accomplish the job right away. The editor is continually upgraded by our staff, receiving handy features and turning out to be greater. To start your journey, take these basic steps:

Step 1: Firstly, access the pdf editor by pressing the "Get Form Button" above on this page.

Step 2: With our online PDF file editor, it is easy to do more than simply complete blanks. Try all the functions and make your documents appear perfect with custom text added, or tweak the original content to excellence - all accompanied by the capability to insert stunning pictures and sign it off.

It is an easy task to complete the document adhering to this helpful tutorial! Here's what you must do:

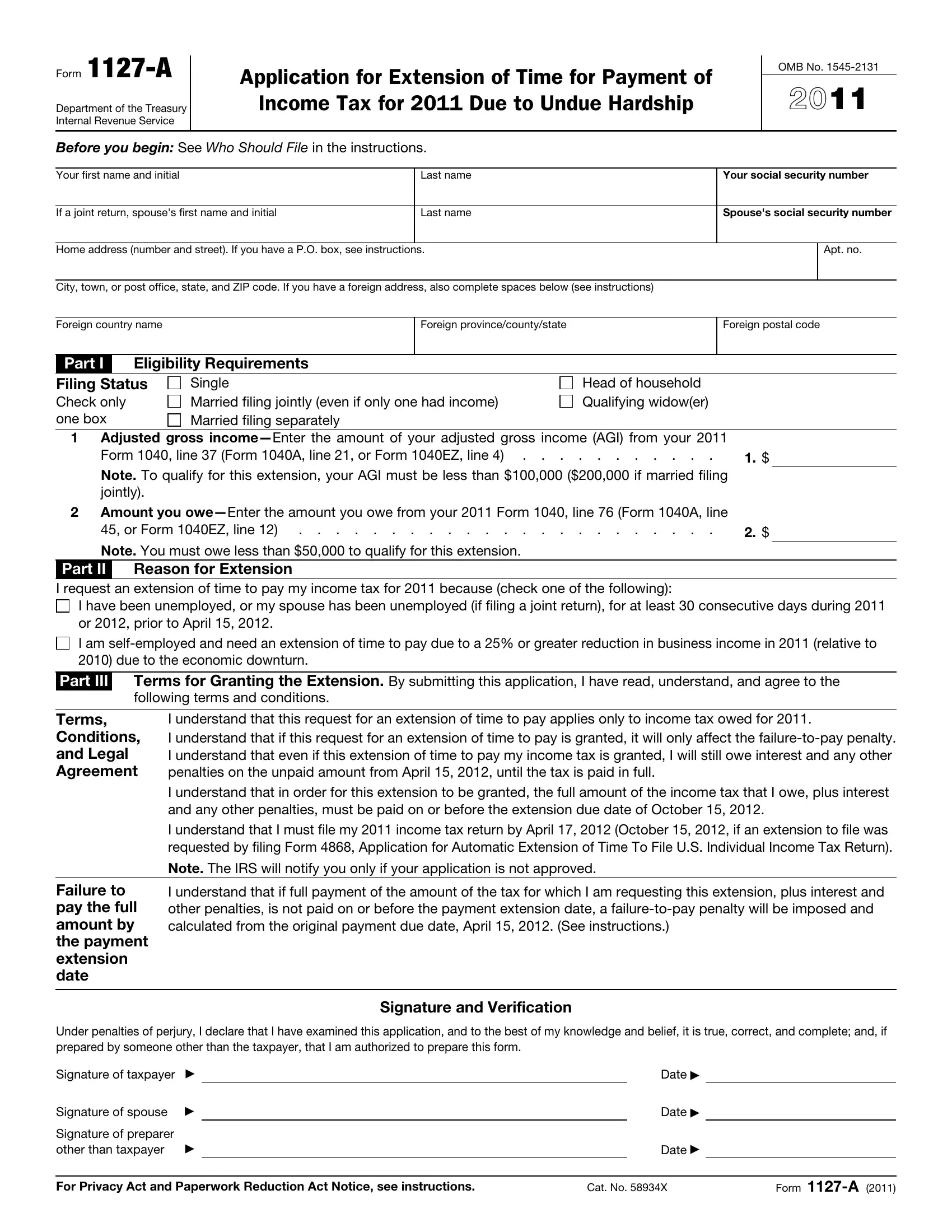

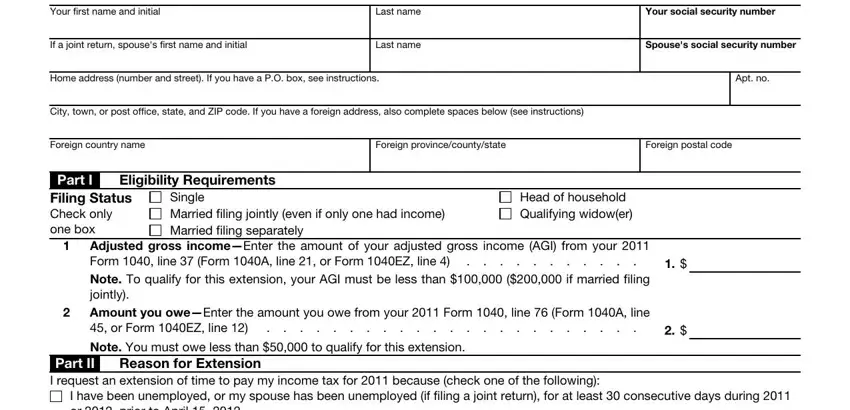

1. It is important to fill out the 1127a correctly, therefore be careful while working with the segments including all these fields:

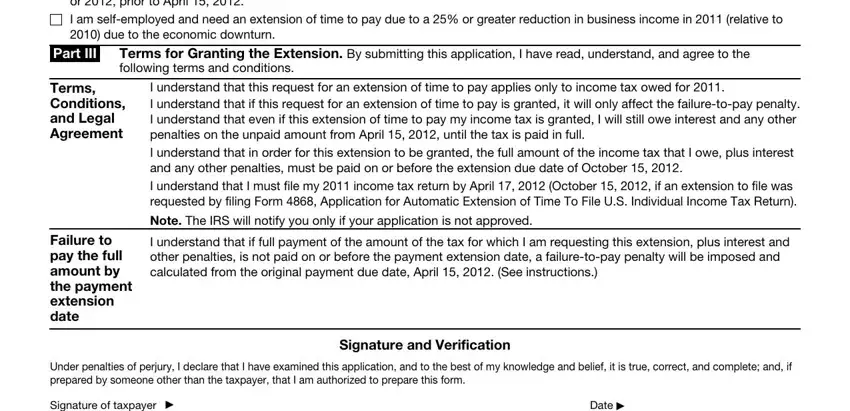

2. The subsequent part is to submit the following blank fields: I have been unemployed or my, Part III, Terms for Granting the Extension, I understand that this request for, Note The IRS will notify you only, I understand that if full payment, Terms Conditions and Legal, Failure to pay the full amount by, Under penalties of perjury I, Signature and Verification, Signature of taxpayer , and Date .

People frequently get some points incorrect while filling out I have been unemployed or my in this section. You should revise what you type in here.

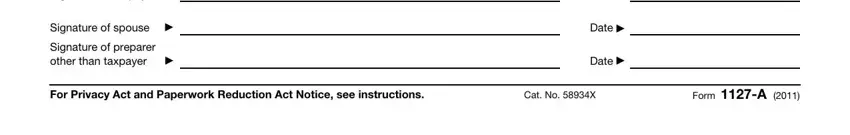

3. This subsequent section should also be rather simple, Signature of taxpayer , Signature of spouse , Signature of preparer other than, Date , Date , Date , For Privacy Act and Paperwork, Cat No X, and Form A - all these blanks must be completed here.

Step 3: After double-checking the filled out blanks, click "Done" and you're good to go! Find the 1127a once you join for a 7-day free trial. Quickly gain access to the pdf document from your personal account page, together with any modifications and adjustments being automatically synced! Here at FormsPal, we strive to ensure that all your details are maintained secure.