Dealing with PDF forms online is actually simple with this PDF editor. Anyone can fill in pa rent rebate forms here within minutes. To maintain our tool on the cutting edge of efficiency, we work to put into operation user-oriented capabilities and improvements regularly. We are always grateful for any suggestions - play a pivotal role in remolding how we work with PDF forms. It merely requires a few simple steps:

Step 1: Click on the orange "Get Form" button above. It will open up our pdf editor so that you can begin filling in your form.

Step 2: When you open the tool, you will find the form prepared to be filled out. Aside from filling in different blanks, you could also perform other actions with the file, namely putting on your own text, changing the original textual content, adding illustrations or photos, putting your signature on the document, and much more.

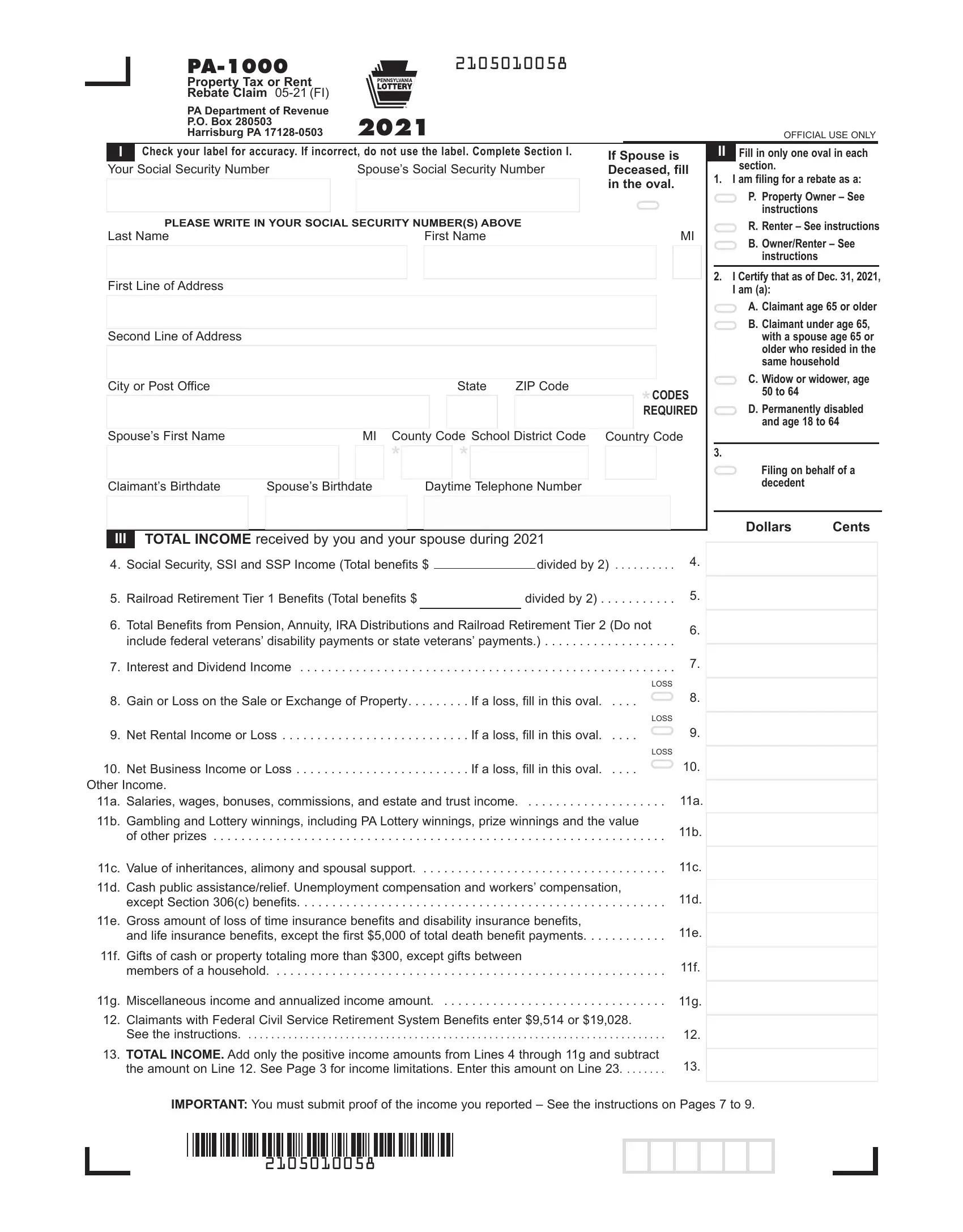

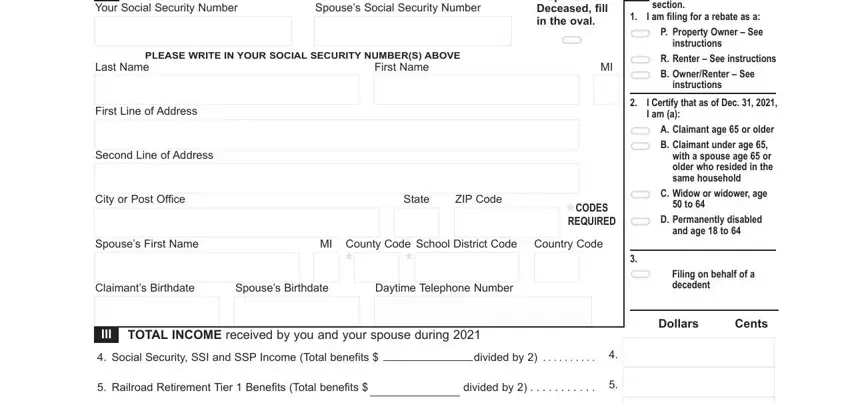

To be able to finalize this document, be certain to enter the required details in every single blank:

1. The pa rent rebate forms will require particular information to be typed in. Make sure the subsequent blanks are filled out:

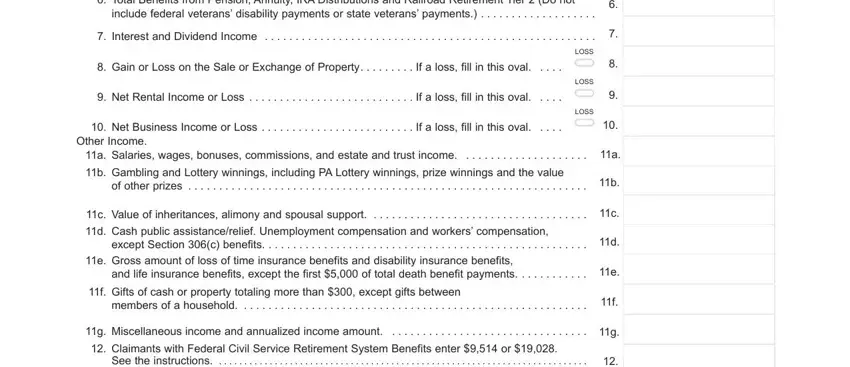

2. Just after the last array of fields is filled out, proceed to enter the relevant details in these: Total Benefits from Pension, Interest and Dividend Income , Gain or Loss on the Sale or, Net Rental Income or Loss , Net Business Income or Loss , Other Income, LOSS, LOSS, LOSS, a Salaries wages bonuses, b Gambling and Lottery winnings, c Value of inheritances alimony, d Cash public assistancerelief, f Gifts of cash or property, and g Miscellaneous income and.

3. Through this stage, have a look at Claimants with Federal Civil, TOTAL INCOME Add only the, and IMPORTANT You must submit proof of. All these have to be filled out with utmost accuracy.

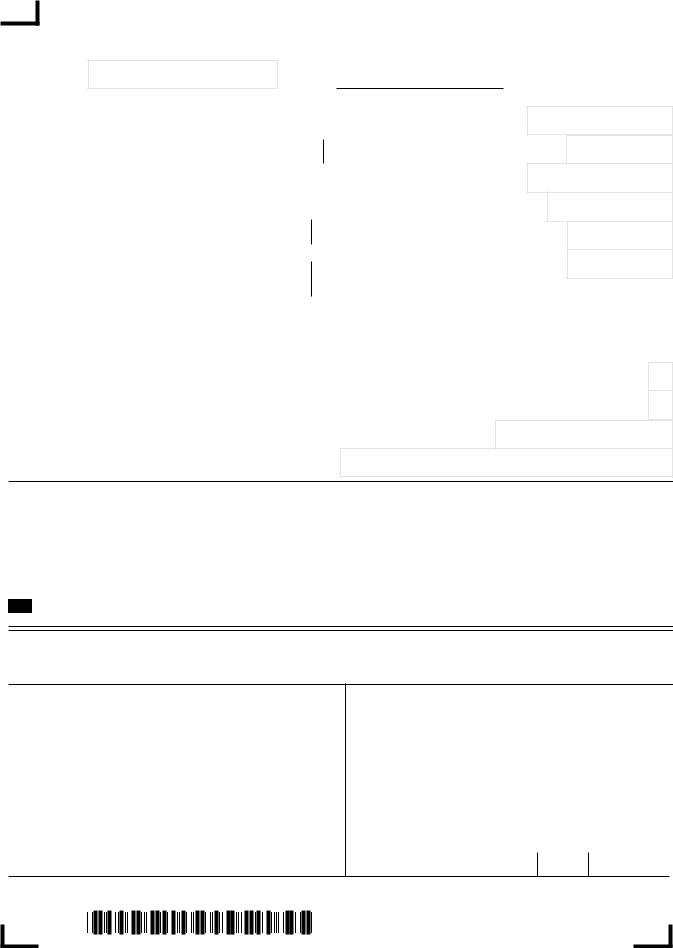

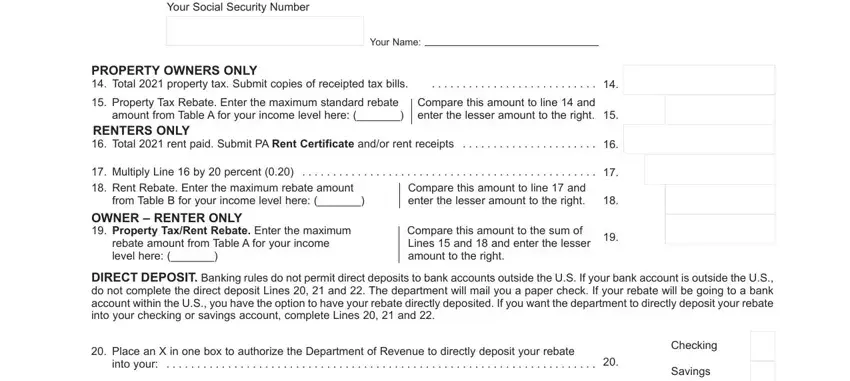

4. This subsection arrives with the following blank fields to look at: Your Social Security Number, Your Name, PROPERTY OWNERS ONLY Total , Property Tax Rebate Enter the, Compare this amount to line and, Multiply Line by percent , Compare this amount to the sum of, DIRECT DEPOSIT Banking rules do, Place an X in one box to, Checking, and Savings.

Those who use this PDF frequently get some points incorrect while filling out Multiply Line by percent in this section. Remember to review what you type in here.

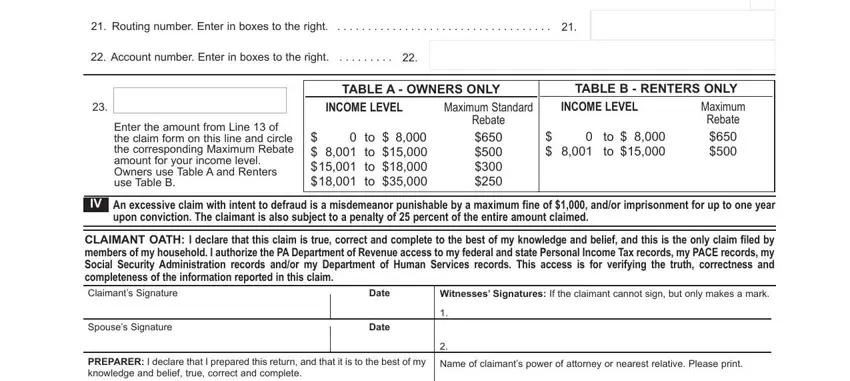

5. To conclude your document, this last segment includes a couple of extra blank fields. Filling out Routing number Enter in boxes to, Account number Enter in boxes to, TABLE A OWNERS ONLY, TABLE B RENTERS ONLY, Enter the amount from Line of the, INCOME LEVEL Maximum Standard, INCOME LEVEL Maximum Rebate to , An excessive claim with intent to, CLAIMANT OATH I declare that this, Witnesses Signatures If the, Spouses Signature Date, PREPARER I declare that I prepared, and Name of claimants power of will certainly wrap up the process and you will be done in an instant!

Step 3: Ensure that your details are accurate and then press "Done" to complete the process. Create a 7-day free trial option at FormsPal and gain immediate access to pa rent rebate forms - with all changes saved and accessible inside your personal account page. FormsPal ensures your information privacy with a protected system that in no way records or shares any type of private data involved. Feel safe knowing your files are kept confidential every time you work with our tools!