You could complete ar 1r easily by using our online PDF tool. To make our tool better and simpler to utilize, we constantly develop new features, taking into account feedback coming from our users. This is what you would need to do to get going:

Step 1: Firstly, access the pdf editor by clicking the "Get Form Button" above on this page.

Step 2: The editor helps you modify the majority of PDF documents in many different ways. Enhance it by including any text, correct existing content, and include a signature - all manageable within a few minutes!

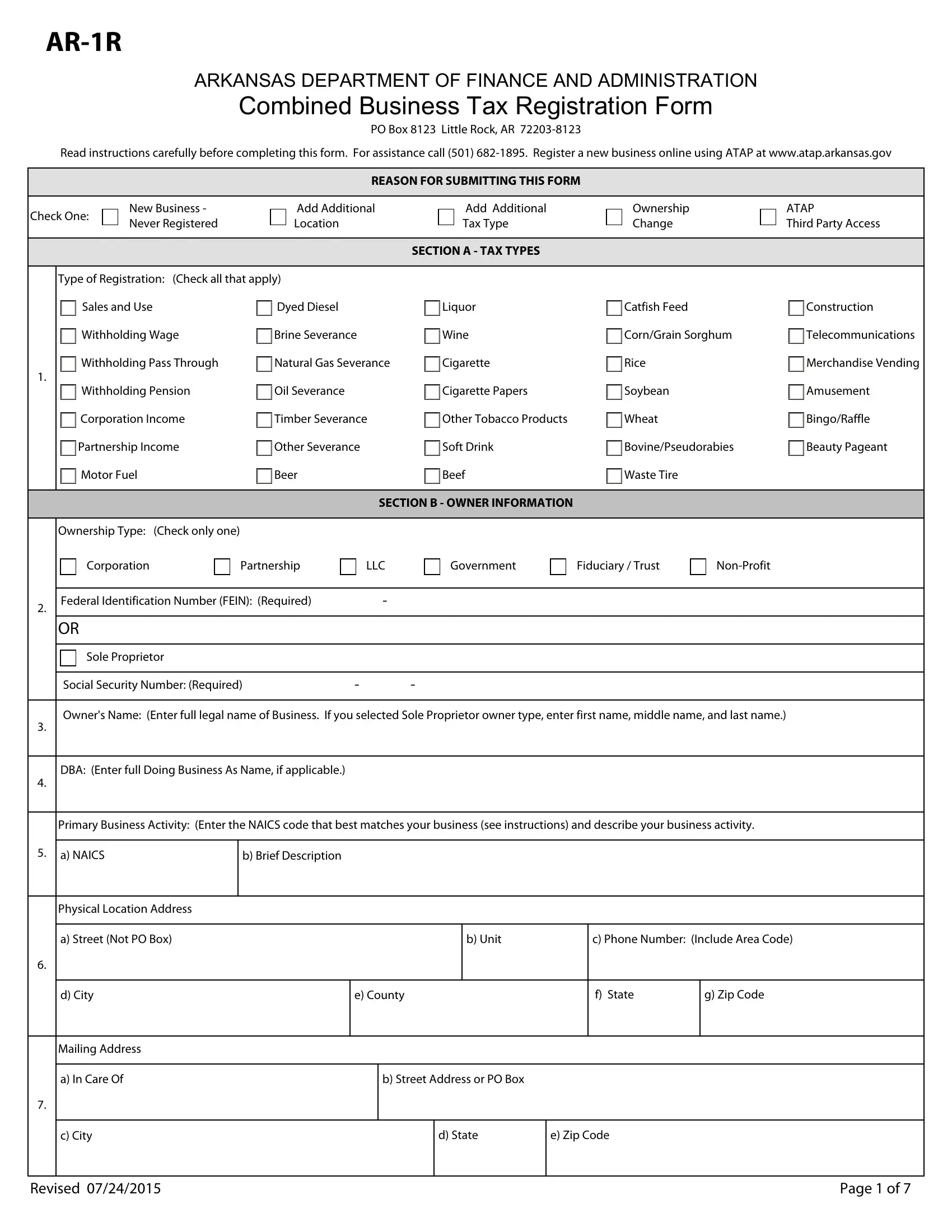

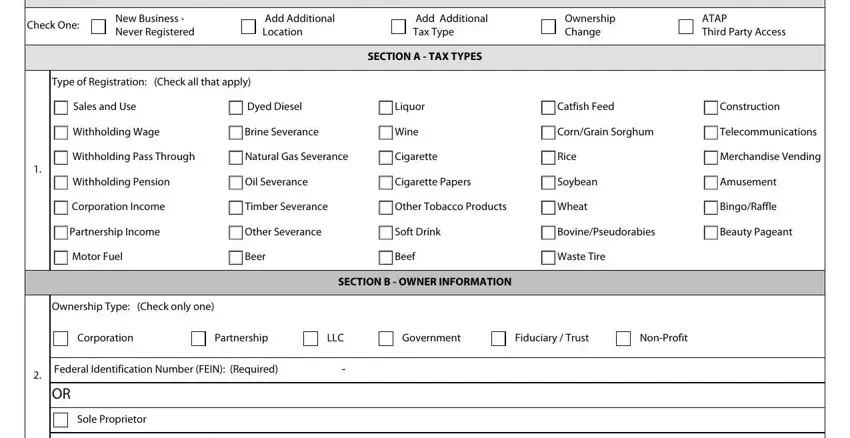

This form requires specific data to be filled out, thus you should take whatever time to enter what is expected:

1. It's very important to complete the ar 1r accurately, therefore be mindful while working with the sections that contain these specific fields:

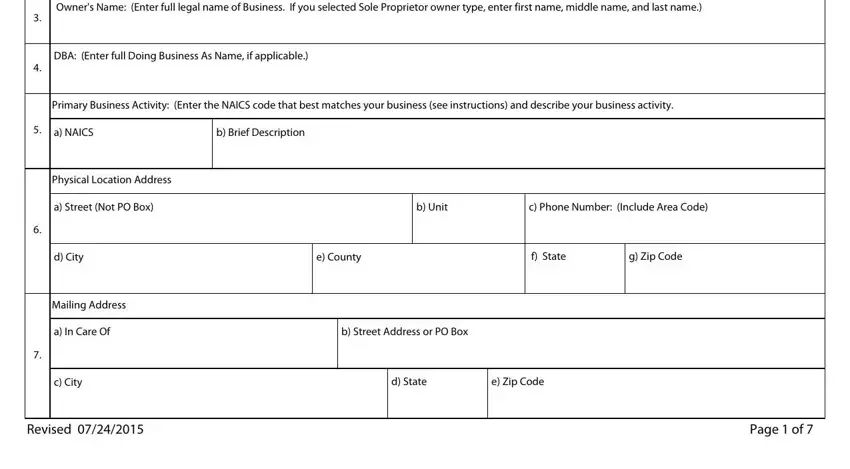

2. Once this part is complete, you're ready to include the necessary particulars in Owners Name Enter full legal name, DBA Enter full Doing Business As, Primary Business Activity Enter, a NAICS, b Brief Description, Physical Location Address, a Street Not PO Box, b Unit, c Phone Number Include Area Code, d City, e County, f State, g Zip Code, Mailing Address, and a In Care Of so you're able to move on further.

You can certainly make a mistake when completing your a NAICS, consequently be sure you reread it prior to when you submit it.

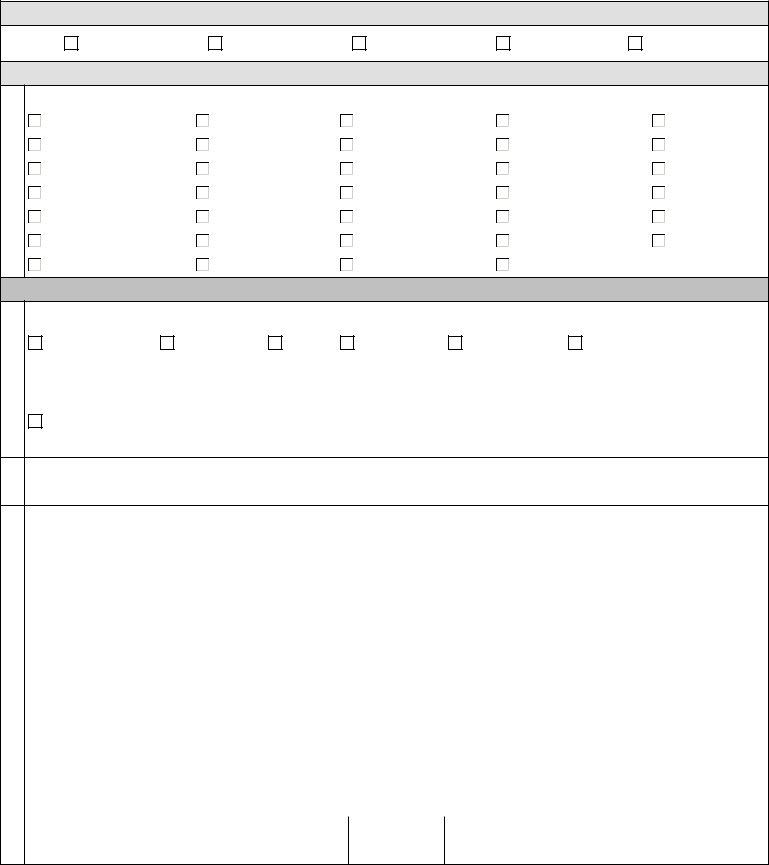

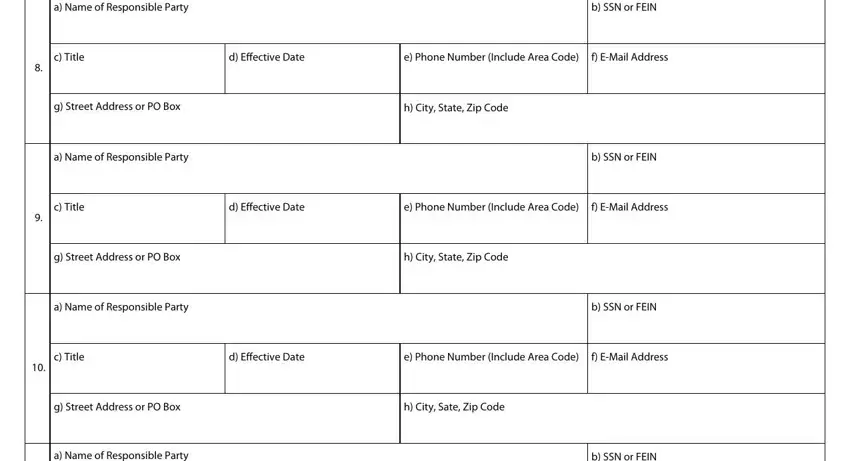

3. This subsequent section is considered rather simple, a Name of Responsible Party, b SSN or FEIN, c Title, d Effective Date, e Phone Number Include Area Code, f EMail Address, g Street Address or PO Box, h City State Zip Code, a Name of Responsible Party, b SSN or FEIN, c Title, d Effective Date, e Phone Number Include Area Code, f EMail Address, and g Street Address or PO Box - all of these form fields is required to be completed here.

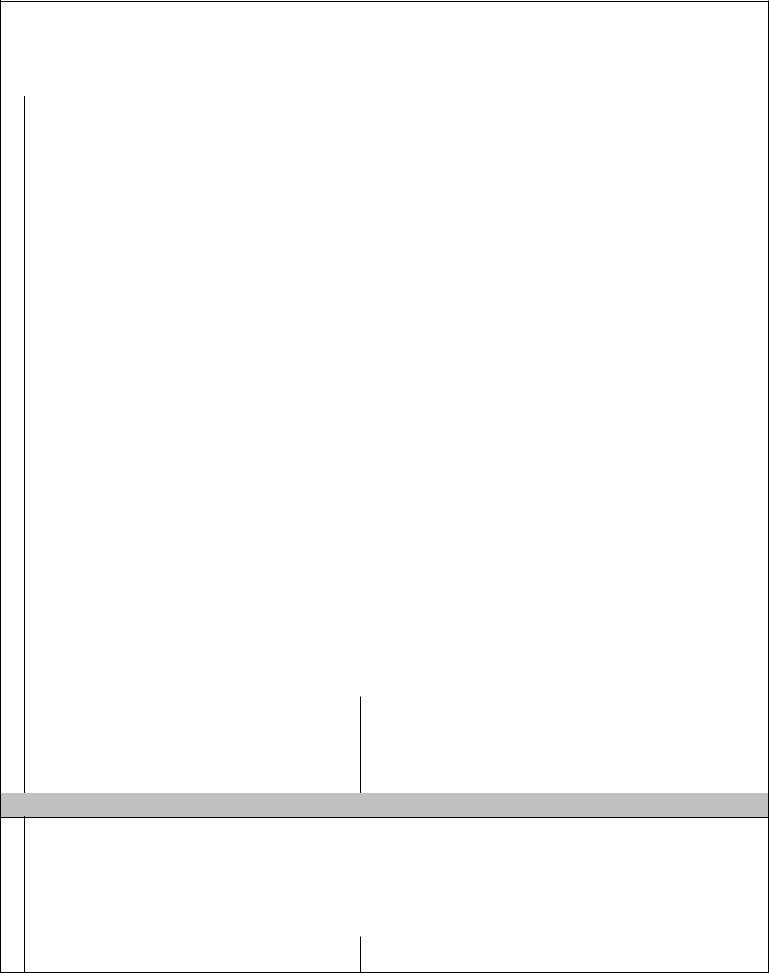

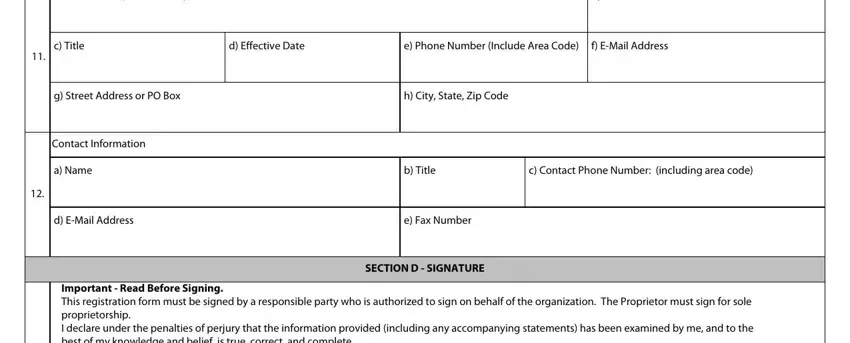

4. This next section requires some additional information. Ensure you complete all the necessary fields - a Name of Responsible Party, b SSN or FEIN, c Title, d Effective Date, e Phone Number Include Area Code, f EMail Address, g Street Address or PO Box, h City State Zip Code, Contact Information, a Name, b Title, c Contact Phone Number including, d EMail Address, e Fax Number, and Important Read Before Signing - to proceed further in your process!

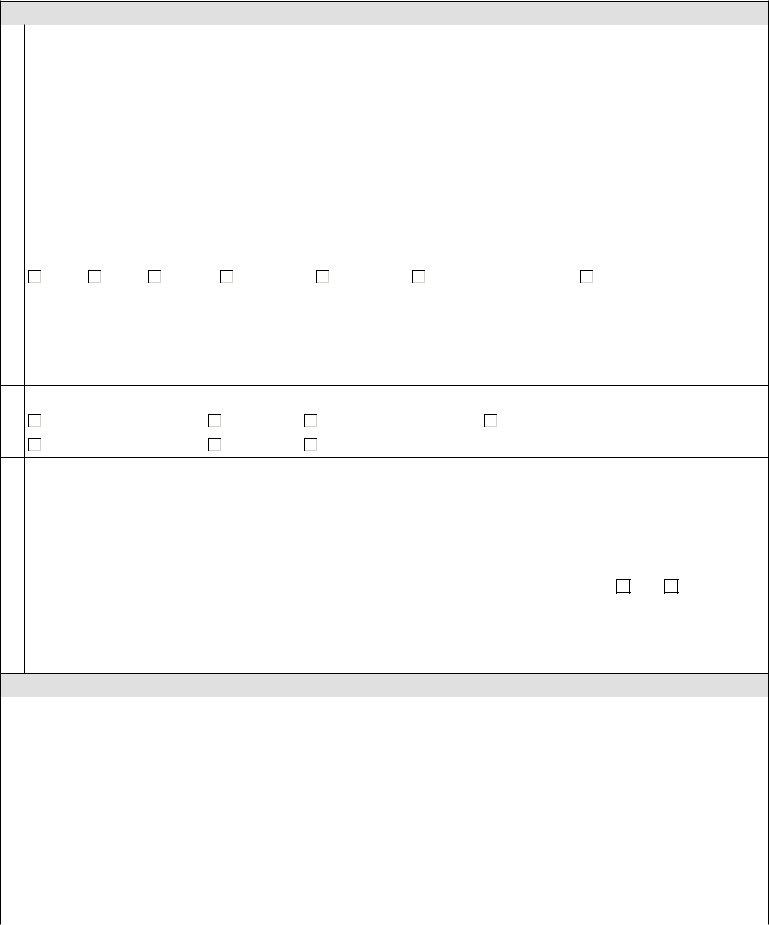

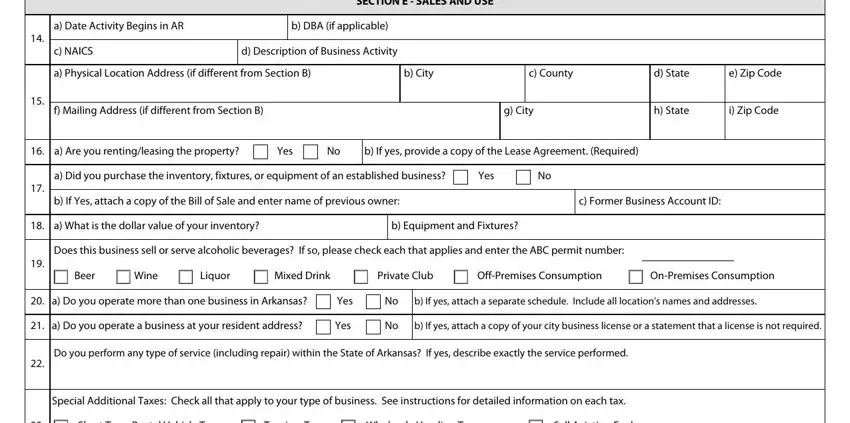

5. To conclude your document, the last area includes a number of extra blanks. Completing a Date Activity Begins in AR, b DBA if applicable, c NAICS, d Description of Business Activity, SECTION E SALES AND USE, a Physical Location Address if, b City, c County, d State, e Zip Code, f Mailing Address if different, g City, h State, i Zip Code, and a Are you rentingleasing the will certainly finalize everything and you'll be done before you know it!

Step 3: Always make sure that the details are correct and then just click "Done" to conclude the project. Get hold of the ar 1r after you sign up at FormsPal for a free trial. Instantly access the form from your personal account, with any edits and adjustments all saved! FormsPal offers secure form tools devoid of data recording or distributing. Rest assured that your information is secure with us!