Navigating the complexities of banking processes often requires dealing with specific forms designed to safeguard both the financial institution and the account holders. Among these, the Bank Account Activation Form plays a pivotal role, especially for individuals seeking to reactivate their dormant accounts. Filled out in capital letters for clarity, this form encompasses a comprehensive suite of information, beginning with basic customer details such as account name, number, mother’s maiden name, nationality, and date of birth, extending to the decision on opting for additional services like monthly e-mail statements, card services, transaction alerts, and alternate channels including mobile and online banking. Moreover, it facilitates the updating of customer information, if necessary, signifying its dual purpose not only as a reactivation instrument but also as a tool for information refresh. The form further outlines the conditions under which the reactivated account will operate, touching on aspects such as the bank's obligations, electronic banking terms, and the client’s responsibilities towards maintaining the confidentiality of their security information. The form’s structure, requiring an intricate disclosure of personal and financial data, underscores the importance of accuracy and honesty in banking operations, while also reminding clients of their roles in safeguarding their account’s security.

| Question | Answer |

|---|---|

| Form Name | Bank Account Activation Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | how to activate my fcmb account, fcmb account reactivation code, my fcmb account update online, how to remove my fcmb account from dormant |

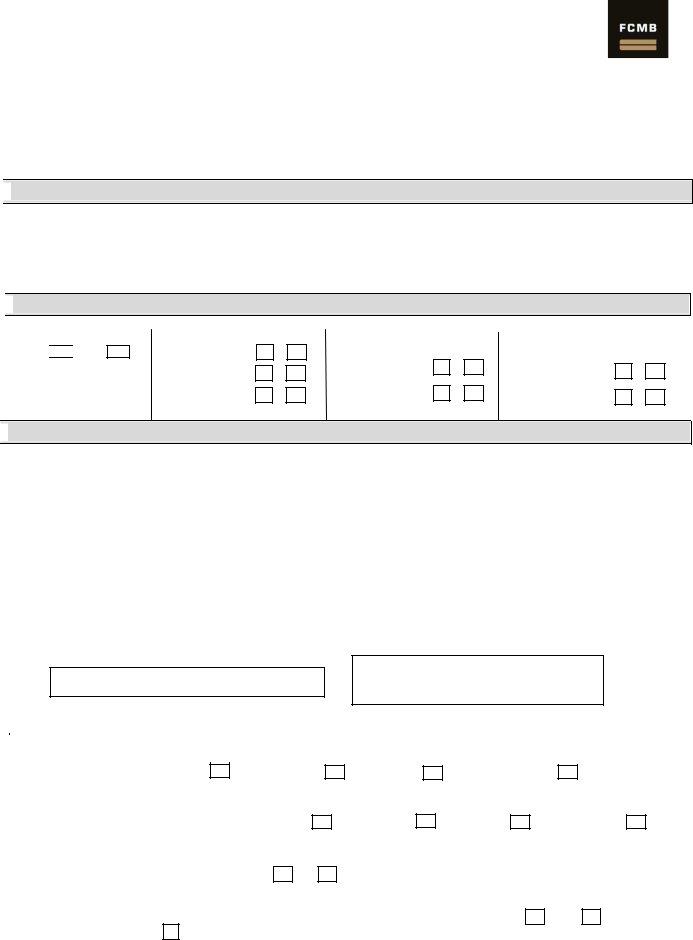

REACTIVATION OF ACCOUNT FORM (INDIVIDUAL)

(PLEASE COMPLETE ALL SECTIONS IN CAPITAL LETTERS) NOTE: INFORMATION PROVIDED HEREIN WILL BE USED TO UPDATE YOUR DETAILS WITH THE BANK

CUSTOMER INFORMATION

Account Name …………………………………………………………………… (Mr./Mrs./Miss) Account Number: ……………………………………………………………

Mothe ’s Maide Na e………………………………Natio alit …………………………………Date of Bi th DD/MM/YYYY ……………………………………………

ADDITIONAL SERVICES (IF REQUIRED)

MONTHLY

Yes No

CARD SERVICES Yes No

Verve Card

Visa Card

MasterCard

(Form Required)

TRANSACTION ALERT

Yes No

SMS Alert

Email Alert

ALTERNATE CHANNELS

Yes No

Mobile Banking

Online Banking

CUSTOMER INFORMATION UPDATE (IF APPLICABLE)

Add ess ……………………………………………………………………………………………………………………… Mo ile Pho e Nu e : ………………………………………

Mo ile Pho e Nu e : ………………………………… E ail add ess: ………………………………………………………………………………………………………………..

O |

upatio : ……………………………………… E plo e ’s Na e: ………………………………………………………………………………………………………………………….. |

E |

plo e ’s Add ess Not P.O.Bo …………………………………………………………………………………………………………………………………………………………….. |

I/We hereby certify that the information given on this form is correct and should be used to update my details with your BANK. By the signature below, I/We have read, understood and agreed with the Account reactivation agreement outlined on the reverse page of this form.

A ou t Holde ’s “ig atu e a d Date

|

FOR BANK USE ONLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reason for Dormancy: Relocation |

|

Insufficient funds |

|

|

|

|

Service Issues |

|

|

Using other account |

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Othe easo Please “pe if ………………………………… |

|

Do |

i iled B a h: …………………………………………………. |

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vote ’s Ca d |

|

|

|

|

|||||||

|

Means of Identification (Tick One): |

International Passport |

|

|

|

|

|

Drivers License |

|

|

National I.D. |

|

|

|

|

|

|

||||||||||||

|

Othe s Pls “pe if ………………… I.D. Ca d No: …………………………………Issua e Date: ……………………….. E pi |

Date……………………………………… |

|

||||||||||||||||||||||||||

Reside tial / Wo k pe it Fo Fo eig |

|

|

No |

|

|

|

|

Issua e Date: ……………………….. E pi Date…………………………… |

|

||||||||||||||||||||

Natio als Yes |

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Documentation Complete: Yes |

|

No |

|

|

|

||||||||

|

Walk in ( Y/N) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Broker Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CSO Name & Sign: |

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Account Officer Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CSM Name & Sign: |

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REACTIVATION AGREEMENT |

|

|

1. We confirm that my/our account(s) and all banking transaction between e/us the usto e , o I , o |

e , o us o |

e a d Fi st Cit Mo u e t Ba k Pl the Ba k shall e go e ed the conditions specified below and/or |

the terms of any specific agreement between me/us and the Bank or where not regulated by either the conditions or such agreement, by customary banking practices in Nigeria. I/We confirm that all information provided here will supersede all previous information given during account opening. The information here should therefore be used to update my/our details with you.

2.I/we/am/are aware that First city Monument Bank PLC is a member of a credit Reference Agency (CRA) and other credit Bureau Organization (CBOs) licensed by the central Bank of Nigeria (CBN) to create, organize and manage database for the exchange and sharing of information on credit status and history of individual and business. I/we/am/are also aware that this information shall be used for business purpose approved by the CBN and any relevant statue. As a member

of CRA and/or CBOs, the Ba k is u de o ligatio to dis lose to CRA o CBOs edit i fo atio a d a othe o fide tial o pe so al i fo atio dis losed to it i the ou se of a ke \customer relationship with it.

3.I/we agree that the Bank may collect, use and disclose such information to CRA or CBOs and that the credit bureau may use the information for any approved business purpose as may from time to time be prescribed by the CBN and\or any relevant statute.

4.I/we understand that information held about me/us by the CRA or CBOs may already be linked to records relating to one or more of my/our partners or associates. I/we may be treated as financially linked and our/my application will be assessed with reference to any associated records. In addition, for any joint application made by us/me with any other person(s), new financial association may be created at the CRAs or CBOs which link our financial records.

5.I/we hereby warrant that you are entitled to disclose information, both written and oral, about me/us, any

6. I/ e he e elease a d dis ha ge Fi st Cit Mo u e t Ba k Pl f o its, o ligatio u de the Ba ke ’s dut of se e a d forswear my/our right to any claim, damages, loss etc on account of such disclosure to CRAs or use by the CRAs or CBOs in accordance with the provision of any CBN Guideline and /or relevant statute.

ELECTRONIC BANKING

We confirm and agree that the following terms and conditions shall govern my/our Electronic Banking transaction with the Bank:

Definitions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

“e i e ea |

s the Ele t o |

i |

Ba |

|

ki g “e |

i e of Fi st |

it |

Mo |

u |

e t Ba |

k Pl , i |

ludi |

g i te |

et Ba ki g, Telepho |

e Ba ki g , Mo ile Ba ki g, “e u e essage fa ilit a d ills pa e t se i e A ess ode, Pass code, user name and |

|||||||||||

pass |

o d |

|

ea s the e |

a |

li |

g |

ode |

ith |

hi h ou a |

ess the s ste |

a |

d hi h is k o |

to |

ou o l . |

|

|

|

|||||||||

A |

ou |

t |

ea |

s a |

u |

e |

t o |

sa i |

gs a |

ou |

t o othe a |

ou t |

ai |

tai |

ed |

ith the BANK at a |

of the BANK’s |

a |

hes i Nige ia |

|||||||

PIN |

eans |

your personal identification number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Maili |

g Add ess |

ea |

s the |

usto |

e ’s aili g add ess i |

the BANK’“ |

e o ds. |

|

|

|

|

|

|

|||||||||||||

I |

st u tio |

|

ea s the usto |

e ’s |

e |

uest to the BANK fo |

the se |

i es. |

|

|

|

|

|

|

|

|||||||||||

ATM |

ea |

s Auto |

ated Telle |

Ma hi |

e that dispe |

ses |

ash to a count holders or accepts cash deposits with the use of a smartcard i.e. debit card or credit card |

|||||||||||||||||||

ATM Ca d |

ea s the |

a d used |

|

a |

usto |

e fo |

p o essi g t a sa tio th ough i |

te s |

it h o |

a ious pa |

e t |

ha |

els e.g. ATM |

|||||||||||||

I |

te s |

it h |

|

ea |

s a |

o |

li |

e electronic transaction processing payment infrastructure that connects different payment channels to the payment processor and enablers |

||||||||||||||||||

“e u e Message Fa ilit |

ea s the fa ilit |

ithi the |

ake pa e t, e uest fo |

he u ooks, Ba |

ke ’s d aft o the pu hases o sale of se u ities a |

send electronic message

d i te ests i |

utual fu ds. |

1. .The service allows the customers to give the BANK instruction by use of telephone, ATM, PIN, password, Access code, User name and secure message (email,SMS) for the following:

i. o tai i fo |

atio |

ith |

ega di g usto |

e ’s |

ala |

e as at the last date of usi ess with the BANK. |

||

Ii.obtain information with regards to any instrument in clearing or any credit standing in the customer account as at the last date of t a sa tio o the usto e ’s a ou t. |

||||||||

iii. autho ize the BANK to de it usto |

e ’s a |

ou t to pa a spe ified utility bill such as TELEPHONE, PHCN, WATER RATE and/or any other bills as specified by the customer subject however to availability of such bill payment under this |

||||||

service. |

|

|

|

|

|

|

|

|

iv. autho izi |

g the BANK to effe t a t a |

sfe |

of fu ds f o the usto e ’s a |

ount to any other account with the BANK. |

||||

v.authorizing the BANK to effect any stop payment order |

|

|||||||

Vi.u fo esee |

i u |

sta |

es su h as A t of God, Fo |

e Majeu e, a d othe |

auses e o d the BANK’“ o t ol. |

|||

2. For the service to be available to any customer, he/she must have: any one or a combination of the following:

i.An account with BANK

ii.A pass code, access code, username and password

iii.A touch- tone telephone/GSM handset and computer

. authorizing the BANK to debit customer account and load same into any form of prepaid card.

3. O e eipt of i |

st u tio |

, the BANK ill e dea o to a out the usto e ’s i st u tio p o ptl , e epti g all o a |

i. A pe so al ide |

tifi atio |

Nu e PIN |

ii. An

4.Under no circumstances shall the customer allow any body access to his/her account through the service.

5.The passcode/Access

i.The customer understands that his/her Passcode, Access code/password/

ii.The customer instructs and authorizes the BANK to comply with any instruction given to the BANK through the use of the service.

iii. |

O e the BANK is i st u ted |

ea s of the |

usto |

e ’s pass ode, A |

ess ode a |

d PIN the BANK is e titled to assu |

e that those are the instructions given by the customer and to rely on same. |

||

iv. |

The custo e ’s pass ode, A |

ess ode ust |

e ha |

ged i |

ediatel it |

e o es k |

o to so eo e else. |

usto e ’s pass ode, A ess ode if a |

ea s of the usto e ’s pass ode, A ess ode e o es k o to a |

v. The BANK is exempted from any form of liability whatsoever for complying with any or all instruction(s) given by means of the |

|||||||||

third party or otherwise becomes compromised.

vi.Where a customer notifies the BANK through

vii. |

O |

e a usto |

e ’s Pass |

ode/A |

ess |

ode is gi e , it shall |

e suffi ie |

t o fi |

atio |

of the authe ti it |

of the instruction given. |

|||

viii. |

The |

usto |

e |

shall e |

espo |

si |

le fo |

a |

i st u tio gi e |

ea |

s of the |

usto |

e ’s pass ode/A |

ess ode. A o di gl , the BANK shall not be responsible for any fraudulent, duplicate or erroneous instruction instruction |

given |

ea s of the |

usto e ’s pass |

ode/A |

ess |

ode. |

|

|

|

|

|

||||

6. Custo |

e ’s espo si ilit |

: |

|

|

|

|

|

|

|

|

|

|

||

i.The customer undertakes to be absolutely responsible for safeguarding his username, access code, passcode, PIN and password, and under no circumstance shall the customer disclose any or all of these to any person.

ii.The customer undertakes to ensure the secrecy of his accesscode, passcode, PIN and password by not reproducing same in any manner whatsoever either in writing or otherwise capable of making it known to person other than the customer.

iii. |

The BANK is expressly exempted from any liability arising from unauthorized access to the customer account and/or data as contai |

ed i the BANK’s e o ds ia the se i e, hi h a ises as a |

esult of i |

a |

ilit a |

d/o othe ise of |

|||||||||||

the customer to safeguard his PIN pass word/Access code and/or password and/or failure to log out of the system completely by allowing on screen display of his account information. |

|

|

|

|

|||||||||||||

iv. |

The BANK is further relieved of any liability as regards breach of breach of duty of sec e |

a isi |

g out of usto |

e ’s i |

a ilit to s |

upulousl o se e a d i ple e t the p o isio of lauses 6 |

, |

a |

o e, a |

d/or instances of |

|||||||

ea h of su h dut |

ha ke s a d othe |

u autho ized a ess to the |

usto |

e ’s a |

ou t ia the se |

i e. |

|

|

|

|

|

|

|

|

|||

v. The custo |

e shall |

e espo si |

le fo a |

f aud, loss a d/o lia ilit |

to the BANK o |

thi d pa t |

a isi |

g f o |

usage of the |

usto |

e ’s access code, password, PIN and/or password being used by a third party and other unauthorized access. |

||||||

Accordingly the BANK shall not |

e espo |

si le fo a f aud that a ises f o |

usage of the usto |

e ’s a ess |

ode, pass o d, PIN a d/o pass |

o d. |

|

|

|

|

|||||||

vi.where a customer notifies the BANK of his intention to change his access code and/or passcode arising from either his loss of memory of same or that it has come to notice of third party, the BANK shall with the consent of the customer, delete same and thereafter allow the customer to enter a new passcode, access code and password. Provided that the BANK shall not be responsible for any loss(es) that occurs between the period of such memory of the access code, passcode, and/or password or knowledge of a third party and the time the report is lodged with the BANK

vii. |

where the customer shall be responsible for any fraud, loss and/or liability to the BANK a isi |

g f o |

usage of the usto e ’s a ess ode, pass ode, PIN a d/o pass o d ei g used |

a thi d pa t a d other unauthorized |

a |

ess. A o di gl , the BANK shall ot e espo si le fo a f aud that a ises f o usage of the usto e |

’s a |

ess code, passcode, PIN and/or password. |

|

7.Upon enrolling of a customer for the service, the customer may be charged the applicable monthly fee and/or usage fee whether or not the customers make use of the service during the period in question.

8.Under no circumstances will the BANK be liable for any damages, including without limitation direct or indirect, special, incidental or consequential damages, losses or expenses arising in connection with this service or use thereof or inability to use by any party, or in connection with any failure of performance, error, omission, interruption, defect, delay in operation, transmission, computer virus or line or system failure, even if the bank or its representative thereof are advised of the possibility of such damaged, losses or hyperlink to other internet resources are at the customer risk.

9.Copyright in the pages and in the screens displaying the pages, and in the information and arrangement is owned by the BANK.

10.The BANK shall not be responsible for any electronic virus or viruses that the customer may encounter in course of making use of this service.