The idea around our PDF editor was to help it become as easy to use as possible. The general procedure of filling in 2346a va easy should you comply with these steps.

Step 1: The first thing requires you to press the orange "Get Form Now" button.

Step 2: Now you will be on your file edit page. You can include, enhance, highlight, check, cross, insert or remove fields or words.

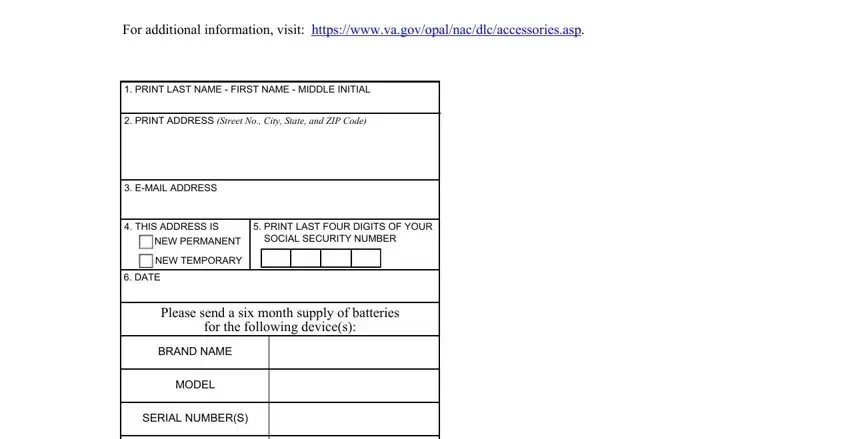

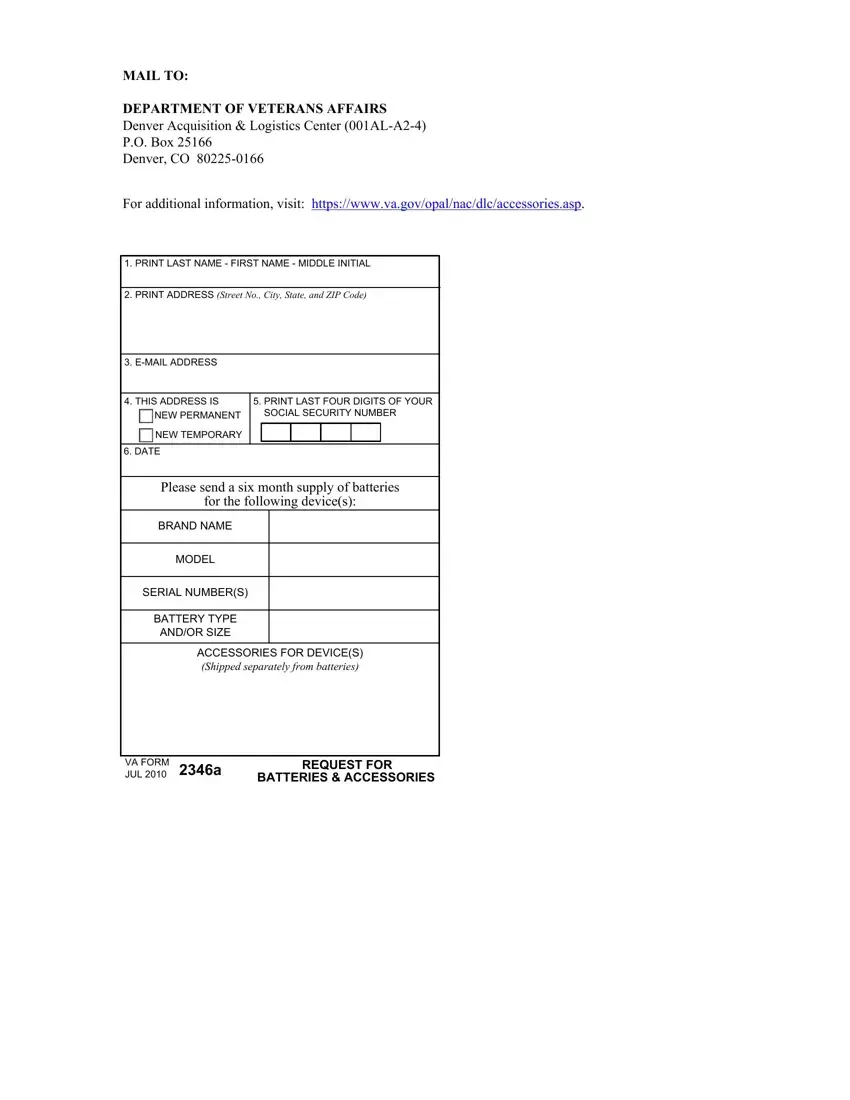

You have to enter the following data to be able to create the template:

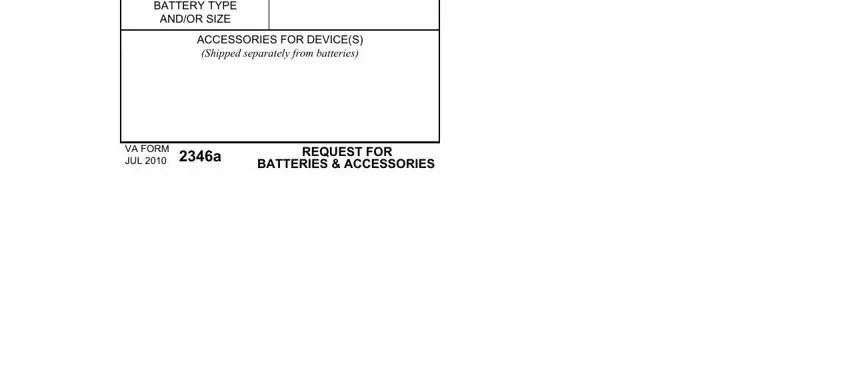

You have to type in the crucial data in the BATTERY TYPE ANDOR SIZE, ACCESSORIES FOR DEVICES Shipped, VA FORM JUL a, and REQUEST FOR BATTERIES ACCESSORIES space.

Step 3: As soon as you've hit the Done button, your document should be accessible for upload to any kind of gadget or email address you identify.

Step 4: Try to make as many copies of your form as you can to remain away from potential worries.

NEW TEMPORARY

NEW TEMPORARY