When dealing with taxes and vehicle registration in Arkansas, one cannot overlook the importance of the Arkansas 1064 form. This crucial document serves multiple purposes, primarily facilitating the process for vehicle owners to claim tax credits on new and unused vehicles that were sold for the first time. The form stands as a testament to the state's commitment to promote fairness and efficiency in tax collection, while also ensuring that vehicle transactions are transparent and compliant with state laws. Its design caters to both the individuals involved in the sale or purchase of a vehicle and the state authorities, streamlining the exchange of information and speeding up the process. By understanding the Arkansas 1064 form, vehicle owners and dealers alike can navigate the complexities of tax credits and vehicle registration with more confidence, ensuring they meet all legal requirements while taking advantage of the financial benefits available to them.

| Question | Answer |

|---|---|

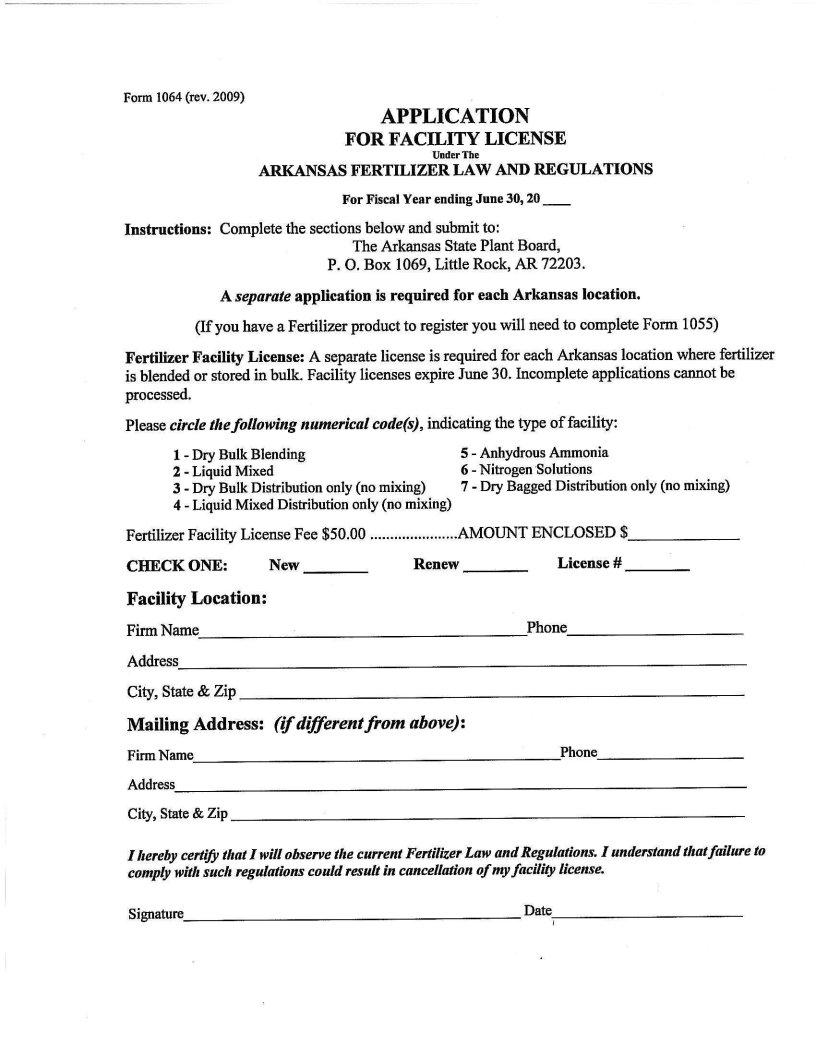

| Form Name | Arkansas Form 1064 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | arkansas fertilizer registration |