Dear Beneficiary:

Please accept our condolences on your recent loss. We understand this is a difficult time, and we hope that we can alleviate any concerns you may have about your claim.

To help process your claim in the fastest possible manner, New York Life Insurance Company is providing this easy to use Claim Form for your convenience. Please review the form in its entirety, and then follow the step-by-step instructions to submit your claim.

New York Life Insurance Company prides itself on the speed with which it pays claims. Most claim payments are sent to the beneficiaries within ten business days from the date the Company receives the completed Claim Form, death certificate and other documents as appropriate to the claim.*

The claim form allows beneficiaries receiving $5,000 or more to elect to receive their proceeds in the form of a Continued Interest Account, in addition to the option of receiving a lump sum payment by check. The Continued Interest Account is an interest bearing account that enables you to leave funds on deposit while you make important decisions during a difficult time. It provides immediate access to all of the proceeds at any time simply by writing a check for the full amount. Please see the enclosed page entitled “Important Information About The Continued Interest Account” which describes this option in greater detail.

Please be assured that New York Life will act as quickly as possible to complete the processing of your claim once we receive all the necessary information and documentation. If you have any questions, please contact us at 1-800-695-5165, between the hours of 8 am to 5 pm Monday through Friday.

Sincerely,

Matt Pittarelli

Corporate Vice President

*The claim form may have been sent before New York Life determined whether any insurance was in force at the time of death, and the beneficiary to whom the proceeds may be payable. New York Life retains the right to make such determination.

AARP has extensive grief and loss information and resources designed to assist family and friends during this

difficult time. This information can be found online at www.griefandloss.org.

HOW TO COMPLETE YOUR CLAIM FORM

Please read this page before you start to complete your Claim Form

To complete the processing of your claim, we must have a fully completed Claim Form from each beneficiary, one certified death certificate and other documents as appropriate for the claim.

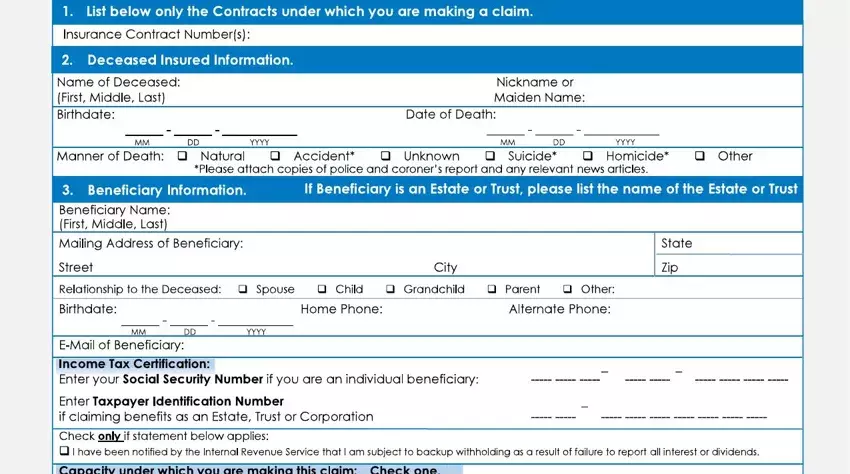

SECTION 1

Information about the deceased is necessary for purpose of identification and benefit determination. Please be sure to enter the insurance contract number on the Claim Form.

SECTION 2

Information about the Beneficiary is necessary for claims processing.

Taxpayer Identification Number: Life insurance benefits are generally not subject to income tax. However, New York Life pays interest on the insurance proceeds from the date of death.

Since the interest paid to you may be taxable, you should consult your tax advisor.

The Federal Government requires us, and all other financial institutions, to report interest we pay to you. Therefore, we are required to obtain your Social Security or other Taxpayer Identification Number, which you must certify under penalties of perjury. If you are applying for a tax number, the Federal Government requires us to withhold a portion of your interest as a deposit against the taxes that may be due.

Some persons may have been notified by the Internal Revenue Service that they are subject to “backup withholding” because in the past they did not report all their interest or dividends. If you have been so notified, and a back up withholding order has not been rescinded, you must cross out the statement right below your Social Security or Taxpayer Identification Number. We may contact you for more information if there are any questions about your Taxpayer Identification Number or back up withholding status, or if you are a non-resident alien or foreign entity.

Claims by an Estate: If the claim is being filed by an Executor or Administrator, he or she must sign the Claim Form and submit a copy of the appointment papers. Be sure to use the Estate’s tax number.

Assignments: If you have assigned all or any portion of the benefit to a funeral home for final expenses, please include that assignment. If the deceased assigned the insurance proceeds to a bank or other financial institution, the Claim Form must be signed by an authorized representative of that institution.

If the Beneficiary is a Minor: If there is a legal guardian for a minor, the guardian should sign the Claim Form and submit a copy of the guardianship papers. If no legal guardian has been appointed, contact us for further information.

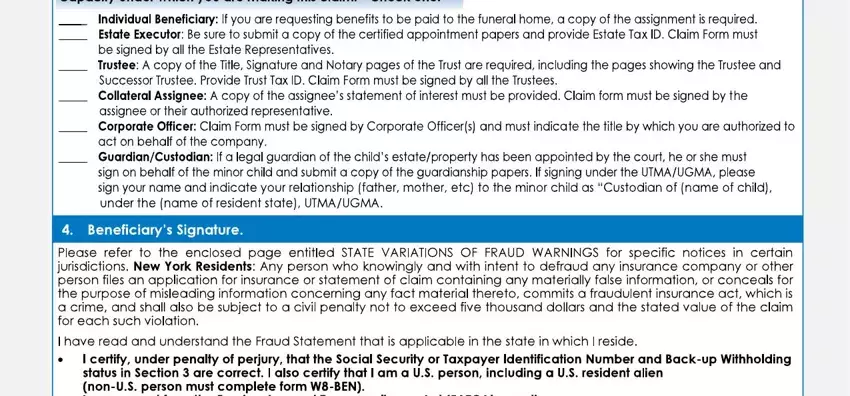

SECTION 3

We offer two payment options: a Continued Interest Account and a Lump Sum Payment. If no option is chosen, New York Life will pay the claim in a Lump Sum Payment.

SECTION 4

Please sign the Claim Form in the same manner as you would normally sign your checks. Your signature will be used to verify instructions you give us in the future.

SECTION 5

The Medical Information and Authorization section must be completed if all or any portion of the insurance coverage is less than two years old at the time of death.

Illinois Interest Statement:

If the contract was issued in Illinois, you will be paid 9% interest, from the date of death, if your claim is not paid within 15 days of receiving the necessary proof needed to settle the claim.

State Variations of Fraud Warnings

Kindly refer to the applicable fraud warnings for your state of residence.

Arizona Fraud Warning

For your protection Arizona law requires the following to appear on this form. Any person who knowingly presents a false or fraudulent claim for payment of a loss is subject to criminal and civil penalties.

California Fraud Warning

For your protection California Law requires the following to appear on this form: any person who knowingly presents a false or fraudulent claim for the payment of a loss is guilty of a crime and may be subject to fines and confinement in state prison.

Colorado Fraud Warning

It is unlawful to knowingly provide false, incomplete or misleading facts or information to an insurance company for the purpose of defrauding or attempting to defraud the company. Penalties may include imprisonment, fines, denial of insurance and civil damages. Any insurance company or agent of an insurance company who knowingly provides false, incomplete, or misleading facts or information to a policyholder or claimant for the purpose of defrauding or attempting to defraud the policyholder or claimant with regard to a settlement or award payable from insurance proceeds shall be reported to the Colorado Division of Insurance within the Department of Regulatory Agencies.

District of Columbia Fraud Warning

Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

Florida Fraud Warning

Any person who knowingly and with intent to injure, defraud, or deceive any insurer files a statement of claim or an application containing any false, incomplete, or misleading information is guilty of a felony of the third degree.

New Jersey Fraud Warning

Any person who knowingly files a statement of claim containing any false or misleading information is subject to criminal and civil penalties.

Oregon Fraud Warning

Willfully falsifying material facts on an application or claim may subject you to criminal penalties.

Pennsylvania Fraud Warning

Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information or conceals for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime and subjects such person to criminal and civil penalties.

Puerto Rico Fraud Warning

Any person who knowingly and with the intention of defrauding presents false information in an insurance application, or presents, helps, or causes the presentation of a fraudulent claim for the payment of a loss or any other benefit, or presents more than one claim for the same damage or loss, shall incur a felony and, upon conviction, shall be sanctioned for each violation with the penalty of a fine of not less than five thousand dollars ($5,000) and not more than ten thousand dollars ($10,000), or a fixed term of imprisonment for three (3) years, or both penalties. If aggravating circumstances are present, the penalty thus established may be increased to a maximum of five (5) years, if extenuating circumstances are present, it may be reduced to a minimum of two (2) years.

Virginia Fraud Warning

It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company. Penalties include imprisonment, fines and denial of insurance benefits.

Maryland Fraud Warning

Any person who knowingly and willfully presents a false or fraudulent claim for payment of a loss or benefit or who knowingly and willfully presents false information in an application for insurance is guilty of a crime and may be subject to fines and may be subject to fines and confinement in prison.

Fraud Warning For All Other States

Any person who knowingly and with the intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information, or conceals for the purpose of misleading, information concerning any fact material thereto, commits a fraudulent insurance act, which is a crime and subjects such person to criminal and civil penalties. Penalties may include imprisonment, fines, or a denial of insurance benefits if a person provides false information.

Important Information about the Continued Interest Account

Individuals receiving claim proceeds of $5,000 or more have the option to be paid through a Continued Interest Account. Other options, such as receiving a lump sum payment by paper check, are also available. If the beneficiary is a corporation, trust or estate, a single check will be issued.

If you select the Continued Interest Account as the payment option, the full amount of your proceeds will be deposited into a draft account. The draft account gives immediate access to all or any part of the proceeds, simply by writing a draft, which is similar in form to a check. The delivery of the Continued Interest Account “checkbook” will amount to our full payment of your proceeds. You may write as many “checks” as you wish each month, from $250 up to the entire balance in the account at any time, without incurring any fee or penalty. Writing a check for the balance of the account will close the account.

When your claim is approved, New York Life will send you a free supply of personalized checks and your Account Certificate. It shows the opening balance, current interest rate and all account details. Each month, you will receive via postal mail a statement showing your account balance, all checks cashed, interest earned, and the current effective annual yield. There is no charge to you for the account or the checks. There is a charge of $10 for an overdraft and $12 for a stop payment order. There is also a $15 charge for weekday overnight delivery of additional checks, and $22 for weekend delivery. In addition, there is a charge of $37.50 for international wire transfers.

You can name your own beneficiaries for the account, and if you wish, authorize a family member to assist you with your account.

New York Life guarantees that the interest rates on your Continued Interest Account will be equal to, or greater than, the Bank Rate Monitor average of rates paid on money market accounts by 100 of the largest banks and thrifts nationwide. The rate you earn will be updated weekly and interest is compounded daily. Your proceeds will always be secure, earning interest and easily available to you.

At any time while there are proceeds left in your account, you also have the flexibility to transfer the remaining proceeds to any of the settlement options we make available. The proceeds being transferred may be

subject to the minimum opening balance requirements associated with the selected option.

To obtain the current interest rate, and for any questions you may have about the Continued Interest Account, please refer to newyorklife.com, or contact us at 1-800-

695-5165, or write us at the address below:

New York Life Insurance Company

Claims Department

PO Box 30713

Tampa, FL 33630

Funds held in the Continued Interest Account will remain with New York Life Insurance Company. Account services will be provided by the Northern Trust Company. The funds will be guaranteed by the financial strength of the insurer for as long as the proceeds remain in the Continued Interest Account.

Continued Interest Account funds are not guaranteed by the Federal Deposit Insurance Corporation (FDIC). However, in the unlikely event of an insurer insolvency, Continued Interest Accounts are guaranteed by the State Guaranty Associations. You may contact the National Organization of Life and Health Insurance Guaranty Associations (www.nolhga.com) to learn more about account coverage limitations.

Any interest credited to proceeds maintained in a Continued Interest Account may be taxable to you. Please consult your tax, investment or other financial advisor regarding tax liability and investment options.

If you open a Continued Interest Account, please keep us informed if you change your mailing address, or wish to close your account. Returned mail or an inactive account may require us under state law to treat your account as unclaimed property and eventually release the funds to the appropriate state. Please be assured that we will try to locate you before releasing such funds. However, the best way to help you maintain control of your account is to promptly notify us of any address change or of your intention to close the account.

For residents of Kentucky: The insurer may receive a benefit from the amounts held in the account. This benefit is generally the amount of investment return earned on the assets in which the funds are invested minus the sum of any administrative fees incurred and the interest paid to accountholders.

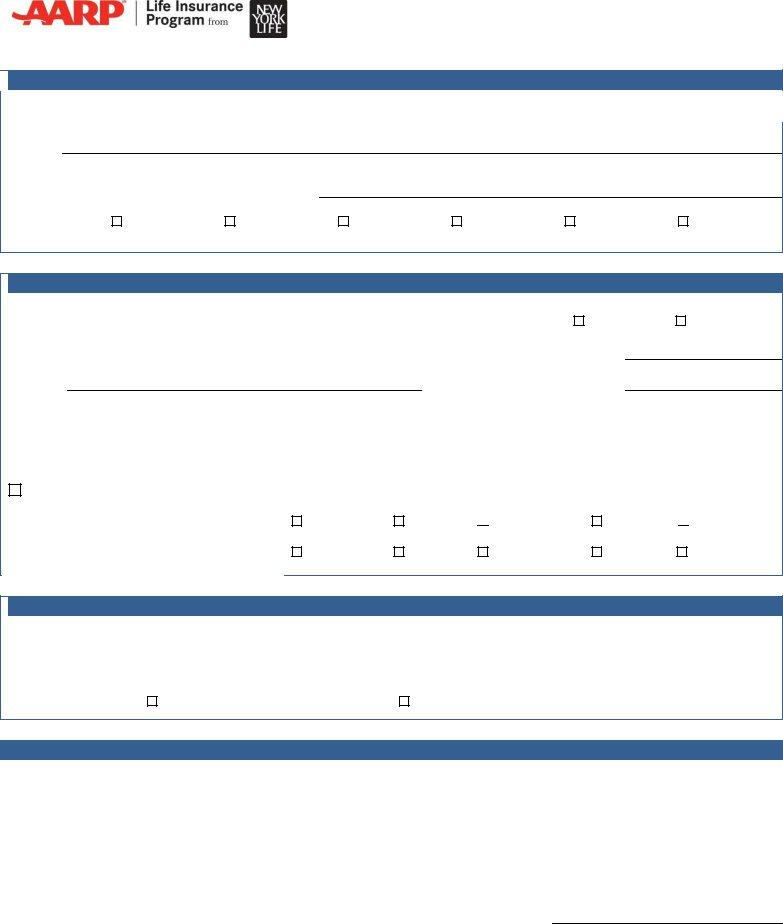

Claim Form

Please type or print legibly

1. Deceased Information

Insurance Contract Number: |

|

Date of Death: |

/ |

/ |

|

|

|

Month |

Day |

Year |

Name:

First

List all other names by which the deceased was known:

Cause of Death: |

Natural |

Accident* |

Middle InitialLast

Unknown |

Suicide* |

Homicide* |

Other |

* Please attach copies of police and coroner’s report and any relevant news articles.

2. Beneficiary Information

Name: |

|

|

|

|

Sex: |

|

Male |

Mailing |

|

|

|

|

Home Phone No: |

( |

) |

Address: |

|

Street |

Apartment No. |

|

|

|

|

|

|

|

Business Phone No: |

( |

) |

CityState Zip

Social Security or |

|

|

|

|

|

Taxpayer Identification Number: |

|

Date of Birth: |

/ |

/ |

|

|

|

Month |

Day |

Year |

Check if statement below applies:

I have been notified by the Internal Revenue Service that I am subject to back-up withholding as a result of failure to report all interest or dividends.

In what capacity are you making this claim? |

Beneficiary |

Executor |

Relationship to the Deceased: |

Spouse |

Child |

|

|

|

3. Settlement Option

You are automatically eligible for the Continued Interest Account if you are a named beneficiary and your proceeds are $5,000 or more. If no option is chosen, New York Life Insurance Company is required to pay the claim in a Lump Sum Payment. *Please note that CIA payments must be made to your physical address and cannot be made to P.O. Boxes.

Continued Interest Account (CIA)

Lump Sum Payment (Payment by Check)

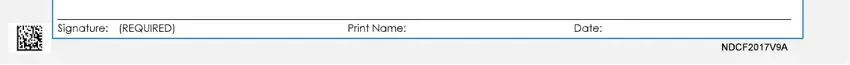

4.Beneficiary’s Signature

I certify that the Social Security or Taxpayer Identification Number and Back-up Withholding status information in Section 2 are correct. I also understand that my signature will be used for signature verification for my Continued Interest Account. I further certify that I am a U.S. person, including a U.S. resident alien (non-US person must complete form W8-BEN). In addition, I have read and understand the Fraud Statement that is applicable to the state in which I reside. New York Residents: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information, or conceals for the purpose of misleading, information concerning any fact material thereto, commits a fraudulent insurance act, which is a crime, and shall also be subject to a civil penalty not to exceed five thousand dollars and the stated value of the claim for each such violation.

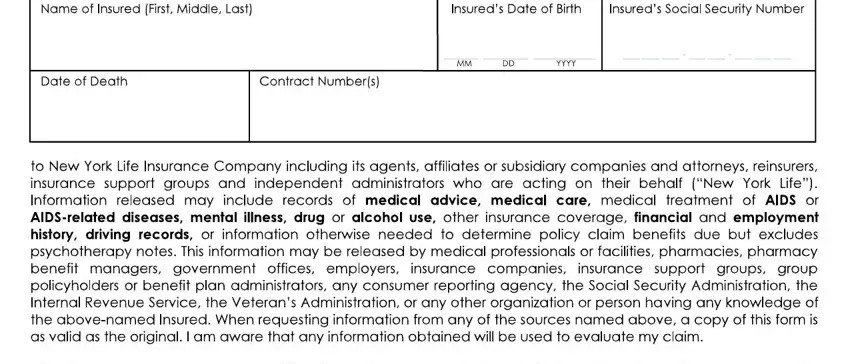

5.Medical Information and Authorization

Please complete this section if all or any portion of the insurance coverage was issued within two years of the insured’s death.

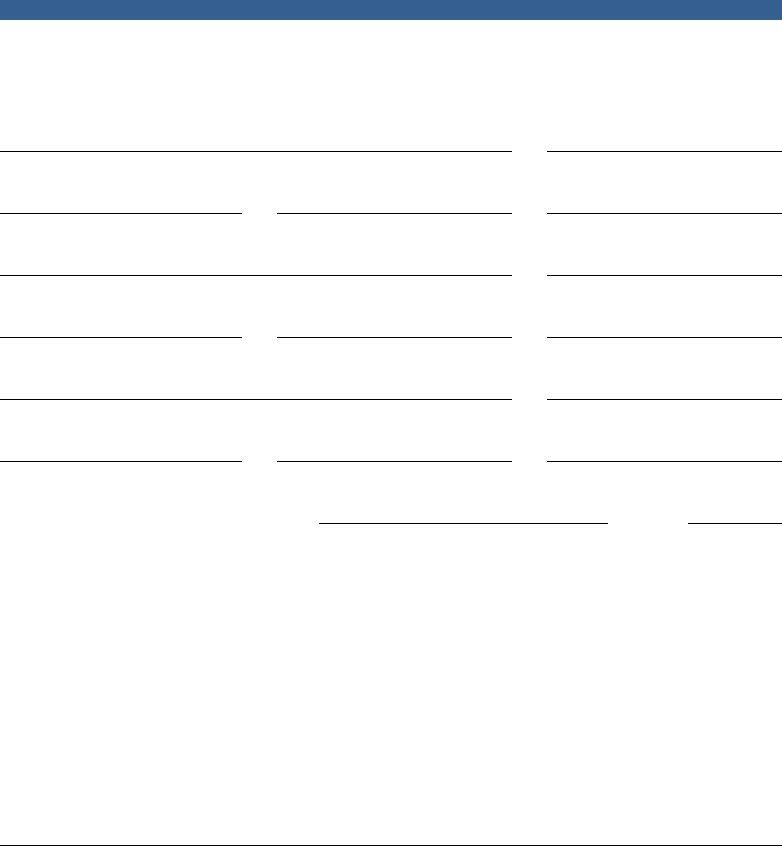

Please list the insured’s family doctor as well as the names, addresses and telephone numbers of any other physicians, clinics and hospitals that may have treated the insured during the past five years.

Primary Care Physician

Street Address |

City, State, Zip Code |

Physician or Hospital Name

Street Address |

City, State, Zip Code |

Physician or Hospital Name

Street Address |

City, State, Zip Code |

()

Telephone Number

Condition

()

Telephone Number

Condition

()

Telephone Number

Condition

Medical Authorization:

I give my permission to release information concerningwho died on

to New York Life including its agents, attorneys, reinsurers and insurance support groups acting on their behalf. Information released may include records of medical advice, medical care, medical treatment of AIDS or AIDS-related diseases, mental illness, drug or alcohol abuse, other insurance coverage, financial and employment history. This information may be released by medical professionals or facilities, pharmacies, government offices, employers, insurance companies, insurance support groups, group policy holders or benefit plan administrators. When requesting information from any of the sources named above, a copy of this form is as good as the original. I am aware that any information obtained will be used to judge my claim. I understand that my claim will not be processed unless this authorization is completed and signed. Either I, or a person I choose, am entitled to receive a copy of this signed authorization. This authorization is valid from the date signed until the claim is resolved, except in those states, which allow for only a one-year limit.

I have the right to revoke this authorization at any time by notifying New York Life in writing at the address on this authorization. My revocation will not be effective to the extent New York Life or any other person already has disclosed or collected information or taken other action in reliance on this authorization. My revocation will also not be effective to the extent state law gives New York Life the right to contest a claim under the policy or the policy itself.

The information New York Life obtains based on this authorization may be subject to further disclosure. For example, New York Life may be required to provide it to an insurance regulatory or other government agency. In this case, the information may no longer be protected by the rules governing this authorization.

Signature |

Relationship to Insured |

Date |

|

Return this Claim Form and a Certified Copy of the death certificate to: |

|

|

New York Life Insurance Company/AARP Operations |

|

|

P.O. Box 30713 |

|

|

Tampa, FL 33630-3713 |

|

6 |

NDCF2011v01a |

|