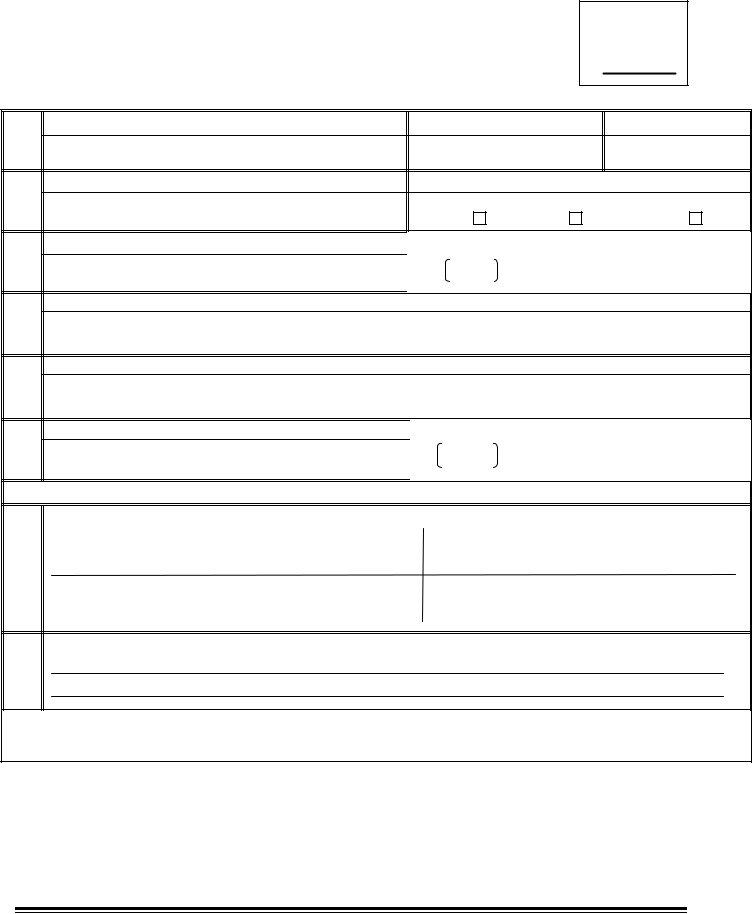

The Amft 71 Arkansas form serves as a critical tool for businesses operating commercial vehicles that traverse through multiple jurisdictions, specifically for the purpose of International Fuel Tax Agreement (IFTA) applications in Arkansas. This intricately designed form is a gateway for obtaining the necessary IFTA license, thereby streamlining the tax reporting and payment process for motor fuel used across state lines. Detailed within the form are sections that require an applicant's legal name, contact information, business type—whether it be sole proprietorship, partnership, or corporation—and even the listing of jurisdictions where the applicant has bulk storage facilities. It also mandates the disclosure of the applicant’s Federal Employee Identification Number or Social Security Number, the Arkansas IRP Account Number, and the U.S. DOT Number, ultimately tying these identifiers to the real-world operation of their commercial vehicles. Furthermore, the form outlines requirements for the number of vehicles for which IFTA decals are needed, and elucidates on the no fee certification, emphasizing the applicant’s agreement to adhere to all reporting, payment, record-keeping, and decal display requirements under penalty of perjury. This not only facilitates a smoother operational flow for businesses involved in interstate commerce but also ensures compliance with the fiscal responsibilities imposed by the IFTA across member jurisdictions.

| Question | Answer |

|---|---|

| Form Name | Amft 71 Arkansas Form |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names |

AM FT |

M OT OR F UE L T A X S E C T ION |

|

P O B OX 1 7 5 2 |

|

LIT T LE ROC K , AR 7 2 2 0 3 |

|

PHONE . (5 0 1 ) 6 8 2 |

|

ARKANSAS IFTA APPLICATION |

Registration

Year

1.

4.

Federal Employee ID Number or Social Security No.

Applicant’s Legal Name

2. Arkansas IRP Account No. |

3. U.S. DOT Number |

Expiration Date

5. Application Type:

Original |

Renewal |

Supplement |

6.

8.

9.

10.

12.

13.

|

Trade/DBA Name (If different than Legal Name) |

|

7. Applicant’s Arkansas Phone Number |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Applicant’s Arkansas Physical Address |

Street |

City |

State |

Zip |

||||||||||

|

Mailing Address |

|

|

|

Street or P.O. Box |

|

|

City |

State |

Zip |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Contact Person’s Name |

|

|

|

|

|

|

|

11. Contact’s Telephone No. |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Type: |

|

|

Sole Proprietor |

|

|

|

|

|

Partnership |

|

|

Corporation |

||

|

|

|

|

|

|

|

|

|

|

||||||

|

PRINT OR TYPE PARTNERS OR CORPORATE OFFICERS NAMES(S), TITLE, AND RESIDENCE ADDRESS |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

NAME |

|

|

|

TITLE |

|

|

|

|

|

PHYSICAL RESIDENCE ADDRESS |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14.List Jurisdictions Where You Have Bulk Storage.

15. |

NUMBER OF VEHICLES REQUIRING IFTA DECALS |

|

NO FEE |

|

|

|

|

CERTIFICATION – The applicant agrees to comply with reporting, payment, record keeping, and display requirements as specified in the International Fuel Tax Agreement. The applicant authorizes the State of Arkansas to withhold any refund of tax overpayment if delinquent taxes are due any member IFTA jurisdiction. Failure to comply with these provisions shall be grounds for revocation of the IFTA license in all member jurisdictions and any falsification subjects him or her to appropriate civic and/or criminal sanction of the base jurisdiction.

APPLICANT AGREES, UNDER PENALTY OF PERJURY, THAT THE INFORMATION GIVEN ON THE IFTA APPLICATION IS, TO THE BEST OF THEIR KNOWLEDGE, TRUE, ACCURATE, AND COMPLETE.

___________________________________ |

___________________________________ |

|

Applicant’s Signature |

Applicant’s Title |

Date |

FOR OFFICE USE ONLY

Decal Registration Numbers: |

Beginning _________________ |

Ending _____________ |

Date Mailed _________ |