Using the online PDF editor by FormsPal, it is easy to complete or alter canada card pdf right here and now. FormsPal team is dedicated to providing you with the absolute best experience with our tool by regularly adding new functions and enhancements. Our tool is now much more useful as the result of the newest updates! So now, filling out PDF files is simpler and faster than before. To get the process started, go through these basic steps:

Step 1: Press the "Get Form" button in the top area of this webpage to open our PDF tool.

Step 2: Once you access the file editor, you'll see the form prepared to be filled out. Aside from filling out various blanks, you may as well do many other actions with the file, such as writing your own textual content, editing the original text, adding illustrations or photos, affixing your signature to the form, and much more.

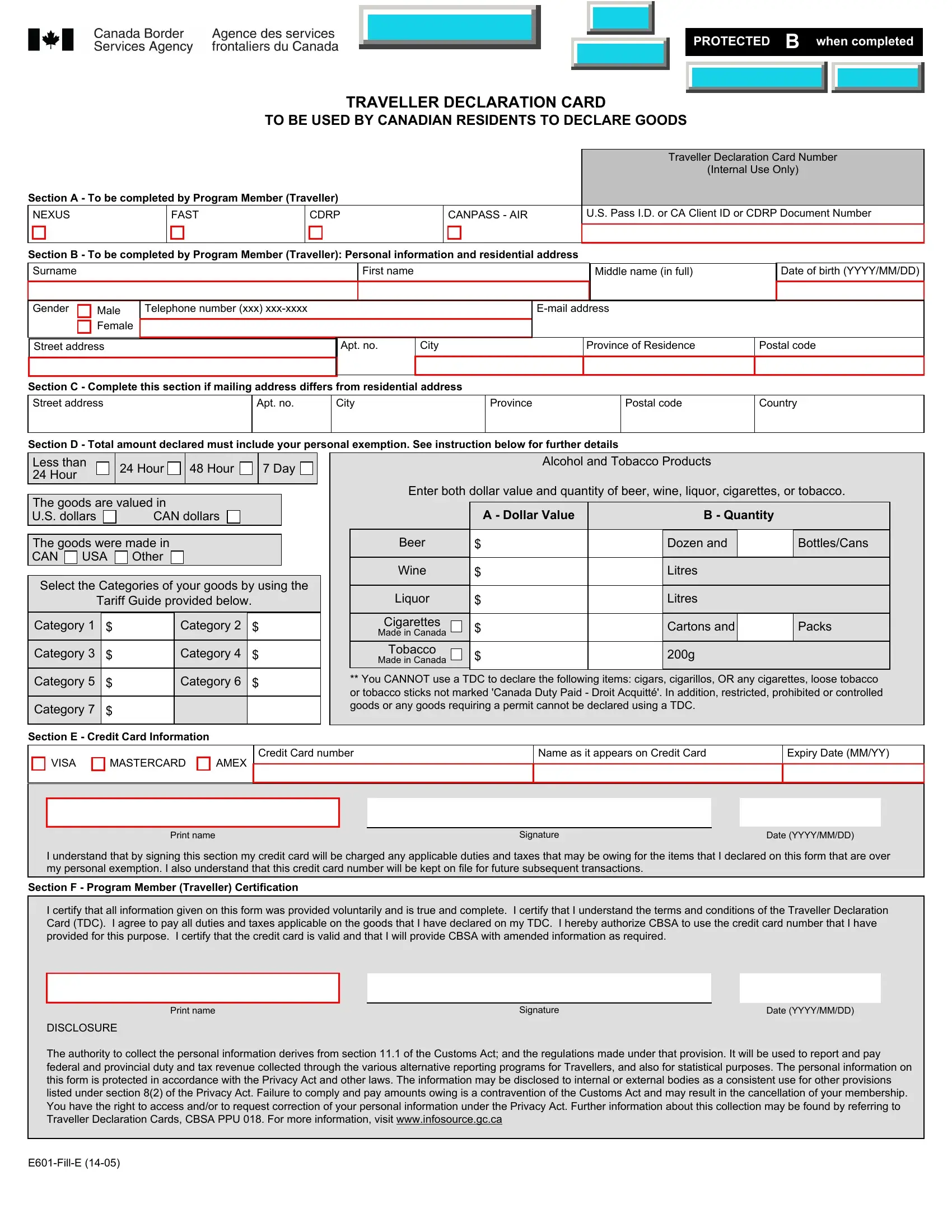

This PDF form requires particular information to be entered, so you should take the time to type in exactly what is asked:

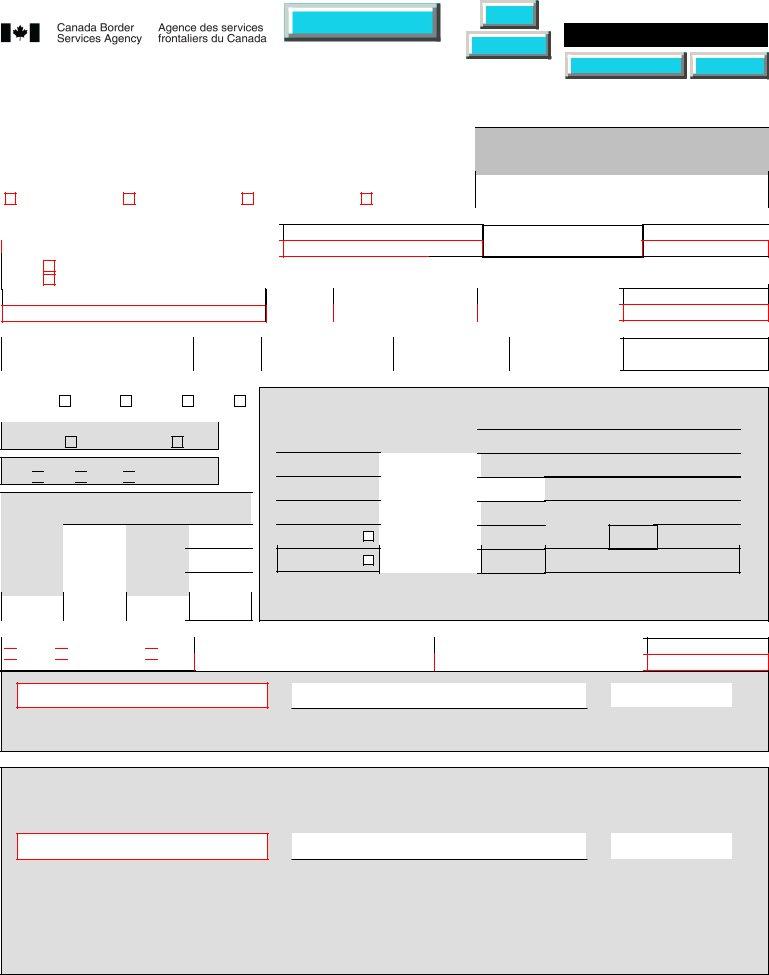

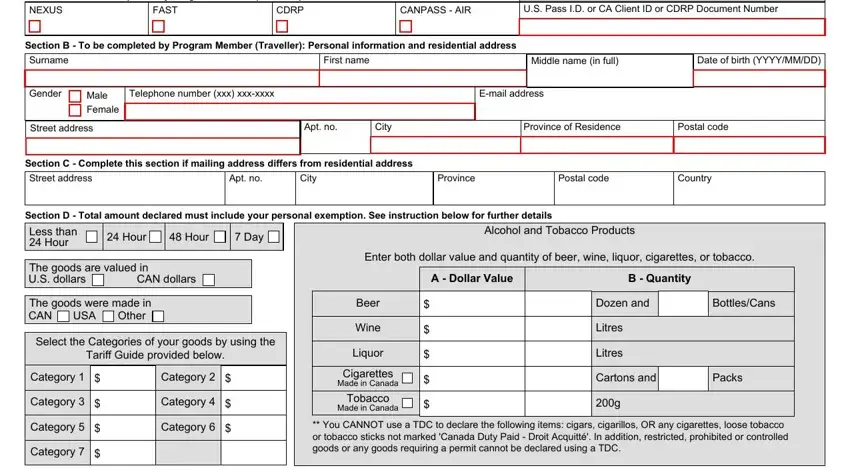

1. It's essential to fill out the canada card pdf properly, so be mindful when filling out the segments including these particular fields:

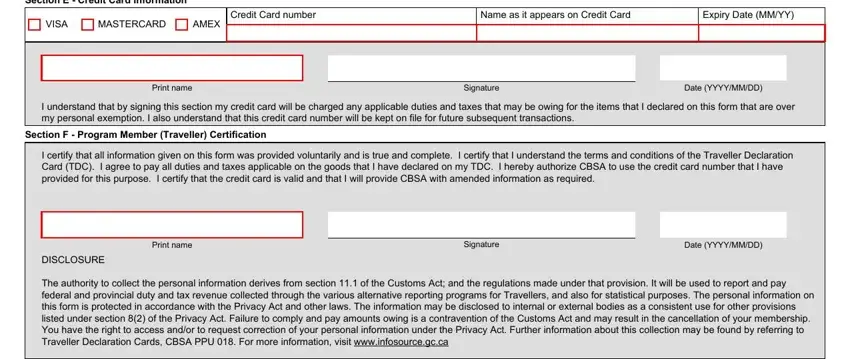

2. Just after filling out the previous step, go to the next step and fill in the essential particulars in all these blank fields - Section E Credit Card Information, VISA, MASTERCARD, AMEX, Credit Card number, Name as it appears on Credit Card, Expiry Date MMYY, Print name, Signature, Date YYYYMMDD, I understand that by signing this, Section F Program Member, I certify that all information, Date YYYYMMDD, and Print name.

Regarding MASTERCARD and AMEX, make sure that you review things here. These two are surely the key fields in this page.

Step 3: Prior to finalizing your document, it's a good idea to ensure that all form fields have been filled in right. As soon as you confirm that it's fine, click on “Done." After registering a7-day free trial account here, you will be able to download canada card pdf or email it promptly. The PDF file will also be at your disposal through your personal account menu with your each change. FormsPal guarantees your information confidentiality with a protected method that in no way saves or shares any sensitive information involved in the process. Feel safe knowing your docs are kept safe whenever you work with our services!