When a corporation in California decides to cease operations or is undergoing a significant change, such as a merger, it's essential to navigate through certain legal steps to ensure compliance with state tax laws. One critical step involves the California Form 3555, also known as the Request for Tax Clearance Certificate. This form serves multiple purposes: it helps confirm that all taxes have been settled or adequately secured by the entity in question, and it remains a crucial document until all statutory periods for audits are closed. Through this form, corporations can report any IRS adjustments not previously accounted for, disclose ongoing or pending examinations, and provide detailed information regarding the responsibilities assumed by an individual or entity for the corporation's tax liabilities post-dissolution or merger. Moreover, Form 3555 demands comprehensive financial information to support the assurance of tax liability clearance. This safeguarding process not only facilitates a smoother transition during significant corporate changes but also protects the entities involved from potential legal and financial repercussions associated with unsettled tax obligations.

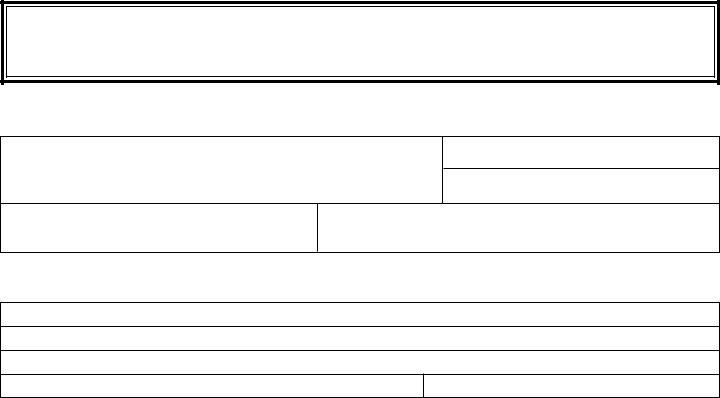

| Question | Answer |

|---|---|

| Form Name | California Form 3555 |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | FTB, LLC, ies, assumer |

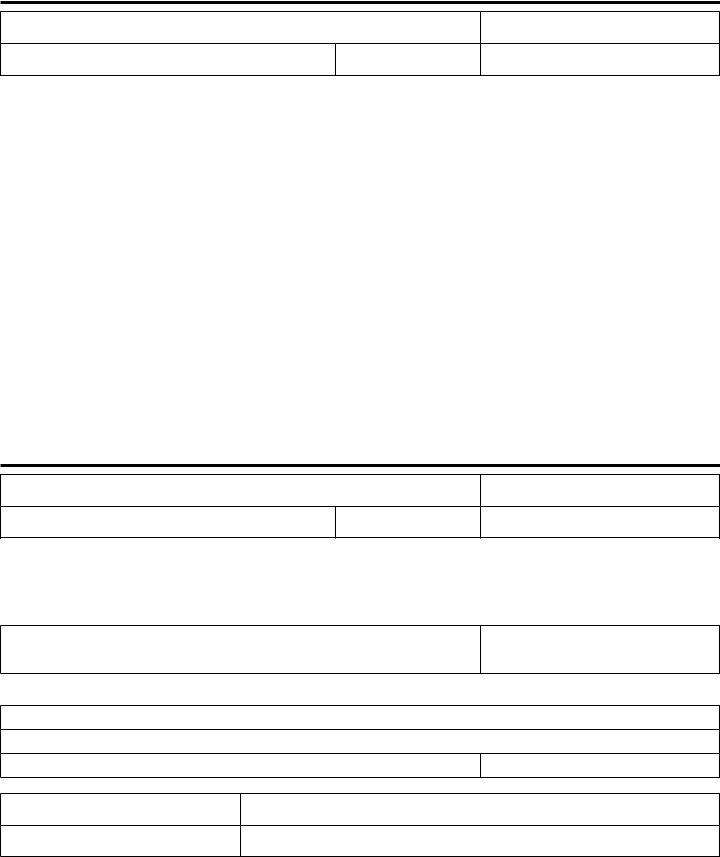

Request for Tax Clearance |

|

|

|

|

CALIFORNIA FORM |

||

|

|

3 5 5 5 |

|||||

Certificate — Corporations |

|

|

|||||

|

|

|

|

|

|

|

|

Corporation name |

|

|

|

|

California corporation number |

||

|

|

|

|

|

|||

Current address |

|

Phone number |

Federal employer identification number |

||||

|

|

( |

) |

|

|

|

|

Date business commenced |

Date business ceased or will |

|

Latest income period for which a |

Date filed: |

|||

in California: |

cease in California: |

|

California tax return has been filed: |

|

|||

|

|

|

|

|

|

|

|

We will issue a tax clearance certificate when all taxes have been paid or secured. All returns remain subject to audit until expiration of the normal statutes of limitation.

Please indicate the status of ANY IRS activity:

Has the IRS redetermined the corporation’s income tax |

Is the IRS or the FTB currently examining the corporation |

|

liability for any prior years that you have not previously |

or has it notified the corporation of a pending examination? |

|

reported to us? ❏ Yes ❏ No |

❏ Yes ❏ No If yes, indicate the years involved: |

|

If yes, send us a copy of the Revenue Agent’s Report. |

Current examination: |

__________________________ |

|

Pending examination: |

__________________________ |

|

|

|

Complete pages 2 and 3 of this form for an individual or other entity assumption of tax liability. Complete page 4 for a corporation, limited liability company, or limited liability partnership assumption of tax liability.

If we are to issue the tax clearance certificate on a taxes paid basis, please check this box and provide a copy of your final tax return. ❏

Supplemental Information. Please furnish the following information if another corporation will continue to conduct the business in California after the merger of the original corporation.

Name of transferee

California corporation number of transferee

Federal employer identification number

Date assets transferred to transferee

Section of the Internal Revenue Code applicable to the transfer of

taxpayer’s business or assets: ______________

If we are to mail the tax clearance certificate to somewhere other than the corporation listed above, please complete the following: (We will send a copy of the tax clearance certificate to the Secretary of State.)

Name

Address

Phone number ( |

) |

Mail completed form to: DOCUMENT FILING SUPPORT UNIT

SECRETARY OF STATE – BUSINESS FILINGS 1500 11TH STREET

SACRAMENTO CA 95814

For more information concerning this form, telephone the Franchise Tax Board at (916)

Assistance for persons with disabilities: We comply with the Americans with Disabilities Act. Persons with hearing or

speech impairments, call: from voice phone (800)

FTB 3555 C1 (REV

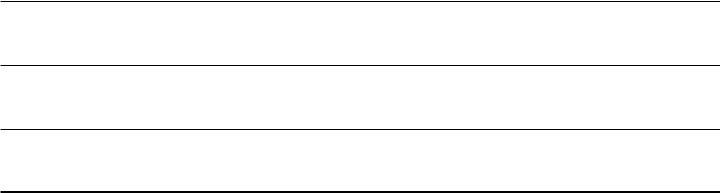

Please complete Section A or B below.

A. INDIVIDUAL ASSUMPTION OF TAX LIABILITY

Corporation name

Current address

|

California corporation number |

Phone number |

Federal employer identification number |

( )

I unconditionally agree to file or cause to be filed with the Franchise Tax Board, under the provisions of the Bank and Corporation Tax Law, all tax returns and data required and to pay in full all accrued or accruing tax liabilities, penalties, interest, and fees due from the above named corporation at the effective date of dissolution or surrender.

My net worth (assets minus liabilities) is not less than: $ _____________________ .

(We require a detailed financial statement [PAGE 3].)

Name of individual assumer (print) |

|

Social security number |

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

Phone number ( |

) |

|

|

|

|

|

|

|

|

Date |

Signature |

|

|

|

|

|

|

B. TRUST ASSUMPTION OF TAX LIABILITY

Corporation name

Current address

|

California corporation number |

Phone number |

Federal employer identification number |

( )

This trust unconditionally agrees to file or cause to be filed with the Franchise Tax Board, under the provisions of the Bank and Corporation Tax Law, all tax returns and data required and to pay in full all accrued or accruing tax liabilities, penalties, interest, and fees due from the above named corporation at the effective date of dissolution or surrender:

(We require a detailed financial statement [PAGE 3].)

Name of trust

Trust federal identification number

Address

Phone number ( |

) |

Date

Trustee’s name (print)

Trustee’s signature

FOR PRIVACY ACT NOTICE, SEE FORM FTB 1131.

FTB 3555 C1 (REV

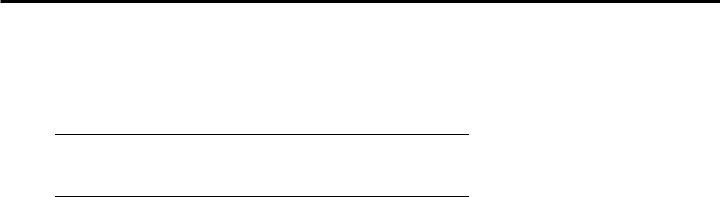

FINANCIAL STATEMENT FOR INDIVIDUAL OR OTHER ENTITY

Corporation name |

Corporation number |

|

|

|

|

Statement of Assets and Liabilities

Item |

|

Present |

Liabilities |

Equity in |

|

value (A) |

balance due (B) |

asset |

|

|

|

|||

Cash |

|

|

|

|

Bank accounts |

|

|

|

|

Stocks and bonds |

|

|

|

|

Cash or loan value of insurance |

|

|

|

|

Household furniture |

|

|

|

|

Real property |

|

|

|

|

Vehicles |

|

|

|

|

|

|

|

|

|

Other assets (describe) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Federal taxes outstanding |

|

|

|

|

Loans |

|

|

|

|

|

|

|

|

|

Other (include judgements) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net assets |

|

|

|

|

(Total column A less total column B) |

|

|

|

$ |

General Information (Please attach additional schedules if necessary.) |

||||

|

|

|

|

|

Net annual income |

Source (name of business or employer) |

|

|

|

|

|

|

|

|

Banks and savings and loan accounts (names and addresses)

Description and license number of each vehicle

Stocks and bonds (name of company, number of shares, etc.)

Real property (brief descriptions and locations)

I certify that the information above is correct to the best of my knowledge.

Assumer’s name (print) _____________________________________________________________________________________________________

Assumer’s address |

____________________________________________________________ Phone number ( |

) |

_______________________ |

Assumer’s signature |

__________________________________________________________________________ |

Date |

_______________________ |

FTB 3555 C1 (REV

CORPORATION, LIMITED LIABILITY COMPANY, OR LIMITED LIABILITY PARTNERSHIP ASSUMPTION OF TAX LIABILITY

The Assumption of Tax Liability

of (1) __________________________________________________________ )

|

) |

|

A corporation |

) ________________________ |

|

|

) |

California Corporation number, Secretary of |

|

State file number, or federal employer |

|

by (2) _________________________________________________________ ) |

identification number |

|

|

||

|

) |

|

A corporation, limited liability company, or limited liability partnership |

) ________________________ |

|

|

|

California Corporation number, Secretary of |

|

|

State file number, or federal employer |

|

|

identification number |

(Name of assumer) __________________________________________________ unconditionally

agrees to file with the Franchise Tax Board all tax returns and data required and pay in full all tax liabilities, penalties, interest and fees of (1) _________________________________________

_________________________________________________________________________________; at the

effective date of dissolution or surrender of the corporation.

|

(2) _________________________________________ |

|

Exact corporation, limited liability company, or limited liability partnership name |

_______________________________________ |

_________________________________________ |

Printed name and title of officer/manager/partner/member |

Signature and title of officer/manager/partner/member |

State of _______________________________

County of _____________________________

On ________________________________________ before me, the undersigned, a notary public in and for

said state, personally appeared _______________________________________________________________

_______________________________________________________________________________________

_______________________________________________________________________________________

personally known to me (or proved to me on the basis of satisfactory evidence) to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged to me that he/she/they executed the same in his/her/their authorized capacity(ies), and that by his/her/their signature(s) on the instrument the entity upon behalf of which the person(s) acted, executed the instrument.

WITNESS my hand and official seal.

Signature ________________________________________________________

Name __________________________________________________________

(typed or printed)

Note: LLC, LLP, and corporation assumers must provide a financial statement.

FTB 3555 C1 (REV