For individuals and businesses operating within Arkansas, understanding the requirements and opportunities presented by the Arkansas ET-1 form is crucial for effective tax management and compliance. Introduced by the Arkansas Department of Finance and Administration, the form is a comprehensive document used to report state and local taxes levied under the Gross Receipts (Sales) Tax and Compensating Use Tax Acts. All figures reported are rounded to the nearest whole dollar, simplifying the calculation process. Additionally, taxpayers are encouraged to use the Arkansas Taxpayer Access Point (ATAP), a secure, web-based service facilitating online access to tax accounts and related information, allowing for a variety of functions including filing and amending returns, making payments, and viewing account activity. The ET-1 form caters to various tax types, including sales, use, food, manufacturing utility, and aviation taxes, each with its own section for detailed reporting. The form also provides avenues for discounts and credits such as a 2% discount for timely filings and payments, and specific tax credits like the Tourism Credit. Understanding new tax regulations, such as Act 866 affecting business closures, and the state tax rate adjustments for certain goods and services, is also essential. This insightful guide aims to break down each component, ensuring accurate and timely filings for all Arkansas taxpayers.

| Question | Answer |

|---|---|

| Form Name | Arkansas Et 1 Form |

| Form Length | 9 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 2 min 15 sec |

| Other names | ar et 1 form, arkansas et, et 1 form get, arkansas excise tax return form et 1 |

Sales Tax for 2020

The Arkansas Department of Finance and Administration would like to remind you about the new Arkansas Taxpayer Access Point (ATAP). ATAP is a

ATAP operates in a secure environment where you will set your password and account access information, and only you can update or change this information. Arkansas taxpayers will be provided with secure access to their tax accounts 24 hours a day, seven days a week, and will afford users the ability to perform the following functions:

File and amend returns* |

Store banking information for use during payment submission |

Make payments |

Register for additional tax types |

Change name and address |

Maintain all tax account types via a single login |

View correspondence |

Assign 3rd party logins (CPA, power of attorney, responsible party, etc.) |

View payments submitted |

File a return using XML return upload for selected taxes |

View recent account activity |

File an Annual Reconciliation for Withholding Tax |

View tax period financial information (tax, penalty, |

Upload |

interest, credits, balance, etc.) |

|

*Individual Income Tax returns are not available to File or Amend on ATAP at this time

What’s New in Sales Tax for 2020

Effective: January 1, 2020

Act 866: Provides that upon the issuance of a final business closure order to a seller/contractor holding an existing state government contract in which further administrative review of the business closure has been waived or all remedies to appeal have been exhausted, the Office of State Procurement shall be notified of the closure order and the Office of State Procurement shall notify each state agency with which the contractor has a contract and the provision of any goods or services, or both, under contract shall cease as soon as reasonably practicable.

Effective: July 1, 2020

State Manufacturing Repair Parts Tax

As of July 1, 2020, the state tax rate on sales of manufacturing repair parts and labor is two and one half percent (2.5%) of the gross receipts or gross proceeds derived from the sale.

All of the Acts referenced above can be located on the Arkansas General Assembly’s website at http://www.arkleg.state.ar.us/SearchCenter/Pages/historicalbil.aspx for further review.

Form

Please use blue or black ink in completing the form. Do not use pencil.

Gross Receipts Tax

This section of the reporting form is used to report all sales by

State Tax

Line 1A Taxable Sales - Insert your state taxable sales from the Taxable Sales Worksheet on this line.

Line 1C Gross Tax Due - Multiply your Taxable Sales in column A by the state rate of 6.5%. Enter amount here.

Line 1D 2% Discount - Multiply Line 1C by 2% (.02) and enter amount here. If the report is postmarked by the 20th of the month due and full payment is made with the report, the 2% discount will be allowed. The discount for state taxes (Lines 1D, 2D, 3D, and 4D) cannot exceed $1000.

Line 1E Tourism Credit - Enter the amount of Tourism Credit if applicable on this line.

Line 1F Net Tax Due

Food Tax

Line 2A Taxable Sales – (Food & Food Ingredients) Insert your state taxable sales from the Taxable Sales Worksheet on this line.

Line 2C Gross Tax Due - Multiply your Taxable Sales in column A by the state rate of 0.125%. Enter the amount here.

Line 2D 2% Discount - Multiply Line 2C by 2% (.02) and enter here. If the report is postmarked by the 20th of the month due and full payment is made with the report, the 2% discount will be allowed. The discount for state taxes (Lines 1D, 2D, 3D, and 4D) cannot exceed $1000.

Line 2E Tourism Credit - Enter the amount of Tourism Credit if applicable here.

Line 2F Net Tax Due

Mfg. Utility Tax

Line 3A Taxable Sales - Insert your state taxable sales from the Taxable Sales Worksheet on this line.

Line 3C Gross Tax Due - Multiply your Taxable Sales in column A by the state rate of 0.625%. Enter amount here.

Line 3D 2% Discount - Multiply Line 3C by 2% (.02) and enter amount here. If the report is postmarked by the 20th of the month due and full payment is made with the report, the 2% discount will be allowed. The discount for state taxes (Lines 1D, 2D, 3D, and 4D) cannot exceed $1000.

Line 3F Net Tax Due

Aviation Tax

Line 4A Taxable Sales - Insert your state taxable sales from the Taxable Sales Worksheet on this line.

Line 4C Gross Tax Due - Multiply your Taxable Sales in column A by the state rate of 6.5%. Enter amount here.

Line 4D 2% Discount - Multiply Line 4C by 2% (.02) and enter amount here. If the report is postmarked by the 20th of the month due and full payment is made with the report, the 2% discount will be allowed. The discount for state taxes (Lines 1D, 2D, 3D, and 4D) cannot exceed $1000.

Line 4F Net Tax Due

Vendor Use Tax

This section of the reporting form is used to report all sales by

State Tax

Line 5A Taxable Sales - Insert your state taxable sales from the Taxable Sales Worksheet on this line. Line 5C Gross Tax Due - Multiply Line 5A by 6.5% and enter amount here.

Food Tax

Line 6A Taxable Sales - Insert your state taxable sales from the Taxable Sales Worksheet on this line. Line 6C Gross Tax Due - Multiply Line 6A by 0.125% and enter amount here.

Mfg. Utility Tax

Line 7A Taxable Sales - Insert your state taxable sales from the Taxable Sales Worksheet on this line. Line 7C Gross Tax Due - Multiply Line 7A by 0.625% and enter amount here.

Aviation Tax

Line 8A Taxable Sales - Insert your state taxable sales from the Taxable Sales Worksheet on this line. Line 8C Gross Tax Due - Multiply Line 8A by 6.5% and enter amount here.

Consumer Use Tax

This section of the reporting form is used to report all taxable purchases by all taxpayers. Taxable purchases are purchases from out-

State Tax

Line 9A Taxable Purchases - Insert your state taxable sales from the Taxable Sales Worksheet on this line. Line 9C Gross Tax Due - Multiply your Taxable Sales in column A by the state rate of 6.5%. Enter amount here. Line 9D Economic Dev Credit - Enter the amount of Economic Dev Credit if applicable on this line.

Line 9E Net Tax Due

Food Tax

Line 10A Taxable Purchases - Insert your state taxable sales from the Taxable Sales Worksheet on this line.

Line 10C Gross Tax Due - Multiply your Taxable Sales in column A by the state rate of 0.125%. Enter amount here. Line 10D Economic Dev Credit - Enter the amount of Economic Dev Credit if applicable here.

Line 10E Net Tax Due

Mfg. Utility Tax

Line 11A Taxable Purchases - Insert your state taxable sales from the Taxable Sales Worksheet on this line.

Line 11C Gross Tax Due - Multiply your Taxable Sales in column A by the state rate of 0.625%. Enter amount here. Line 11D Economic Dev Credit - Enter the amount of Economic Dev Credit if applicable on this line.

Line 11E Net Tax Due

Aviation Tax

Line 12A Taxable Purchases - Insert your state taxable sales from the Taxable Sales Worksheet on this line. Line 12C Gross Tax Due - Multiply your Taxable Sales in column A by the state rate of 6.5%. Enter amount here. Line 12D Economic Dev Credit - Enter the amount of Economic Dev Credit if applicable on this line.

Line 12E Net Tax Due

Mfg. Repair Tax

Line 13A Taxable Purchases - Insert your state taxable sales from the Taxable Sales Worksheet on this line. Line 13C Gross Tax Due - Multiply your Taxable Sales in column A by the state rate of 3.5%. Enter amount here. Line 13D Economic Dev Credit - Enter the amount of Economic Dev Credit if applicable on this line.

Line 13E Net Tax Due

Special Additional Excise Taxes

This section of the reporting form is used to report any of the Special Additional Taxes filed on the

For Future Use

Line 14 For Future Use.

Tourism Tax

Line 15A Taxable Sales & Purchases - Insert your state taxable sales from the Taxable Sales Worksheet on this line. Line 15C Gross Tax Due - Multiply Column A by the state rate of 2%. Enter amount here.

Line 15D 2% Discount - Multiply Line 15C by 2% (.02) and enter amount here. If the report is postmarked by the 20th of the month due and full payment is made with the report, the 2% discount will be allowed. Discount cannot exceed $1,000.00.

Line 15E Net Tax Due

Short Term Rental Tax

Line 16A Taxable Sales - Insert your state taxable sales from the Taxable Sales Worksheet on this line. Line 16C Gross Tax Due - Multiply Column A by the state rate of 1%. Enter amount here.

Line 16D 2% Discount - Multiply Line 16C by 2% (.02) and enter amount here. If the report is postmarked by the 20th of the month due and full payment is made with the report, the 2% discount will be allowed. Discount cannot exceed $1,000.00

Line 16E Net Tax Due

Short Term Rental Vehicle Tax

Line 17A Taxable Sales - Insert your state taxable sales from the Taxable Sales Worksheet on this line. Line 17C Gross Tax Due - Multiply Column A by the state rate of 10%. Enter amount here.

Line 17D 2% Discount - Multiply Line 17C by 2% (.02) and enter amount here. If the report is postmarked by the 20th of the month due and full payment is made with the report, the 2% discount will be allowed. Discount cannot exceed $1,000.00.

Line 17E Net Tax Due

For Future Use

Line 18 For Future Use.

Residential Moving Tax

Line 19A Taxable Sales - Insert your state taxable sales from the Taxable Sales Worksheet on this line. Line 19C Gross Tax Due - Multiply Column A by the state rate of 4.5%. Enter amount here.

Line 19D 2% Discount - Multiply Line 19C by 2% (.02) and enter amount here. If the report is postmarked by the 20th of the month due and full payment is made with the report, the 2% discount will be allowed. Discount cannot exceed $1,000.00.

Line 19E Net Tax Due

Wholesale Vending Tax

Line 20A Taxable Sales - Insert your state taxable sales from the Taxable Sales Worksheet on this line. Line 20E Gross Tax Due - Multiply Line 20A 7% and enter amount here.

Alcoholic Beverage Taxes

This section of the reporting form is used to report any of the Alcoholic Beverage Taxes filed on the

10% Mixed Drink Tax

Line 21A Taxable Sales - Insert your state taxable sales from the Taxable Sales Worksheet on this line. Line 21E Gross Tax Due - Multiply Line 21A by 10% and enter amount here.

4% Additional Mixed Drink Tax

Line 22A Taxable Sales - Insert your state taxable sales from the Taxable Sales Worksheet on this line. Line 22E Gross Tax Due - Multiply Line 22A by 4% and enter amount here.

Liquor & Wine Excise Tax

Line 23A Taxable Sales - Insert your state taxable sales from the Taxable Sales Worksheet on this line. Line 23E Gross Tax Due - Multiply Line 23A by 3% and enter amount here.

Beer Excise Tax

Line 24A Taxable Sales - Insert your state taxable sales from the Taxable Sales Worksheet on this line. Line 24E Gross Tax Due - Multiply Line 24A by 1% and enter amount here.

Line 25 Total Special & Alcoholic Beverage Taxes - Add the net tax due from lines 14 thru 24 and enter here. Place this amount on Line 34 on the front page of the tax return.

Local Sales and Use Taxes

Column A City & County - Insert the name of each city or each county you want to report if it is not

Column B Code - Insert the Local Tax code for each city and each county. These codes can be found in this instruction packet and on our Website at www.arkansas.gov/salestax.

Column C Type Tax - depending on what type of transaction you are reporting, this designates which line you should use in column D, F, H, and I. Use tax is for

Column D Taxable Sales & Purchases – (Lines 26 thru 31) – Report sales tax in the top portion of each line and use tax in the bottom portion of each line. A local rental vehicle tax is also due and should be combined with the amount remitted for local sales tax. Round all figures to the nearest whole dollar. If you have more than six (6) cities and counties to report, attach Schedule L, located at www.arkansas.gov/salestax.

Column E Tax Rate – Enter the appropriate tax rate (found on the attached list) for the city and the county you are reporting. This list is updated quarterly; please check for possible rate changes.

Column F Gross Tax Due – Multiply the taxable sales or purchases by the applicable tax rate (Column E) and enter the calculated amount here.

Column G 2% Discount – For Sales Tax accounts only, multiply the Gross Sales Tax Due by 2% (.02) and enter the amount here. If the report is postmarked by the 20th of the month due and full payment is made with the report, the 2% discount will be allowed. The discount shall not exceed three thousand dollars ($3,000) per city and county reported. Use Tax accounts are not eligible for the 2% discount.

Column H Local Tax Rebate – Enter the amount of additional local taxes paid in excess of $2,500 to a seller on qualifying purchases which are eligible for the local tax rebate.

Column I Net Tax Due – Subtract the 2% Discount Amount and any amounts entered in Column H from the Gross Tax Due Amount for the applicable line. Enter the difference here.

Line 32 Total Local Sales and Use Tax – Add the local taxes from all schedules and enter here. Place this amount on Line 35 on the front page of the tax report.

TOTALS (Lines 33 - 38)

Line 33 Total State Tax - Add Net Tax Due for Lines 1 through 13 and place the total on this line.

Line 34 Total Special & Alcoholic Beverage Tax – Amount from Line 25 should be entered here.

Line 35 Total Local Tax – Amount from Line 32 should be entered here.

Line 36 Total Tax Due – Add Lines 33, 34, and 35 and place the total amount here.

Line 37 Less Prepayments (if required) – Those businesses which are required to make prepayments of sales and/or vendor use tax should take a deduction for those prepayments here.

Line 38 Net Tax Due – Subtract Line 37 from Line 36 and enter the amount here.

Sign Here: Return must be signed by a responsible party.

Payment Voucher Instructions

Insert the amount being paid with the return in the Amount Paid boxes. Also, to ensure payment gets credited to your account, please write your account number on your check. PLEASE LEAVE VOUCHER ATTACHED TO FORM.

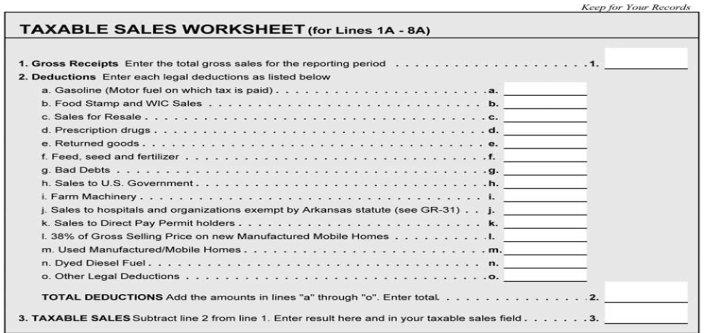

NOTE: In order to determine your taxable sales, we have provided a worksheet below for you to use:

Amended Returns

Form

Tax Types reported on form

Below are brief descriptions of the taxes remitted and collected on form

Sales Tax (Gross Receipts Tax)

Sales or gross receipts tax is levied on retail sales and is collected by the retailer from customers and remitted by the retailer to the State. The retailer gets to retain 2% of the tax collected ($1,000 per month maximum) as a collection fee if the retailer’s remittance is on or before the dates due.

Current Tax Rate is 6.5%

Use Tax (Compensating Use Tax)

The compensating or use tax is levied on retail sales to every person in this State for the privilege of storing, using, distributing or consuming, within the State, any article of tangible personal property or taxable service purchased from outside the State. The tax is in lieu of the State sales tax. It is collected by

Current Tax Rate is 6.5%

Food Tax

As of January 1, 2019, the state tax rate on sales of food and food ingredients is

Current Tax Rate is 0.125%.

Manufacturing Utility Tax

As of July 1, 2015, the state tax rate on sales of natural gas or electricity to a manufacturer for use directly in the manufacturing process is five eighths of one percent (0.625%) of the gross receipts or gross proceeds derived from the sale. See Rule

Current Tax Rate is 0.625%.

Aviation Sales Tax

The sales tax on aircraft and aviation fuel, aviation services, parts, accessories and other sales taxes remitted by aircraft dealers, airports and flying fields are collected by the Commissioner of Revenues and remitted to the State Treasury.

Current Tax Rate is 6.5%.

Aviation Use Tax

The use tax on aircraft and aviation fuel, aircraft parts and accessories is collected by the Commissioner of Revenues and remitted to the State Treasury.

Current Tax Rate is 6.5%.

2% Tourism Tax

The tax is levied upon the gross receipts or gross proceeds derived from admissions to tourist attractions or the sale or rental on items related to tourism. The tax is collected, reported and paid in the same manner as all other gross receipts taxes. The monies collected are deposited as special revenues and credited to the Tourism Development Trust Fund. Current Tax Rate is 2% and is levied upon the gross receipts of the following:

Admission to theme parks, water parks, water slides, river and lake boat cruises and excursions, local sightseeing and excursion tours, helicopter tours, excursion railroads, carriage rides, horse racing, dog racing, indoor or outdoor plays or music shows, folk centers, observation towers, privately owned or operated museums, privately owned historic sites or buildings, and natural formations; the services of furnishing hotel and motel rooms, lodging houses, condominiums and tourist camps or courts to transient guests; camping fees at public or private campgrounds; rentals of watercraft, boats, motors, and related motor equipment; life jackets and cushions, water skis, oars, and paddles.

Short Term Rental Tax

In addition to the Gross Receipts and Compensating Use Tax, there is levied an additional tax of 1% on all tangible personal property that is rented or leased for a period of less than 30 days. The tax is applicable to all rentals or leases regardless of whether tax was paid on the rental property at the time of purchase.

Current Tax Rate is 1%.

Short Term Rental Vehicle Tax

A rental vehicle tax is levied on the gross receipts or gross proceeds derived from rentals of licensed motor vehicles for a period of less than 30 days. A local rental vehicle tax is also due and should be combined with the amount remitted for local sales tax. The rate will be equal to the local tax rate in effect for the jurisdiction where the rental occurs.

Current Tax Rate is 10% plus the local rental vehicle tax.

Residential Moving Tax

A gross receipts tax is levied upon the rental of gasoline or diesel powered trucks rented or leased for residential moving or shipping. Current Tax Rate is 4.5%.

Wholesale Vending Tax

Vending machine operators have three options with regard to the payment of tax. Sales made through vending machines are not subject to the gross receipts tax, but the vending device operator must (1) pay a "wholesale vending tax" of 7% on property purchased for resale through a vending device, (2) pay sales tax on all purchases from vendors with no sales for resale exemption or (3) purchase a vending machine decal instead of paying sales tax or wholesale tax. If a vending machine operator chooses this option, all machines operated must have decals on them.

Current Tax Rate is 7%.

Mixed Drink Tax

In addition to the gross receipts tax, holders of mixed drink permits (except private club permits) issued by the Alcoholic Beverage Control Division must collect and remit the ten percent (10%) supplemental gross receipts tax on all sales of alcoholic beverages except beer and wine.

In addition to the gross receipts tax, holders of private club permits issued by the Alcoholic Beverage Control Division must collect and remit the 10% supplemental gross receipts tax upon all charges to members for the preparation and serving of mixed drinks or for the cooling and serving of beer and wine. A private club which also has a beer permit should collect the state and local sales tax but not the ten percent (10%) supplemental tax on its sales of beer.

Current Tax Rate is 10%.

Additional Mixed Drink

In addition to the gross receipts tax and ten percent (10%) supplemental tax, holders of mixed drink permits must collect and remit the four percent (4%) supplemental gross receipts tax on all sales of alcoholic beverages except beer and wine.

In addition to the gross receipts tax and ten percent (10%) supplemental tax, holders of private club permits must collect and remit the four percent (4%) supplemental gross receipts tax upon all charges to members for the preparation and serving of mixed drinks only. Current Tax Rate is 4%.

Liquor & Wine Excise Tax

A special Alcoholic Beverage Excise Tax of 3% is levied upon all retail receipts or proceeds derived from the sale of liquor, cordials, liqueurs, specialties, sparkling and still wines. The tax is collected by the retailer in addition to the retail price of such products and remitted to the Commissioner of Revenues. This tax is in addition to the Gross Receipts Tax.

Current Tax Rate is 3%.

Beer Excise Tax

The tax is levied on the retail sales of beer for off premises consumption. This tax is in addition to the Gross Receipts Tax. Current Tax Rate is 1%.

Local Sales and Use Taxes

Local taxes are collected and remitted similar to the state sales and use tax. You must report each city tax or county tax separately on the form.

Businesses that hold an active Arkansas Sales and Use Tax permit and file Excise Tax returns with DFA may deduct the amount of additional city or county tax on business purchases on which the full amount of local tax has been collected by the seller. The total amount of the additional tax for a qualifying rebate for each city and county for which the tax was paid must be listed on the form.

When completing the form, a credit for any additional tax paid will be deducted from the local tax due for that reporting period.

Lines 26 – 31

Report sales tax or local rental vehicle tax in the top portion of each line and use tax in the bottom portion of each line. Round all figures to the nearest whole dollar. If you have more than six (6) cities and counties to report, attach additional Schedule L, located at www.arkansas.gov/salestax.

Column A (City & County) – Enter the name of the city or county for which you are reporting tax.

Column B (Code) – Enter the local code as assigned by the Department of Finance and Administration (See enclosed list.) This list is updated quarterly and can be obtained from the Sales and Use Tax Section’s website at www.arkansas.gov/salestax.

Column D (Taxable Sales or Purchases) – Enter the taxable amount of sales or purchases.

Column E (Rate) – Enter the appropriate tax rate (found on the attached list) for the city or county you are reporting. This list is updated quarterly; please check for any possible rate changes.

Column F (Gross Tax Due) – Multiply the taxable sales or purchases by the tax rate and enter here.

Column G (2% Discount) – Multiply the Gross Sales Tax Due by 2% (.02) if paid and postmarked by the 20th of the month due. The discount does not apply to use tax or local rental vehicle tax. The discount shall not exceed three thousand dollars ($3,000) per city and county reported.

Column H (Local Tax Rebate) – Enter the amount of additional local tax paid to a seller on qualifying purchases eligible for the local tax rebate. (See Local Tax Rebate Computation below)

Column I (Net Tax Due) – Subtract the 2% Discount amount from the Gross Tax Due amount. Enter the difference here.

Line 32 Total Local Sales & Use Tax – Add the local taxes from all schedules and enter here.

EXAMPLE:

Local Sales and Use Taxes |

|

(If you have additional local taxes to report, please attach a supplemental schedule) |

|

|||||

|

|

Tax |

Taxable Sales |

|

|

Less 2% |

Local Cap |

|

A. City & County |

B. Code |

C. Type |

D & Purchases |

E. Rate F. Gross Tax Due |

G. Discount |

H. Rebate |

I. Net Tax Due |

|

26. |

6005 |

SALES |

10,000 |

1.500% |

150.00 |

3.00 |

|

147.00 |

LITTLE ROCK |

|

|

|

|

|

|

||

USE |

|

|

|

|

|

|||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

27. |

6000 |

SALES |

10,000 |

1.000% |

100.00 |

2.00 |

|

98.00 |

PULASKI CO. |

|

|

|

|

|

|

||

USE |

|

|

|

|

|

|||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

28. |

2301 |

SALES |

0 |

2.125% |

0 |

|

99.75 |

|

CONWAY |

|

|

|

|

|

|

||

USE |

|

|

|

|

|

|||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

29. |

2300 |

SALES |

0 |

0.500% |

0 |

|

28.50 |

|

FAULKNER CO. |

|

|

|

|

|

|

||

USE |

|

|

|

|

|

|||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

30. |

|

SALES |

|

|

|

|

|

|

|

|

USE |

|

|

|

|

|

|

31. |

|

SALES |

|

|

|

|

|

|

|

|

USE |

|

|

|

|

|

|

RECENT LOCAL TAX CHANGES

The following cities and counties have recent tax CHANGES. Please refer to the city and county local tax listing for the complete listing and current rates in local taxes. This list contains rate change information based on information available July 1, 2020.

City or County Name |

Code |

Date |

Rate |

County |

Recent Action |

|

|

|

|

|

|

Siloam Springs |

7/1/2020 |

2.000% |

Benton |

Annexation |

|

|

|

|

|

|

|

Rogers |

7/1/2020 |

2.000% |

Benton |

Annexation |

|

|

|

|

|

|

|

Bentonville |

7/1/2020 |

2.000% |

Benton |

Annexation |

|

|

|

|

|

|

|

Gentry |

7/1/2020 |

2.000% |

Benton |

Annexation |

|

|

|

|

|

|

|

Pea Ridge |

7/1/2020 |

1.000% |

Benton |

Annexation |

|

|

|

|

|

|

|

Garfield |

7/1/2020 |

1.500% |

Benton |

Increased |

|

|

|

|

|

|

|

Bella Vista |

7/1/2020 |

2.000% |

Benton |

Increased |

|

|

|

|

|

|

|

Berryville |

7/1/2020 |

2.000% |

Carroll |

Annexation |

|

|

|

|

|

|

|

Piggott |

7/1/2020 |

2.000% |

Clay |

Annexation |

|

|

|

|

|

|

|

Kibler |

7/1/2020 |

1.000% |

Crawford |

Annexation |

|

|

|

|

|

|

|

Rudy |

7/1/2020 |

0.500% |

Crawford |

Annexation |

|

|

|

|

|

|

|

Dumas |

7/1/2020 |

3.000% |

Desha |

Increased |

|

|

|

|

|

|

|

Conway |

7/1/2020 |

2.125% |

Faulkner |

Annexation |

|

Paris |

7/1/2020 |

1.500% |

Logan |

Annexation |

|

St. Paul |

7/1/2020 |

2.000% |

Madison |

Enacted |

|

Texarkana |

7/1/2020 |

2.500% |

Miller |

Annexation |

|

Trumann |

7/1/2020 |

2.000% |

Poinsett |

Annexation |

|

Dover |

7/1/2020 |

2.000% |

Pope |

Increased |

|

Jacksonville |

7/1/2020 |

2.000% |

Pulaski |

Deannexation |

|

Sherwood |

7/1/2020 |

2.000% |

Pulaski |

Annexation |

|

Benton |

7/1/2020 |

2.500% |

Saline |

Annexation |

|

Elm Springs |

7/1/2020 |

1.000% |

Washington |

Annexation |

|

Goshen |

7/1/2020 |

2.000% |

Washington |

Increased |

|

Prairie Grove |

7/1/2020 |

2.750% |

Washington |

Deannexation |

|

Winslow |

7/1/2020 |

2.000% |

Washington |

Enacted |

|

Farmington |

7/1/2020 |

2.000% |

Washington |

Annexation |

|

McCrory |

7/1/2020 |

1.000% |

Woodruff |

Annexation |

|

|

|

|

|

|

|

City or County Name |

Code |

Date |

Rate |

County |

Recent Action |

|

|

|

|

|

|

Drew County |

7/1/2020 |

2.250% |

- |

Increased |

|

Greene County |

7/1/2020 |

1.375% |

- |

Decreased |

|

Hempstead County |

7/1/2020 |

3.000% |

- |

Increased |

|

Ouachita County |

7/1/2020 |

2.500% |

- |

Decreased |

|

Stone County |

7/1/2020 |

1.500% |

- |

Increased |

|

Washington County |

7/1/2020 |

1.500% |

- |

Increased |

|

Crossett |

10/1/2020 |

1.750% |

Ashley |

Increased |

|

Bentonville |

10/1/2020 |

2.000% |

Benton |

Annexation |

|

Monette |

10/1/2020 |

1.000% |

Craighead |

Deannexation |

|

Booneville |

10/1/2020 |

1.000% |

Logan |

Decreased |

|

Leachville |

10/1/2020 |

1.000% |

Mississippi |

Enacted |

|

Van Buren County |

10/1/2020 |

1.500% |

- |

Decreased |

|

|

|

|

|

|

|

*Denotes multiple changes for this jurisdiction.

**Denotes jurisdiction is in multiple Counties.

Local Tax Rebate Computation

To compute the amount of rebate, take the invoice amounts exceeding $2,500 (not including tax) and subtract $2,500 from the total Invoice amount. This result is multiplied by the local tax rate that is applicable and the product is the local tax rebate.

Local Tax Rebate EXAMPLE

1. |

Invoice Amount |

|

$8,935.00 |

2. |

Single Transaction Amount |

|

$2,500.00 |

3. |

Amount subject to Local Tax Rate |

|

$6,435.00 |

4. |

Local City Rate |

|

1.000% |

6. |

Total Local Tax Rebate |

|

$64.35 |

You must use this method to compute each Rebate for each local tax. For more information, visit our web site: www.arkansas.gov/salestax

Please Note (Texarkana):

In Accordance with Arkansas statute

To claim a local tax rebate on the available .5% portion of the Texarkana City tax on business purchases, complete and submit the ET- 179A, Local Tax Rebate Form according to the instructions on the form. The