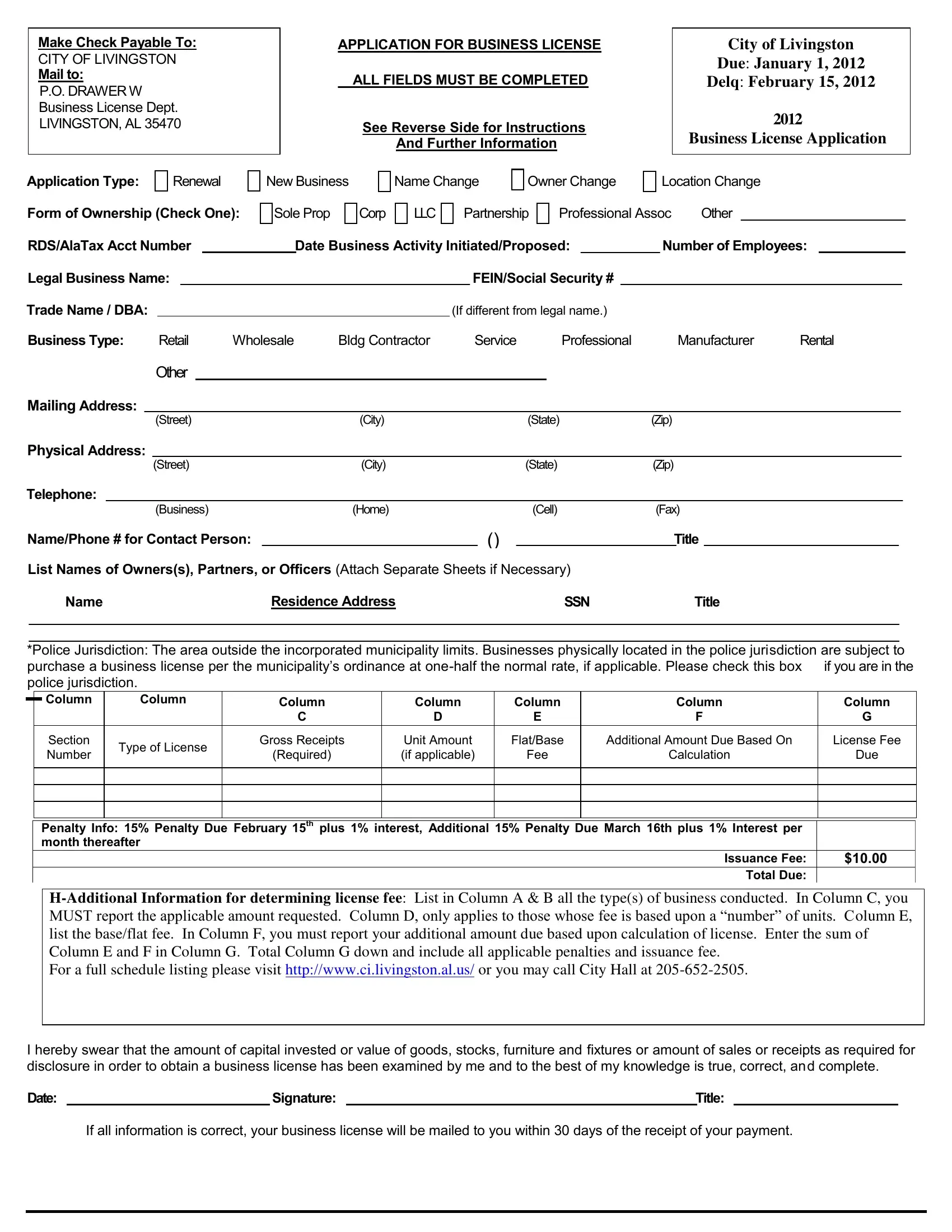

Make Check Payable To:

CITY OF LIVINGSTON

Mail to:

P.O. DRAWER W

Business License Dept.

LIVINGSTON, AL 35470

Application Type: |

|

Renewal |

APPLICATION FOR BUSINESS LICENSE

ALL FIELDS MUST BE COMPLETED

See Reverse Side for Instructions

And Further Information

New Business |

Name Change |

Owner Change |

City of Livingston

Due: January 1, 2012

Delq: February 15, 2012

2012

Business License Application

Location Change

Form of Ownership (Check One): |

|

Sole Prop |

|

|

Corp |

|

LLC |

|

|

Partnership |

|

|

Professional Assoc |

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RDS/AlaTax Acct Number |

|

|

|

Date Business Activity Initiated/Proposed: |

|

Number of Employees: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Legal Business Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FEIN/Social Security # |

|

|

|

|

|

|

|

|

|

Trade Name / DBA: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(If different from legal name.) |

|

|

|

|

|

|

|

|

|

Business Type: |

|

Retail |

Wholesale |

Bldg Contractor |

|

|

Service |

Professional |

|

|

|

Manufacturer |

Rental |

|

|

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Street) |

|

|

|

|

|

|

(City) |

|

|

|

|

|

|

(State) |

(Zip) |

|

|

|

|

|

|

|

Physical Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Street) |

|

|

|

|

|

|

(City) |

|

|

|

|

|

|

(State) |

|

|

|

(Zip) |

|

|

|

|

|

|

|

Telephone: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Business) |

|

|

|

|

|

(Home) |

|

|

|

|

|

|

(Cell) |

|

|

|

(Fax) |

|

|

|

Name/Phone # for Contact Person: |

|

|

|

|

|

|

|

|

|

|

|

() |

|

|

|

|

|

|

|

|

|

|

Title |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

List Names of Owners(s), Partners, or Officers (Attach Separate Sheets if Necessary) |

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

Residence Address |

|

|

|

|

|

|

|

|

|

|

SSN |

|

|

|

Title |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*Police Jurisdiction: The area outside the incorporated municipality limits. Businesses physically located in the police jurisdiction are subject to purchase a business license per the municipality’s ordinance at one-half the normal rate, if applicable. Please check this box if you are in the

police jurisdiction.

|

|

Column |

Column |

Column |

Column |

Column |

Column |

|

|

|

|

|

|

C |

D |

E |

F |

|

|

|

|

|

|

|

|

|

|

Section |

Type of License |

Gross Receipts |

Unit Amount |

Flat/Base |

Additional Amount Due Based On |

|

|

Number |

(Required) |

(if applicable) |

Fee |

Calculation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Penalty Info: 15% Penalty Due February 15th plus 1% interest, Additional 15% Penalty Due March 16th plus 1% Interest per |

|

month thereafter |

|

Issuance Fee: |

$10.00 |

Total Due: |

|

H-Additional Information for determining license fee: List in Column A & B all the type(s) of business conducted. In Column C, you MUST report the applicable amount requested. Column D, only applies to those whose fee is based upon a “number” of units. Column E,

list the base/flat fee. In Column F, you must report your additional amount due based upon calculation of license. Enter the sum of Column E and F in Column G. Total Column G down and include all applicable penalties and issuance fee.

For a full schedule listing please visit http://www.ci.livingston.al.us/ or you may call City Hall at 205-652-2505.

I hereby swear that the amount of capital invested or value of goods, stocks, furniture and fixtures or amount of sales or receipts as required for disclosure in order to obtain a business license has been examined by me and to the best of my knowledge is true, correct, and complete.

If all information is correct, your business license will be mailed to you within 30 days of the receipt of your payment.

Please complete all areas of the form in full. The form should be typed or printed legibly.

The form should be dated and signed by an owner, partner, or officer of the business. The form will initiate the process for registering your business with the municipality.

If your business will have a physical location within the municipality, please use that address on the front of this form. (Complete separate forms for each physical location in the city)

This form is intended as a simplified, standard mechanism for businesses to initiate contact with a municipality concerning their activities within that city. A business license will be required prior to engaging in business. If a business intends to maintain a physical location within the city, there are normally zoning and building code approvals required prior to the issuance of a license.

In certain instances, a business may simply be required to register with the city to create a mechanism for the reporting and payment of any tax liabilities. If that is the case, you will be provided the materials for that registration process.

The completion and submission of this form does not guarantee the approval or subsequent issuance of a license to do business. Any prerequisites for a particular type and location of the business must be satisfied prior to licensing.

Should you have any questions concerning the completion of this form or the licensing and/or registration process, please call the number on the front of this form to obtain a more detailed explanation.