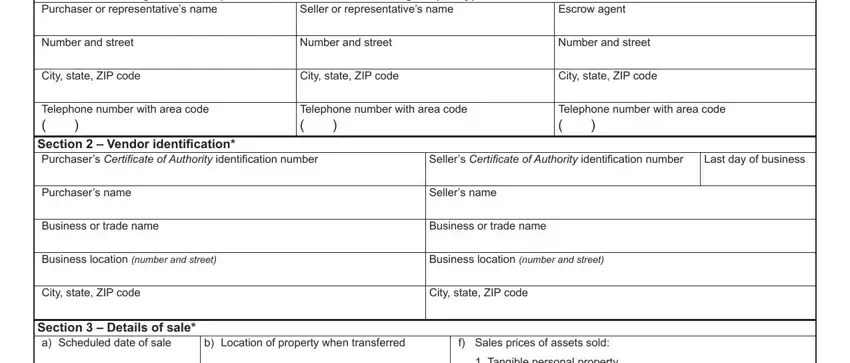

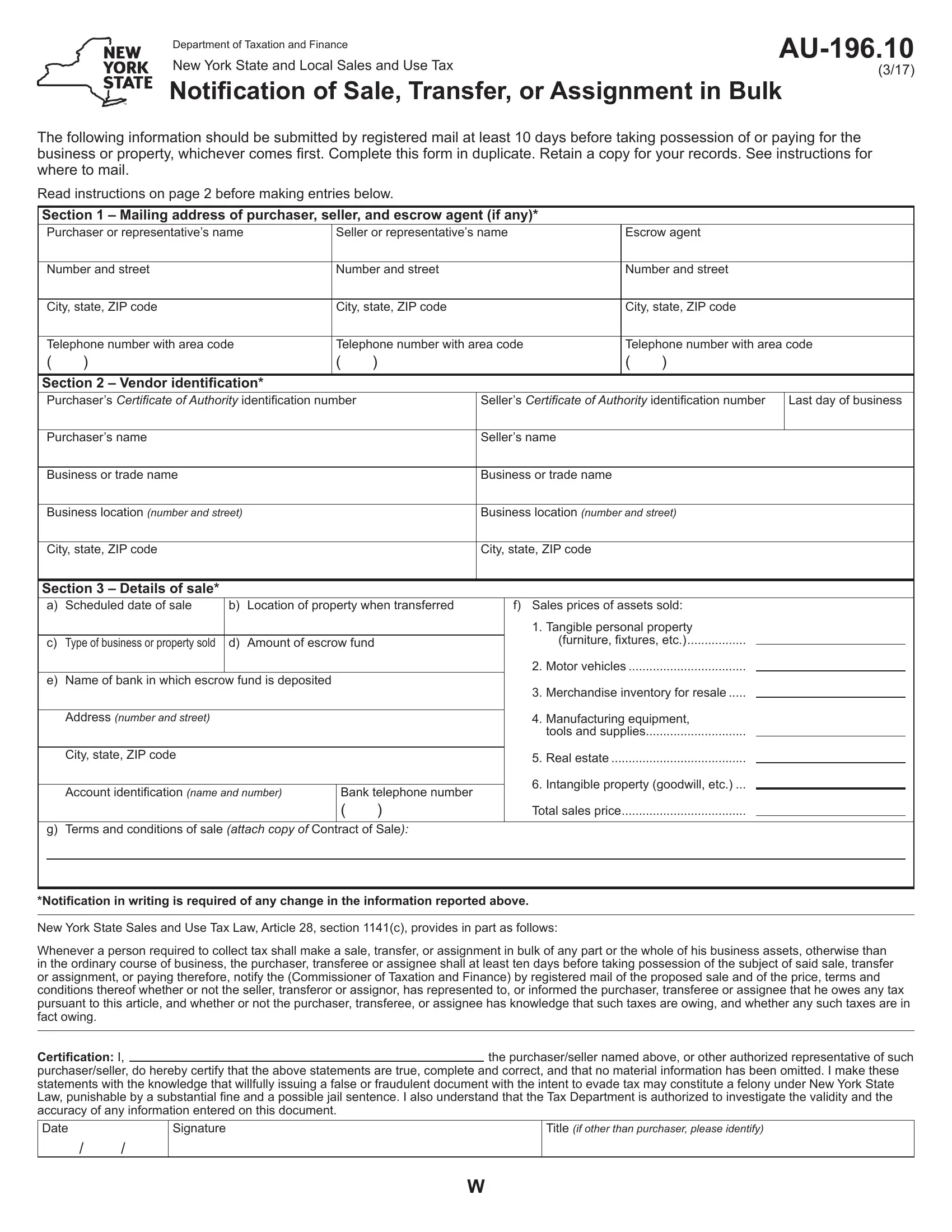

Section 1 – Mailing address of purchaser, seller, and escrow agent (if any)

Since Transaction Desk Audit Bureau will be contacting the

purchaser, seller, and escrow agent, a mailing address for each is required. The mailing address provided may be the business or home address of the oficer, partner, or other representative responsible for the records of the parties involved. If the mailing

address is that of a representative, a power of attorney must be attached.

Section 2 – Vendor identiication

List each vendor’s identiication number as shown on the Certiicate of Authority issued by the NYS Tax Department. If the purchaser is

not a registered vendor, indicate none.

List the purchaser and seller as stated in the sales contract, including their trade name (corporation, partnership, name under

which an individual owner is doing business, assignee, trustee, estate, etc.) and business location.

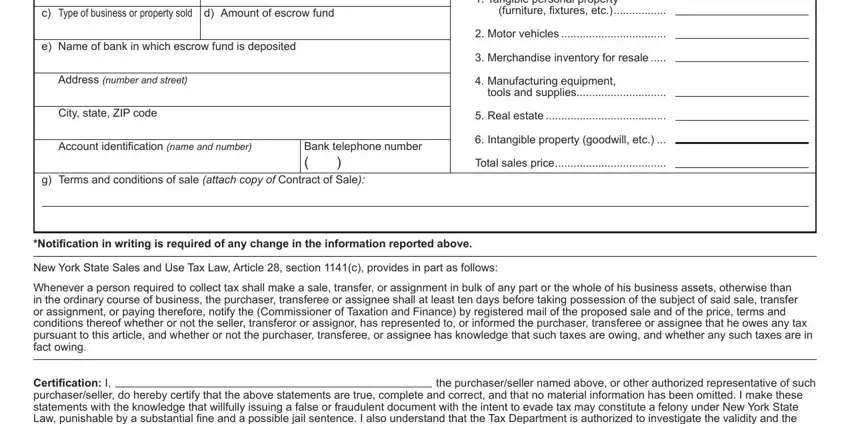

Section 3 – Details of sale

In connection with the proposed sale, the following information is required:

a)Scheduled date of sale – The date to be entered is the date

that the purchaser is taking possession of the business or property sold, or paying therefor, whichever comes irst.

b)Location of property when transferred to the purchaser – If more than one location, attach a detailed schedule.

c)Type of business or property sold – for example, restaurant,

retail clothing, fuel oil distributor, wholesale automotive supply, hardware manufacturer, etc.

d)Amount of escrow fund (if any).

e)Name, address, and telephone number of bank and identiication of account in which escrow fund is or will be deposited.

f)Sales prices of assets sold – If the sales contract does not provide a sales price for the asset, the amount to be listed is

the depreciable value for income tax purposes or the fair market value, whichever is higher. Do not reduce the sales price or

valuation assigned by the amount of any mortgage or other liability assumed by the purchaser.

1.Sales price of tangible personal property. Include furniture, ixtures, supplies, and all other tangible personal property (except for inventory for resale, manufacturing equipment, tools and supplies, and motor vehicles).

2.Sales price of motor vehicles.

3.Sales price of merchandise inventory for resale. Inventory for resale may be transferred exempt from sales tax.

The purchaser must give the seller a properly completed

Form ST-120, Resale Certiicate, within 90 days of the sale.

4.Sales price of manufacturing equipment, tools, and supplies. Include all equipment or machinery for use or consumption directly and predominantly in the production of tangible personal property, gas, electricity, refrigeration or steam

for sale, and tools and supplies used in connection with such machinery or equipment. Machinery, equipment, and

parts entitled to exemption in accordance with Tax Law sections 1105-B, 1115(a)(12), and 1210(a)(1), may be transferred exempt from sales tax. The purchaser must give the seller a properly completed Form ST-121, Exempt Use Certiicate, within 90 days of the sale.

5.Sales price of real estate.

6.Sales price of intangible assets. Include goodwill, accounts

receivable, notes receivable, mortgages, securities, and all other intangible assets.

g)Terms and conditions of sale – Outline manner of payment and any conditional provisions of the contract.

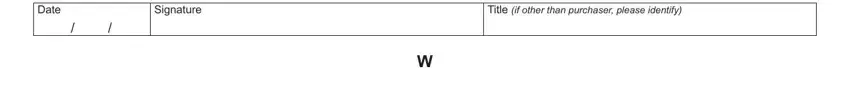

Mailing address

Mail original to:

NYS TAX DEPARTMENT

TDAB–BULK SALES UNIT

W A HARRIMAN CAMPUS

ALBANY NY 12227-0299

If not using U.S. Mail, see Publication 55, Designated Private Delivery Services.

Attention

Any person who is required to ile Form AU-196.10 and who, in addition, has to obtain a Certiicate of Authority, must ile Form DTF-17, Application to Register for a Sales Tax Certiicate of Authority. This application must be iled at least 20 days before

either taking possession of the business assets or paying for them, whichever comes irst. Failure to ile a timely registration for a Certiicate of Authority may, in addition to any other penalty imposed by the Tax Law, result in a penalty of up to $200. You can ile this application online at www.businessexpress.ny.gov (see

Need help?).

If you sell tangible personal property or services subject to tax,

receive amusement charges, operate a hotel, purchase or sell

tangible personal property for resale, or sell automotive fuel or cigarettes without a Certiicate of Authority, in addition to any other penalty imposed, you are subject to a penalty not exceeding $500 for the irst day plus an amount not exceeding $200 for each subsequent day on which such sales or purchases are made, not to exceed $10,000 in the aggregate.

Need help?

Internet access: www.tax.ny.gov

(for information, forms, and publications)

Sales Tax Information Center: |

(518) 485-2889 |

To order forms and publications: |

(518) 457-5431 |

Text Telephone (TTY) Hotline |

|

(for persons with hearing and |

|

speech disabilities using a TTY): |

(518) 485-5082 |