By using the online editor for PDFs by FormsPal, it is possible to complete or alter FEIN right here and now. FormsPal is devoted to providing you with the ideal experience with our tool by constantly introducing new features and enhancements. With all of these improvements, using our tool becomes better than ever before! If you're seeking to get going, this is what it's going to take:

Step 1: Access the form in our editor by clicking on the "Get Form Button" at the top of this webpage.

Step 2: This tool allows you to modify PDF documents in a variety of ways. Modify it by adding personalized text, correct existing content, and add a signature - all within the reach of several clicks!

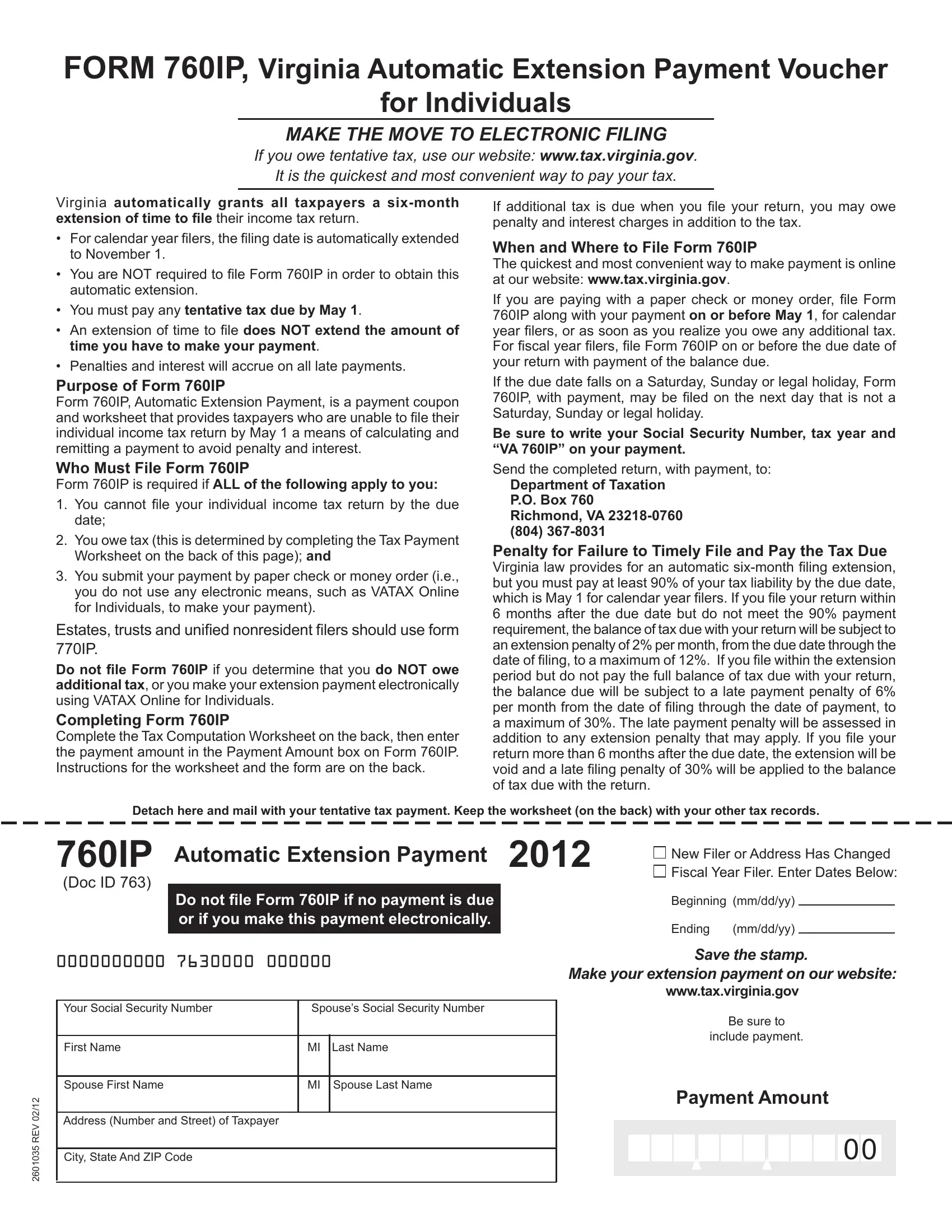

This PDF form needs some specific information; to ensure accuracy and reliability, please be sure to take heed of the subsequent guidelines:

1. While filling out the FEIN, be certain to incorporate all of the needed blank fields in their associated section. It will help to facilitate the work, enabling your details to be processed fast and appropriately.

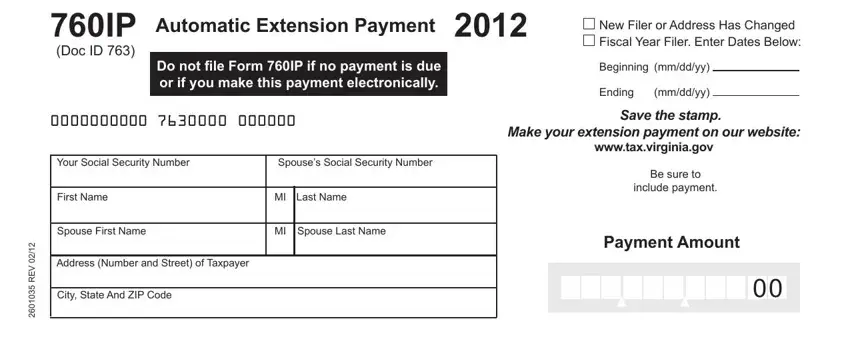

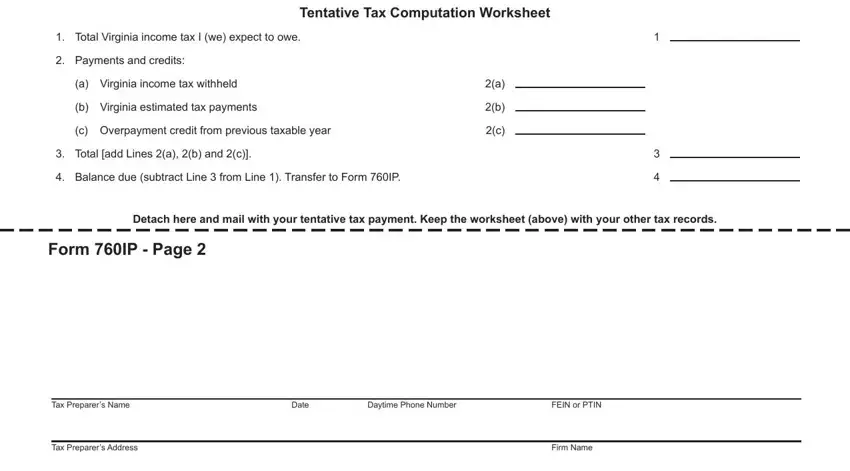

2. After this part is done, go on to enter the applicable information in these - Tentative Tax Computation Worksheet, Total Virginia income tax I we, Payments and credits, a Virginia income tax withheld, b Virginia estimated tax payments, c Overpayment credit from previous, Total add Lines a b and c, Balance due subtract Line from, Detach here and mail with your, Form IP Page , Tax Preparers Name, Date, Daytime Phone Number, Tax Preparers Address, and FEIN or PTIN.

Those who use this document often make some mistakes while completing Tentative Tax Computation Worksheet in this section. You should definitely read again whatever you enter here.

Step 3: Spell-check all the information you've inserted in the blanks and then click the "Done" button. Make a free trial subscription with us and get immediate access to FEIN - which you may then make use of as you want from your FormsPal account page. At FormsPal, we endeavor to ensure that all your information is kept protected.