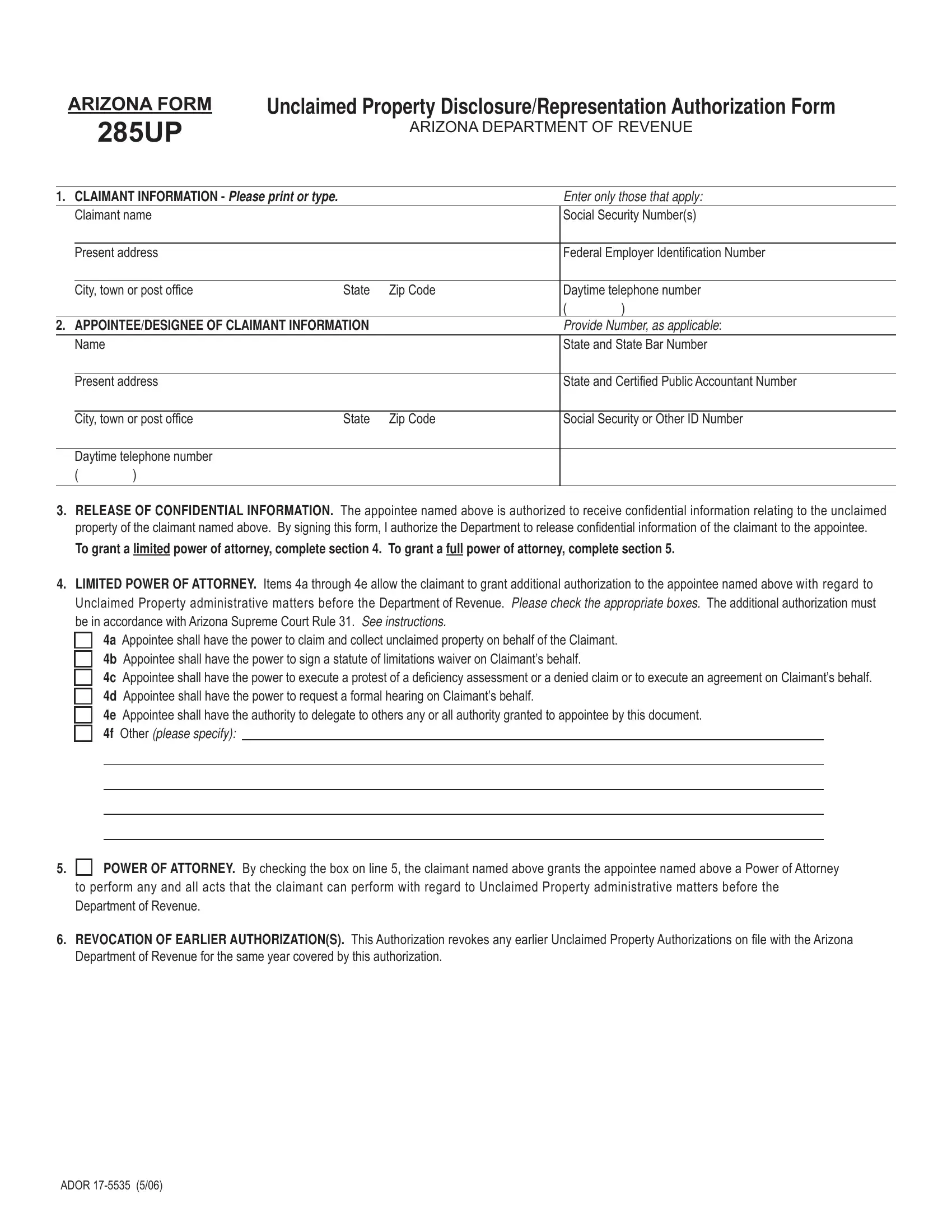

In case you need to fill out arizona property disclosure form, you won't have to install any sort of software - simply try our PDF tool. We are committed to giving you the ideal experience with our tool by consistently adding new functions and upgrades. With all of these updates, working with our tool becomes better than ever before! All it takes is just a few simple steps:

Step 1: Access the PDF inside our editor by clicking the "Get Form Button" in the top part of this page.

Step 2: After you open the editor, you will see the form all set to be filled out. Aside from filling in various blank fields, you can also do various other things with the form, namely adding your own textual content, changing the original text, inserting graphics, putting your signature on the PDF, and much more.

Concentrate when filling out this form. Make certain all necessary areas are done correctly.

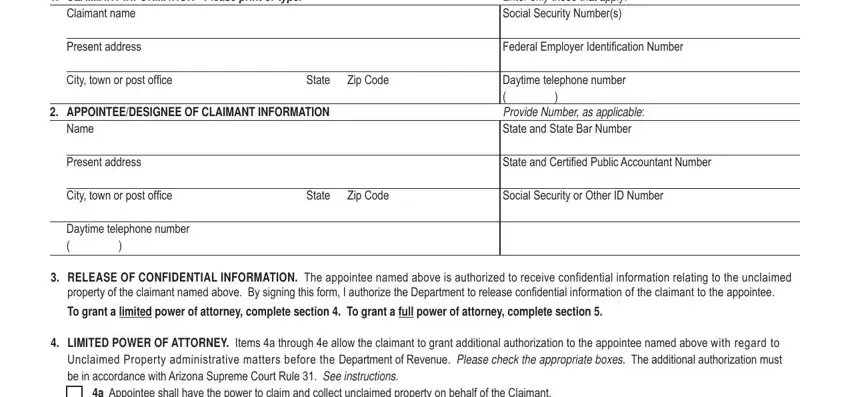

1. Fill out the arizona property disclosure form with a selection of necessary blank fields. Note all of the information you need and be sure there is nothing left out!

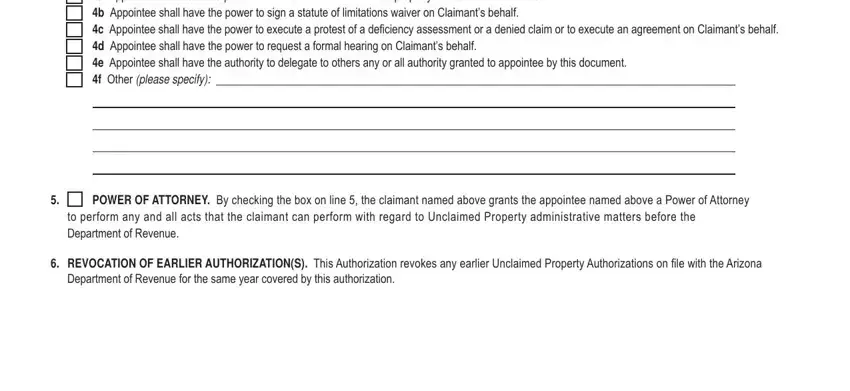

2. Once the previous part is done, you have to include the required specifics in a Appointee shall have the power, POWER OF ATTORNEY By checking the, to perform any and all acts that, and REVOCATION OF EARLIER so you can move forward to the third part.

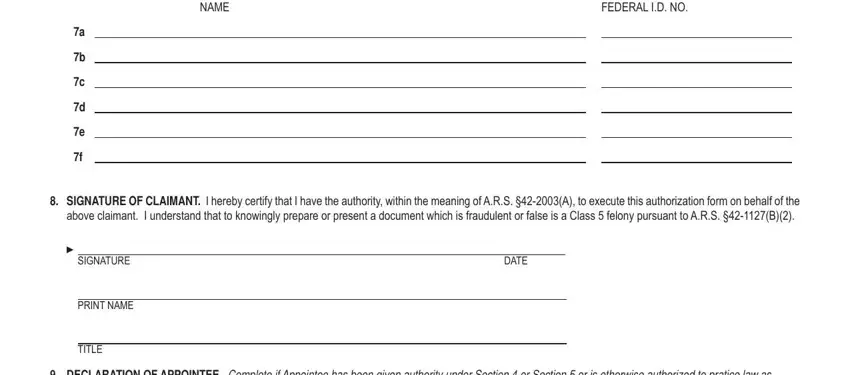

3. Through this part, have a look at NAME, FEDERAL ID NO, SIGNATURE OF CLAIMANT I hereby, above claimant I understand that, SIGNATURE, PRINT NAME, TITLE, DATE, and DECLARATION OF APPOINTEE Complete. All these will need to be filled out with highest accuracy.

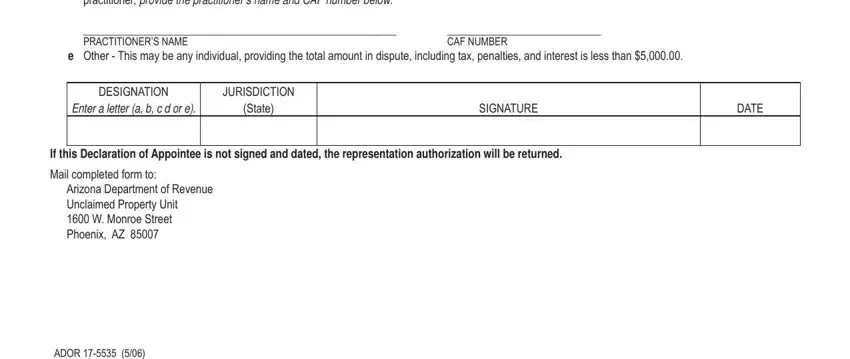

4. You're ready to start working on this fourth section! Here you have these practitioner provide the, PRACTITIONERS NAME, CAF NUMBER, e Other This may be any, DESIGNATION, JURISDICTION, Enter a letter a b c d or e, State, SIGNATURE, DATE, If this Declaration of Appointee, Mail completed form to, Arizona Department of Revenue, and ADOR empty form fields to fill in.

Be very mindful when filling in State and CAF NUMBER, because this is the part in which many people make errors.

Step 3: Before finalizing your document, make certain that form fields are filled in properly. Once you are satisfied with it, click “Done." Obtain your arizona property disclosure form once you subscribe to a 7-day free trial. Readily view the pdf inside your personal account, with any modifications and changes being all preserved! Whenever you work with FormsPal, you can complete documents without having to worry about personal information incidents or records being shared. Our secure system helps to ensure that your personal details are maintained safely.