Should you want to fill out texas workforce commission domestic annual, it's not necessary to download any applications - simply use our online tool. In order to make our tool better and more convenient to work with, we continuously come up with new features, with our users' suggestions in mind. With just several basic steps, you are able to begin your PDF editing:

Step 1: Press the orange "Get Form" button above. It is going to open our editor so you can start filling out your form.

Step 2: As soon as you launch the tool, you will notice the form all set to be filled out. In addition to filling out various fields, you could also perform some other things with the form, namely writing any text, changing the initial text, inserting illustrations or photos, affixing your signature to the document, and a lot more.

This document will require specific details; in order to guarantee consistency, don't hesitate to take note of the suggestions below:

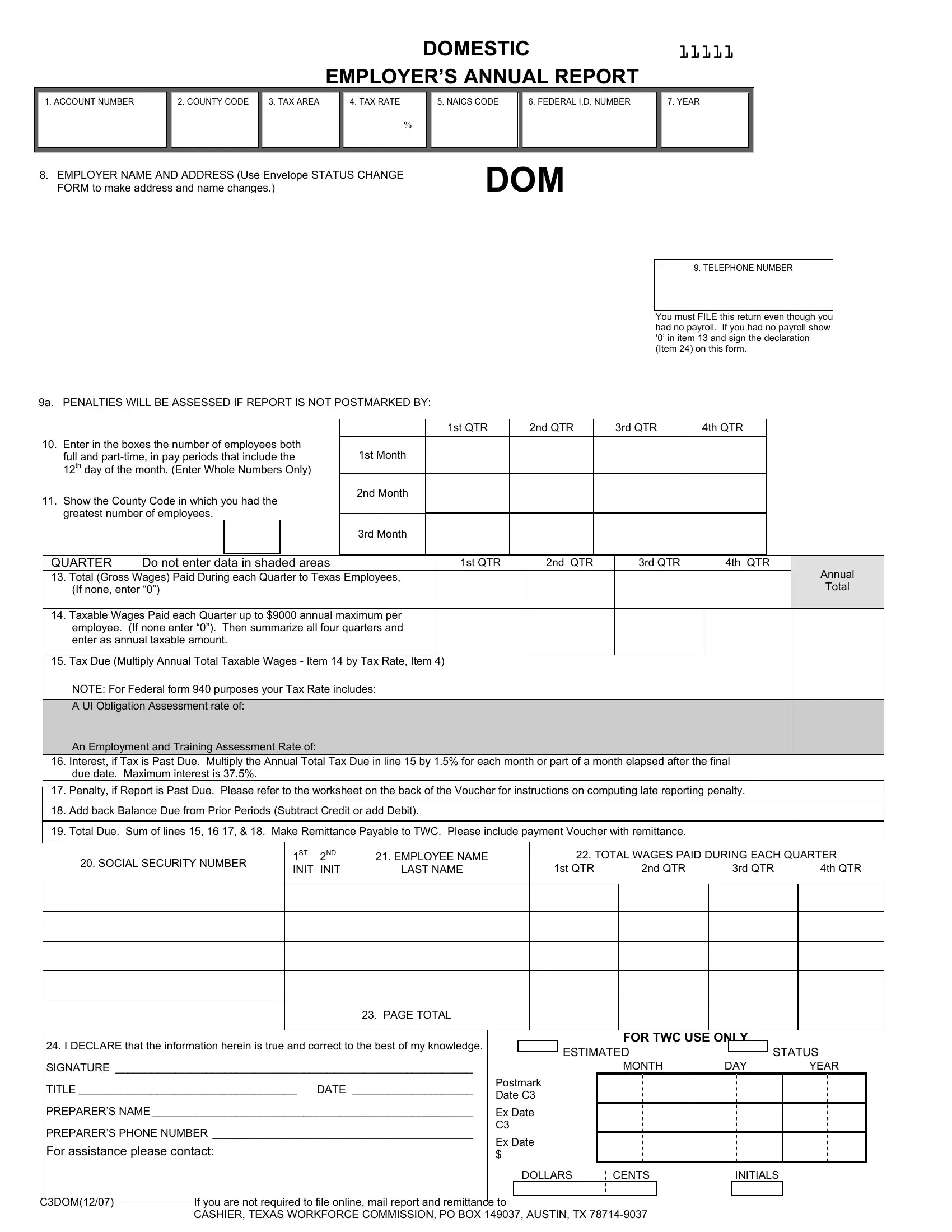

1. You'll want to complete the texas workforce commission domestic annual properly, so be careful when filling out the parts comprising all these fields:

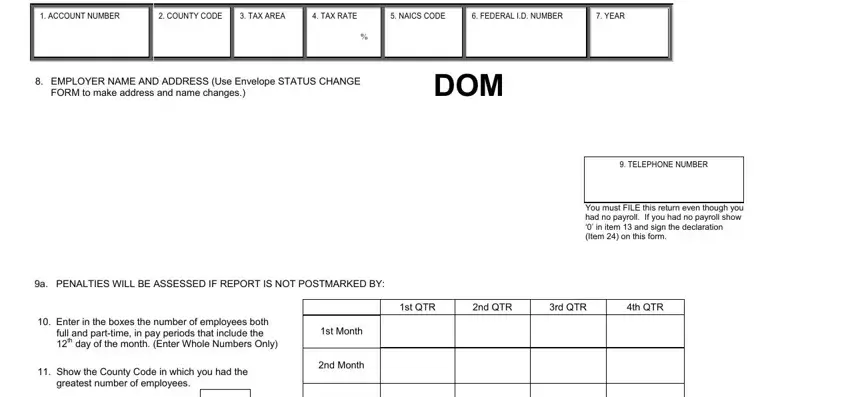

2. The subsequent part is usually to complete all of the following fields: QUARTER Total Gross Wages Paid, Do not enter data in shaded areas, If none enter , st QTR, nd QTR, rd QTR, th QTR, Annual Total, Taxable Wages Paid each Quarter, Tax Due Multiply Annual Total, NOTE For Federal form purposes, An Employment and Training, Interest if Tax is Past Due, due date Maximum interest is , and Penalty if Report is Past Due.

It is possible to make errors when filling out the st QTR, and so make sure you go through it again before you'll submit it.

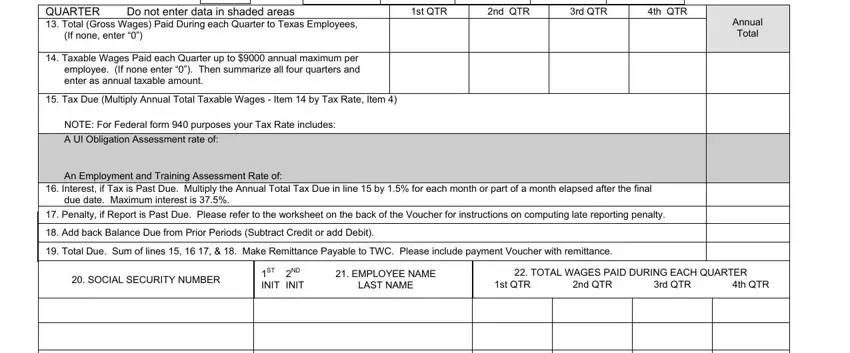

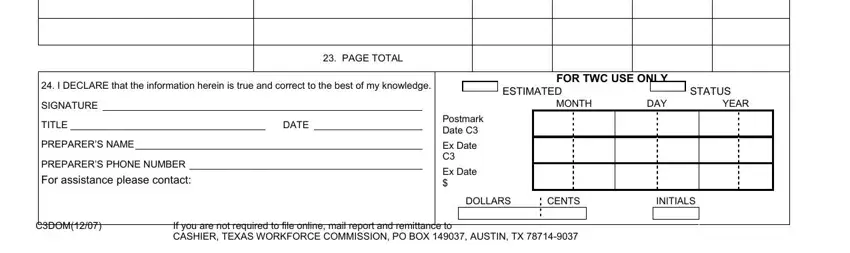

3. Through this step, look at PAGE TOTAL, I DECLARE that the information, SIGNATURE , TITLE DATE , PREPARERS NAME , PREPARERS PHONE NUMBER , For assistance please contact, Postmark Date C, Ex Date C, Ex Date , FOR TWC USE ONLY, ESTIMATED, MONTH, DAY, and STATUS. These have to be completed with greatest precision.

Step 3: Soon after double-checking the fields and details, click "Done" and you're good to go! Sign up with FormsPal today and immediately use texas workforce commission domestic annual, prepared for downloading. Every edit you make is handily kept , which enables you to edit the file further when necessary. FormsPal guarantees your information privacy via a secure system that in no way saves or shares any sort of private information used in the file. Be confident knowing your paperwork are kept safe any time you work with our service!