Using the online editor for PDFs by FormsPal, you may fill in or edit Arizona Form 74 right here. Our team is committed to providing you the absolute best experience with our editor by constantly adding new functions and upgrades. Our tool has become a lot more helpful thanks to the most recent updates! Currently, editing PDF documents is simpler and faster than ever before. Should you be seeking to start, this is what it will take:

Step 1: Just click on the "Get Form Button" at the top of this page to start up our pdf editing tool. Here you will find all that is necessary to fill out your document.

Step 2: The editor offers the opportunity to customize PDF files in various ways. Transform it by writing customized text, correct what is already in the document, and place in a signature - all within the reach of several mouse clicks!

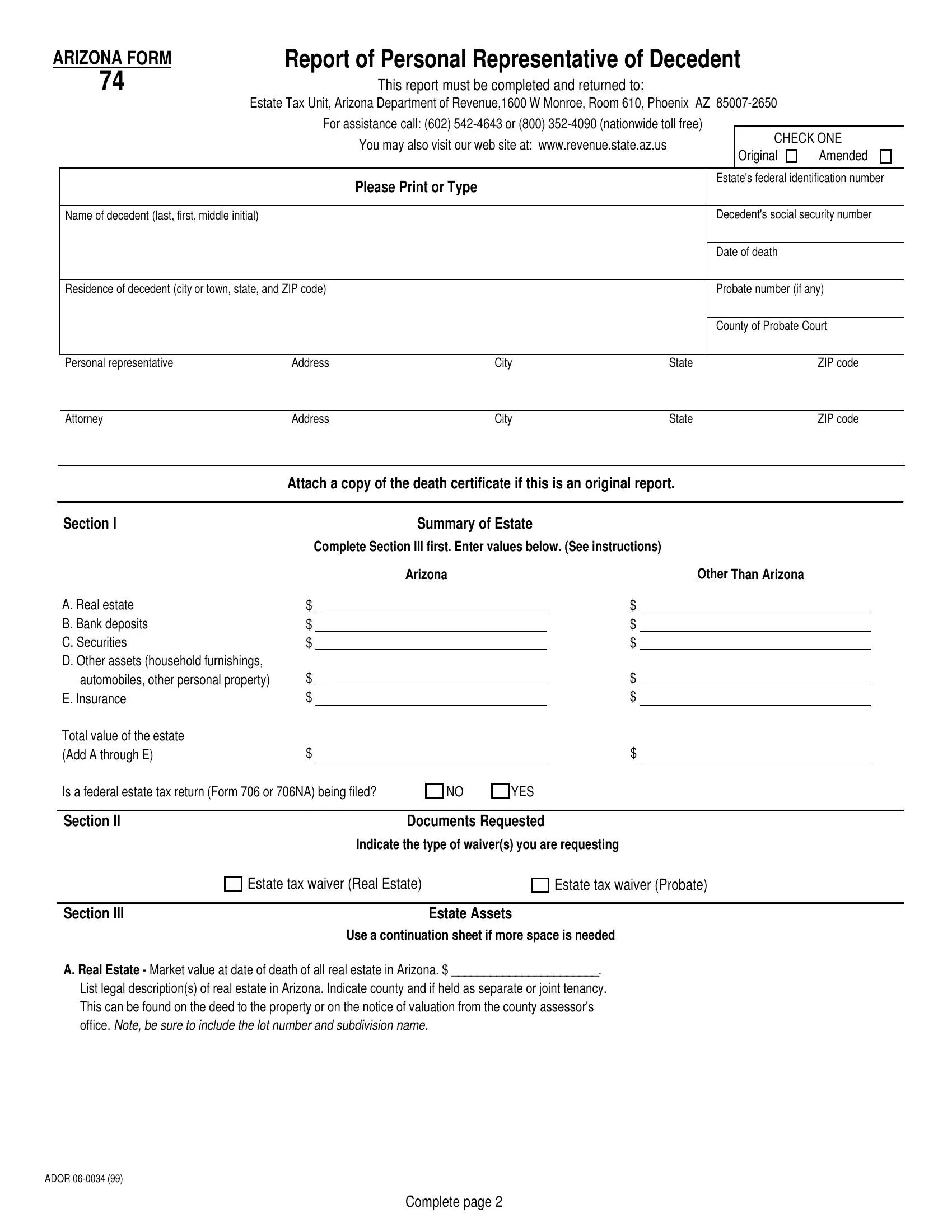

This PDF will require specific details to be entered, so be certain to take the time to fill in what's requested:

1. It is important to fill out the Arizona Form 74 accurately, so pay close attention while filling in the parts comprising all these blanks:

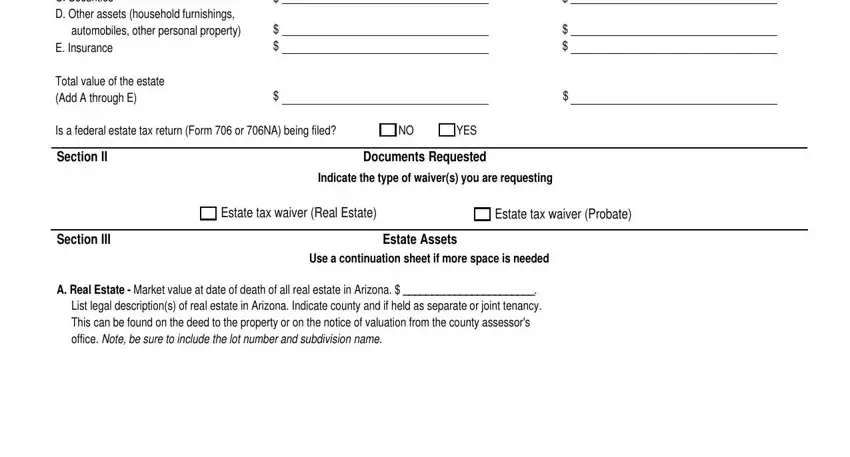

2. Once your current task is complete, take the next step – fill out all of these fields - A Real estate B Bank deposits C, Total value of the estate Add A, Is a federal estate tax return, Section II, Documents Requested, Indicate the type of waivers you, Estate tax waiver Real Estate, Estate tax waiver Probate, Section III, Estate Assets, Use a continuation sheet if more, and A Real Estate Market value at with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

In terms of Estate Assets and Total value of the estate Add A, be certain you take a second look here. Both these could be the most significant fields in this document.

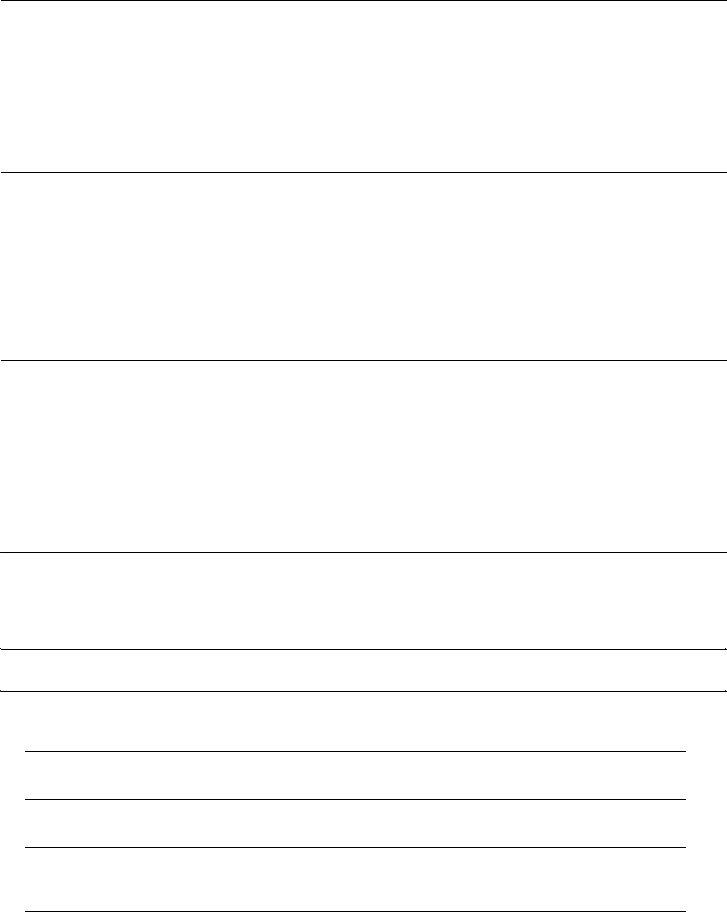

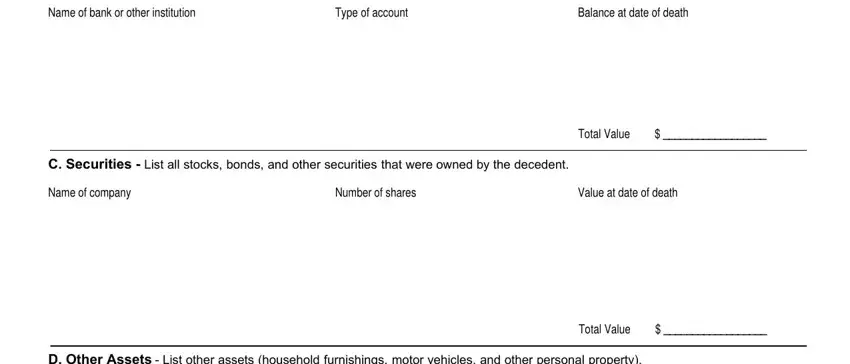

3. Completing Name of bank or other institution, Type of account, Balance at date of death, C Securities List all stocks, Name of company, Number of shares, Value at date of death, Total Value, D Other Assets List other assets, and Total Value is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

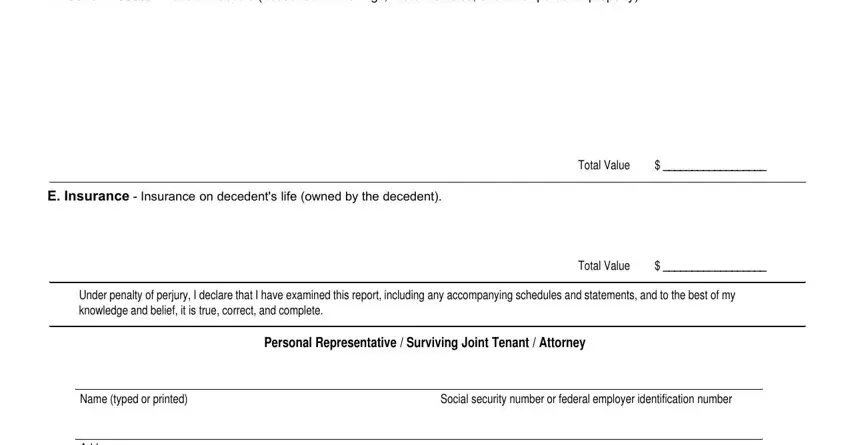

4. To move ahead, this fourth step involves filling in a handful of empty form fields. Included in these are D Other Assets List other assets, E Insurance Insurance on, Total Value, Total Value, Under penalty of perjury I declare, Personal Representative Surviving, Name typed or printed, Social security number or federal, and Address, which you'll find key to moving forward with this PDF.

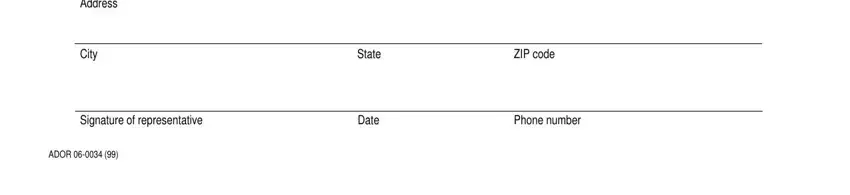

5. Lastly, the following final section is what you should complete prior to submitting the PDF. The blanks at issue include the next: Address, City, Signature of representative, ADOR , State, Date, ZIP code, and Phone number.

Step 3: Soon after double-checking your form fields you have filled in, click "Done" and you're good to go! Join us right now and easily get Arizona Form 74, ready for downloading. All modifications you make are kept , letting you change the form later as needed. FormsPal is focused on the privacy of our users; we make certain that all personal data put into our editor stays confidential.