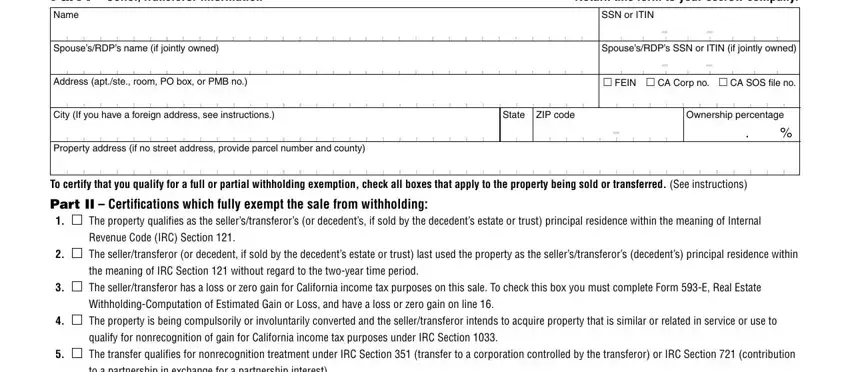

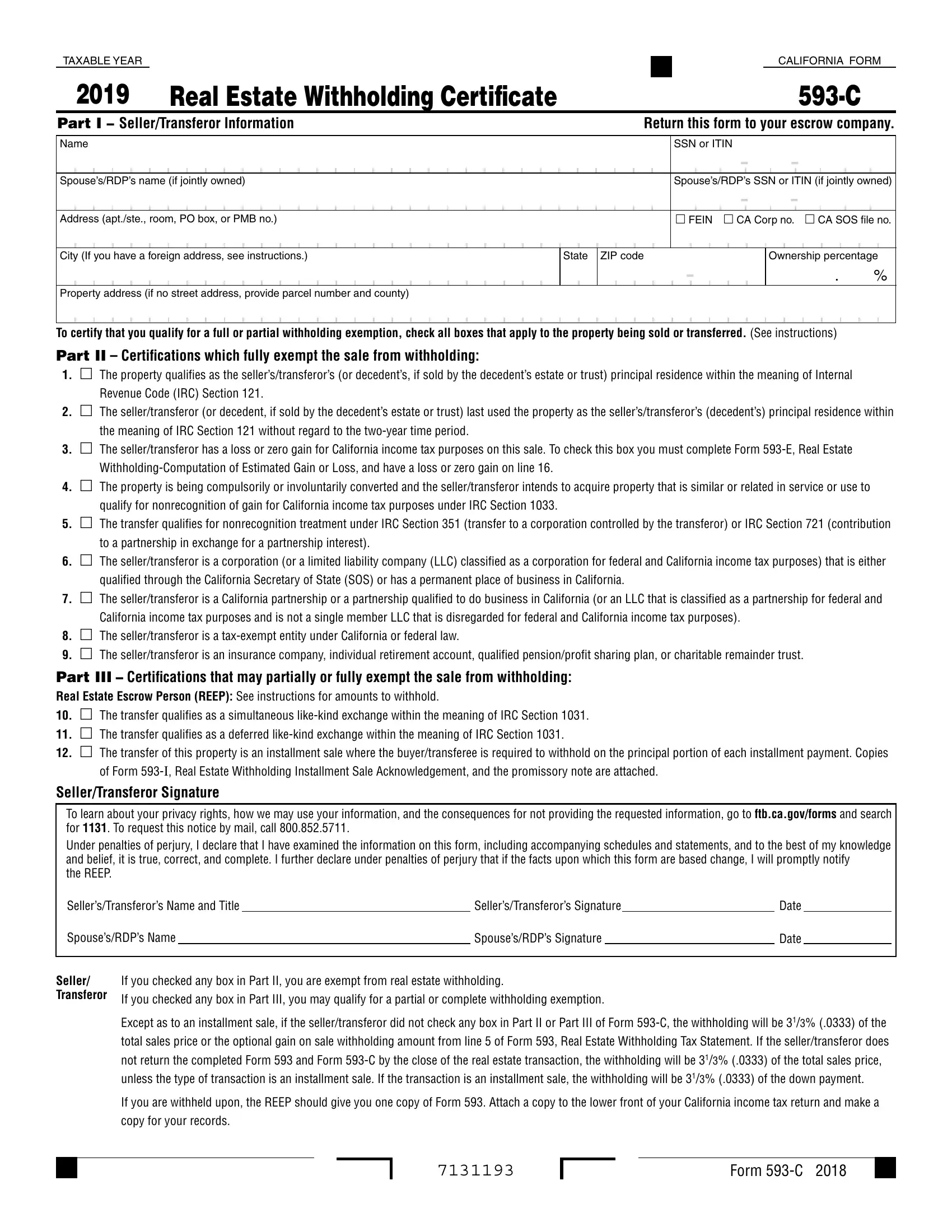

Property address (if no street address, provide parcel number and county)

To certify that you qualify for a full or partial withholding exemption, check all boxes that apply to the property being sold or transferred. (See instructions)

Part II – Certifications which fully exempt the sale from withholding:

1. The property qualifies as the seller’s/transferor’s (or decedent’s, if sold by the decedent’s estate or trust) principal residence within the meaning of Internal Revenue Code (IRC) Section 121.

2. The seller/transferor (or decedent, if sold by the decedent’s estate or trust) last used the property as the seller’s/transferor’s (decedent’s) principal residence within the meaning of IRC Section 121 without regard to the two-year time period.

3. The seller/transferor has a loss or zero gain for California income tax purposes on this sale. To check this box you must complete Form 593-E, Real Estate Withholding-Computation of Estimated Gain or Loss, and have a loss or zero gain on line 16.

4. The property is being compulsorily or involuntarily converted and the seller/transferor intends to acquire property that is similar or related in service or use to qualify for nonrecognition of gain for California income tax purposes under IRC Section 1033.

5. The transfer qualifies for nonrecognition treatment under IRC Section 351 (transfer to a corporation controlled by the transferor) or IRC Section 721 (contribution to a partnership in exchange for a partnership interest).

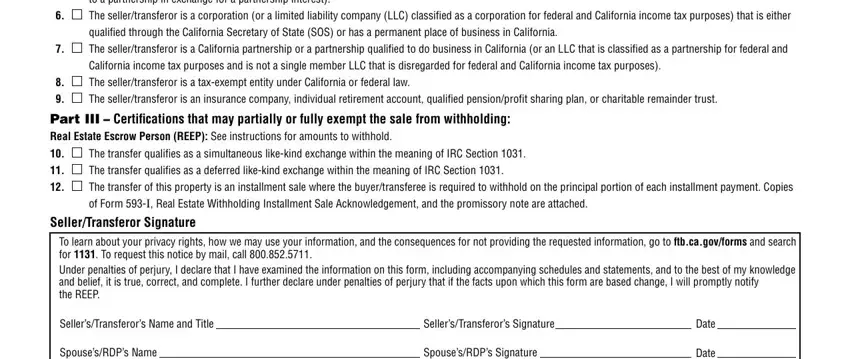

6. The seller/transferor is a corporation (or a limited liability company (LLC) classified as a corporation for federal and California income tax purposes) that is either qualified through the California Secretary of State (SOS) or has a permanent place of business in California.

7. The seller/transferor is a California partnership or a partnership qualified to do business in California (or an LLC that is classified as a partnership for federal and California income tax purposes and is not a single member LLC that is disregarded for federal and California income tax purposes).

8. The seller/transferor is a tax-exempt entity under California or federal law.

9. The seller/transferor is an insurance company, individual retirement account, qualified pension/profit sharing plan, or charitable remainder trust.

Part III – Certifications that may partially or fully exempt the sale from withholding:

Real Estate Escrow Person (REEP): See instructions for amounts to withhold.

10. The transfer qualifies as a simultaneous like-kind exchange within the meaning of IRC Section 1031.

11. The transfer qualifies as a deferred like-kind exchange within the meaning of IRC Section 1031.

12. The transfer of this property is an installment sale where the buyer/transferee is required to withhold on the principal portion of each installment payment. Copies of Form 593-I, Real Estate Withholding Installment Sale Acknowledgement, and the promissory note are attached.

Seller/Transferor Signature

To learn about your privacy rights, how we may use your information, and the consequences for not providing the requested information, go to ftb.ca.gov/forms and search for 1131. To request this notice by mail, call 800.852.5711.

Under penalties of perjury, I declare that I have examined the information on this form, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete. I further declare under penalties of perjury that if the facts upon which this form are based change, I will promptly notify

the REEP.

Seller’s/Transferor’s Name and Title |

|

Seller’s/Transferor’s Signature |

|

Date |

Spouse’s/RDP’s Name |

|

|

Spouse’s/RDP’s Signature |

|

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

Seller/ |

If you checked any box in Part II, you are exempt from real estate withholding. |

|

|

|

|

Transferor |

If you checked any box in Part III, you may qualify for a partial or complete withholding exemption. |

|

|

|

|

|

|

|

|

|

Except as to an installment sale, if the seller/transferor did not check any box in Part II or Part III of Form 593-C, the withholding will be 31/3% (.0333) of the total sales price or the optional gain on sale withholding amount from line 5 of Form 593, Real Estate Withholding Tax Statement. If the seller/transferor does not return the completed Form 593 and Form 593-C by the close of the real estate transaction, the withholding will be 31/3% (.0333) of the total sales price, unless the type of transaction is an installment sale. If the transaction is an installment sale, the withholding will be 31/3% (.0333) of the down payment.

If you are withheld upon, the REEP should give you one copy of Form 593. Attach a copy to the lower front of your California income tax return and make a copy for your records.