Handling PDF documents online is always easy with our PDF tool. You can fill out f irs 8453 form here and try out various other options available. The tool is consistently updated by our staff, getting handy features and becoming greater. If you are seeking to start, this is what it's going to take:

Step 1: First, open the pdf tool by clicking the "Get Form Button" above on this webpage.

Step 2: The tool lets you work with your PDF document in various ways. Change it by writing personalized text, adjust what is originally in the document, and put in a signature - all doable in minutes!

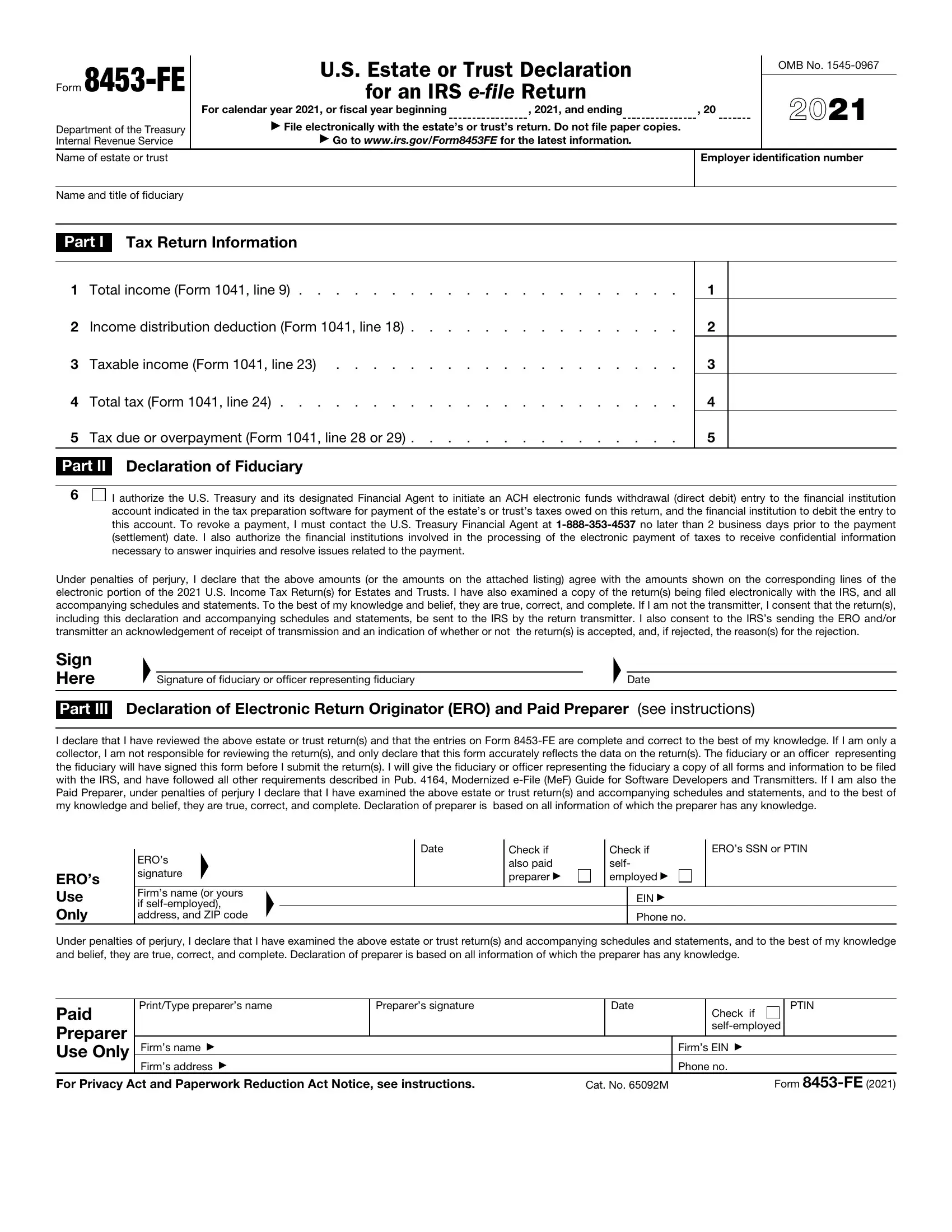

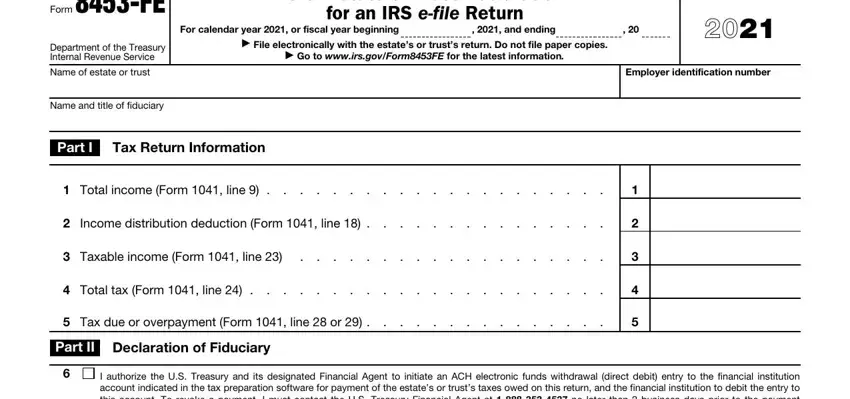

As for the fields of this particular form, here is what you should consider:

1. While completing the f irs 8453 form, be sure to include all of the needed fields within its corresponding form section. This will help to expedite the process, allowing for your details to be handled quickly and correctly.

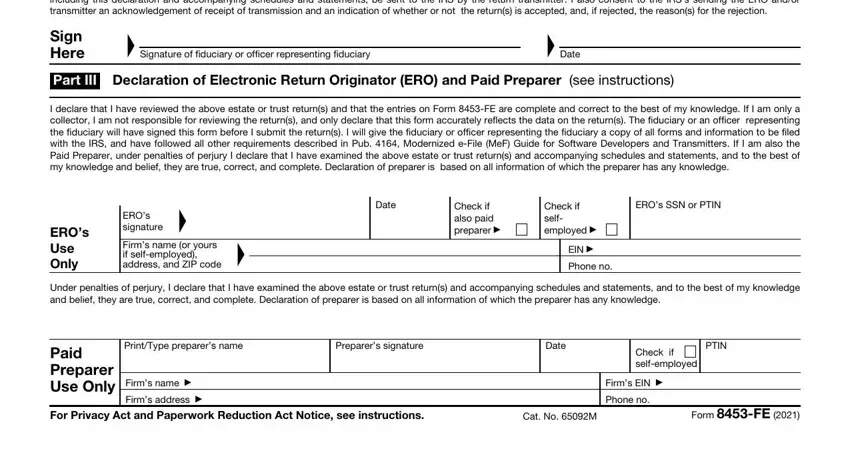

2. The subsequent stage is usually to fill in these blanks: Under penalties of perjury I, Sign Here, Signature of fiduciary or officer, Date, Part III Declaration of Electronic, I declare that I have reviewed the, EROs Use Only, EROs, signature address and ZIP code , Firms name or yours if selfemployed, Date, Check if also paid preparer , Check if self employed , EROs SSN or PTIN, and EIN .

People often make some mistakes while completing Firms name or yours if selfemployed in this section. Make sure you read twice everything you type in here.

Step 3: Ensure that the details are correct and click "Done" to complete the process. Grab your f irs 8453 form the instant you subscribe to a free trial. Immediately view the pdf inside your FormsPal account, with any edits and changes conveniently saved! Here at FormsPal, we strive to ensure that all of your information is maintained protected.