Once you open the online tool for PDF editing by FormsPal, it is possible to fill in or modify sample filled up bir form 1706 right here and now. FormsPal is committed to making sure you have the absolute best experience with our editor by consistently adding new capabilities and enhancements. With these updates, working with our editor gets better than ever! With just a couple of simple steps, you may begin your PDF journey:

Step 1: Simply click on the "Get Form Button" above on this site to launch our pdf file editor. Here you'll find all that is required to fill out your document.

Step 2: The tool will allow you to modify your PDF document in various ways. Modify it by writing customized text, correct original content, and put in a signature - all when you need it!

It will be an easy task to complete the pdf with our detailed tutorial! This is what you want to do:

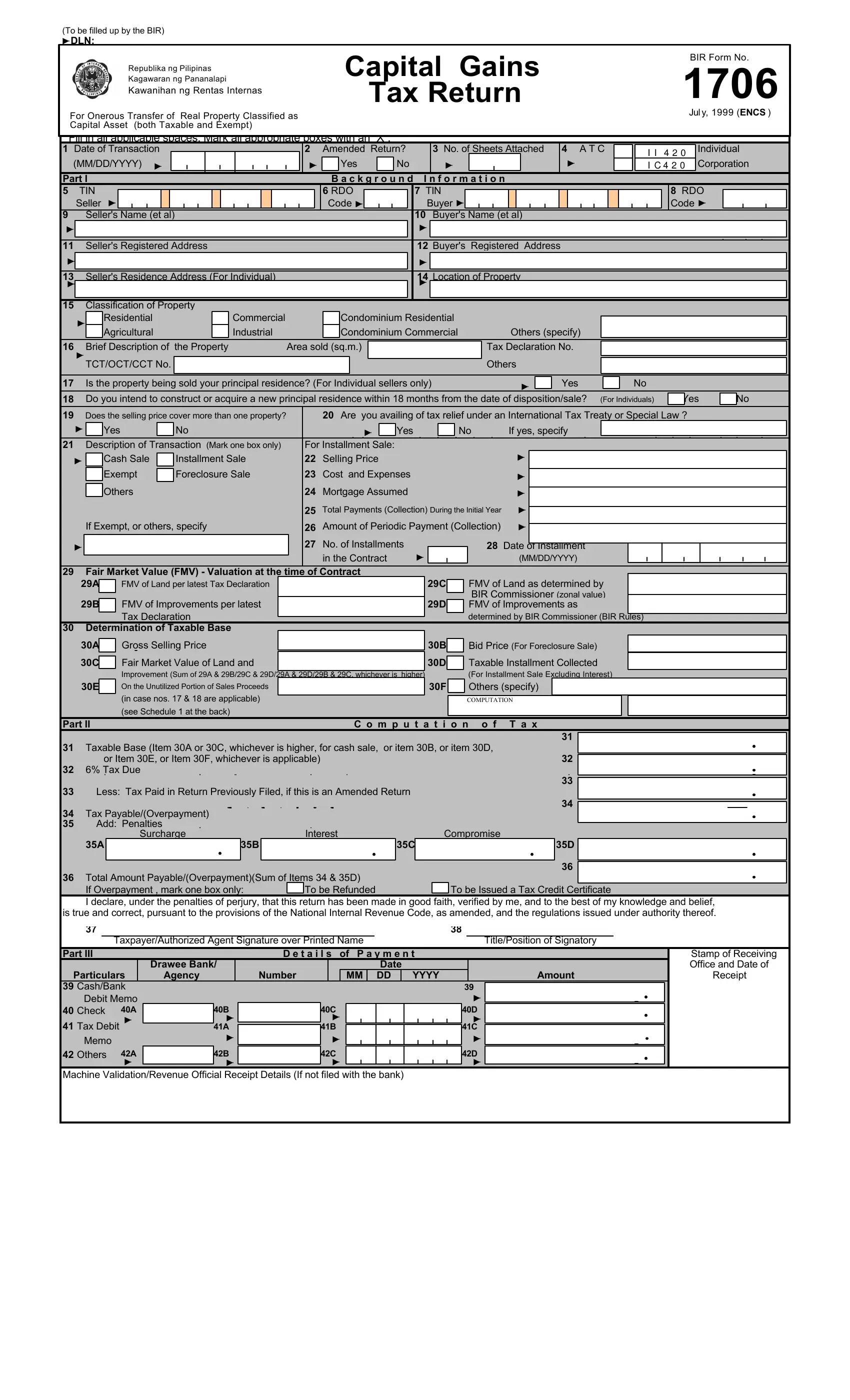

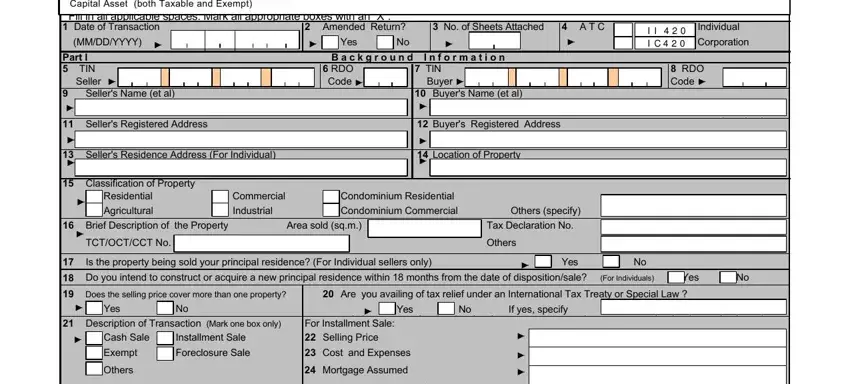

1. Start completing the sample filled up bir form 1706 with a number of necessary blank fields. Get all of the required information and make sure nothing is neglected!

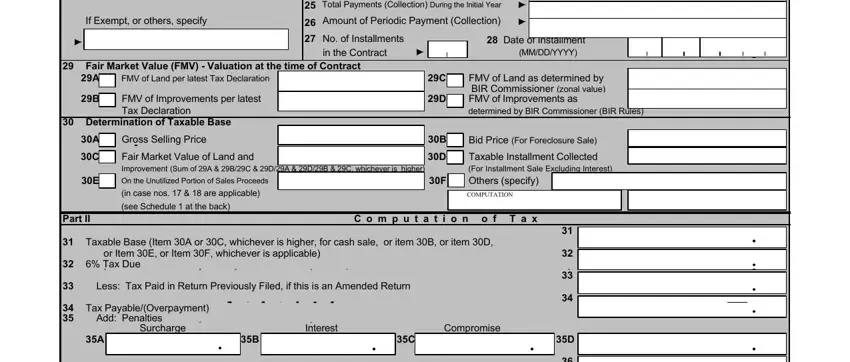

2. Just after filling in the last step, go to the next part and enter the necessary particulars in all these blank fields - If Exempt or others specify, Total Payments Collection During, Amount of Periodic Payment, No of Installments, Date of Installment, in the Contract, MMDDYYYY, Fair Market Value FMV Valuation, FMV of Land per latest Tax, FMV of Improvements per latest Tax, Determination of Taxable Base, Part II, Gross Selling Price, Fair Market Value of Land and, and On the Unutilized Portion of Sales.

You can potentially make a mistake when filling out the Total Payments Collection During, for that reason make sure you go through it again before you decide to submit it.

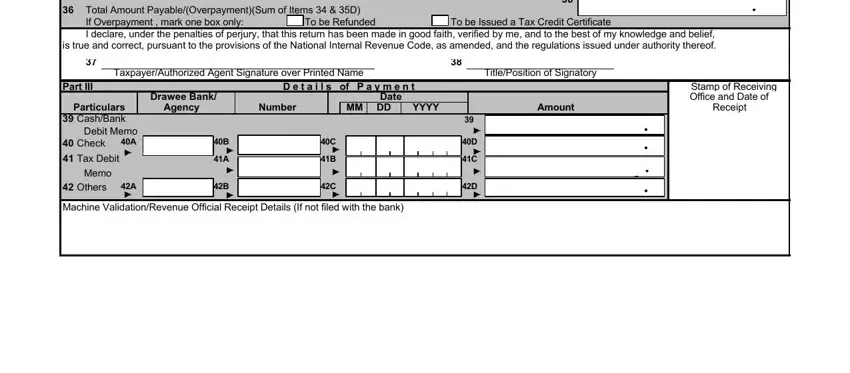

3. The third step is generally easy - fill out all of the fields in Total Amount, If Overpayment mark one box only, To be Issued a Tax Credit, To be Refunded, TaxpayerAuthorized Agent Signature, TitlePosition of Signatory, Part III, Particulars CashBank Debit Memo A, Tax Debit, Memo Others, Drawee Bank Agency, D e t a i l s of P a y m e n t, Date, Number, and MM DD YYYY in order to complete the current step.

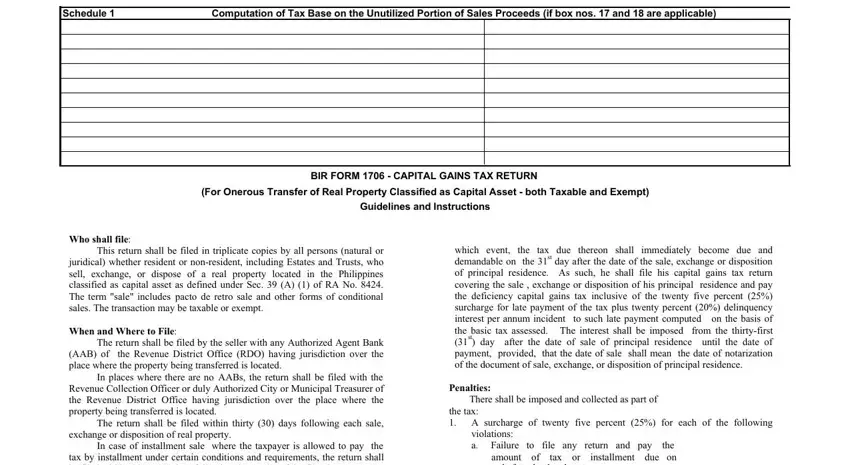

4. Your next part will require your details in the following areas: Schedule , Computation of Tax Base on the, For Onerous Transfer of Real, BIR FORM CAPITAL GAINS TAX RETURN, Guidelines and Instructions, Who shall file, This return shall be filed in, When and Where to File, The return shall be filed by the, In places where there are no AABs, The return shall be filed within, exchange or disposition of real, In case of installment sale where, which event the tax due thereon, and Penalties There shall be imposed. Always give all required info to go onward.

Step 3: Go through all the details you've typed into the blanks and hit the "Done" button. Try a free trial option with us and obtain immediate access to sample filled up bir form 1706 - available from your personal cabinet. FormsPal is committed to the privacy of all our users; we make sure that all personal data entered into our editor continues to be secure.