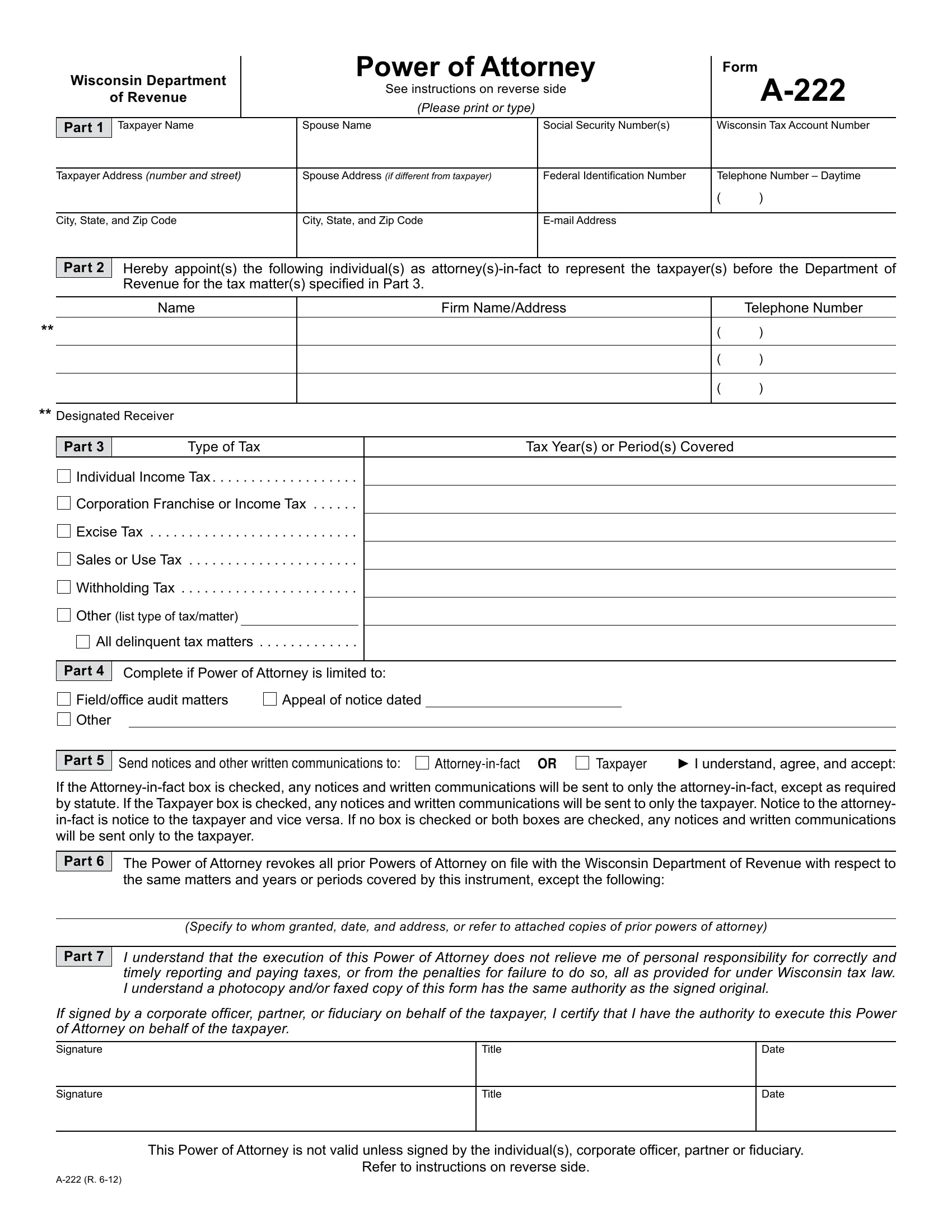

A Power of Attorney (Form A-222), or similar written authori- zation, executed by the taxpayer is required by the Wisconsin Department of Revenue in order for the taxpayer’s repre-

sentative to perform certain acts on behalf of the taxpayer and to receive and inspect certain tax information. Use of Form A-222 is not mandatory. Photocopies and FAX copies of Form A-222 are acceptable.

The Power of Attorney requirement applies to tax and related

credit matters of individuals, partnerships and corporations, including (S) corporations.

When the representative is accompanied by the taxpayer or, if the taxpayer is a corporation, by an officer or authorized employee of the corporation, a Power of Attorney is not re-

quired for the taxpayer’s representative to inspect confidential information or to represent the taxpayer at conferences. Also,

a Power of Attorney is generally not required for a trustee,

receiver, guardian, administrator or executor of an estate, or a representative appointed by a court.

How to Complete Form A-222

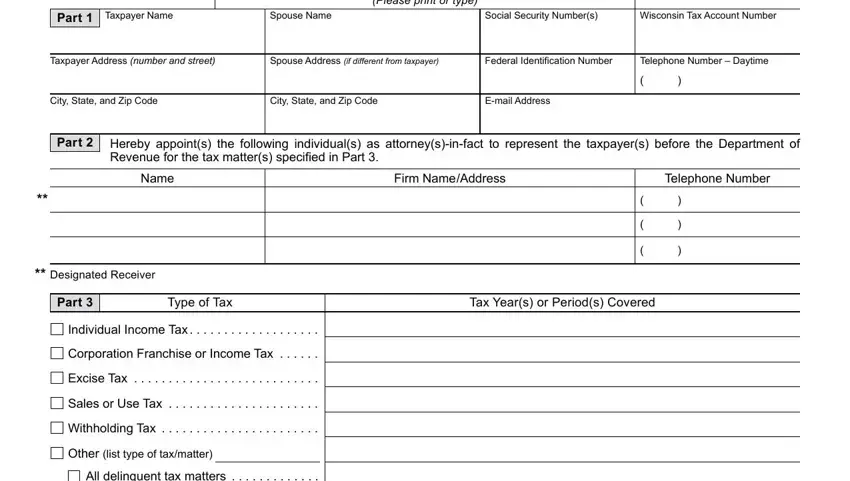

Part 1 – Taxpayer Information

A.Individuals: Enter your name, address, social security number, and telephone number in the space provided.

If a joint return is involved, and you and your spouse are designating the same attorney(s)-in-fact, enter your

spouse’s name and social security number, and your spouse’s address if different from yours. A federal identi- fication number is not required for individuals.

B.Corporation or partnership: Enter the name, business

address, federal identification number, and telephone number.

C.Trust: Enter the name, title, address, and telephone

number of the fiduciary, and the name and federal identi- fication number of the trust.

D.Estate: Enter the name, title, address, and telephone

number of the decedent’s personal representative, and the name and identification number of the estate. The identification number for an estate includes both the

federal identification number if the estate has one and the decedent’s social security number.

E.Other entity: Enter the name, business address, federal identification number, and telephone number.

Note: If you have been assigned a Wisconsin tax ac-

count number by the Wisconsin Department of Revenue, please enter the middle 10 digit numbers in the appropri- ate box.

Part 2 – Appointee

Enter the name, address, and telephone number and com-

plete address, including zip code of each individual appointed as attorney-in-fact. Attach additional pages if needed.

Part 3 – Tax Matters and Years or Periods

In the columns provided, identify the type(s) of tax this Power

of Attorney authorization applies to by checking the appropri- ate box(es). Enter time periods for each tax type for which the Power of Attorney is granted. The word “All” for taxes or periods or the words “Previous”, “Prior” or “Future” are not specific enough. The Power of Attorney can be limited

to specific reporting period(s) that can be stated in year(s),

quarter(s), month(s), etc. If the matter relates to estate or in-

heritance tax, enter the date of the taxpayer’s death instead of the year or period.

Examples:

•Individual Income Tax 2010

•Corporation Franchise/Income Tax 2008-2010 or FY ending 2010

•Sales Tax – First and Second Quarter 2011

•Withholding Tax – January 1, 2000 to 2010

•Other – Homestead Credit Claim – 2011

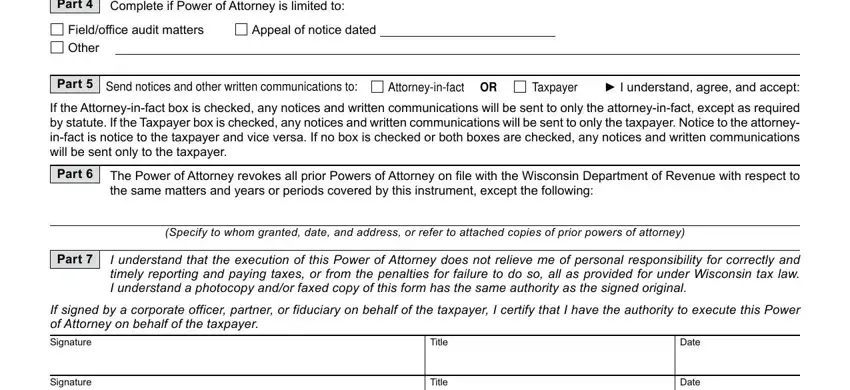

Part 4 – Limited Power of Attorney

If you wish to have this Power of Attorney apply only to spe-

cific issues, check the appropriate box and complete the line when checking “Other”.

Examples:

•Private Letter Ruling

•Revocation Hearing

•Claim For Refund

Part 5 – Mailing of Notices and Written Communications

Check the applicable box to have notices and other writ-

ten communications addressed and sent to the taxpayer or the taxpayer’s attorney-in-fact. Put the name of the repre-

sentative who should receive the notices and other written communications on the ** line in Part 2. If both boxes are

checked, notices and written communication will be sent only to the taxpayer. Notice will be sent to the taxpayer regardless

of the box checked when statutes require notice to be sent to the taxpayer. Notice to the attorney-in-fact is notice to the taxpayer and vice versa.

Part 6 – Revoking a Power of Attorney

By filing a new Form A-222, all prior Powers of Attorney filed with the Department of Revenue for the same matters and

years or periods are revoked unless specifically stated other- wise on the line provided.

Part 7 – Signature of Taxpayer(s)

The Power of Attorney form must be signed by the taxpayer; a signature stamp is not acceptable.

A.Signature of Taxpayer:

1.Individuals: If a joint return is involved and both husband and wife will be represented by the same

individual(s), both spouses must sign the Power of

Attorney. If they are to be represented by different in-

dividuals, each spouse may execute his or her own

Power of Attorney.

2.Partnerships: All partners must sign unless one partner is authorized to act in the name of the partnership.

3.Corporation, trust, estate, or any other entity: A

corporate officer or person having authority to bind the entity must sign.

B.Date: The Power of Attorney should be dated when signed.

The beginning effective date for department action will be the department’s receipt date. The Power of Attorney will

remain in effect until the department is otherwise notified in writing.