When you intend to fill out ca 3523, you won't have to download any kind of programs - simply try using our PDF editor. FormsPal team is aimed at providing you the best possible experience with our tool by consistently introducing new features and upgrades. Our editor is now even more helpful thanks to the most recent updates! Currently, working with PDF forms is simpler and faster than ever before. Getting underway is simple! Everything you need to do is follow the following easy steps below:

Step 1: Firstly, open the pdf tool by clicking the "Get Form Button" at the top of this webpage.

Step 2: This tool provides the opportunity to customize nearly all PDF documents in a variety of ways. Enhance it by adding any text, correct what's originally in the document, and include a signature - all within a few mouse clicks!

It will be simple to complete the document using this practical guide! This is what you need to do:

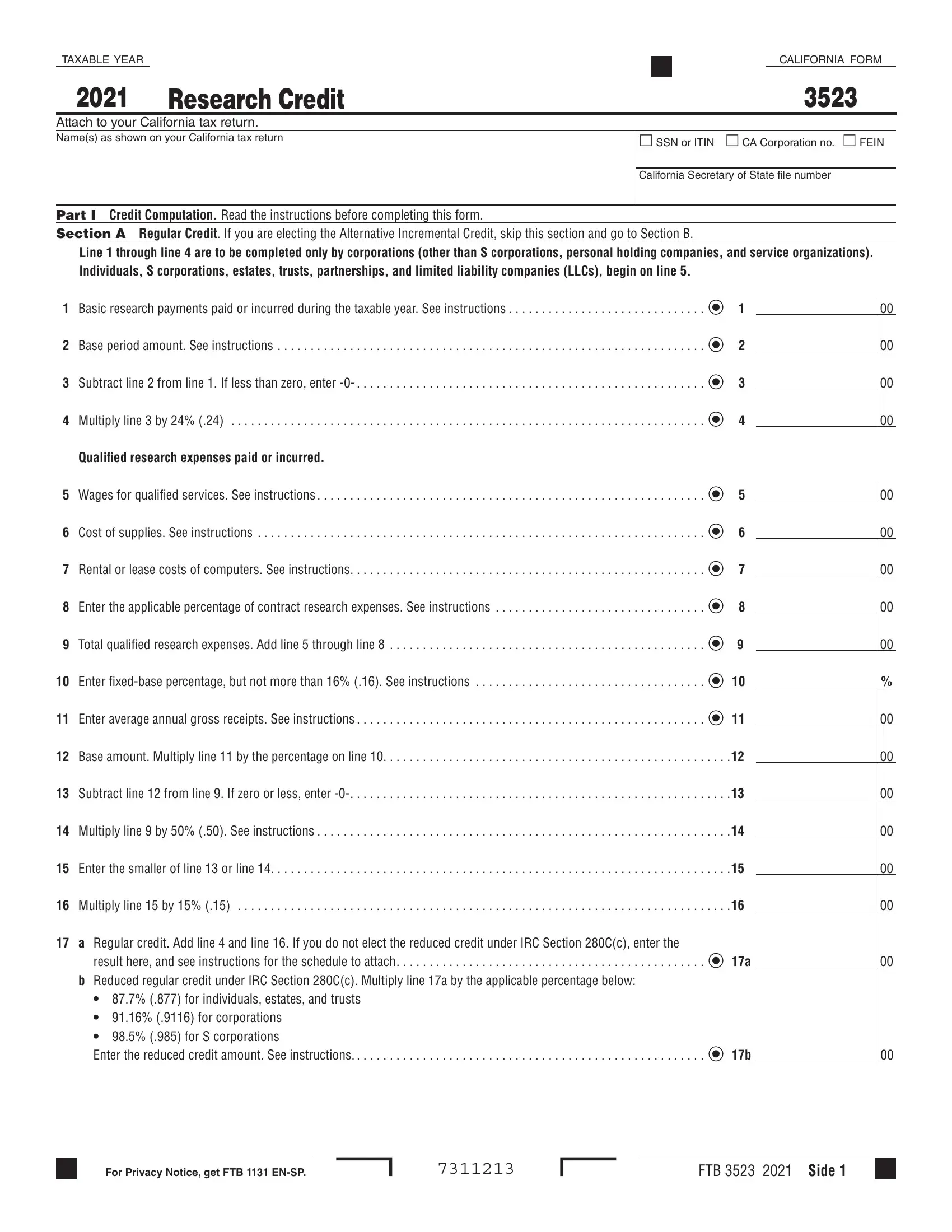

1. The ca 3523 requires particular information to be typed in. Ensure that the following blank fields are filled out:

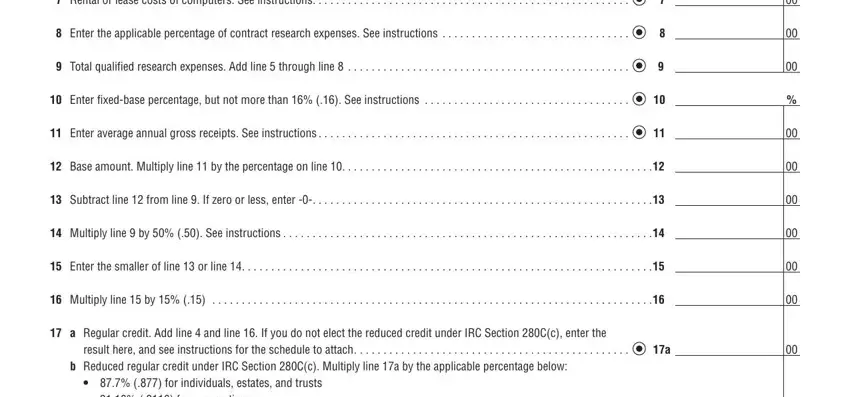

2. Your next step is usually to submit these particular blanks: Rental or lease costs of, Enter the applicable percentage, Total qualified research expenses, Enter fixedbase percentage but, Enter average annual gross, Base amount Multiply line by the, Subtract line from line If zero, Multiply line by See, Enter the smaller of line or, Multiply line by , a Regular credit Add line and, result here and see instructions, b Reduced regular credit under IRC, and for individuals estates and.

3. This third step is fairly uncomplicated, for individuals estates and, For Privacy Notice get FTB ENSP, and FTB Side - these fields is required to be filled out here.

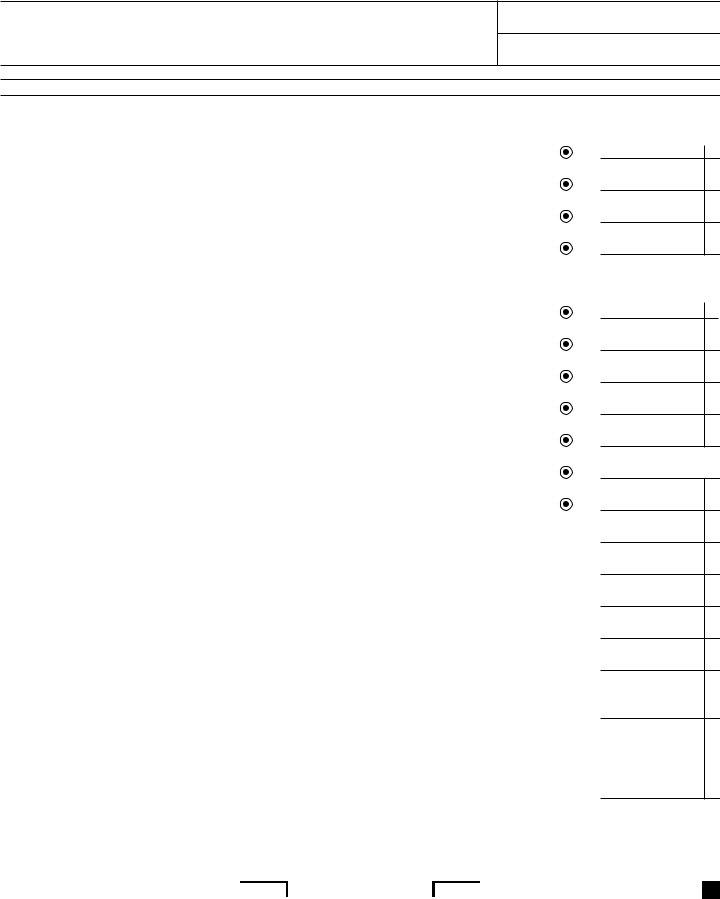

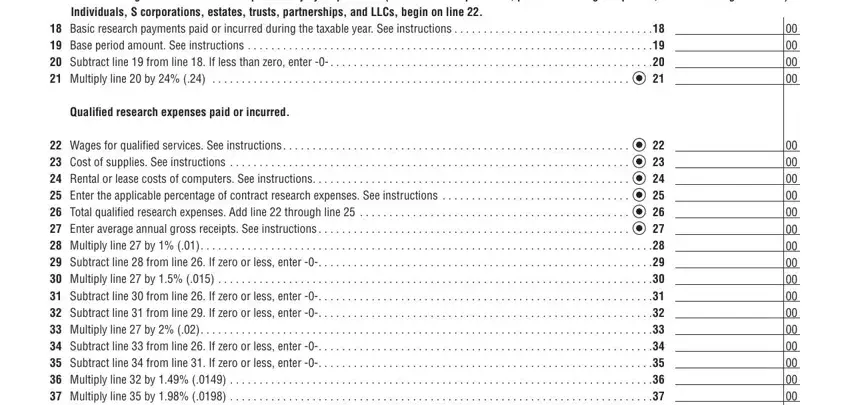

4. Your next subsection needs your details in the following areas: Section B Alternative Incremental, Line through line are to be, Basic research payments paid or, Qualified research expenses paid, and Wages for qualified services See. Make certain to fill out all of the needed info to go further.

Be very mindful when completing Section B Alternative Incremental and Line through line are to be, as this is where many people make a few mistakes.

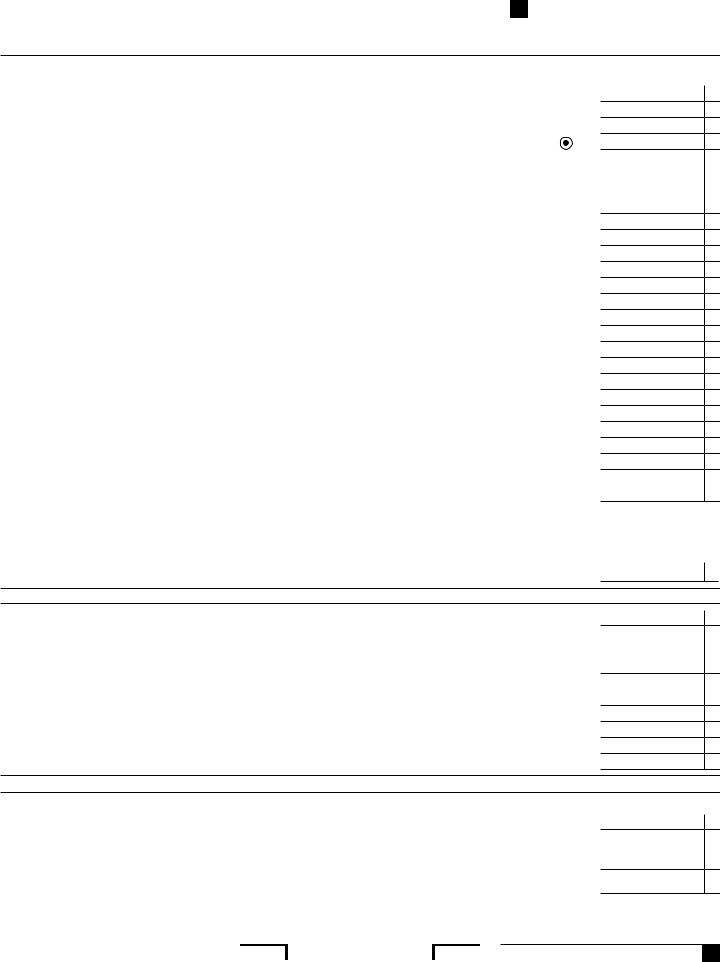

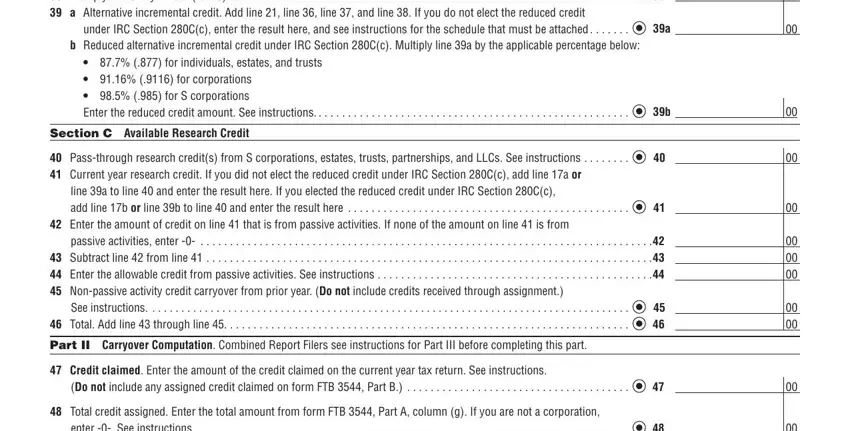

5. To finish your form, this particular subsection has a couple of extra blanks. Entering Wages for qualified services See, under IRC Section Cc enter the, b Reduced alternative incremental, for individuals estates and, Section C Available Research Credit, Passthrough research credits from, line a to line and enter the, Enter the amount of credit on, passive activities enter , See instructions , Part II Carryover Computation, Credit claimed Enter the amount, Do not include any assigned credit, Total credit assigned Enter the, and enter See instructions will wrap up everything and you'll surely be done in a short time!

Step 3: As soon as you've reread the information you filled in, press "Done" to finalize your FormsPal process. Sign up with us today and instantly get ca 3523, ready for downloading. All changes you make are saved , which means you can customize the file at a later stage when required. Here at FormsPal, we endeavor to make sure all of your details are kept secure.