Filling out files with this PDF editor is simpler compared to anything else. To edit form life company beneficiary the document, you'll find nothing you need to do - only proceed with the actions listed below:

Step 1: Click the "Get Form Here" button.

Step 2: So, you can start modifying the form life company beneficiary. Our multifunctional toolbar is at your disposal - add, erase, adjust, highlight, and do other commands with the text in the document.

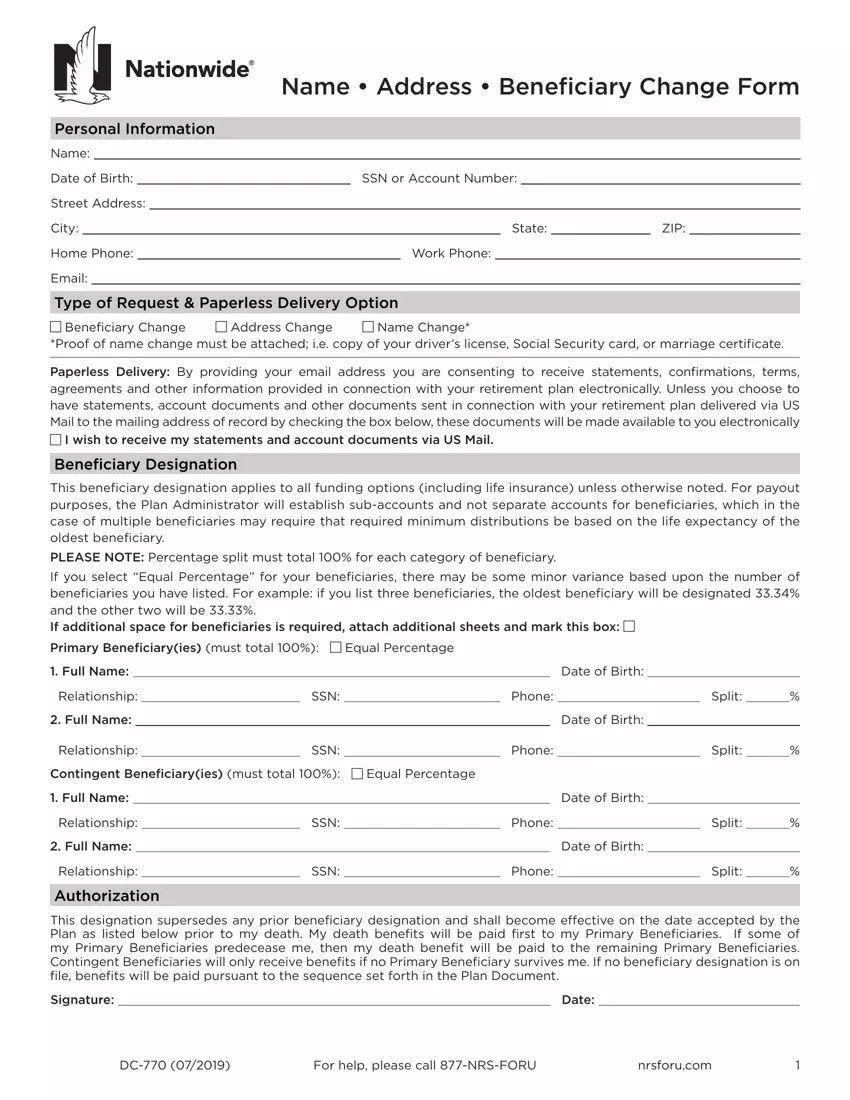

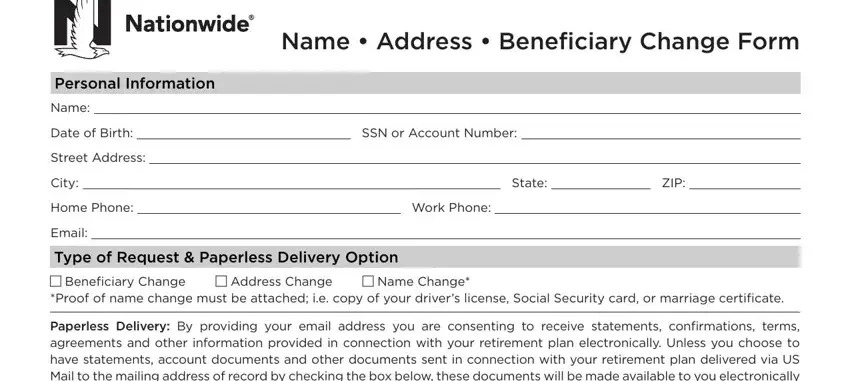

Create the following segments to complete the file:

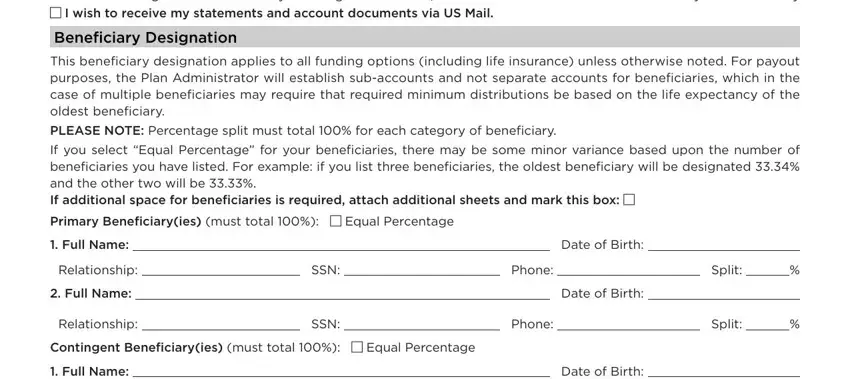

Fill out the Paperless Delivery By providing, Beneficiary Designation, This beneficiary designation, PLEASE NOTE Percentage split must, Full Name, Relationship, Full Name, SSN, Phone, Split, Date of Birth, Date of Birth, Relationship, SSN, and Phone areas with any data that will be demanded by the program.

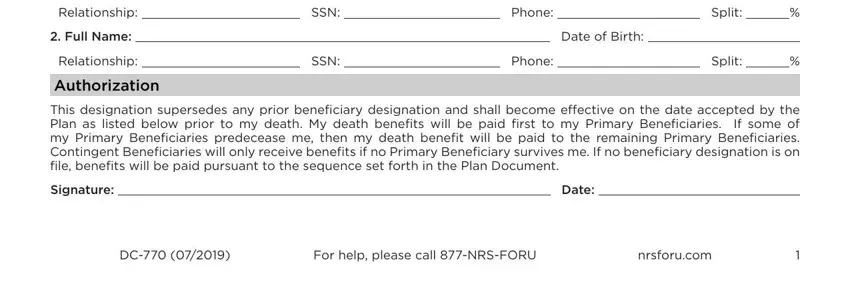

The program will require details to effortlessly fill up the section Relationship, Full Name, Relationship, Authorization, SSN, Phone, Split, Date of Birth, SSN, Phone, Split, This designation supersedes any, Signature, and Date.

Step 3: As soon as you are done, select the "Done" button to upload your PDF document.

Step 4: Ensure that you prevent future worries by creating around two duplicates of your form.