Every transient vendor in Arizona faces the crucial step of navigating through the process of becoming compliant with state tax obligations, a journey that begins with the ADOR 10759 form, also known as the Transaction Privilege Tax Application (Short Form). Aimed at simplifying the registration process for vendors participating in fairs, special events, shows, and swap meets, this form is not just a piece of paperwork but a gateway to lawful business operation in the state. From the basic business information including the type of ownership and identification details, to a comprehensive breakdown of expected business locations and months of operation, the form covers essential territories to ensure vendors are on the right track. It emphasizes on locations, specifically if they're on Indian Reservations, which could influence tax obligations and operational permissions. The necessity of listing the cities where vendors intend to conduct business elucidates the localized nature of tax compliance, underscored by the varied license fees across municipalities. This initiation into the Arizona Department of Revenue's ecosystem is punctuated by the requirement for the business description, underscoring the importance of clarity about one's business activities in determining tax rates and adherence to state economic frameworks. Furthermore, the delineation of fees further underscores the financial aspect of compliance, bringing to light the cost of doing business at the statewide level, inclusive of city-specific taxation commitments. Understanding the ADOR 10759 form is thus foundational for any transient vendor looking to explore Arizona's vibrant marketplace, ensuring they meet legal standards while contributing to the state's economic fabric.

| Question | Answer |

|---|---|

| Form Name | Ador 10759 Arizona Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | blank state farm insurance card, arizona transaction privilege short, tradlet, az application short |

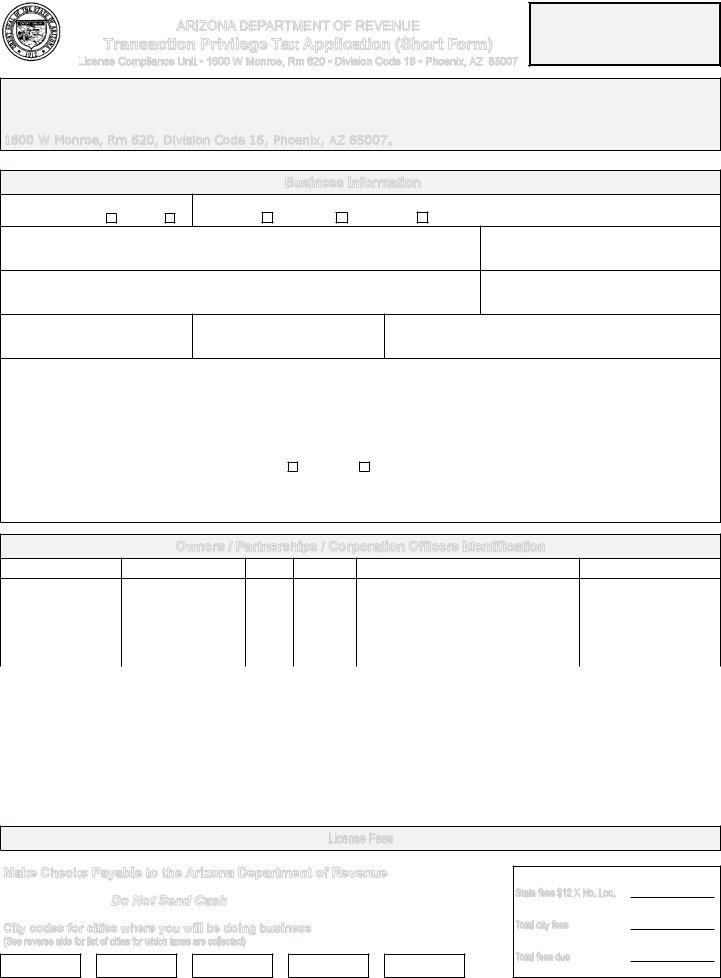

ARIZONA DEPARTMENT OF REVENUE

Transaction Privilege Tax Application (Short Form)

License Compliance Unit • 1600 W Monroe, Rm 620 • Division Code 16 • Phoenix, AZ 85007

To Register, File and

Pay online, go to

www.aztaxes.gov

The simpliied application is used for transient vendors. Each section below must be completed, to receive the license. For licensing questions on transaction privilege or withholding taxes, call (602)

Return the completed application with appropriate fees to: License Compliance Unit, Arizona Department of Revenue, 1600 W Monroe, Rm 620, Division Code 16, Phoenix, AZ 85007.

Incomplete applications will not be processed. All required information is designated with asterisk *

|

|

|

Business Information |

Do you have Arizona employees? |

Type of ownership * |

||

(Check One) |

Yes q |

No q |

(Check One) q Individual q Partnership q Corporation (State and Date of Incorporation): |

Legal business name * |

|

Social Security Number or FEIN * |

|

Business (or DBA) name *

Business Start Date *

Business phone (Include area code) *

()

Location and Date of events / swap meets

Mailing address (street, route, or PO Box) * |

|

|

|

|

City |

State |

Zip Code |

|

|

|

|

|

|

||||

Primary Location of Business (Physical address) No license will be issued without this information * |

City |

State |

Zip Code |

|||||

|

|

|

|

|

|

|

|

|

Is your business located on an Indian Reservation? |

Yes q |

No |

q |

If yes, please tell us which one |

|

|

|

|

|

|

|

|

|

|

|

|

|

Description of Business * |

|

|

|

|

|

|

|

|

Owners / Partnerships / Corporation Oficers Identiication

Social security number *

Name *

Title*

% Owned *

Complete residence address *

Area code & phone number *

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

) |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

) |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Please check the months in which you intend to do business in Arizona |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

Jan |

|

Feb |

|

Mar |

|

Apr |

|

May |

|

|

Jun |

|

Jul |

|

Aug |

|

Sep |

|

Oct |

|

Nov |

|

Dec |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxpayer’s Signature * |

|

Date |

|

|

|

|

|

|

|

License Fees

Make Checks Payable to the Arizona Department of Revenue

Do Not Send Cash

City codes for cities where you will be doing business

(See reverse side for list of cities for which taxes are collected)

State fees $12 X No. Loc.

Total city fees

Total fees due

ADOR 10759 (1/15)

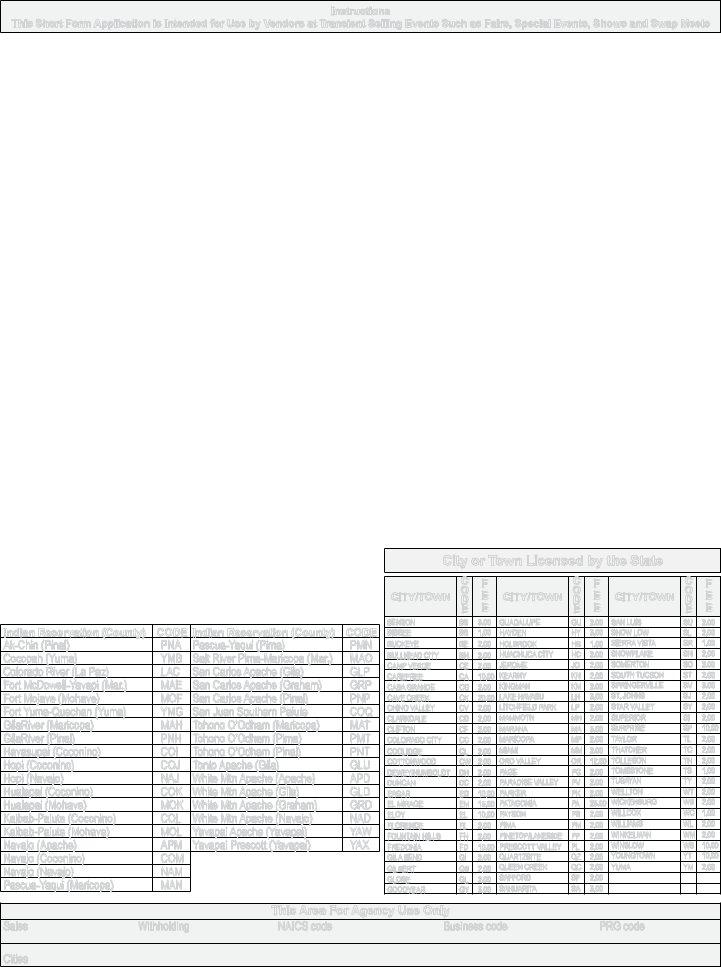

Instructions

This Short Form Application is Intended for Use by Vendors at Transient Selling Events Such as Fairs, Special Events, Shows and Swap Meets

Do you have employees? |

Check yes if you employ individuals in the state of Arizona. If you do not have employees or only have immediate family members |

|

who assist you during a special event or at a swap meet, check no. |

Type of ownership |

Check as applicable. Corporations and partnerships must provide the federal employer identiication number. |

Legal business name or |

Enter the individual’s and spouse’s name if Individual was selected for ownership type. |

owner name |

Enter all partner’s names if Partnership was selected for ownership type. Additional owners may be listed on a separate sheet |

and |

attached. |

|

Enter the organization name owning or controlling the business if Corporation was selected for ownership type. |

Business (or DBA) name |

Enter the name of the business/DBA (doing business as) name, if the same as legal business name, enter same. Commonly, the |

|

business name is the name by which the public knows your business/company/shop. If you wish correspondence to be sent to a name |

|

other than the owner, enter the name of the department or accountancy irm as “In Care Of” to ensure delivery by the postal service. |

Location and Date of event/ swap meet

Enter the address and date of the special event or swap meet. If you do not know the actual address of the event, enter the city/town name in which the event will be held. The location is very important in determining whether an additional city/town license must be obtained for those licensed by the state. Use the City or Town Licensed By The State chart below to determine if you must be licensed through the state for the location in which your event occurs. For cities not listed, please contact the city directly. Also add the city fee amount to the license fee which appears in the lower right corner of the front page.

Mailing address |

Enter mailing address where all correspondence is to be sent. You may elect to use your home address, corporate headquarters, or |

|

accounting irm’s address. |

Primary location of business |

Enter the street address for the primary location of the business. If you conduct most of your business at various special events or swap |

|

meets throughout the state, you may wish to enter your resident location. Even if your mailing address is a PO Box, you must provide a |

|

physical location. For example if you live in a rural community, your physical location may be the intersection of two roads, interstates, or |

|

milepost marker. |

Description of business |

Describe the major activity and principal product you manufacture or commodity sold or service performed. Your description of your business |

|

is very important because it determines your sales tax rate and provides a basis for state economic forecasting. |

Owners identiication |

Enter as many as applicable, attach a separate sheet if additional space is needed. The authority for mandatory requirement for social |

|

security numbers of owners is provided in ARS § |

Signature |

The application must be signed by either the individual owner or, for partnerships or corporation, two partners or two corporate oficers. |

Fees |

The state fee is $12 no matter how many special events you attend. |

|

However, a separate city license fee is required for each city unless |

|

you are currently licensed for the city in which an event will be held. |

|

List the cities in which you will be doing business on the front of the |

|

application form and total to determine the amount due. |

Indian Reservation (County) |

CODE |

Indian Reservation (County) |

CODE |

PNA |

PMN |

||

Cocopah (Yuma) |

YMB |

Salt River |

MAO |

Colorado River (La Paz) |

LAC |

San Carlos Apache (Gila) |

GLP |

Fort |

MAE |

San Carlos Apache (Graham) |

GRP |

Fort Mojave (Mohave) |

MOF |

San Carlos Apache (Pinal) |

PNP |

Fort |

YMG |

San Juan Southern Paiute |

COQ |

GilaRiver (Maricopa) |

MAH |

Tohono O’Odham (Maricopa) |

MAT |

GilaRiver (Pinal) |

PNH |

Tohono O’Odham (Pima) |

PMT |

Havasupai (Coconino) |

COI |

Tohono O’Odham (Pinal) |

PNT |

Hopi (Coconino) |

COJ |

Tonto Apache (Gila) |

GLU |

Hopi (Navajo) |

NAJ |

White Mtn Apache (Apache) |

APD |

Hualapai (Coconino) |

COK |

White Mtn Apache (Gila) |

GLD |

Hualapai (Mohave) |

MOK |

White Mtn Apache (Graham) |

GRD |

COL |

White Mtn Apache (Navajo) |

NAD |

|

MOL |

Yavapai Apache (Yavapai) |

YAW |

|

Navajo (Apache) |

APM |

Yavapai Prescott (Yavapai) |

YAX |

Navajo (Coconino) |

COM |

|

|

Navajo (Navajo) |

NAM |

|

|

MAN |

|

|

City or Town Licensed by the State

|

C |

F |

|

C |

F |

|

C |

F |

CITY/TOWN |

O |

E |

CITY/TOWN |

O |

E |

CITY/TOWN |

O |

E |

D |

D |

D |

||||||

|

E |

E |

|

E |

E |

|

E |

E |

BENSON |

BS |

5.00 |

GUADALUPE |

GU |

2.00 |

SAN LUIS |

SU |

2.00 |

BISBEE |

BB |

1.00 |

HAYDEN |

HY |

5.00 |

SHOW LOW |

SL |

2.00 |

BUCKEYE |

BE |

2.00 |

HOLBROOK |

HB |

1.00 |

SIERRA VISTA |

SR |

1.00 |

BULLHEAD CITY |

BH |

2.00 |

HUACHUCA CITY |

HC |

2.00 |

SNOWFLAKE |

SN |

2.00 |

CAMP VERDE |

CE |

2.00 |

JEROME |

JO |

2.00 |

SOMERTON |

SO |

2.00 |

CAREFREE |

CA |

10.00 |

KEARNY |

KN |

2.00 |

SOUTH TUCSON |

ST |

2.00 |

CASA GRANDE |

CG |

2.00 |

KINGMAN |

KM |

2.00 |

SPRINGERVILLE |

SV |

5.00 |

CAVE CREEK |

CK |

20.00 |

LAKE HAVASU |

LH |

5.00 |

ST. JOHNS |

SJ |

2.00 |

CHINO VALLEY |

CV |

2.00 |

LITCHFIELD PARK |

LP |

2.00 |

STAR VALLEY |

SY |

2.00 |

CLARKDALE |

CD |

2.00 |

MAMMOTH |

MH |

2.00 |

SUPERIOR |

SI |

2.00 |

CLIFTON |

CF |

2.00 |

MARANA |

MA |

5.00 |

SURPRISE |

SP |

10.00 |

COLORADO CITY |

CC |

2.00 |

MARICOPA |

MP |

2.00 |

TAYLOR |

TL |

2.00 |

COOLIDGE |

CL |

2.00 |

MIAMI |

MM |

2.00 |

THATCHER |

TC |

2.00 |

COTTONWOOD |

CW |

2.00 |

ORO VALLEY |

OR |

12.00 |

TOLLESON |

TN |

2.00 |

DEWEY/HUMBOLDT |

DH |

2.00 |

PAGE |

PG |

2.00 |

TOMBSTONE |

TS |

1.00 |

DUNCAN |

DC |

2.00 |

PARADISE VALLEY |

PV |

2.00 |

TUSAYAN |

TY |

2.00 |

EAGAR |

EG |

10.00 |

PARKER |

PK |

2.00 |

WELLTON |

WT |

2.00 |

EL MIRAGE |

EM |

15.00 |

PATAGONIA |

PA |

25.00 |

WICKENBURG |

WB |

2.00 |

ELOY |

EL |

10.00 |

PAYSON |

PS |

2.00 |

WILLCOX |

WC |

1.00 |

FLORENCE |

FL |

2.00 |

PIMA |

PM |

2.00 |

WILLIAMS |

WL |

2.00 |

FOUNTAIN HILLS |

FH |

2.00 |

PINETOP/LAKESIDE |

PP |

2.00 |

WINKELMAN |

WM |

2.00 |

FREDONIA |

FD |

10.00 |

PRESCOTT VALLEY |

PL |

2.00 |

WINSLOW |

WS |

10.00 |

GILA BEND |

GI |

2.00 |

QUARTZSITE |

QZ |

2.00 |

YOUNGTOWN |

YT |

10.00 |

GILBERT |

GB |

2.00 |

QUEEN CREEK |

QC |

2.00 |

YUMA |

YM |

2.00 |

GLOBE |

GL |

2.00 |

SAFFORD |

SF |

2.00 |

|

|

|

GOODYEAR |

GY |

5.00 |

SAHUARITA |

SA |

5.00 |

|

|

|

This Area For Agency Use Only

Sales |

Withholding |

NAICS code |

Business code |

PRG code |

Cities

ADOR 10759 (1/15)