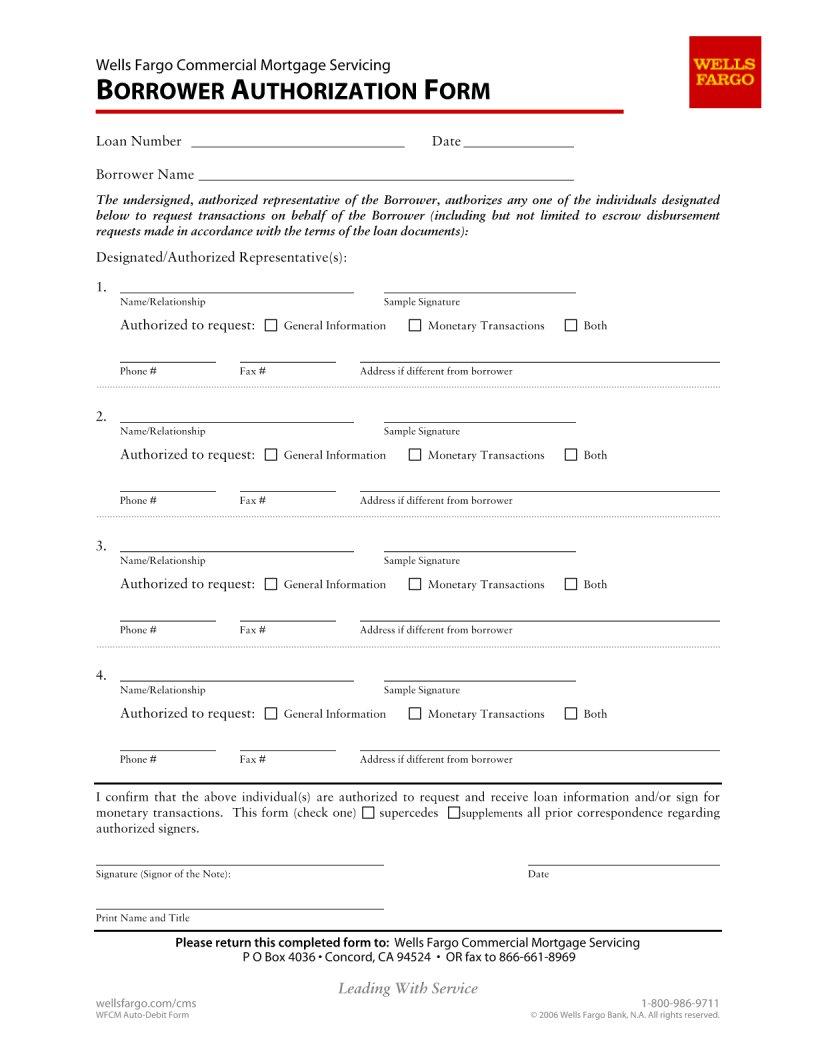

In the journey of obtaining a loan, whether for buying a house, refinancing an existing mortgage, or securing a personal loan, borrowers are introduced to a variety of documents that play pivotal roles in the process. Among these, the Borrower Authorization form stands out as a crucial piece of paperwork. This form is essentially a green light from the borrower, allowing the lender and other authorized parties to verify information critical to the loan application process. It encompasses permissions for the lender to pull credit reports, verify employment and income, and in some cases, discuss the borrower's personal information with third parties like attorneys or real estate agents involved in the transaction. Understanding the scope and implications of this authorization is key for borrowers, as it not only impacts the speed at which their loan can be processed but also how their personal information is handled throughout the process. By signing the Borrower Authorization form, borrowers are taking a significant step towards securing their desired loan, while also placing a degree of trust in their lender to use their personal information responsibly and within the boundaries of the permission granted.

| Question | Answer |

|---|---|

| Form Name | Borrower Authorization Form |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | borrowers authorization fillable, wfcm borrower authorization print, fillable borrower's authorization form, editable borrower authorization form |