Whenever you need to fill out Arizona Form A 4P, you don't need to download any kind of software - just make use of our PDF tool. The editor is consistently maintained by our team, acquiring useful features and growing to be better. Here is what you would need to do to get started:

Step 1: Click on the "Get Form" button above. It is going to open up our tool so you can start filling out your form.

Step 2: With this state-of-the-art PDF tool, you could do more than simply fill out blanks. Edit away and make your forms look professional with custom textual content added in, or adjust the original content to perfection - all that comes with the capability to insert almost any pictures and sign the document off.

It will be straightforward to fill out the pdf using this practical tutorial! Here is what you want to do:

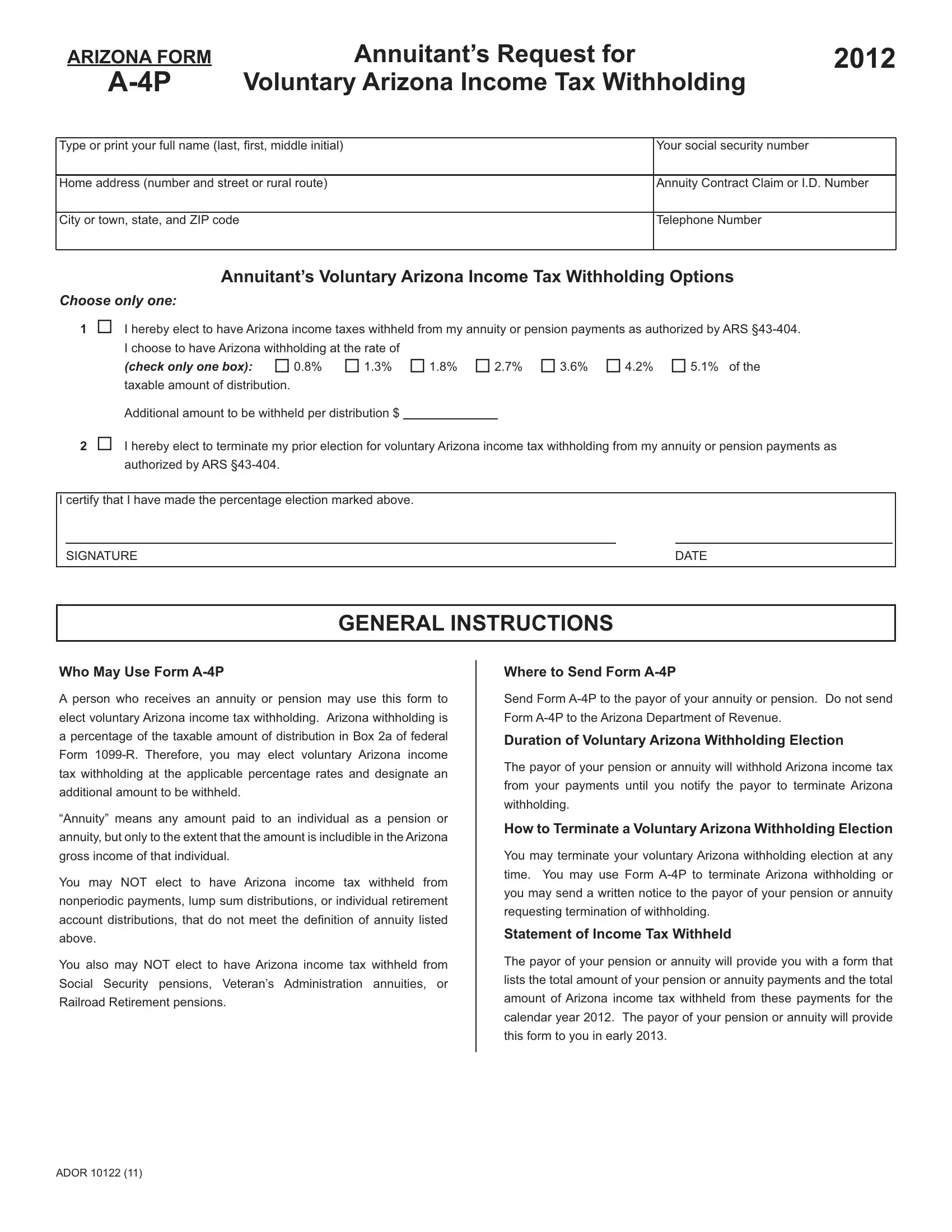

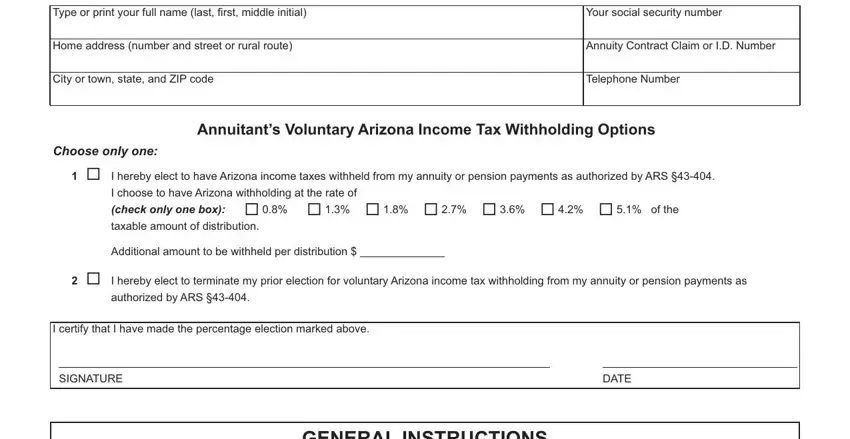

1. To start off, once completing the Arizona Form A 4P, start in the section that features the subsequent blanks:

Step 3: Right after rereading your fields and details, click "Done" and you are good to go! Right after setting up a7-day free trial account with us, you'll be able to download Arizona Form A 4P or email it without delay. The PDF document will also be readily available from your personal account with all your changes. With FormsPal, you can certainly complete forms without the need to get worried about personal information incidents or entries being shared. Our secure system makes sure that your private data is stored safely.