vibr 720b form can be completed easily. Simply use FormsPal PDF editor to perform the job promptly. To keep our editor on the cutting edge of efficiency, we strive to put into action user-oriented features and improvements regularly. We are routinely thankful for any suggestions - assist us with revampimg PDF editing. To begin your journey, consider these easy steps:

Step 1: Click the "Get Form" button in the top part of this page to get into our editor.

Step 2: As soon as you access the tool, you'll see the form ready to be filled in. Besides filling out various blank fields, you might also do several other things with the file, namely writing your own words, changing the original text, inserting illustrations or photos, affixing your signature to the document, and a lot more.

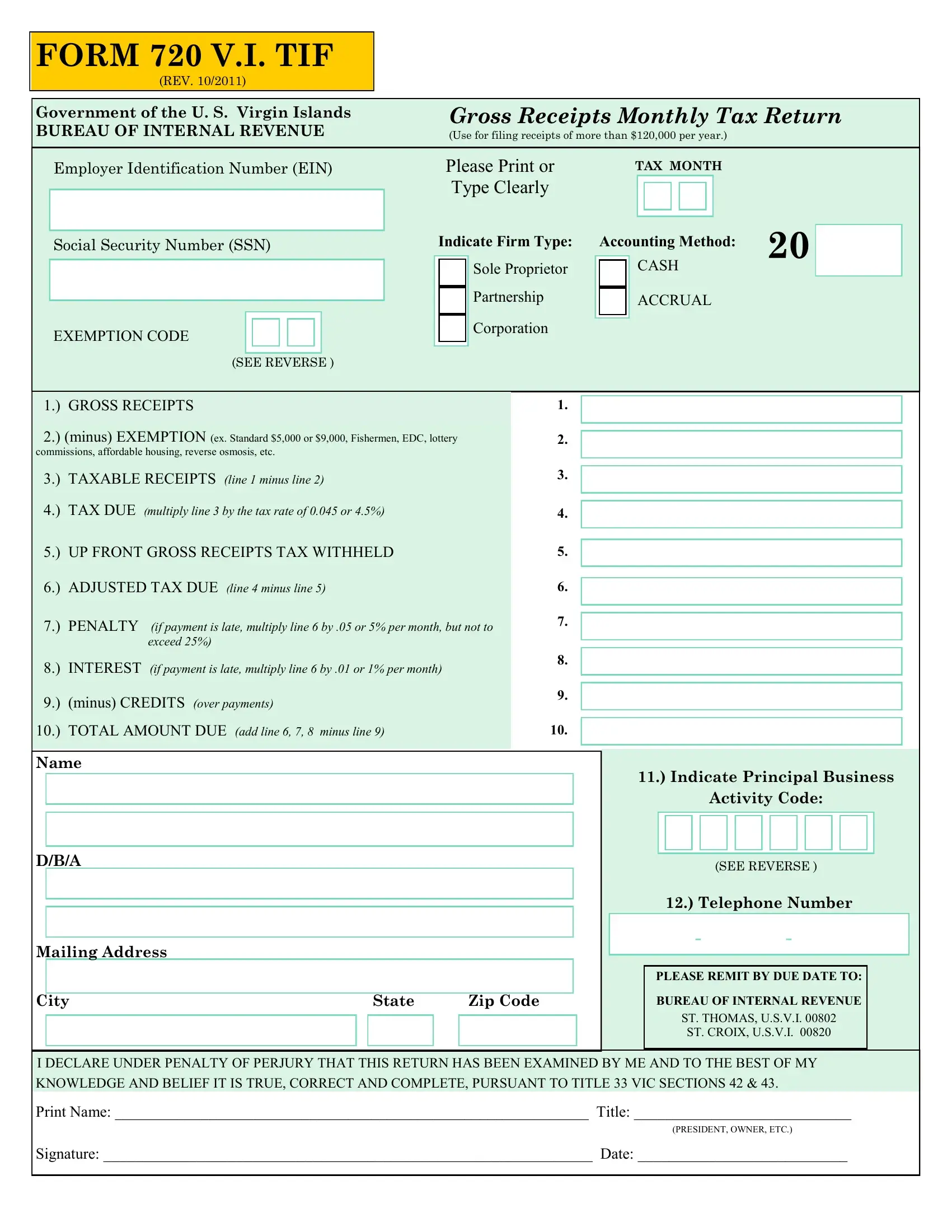

If you want to complete this document, be sure you type in the information you need in each and every field:

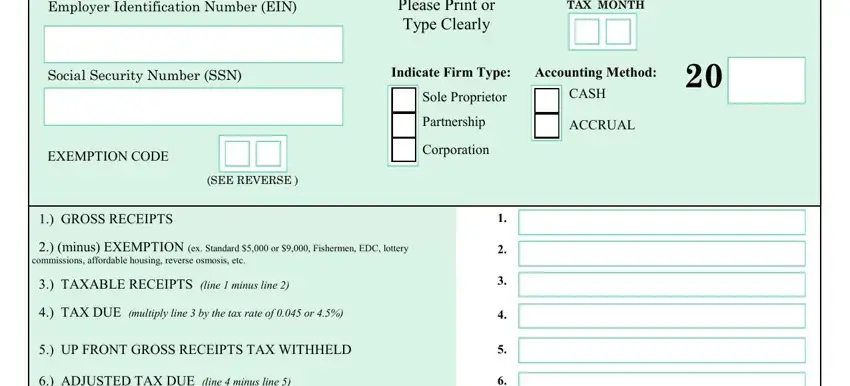

1. Start filling out your vibr 720b form with a group of major fields. Gather all the required information and make sure nothing is omitted!

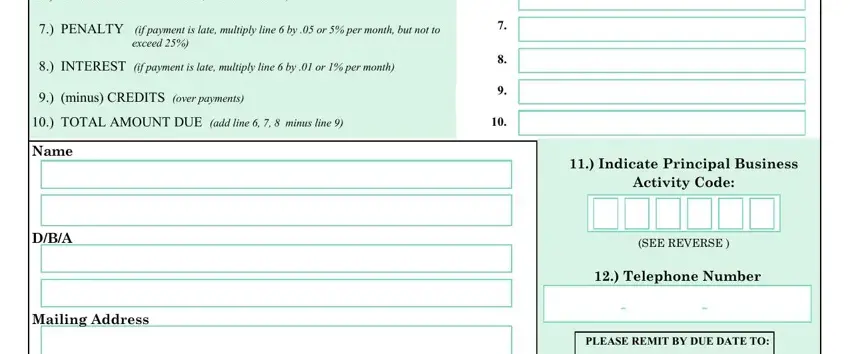

2. Your next step is usually to submit the following blanks: ADJUSTED TAX DUE line minus line , PENALTY if payment is late, INTEREST if payment is late, minus CREDITS over payments, TOTAL AMOUNT DUE add line , Name, DBA, Mailing Address, Indicate Principal Business, Activity Code, SEE REVERSE , Telephone Number, and PLEASE REMIT BY DUE DATE TO.

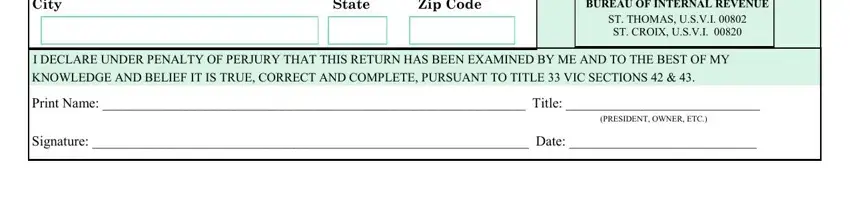

3. Completing City State Zip Code, BUREAU OF INTERNAL REVENUE, ST THOMAS USVI ST CROIX USVI , I DECLARE UNDER PENALTY OF PERJURY, KNOWLEDGE AND BELIEF IT IS TRUE, Print Name Title , PRESIDENT OWNER ETC, and Signature Date is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Always be very mindful while filling in ST THOMAS USVI ST CROIX USVI and PRESIDENT OWNER ETC, because this is the part where a lot of people make some mistakes.

Step 3: Make certain your information is correct and just click "Done" to conclude the task. Create a free trial plan at FormsPal and get immediate access to vibr 720b form - downloadable, emailable, and editable in your FormsPal cabinet. FormsPal guarantees your information privacy by using a secure method that in no way records or shares any kind of sensitive information provided. Rest assured knowing your documents are kept safe whenever you work with our services!