When using the online PDF editor by FormsPal, it is easy to complete or change Form Boe 100 B here and now. Our expert team is relentlessly working to improve the tool and enable it to be even faster for people with its many features. Enjoy an ever-improving experience today! To get the ball rolling, take these easy steps:

Step 1: Press the orange "Get Form" button above. It'll open our editor so that you could start completing your form.

Step 2: With our online PDF editing tool, you can actually do more than just fill in blank fields. Edit away and make your documents look great with custom text put in, or optimize the file's original input to perfection - all backed up by the capability to insert any photos and sign the file off.

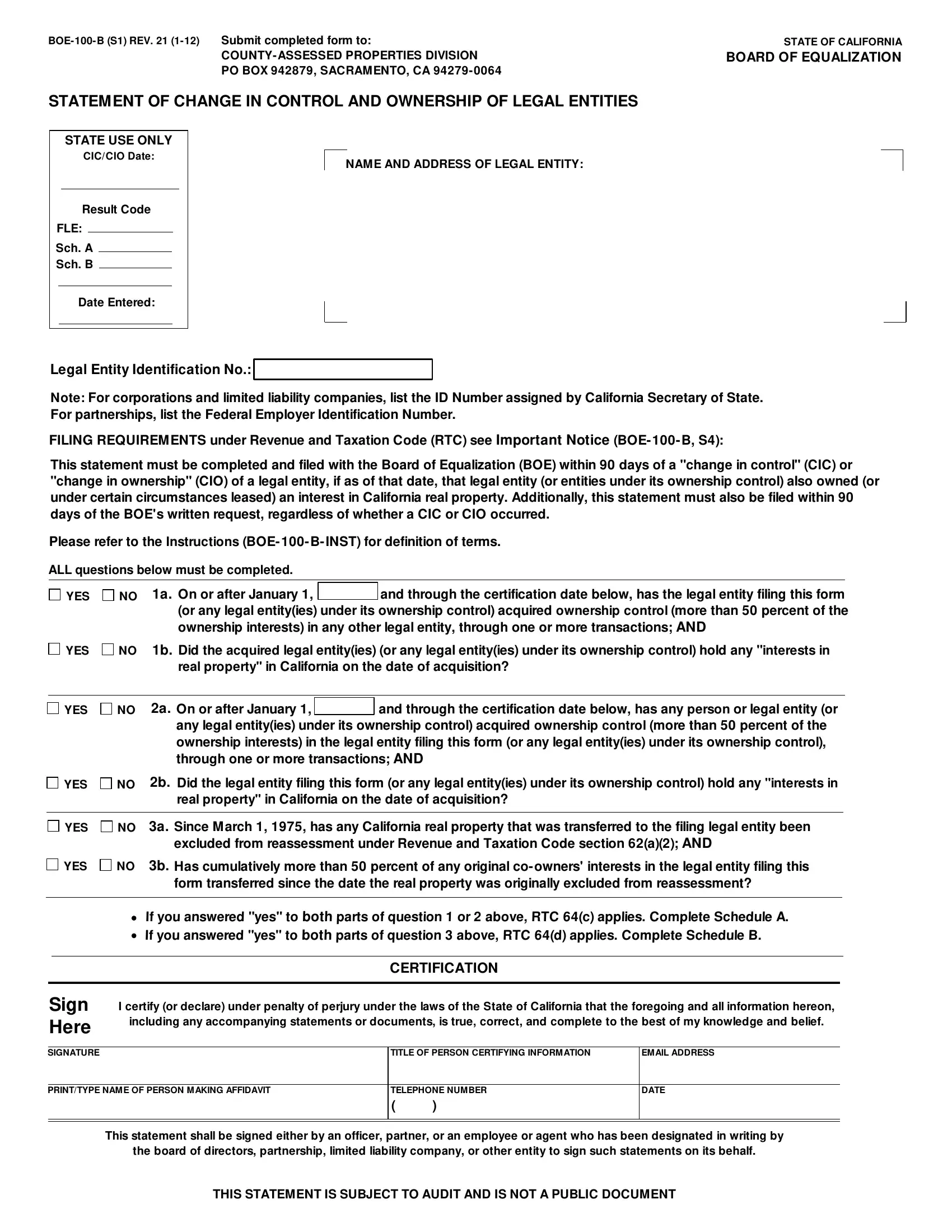

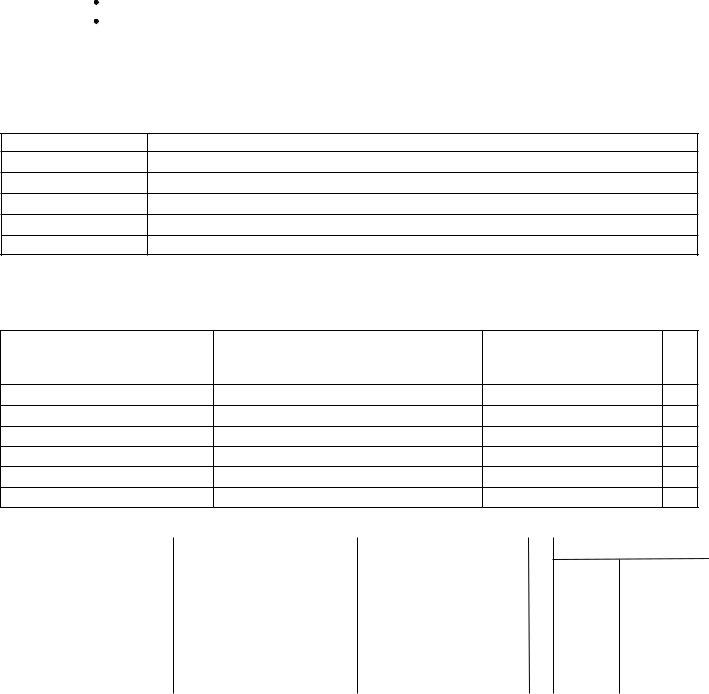

When it comes to blanks of this precise document, here is what you need to know:

1. First of all, once filling in the Form Boe 100 B, start out with the part that has the next blanks:

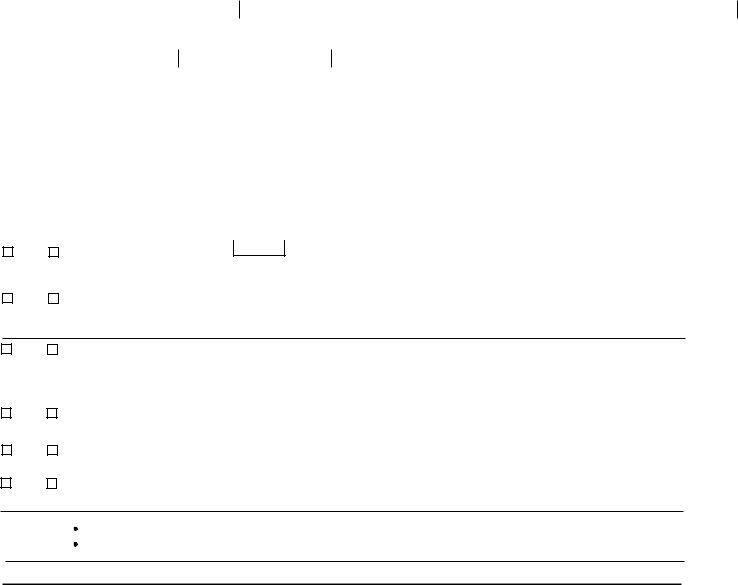

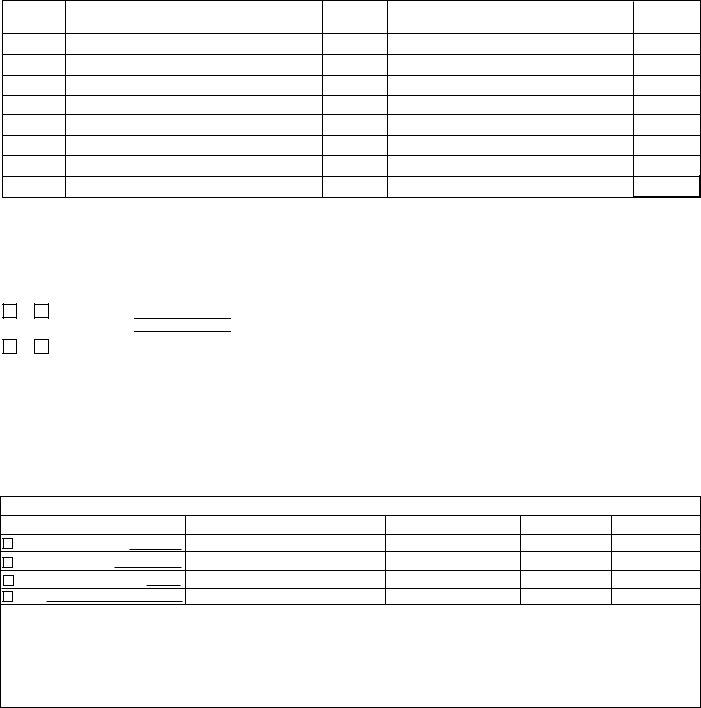

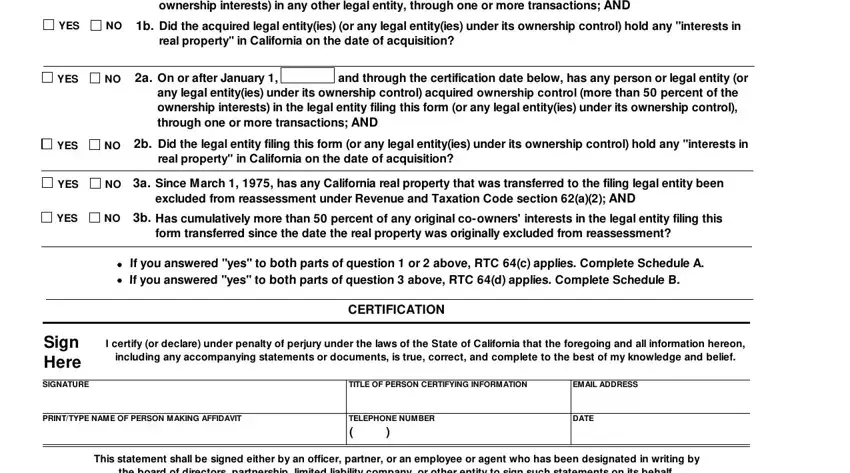

2. Once your current task is complete, take the next step – fill out all of these fields - and through the certification date, AND, YES, NO b Did the acquired legal, real property in California on the, YES, NO a On or after January, and through the certification date, any legal entityies under its, YES, NO b Did the legal entity filing, real property in California on the, YES, NO a Since March has any, and excluded from reassessment under with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

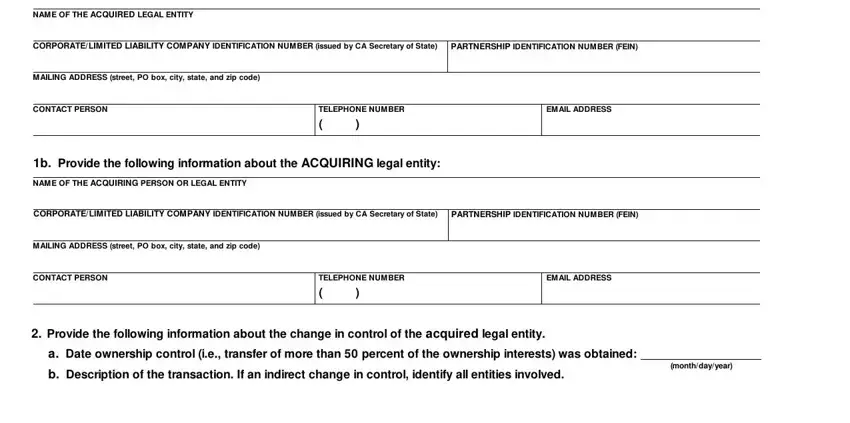

3. This next step is mostly about NAME OF THE ACQUIRED LEGAL ENTITY, CORPORATELIMITED LIABILITY COMPANY, PARTNERSHIP IDENTIFICATION NUMBER, MAILING ADDRESS street PO box city, CONTACT PERSON, TELEPHONE NUMBER, EMAIL ADDRESS, b Provide the following, NAME OF THE ACQUIRING PERSON OR, CORPORATELIMITED LIABILITY COMPANY, PARTNERSHIP IDENTIFICATION NUMBER, MAILING ADDRESS street PO box city, CONTACT PERSON, TELEPHONE NUMBER, and EMAIL ADDRESS - complete all of these blanks.

As for b Provide the following and CONTACT PERSON, make certain you get them right here. These are definitely the most significant fields in the document.

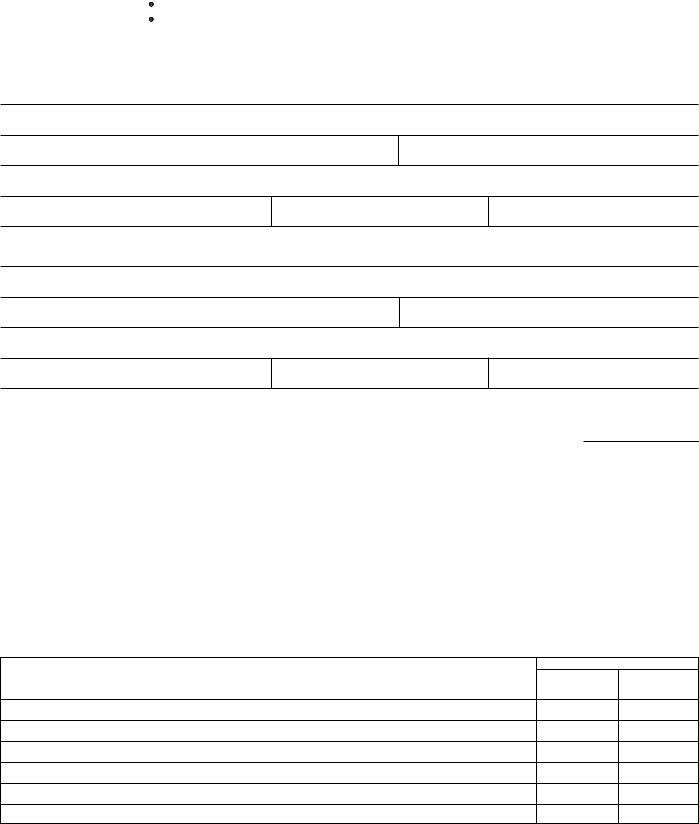

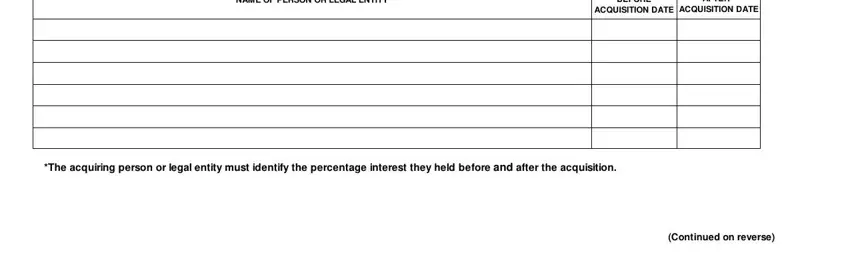

4. This next section requires some additional information. Ensure you complete all the necessary fields - NAME OF PERSON OR LEGAL ENTITY, BEFORE, AFTER, ACQUISITION DATE, ACQUISITION DATE, The acquiring person or legal, and Continued on reverse - to proceed further in your process!

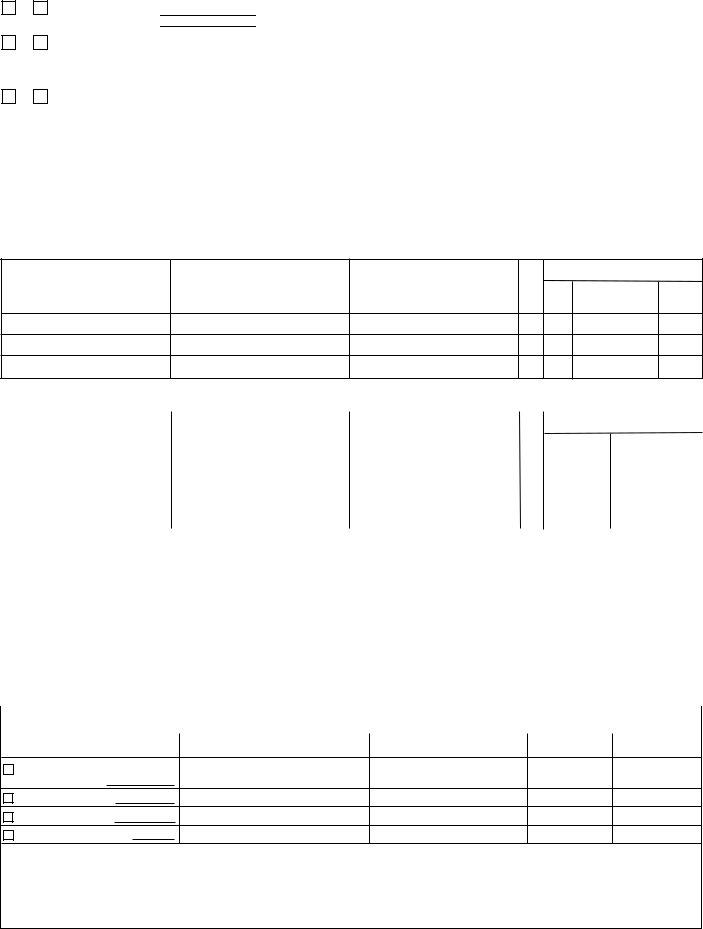

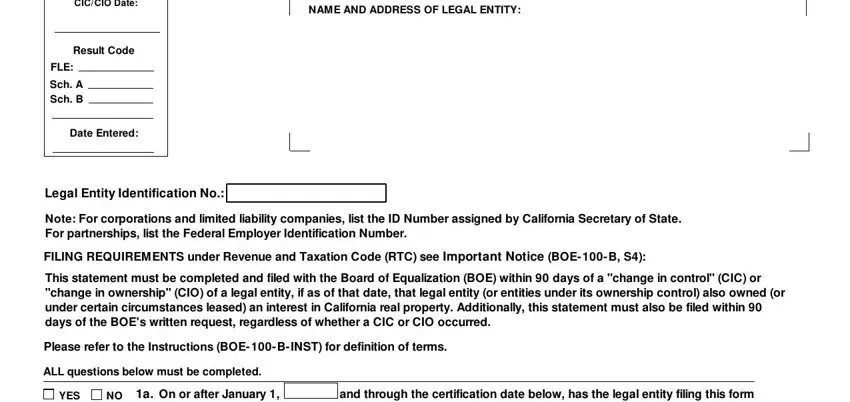

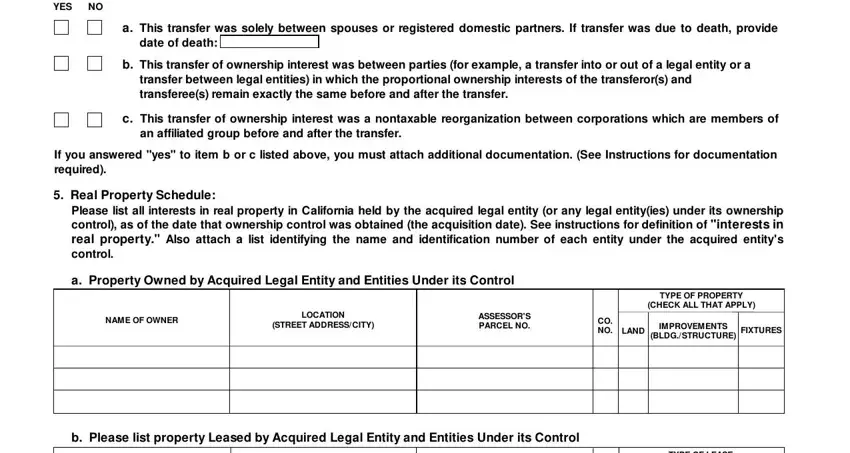

5. As a final point, this last part is precisely what you'll have to complete before closing the form. The blank fields you're looking at are the next: zyxwvutsrqponmlihgfedcbaTSPICA, a This transfer was solely between, YES, date of death, b This transfer of ownership, transfer between legal entities in, c This transfer of ownership, an affiliated group before and, If you answered yes to item b or c, Real Property Schedule, Please list all interests in real, a Property, Owned, by Acquired Legal Entity and, and NAME OF OWNER.

Step 3: Right after you've glanced through the information in the document, press "Done" to conclude your form at FormsPal. Join FormsPal now and instantly get Form Boe 100 B, available for download. Each and every modification you make is handily saved , so that you can change the form at a later time when necessary. FormsPal ensures your data privacy by using a protected system that in no way records or shares any type of private data used in the PDF. Be assured knowing your files are kept safe when you work with our service!