You are able to work with disclosure statement relations form easily in our PDFinity® online tool. To make our tool better and simpler to utilize, we continuously implement new features, with our users' suggestions in mind. This is what you'll have to do to get going:

Step 1: Access the PDF inside our editor by clicking the "Get Form Button" above on this webpage.

Step 2: As soon as you launch the PDF editor, you'll notice the form prepared to be completed. Aside from filling in different blank fields, you may also perform many other things with the file, including putting on any words, modifying the original text, inserting graphics, putting your signature on the form, and much more.

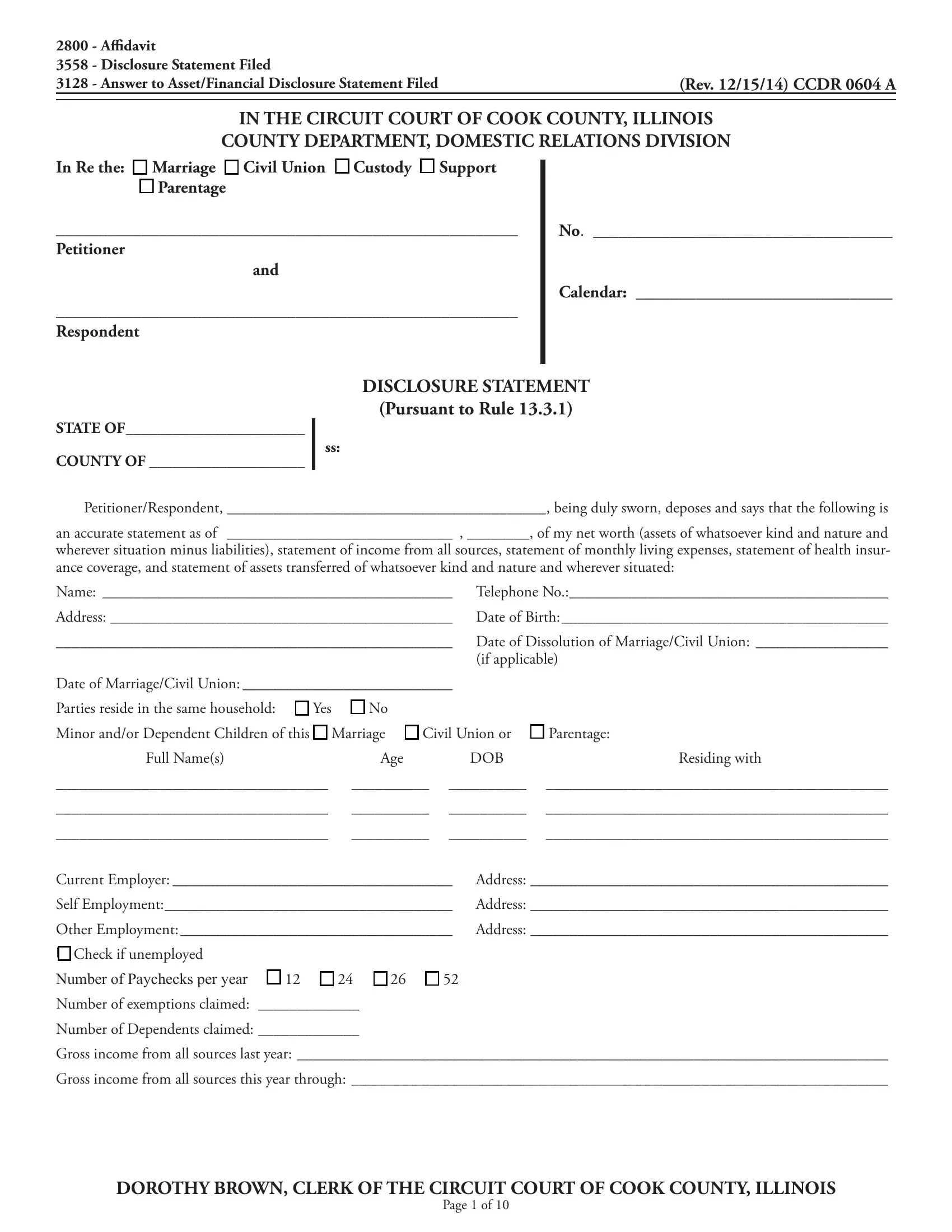

In an effort to fill out this document, be certain to enter the information you need in each blank:

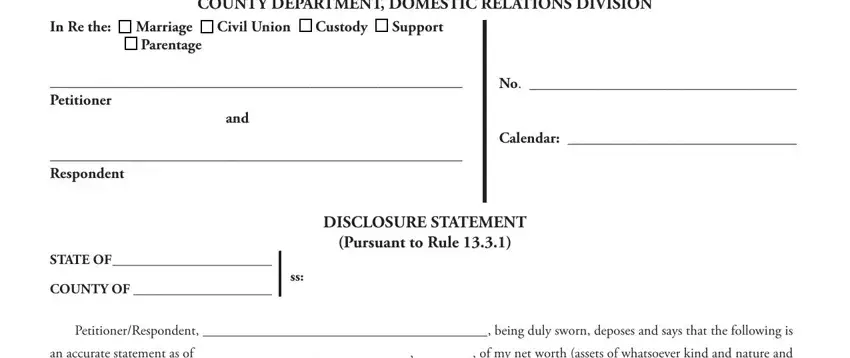

1. Firstly, once filling out the disclosure statement relations form, begin with the section with the next fields:

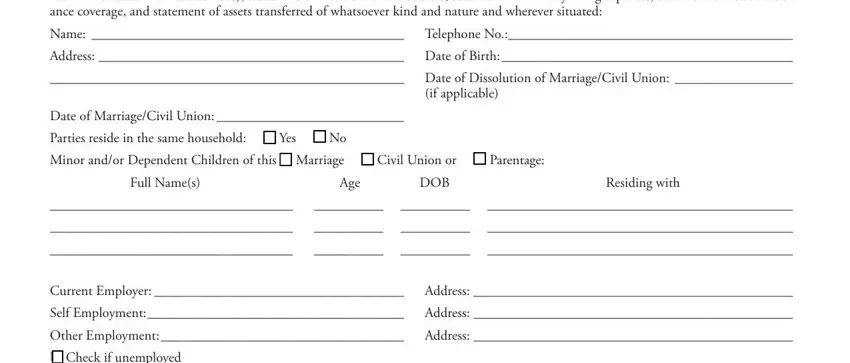

2. Your next stage is usually to complete these particular fields: an accurate statement as of of, Name Telephone No, Address Date of Birth, Date of Dissolution of, if applicable, Date of MarriageCivil Union, Full Names, Age, DOB, Residing with, Current Employer Address, Self Employment Address, and Other Employment Address Check.

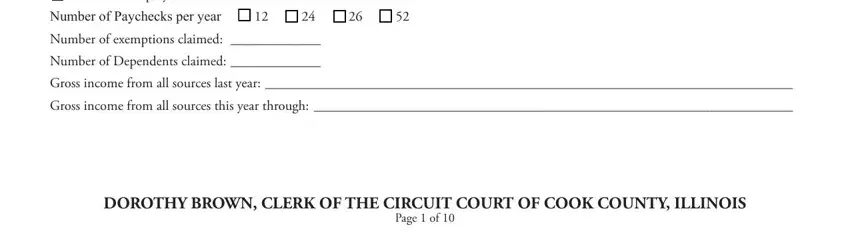

3. The next segment is considered rather uncomplicated, Other Employment Address Check, Number of exemptions claimed, Number of Dependents claimed, Gross income from all sources last, Gross income from all sources this, DOROTHY BROWN CLERK OF THE CIRCUIT, and Page of - each one of these form fields has to be completed here.

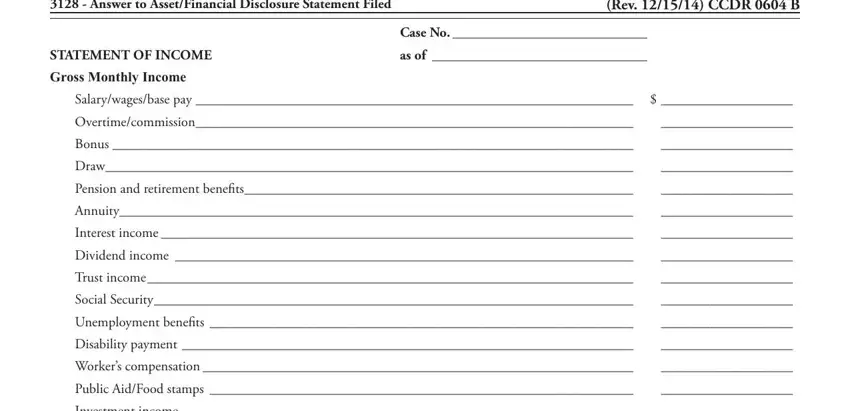

4. The next paragraph will require your input in the following areas: Ai davit Disclosure Statement, STATEMENT OF INCOME, Gross Monthly Income, Rev CCDR B, Case No, as of, Salarywagesbase pay, Overtimecommission, Bonus, Draw, Pension and retirement benei ts, Annuity, Interest income, Dividend income, and Trust income. Just remember to fill in all of the required info to go further.

When it comes to Case No and Salarywagesbase pay, be sure you double-check them here. Those two could be the key ones in this form.

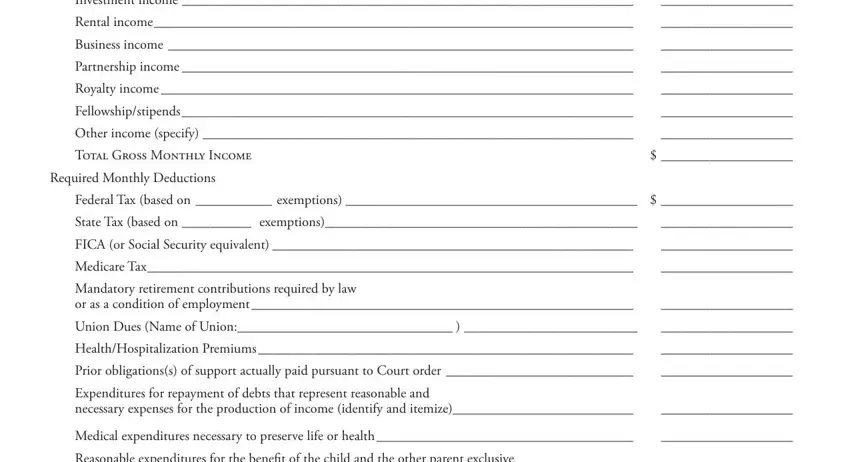

5. Now, the following final part is precisely what you will need to finish prior to finalizing the PDF. The fields under consideration include the next: Investment income, Rental income, Business income, Partnership income, Royalty income, Fellowshipstipends, Other income specify, Total Gross Monthly Income, Required Monthly Deductions, Federal Tax based on exemptions, State Tax based on exemptions, FICA or Social Security equivalent, Medicare Tax, Mandatory retirement contributions, and or as a condition of employment.

Step 3: Reread what you have entered into the blank fields and click the "Done" button. Grab the disclosure statement relations form after you register here for a free trial. Conveniently access the pdf from your FormsPal cabinet, together with any modifications and adjustments being conveniently synced! FormsPal guarantees your data privacy via a protected method that never saves or shares any type of personal information involved. Feel safe knowing your files are kept confidential every time you use our tools!