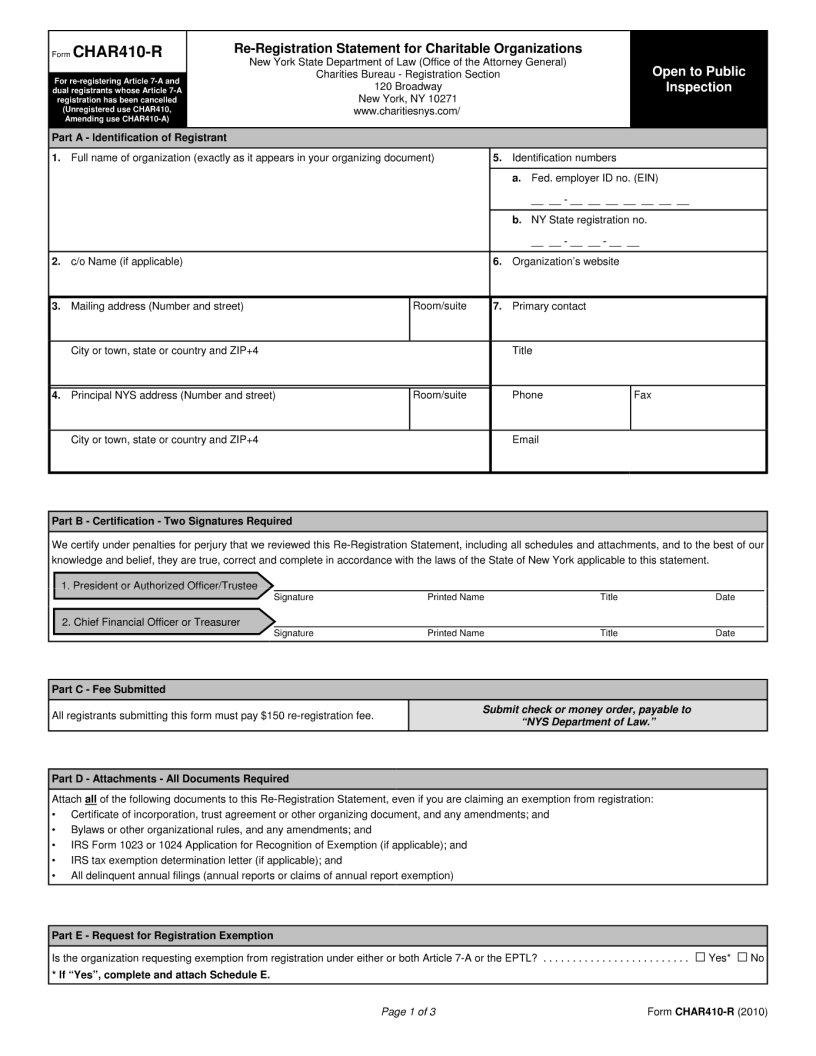

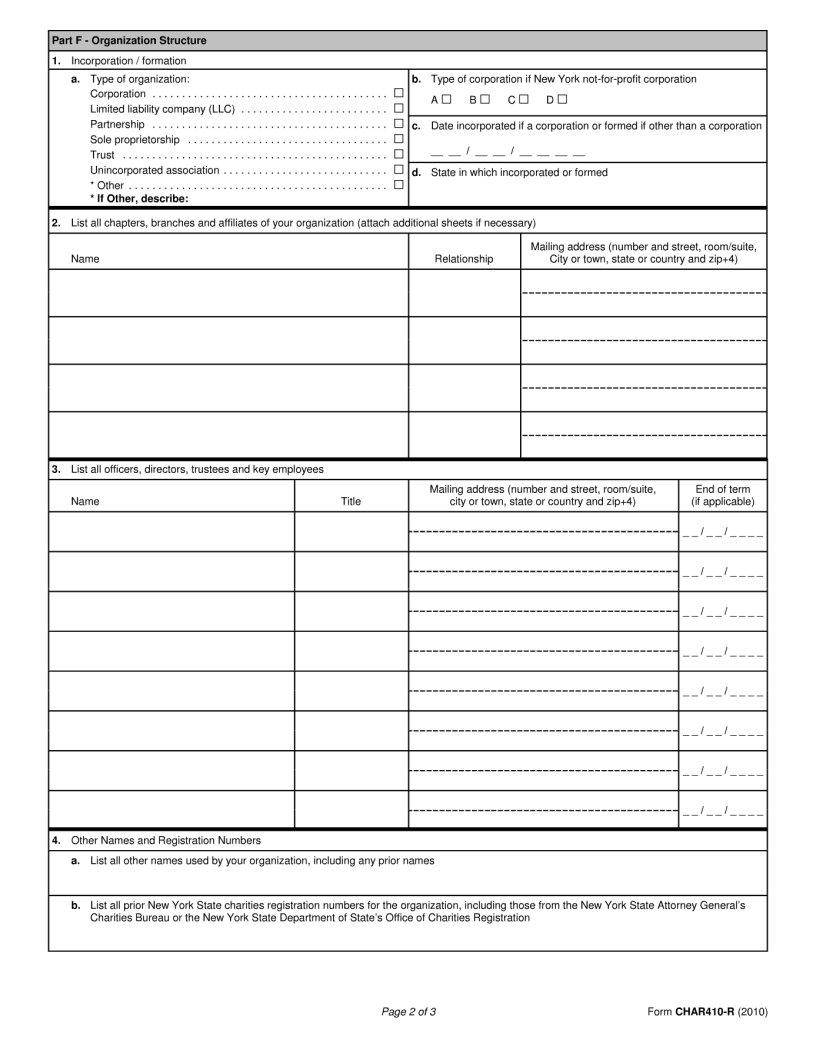

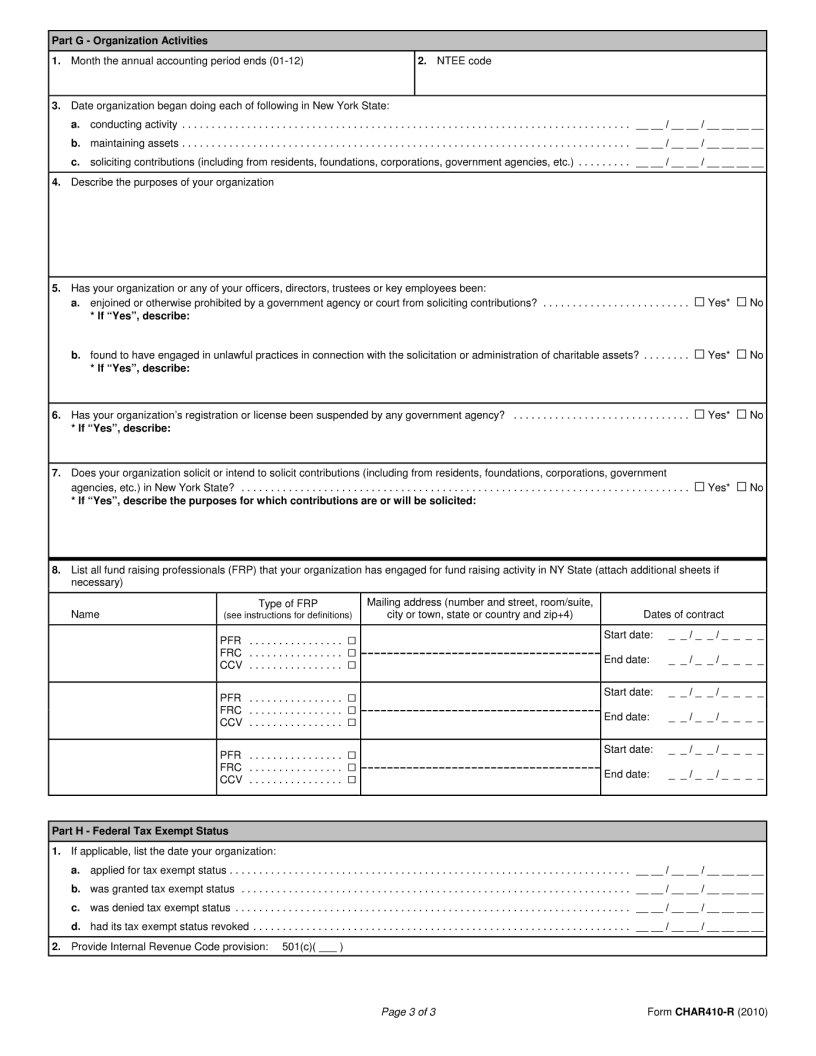

Navigating the landscape of charitable organizations in the United States can be a complex and daunting task, especially when it comes to understanding the various forms and documentation required to ensure compliance with both federal and state regulations. Among these crucial documents is the Char410 R form, a key piece of paperwork for charities operating within certain jurisdictions. This form plays a significant role in the registration process for charitable organizations, serving as a vital tool for transparency, regulatory compliance, and public trust. It is designed to provide state authorities with essential information about a charity's operations, financial situation, and governance. The Char410 R form facilitates the proper oversight of charitable activities, helping to prevent fraud and mismanagement, and ensuring that charities are accountable for the funds they receive and the services they provide to the community. Understanding the major aspects of this form, including its purpose, who needs to fill it out, and the types of information required, is crucial for anyone involved in the management or operation of a charitable organization.

| Question | Answer |

|---|---|

| Form Name | Char410 R Form |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | are churches exempt from char500 or char410, char410 a, char400, char 410 |