You could fill in char500 form 2020 without difficulty using our online editor for PDFs. Our team is continuously endeavoring to expand the tool and insure that it is much faster for clients with its handy functions. Bring your experience one stage further with continuously growing and unique possibilities available today! If you're looking to start, here's what it requires:

Step 1: Click on the "Get Form" button in the top part of this page to access our tool.

Step 2: As soon as you start the online editor, you will see the document ready to be completed. In addition to filling in various fields, you can also perform various other things with the Document, including adding custom words, editing the original textual content, adding illustrations or photos, placing your signature to the PDF, and more.

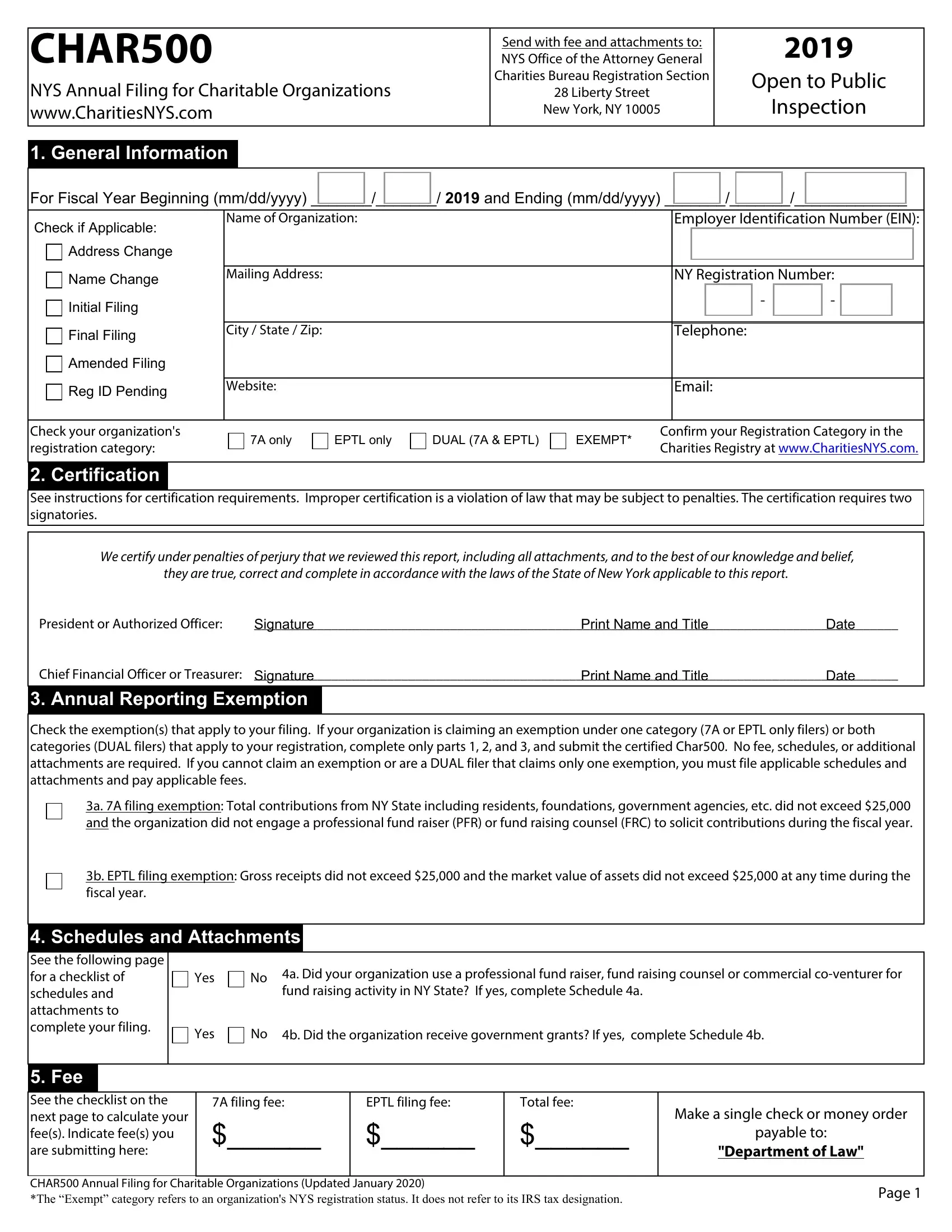

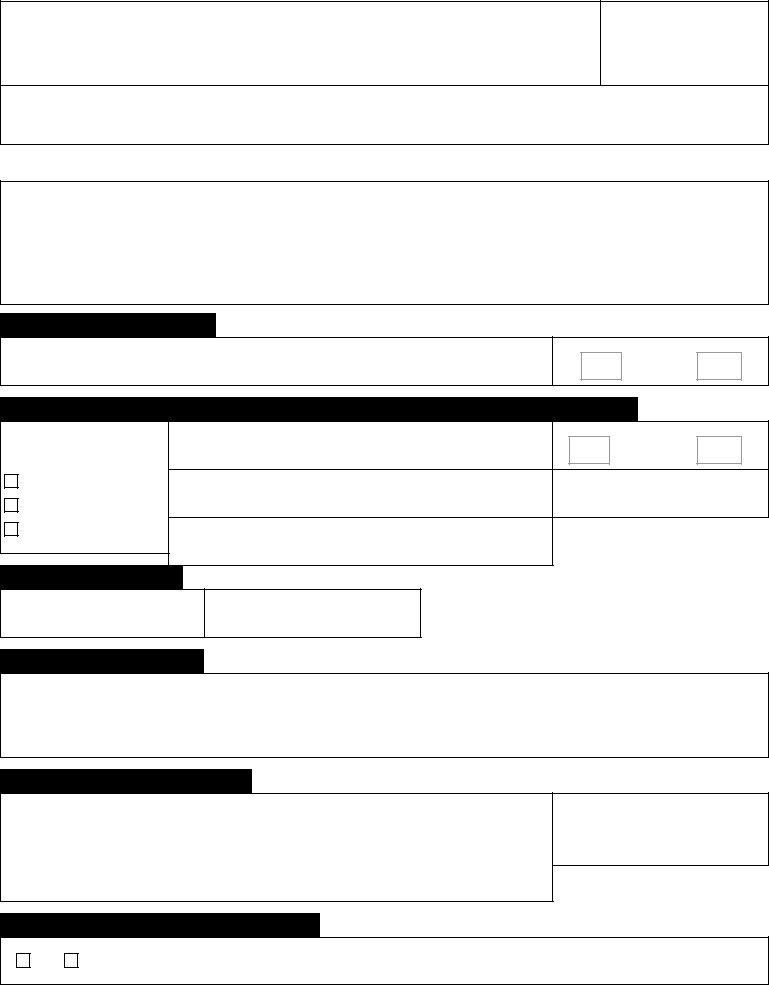

In order to fill out this document, be sure to provide the information you need in every single blank:

1. Start filling out the char500 form 2020 with a number of major blank fields. Consider all of the required information and be sure nothing is overlooked!

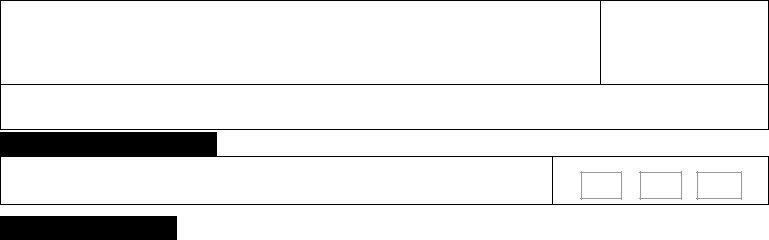

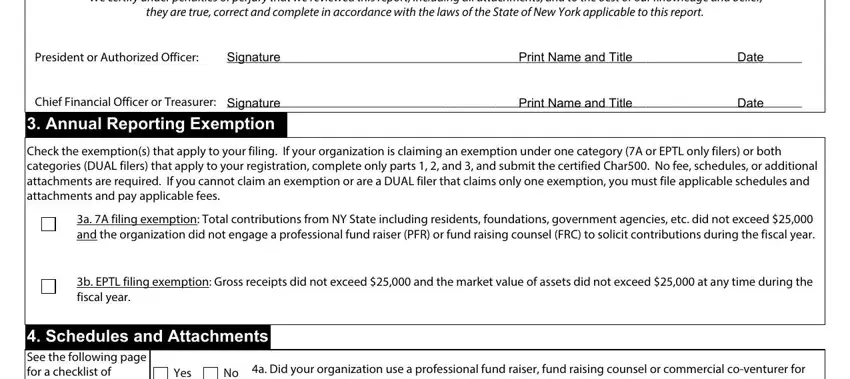

2. Once your current task is complete, take the next step – fill out all of these fields - We certify under penalties of, they are true correct and complete, President or Authorized Officer, Signature, Print Name and Title, Print Name and Title, Signature, Date, Date, Annual Reporting Exemption, Check the exemptions that apply to, a A filing exemption Total, b EPTL filing exemption Gross, Schedules and Attachments See the, and Yes with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

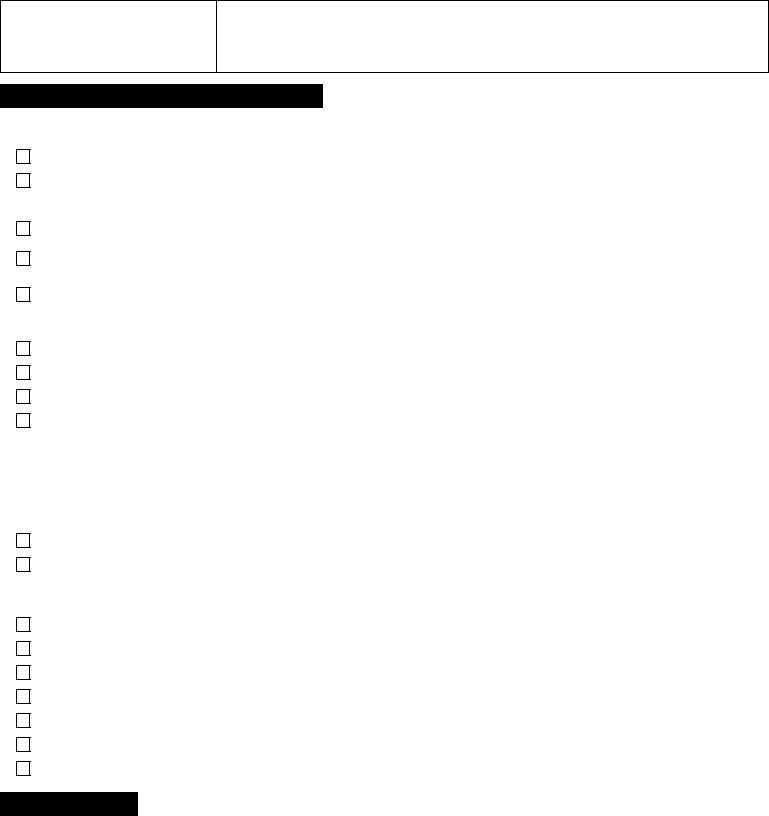

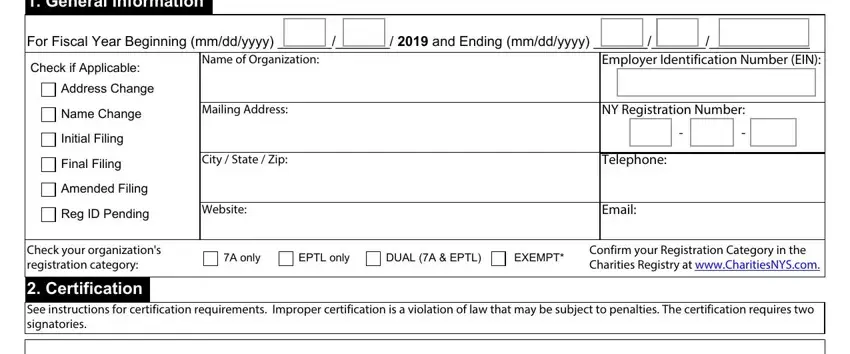

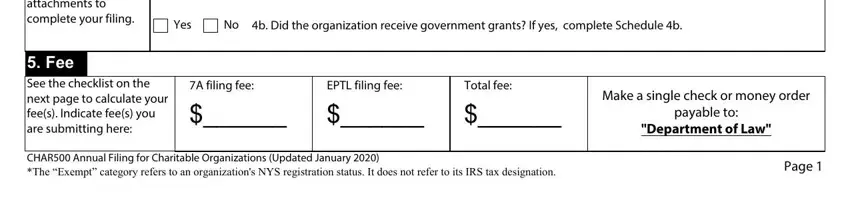

3. This next step is normally simple - fill in all the empty fields in Schedules and Attachments See the, Yes, No b Did the organization receive, Fee See the checklist on the next, A filing fee, EPTL filing fee, Total fee, Make a single check or money order, payable to, Department of Law, CHAR Annual Filing for Charitable, and Page to finish the current step.

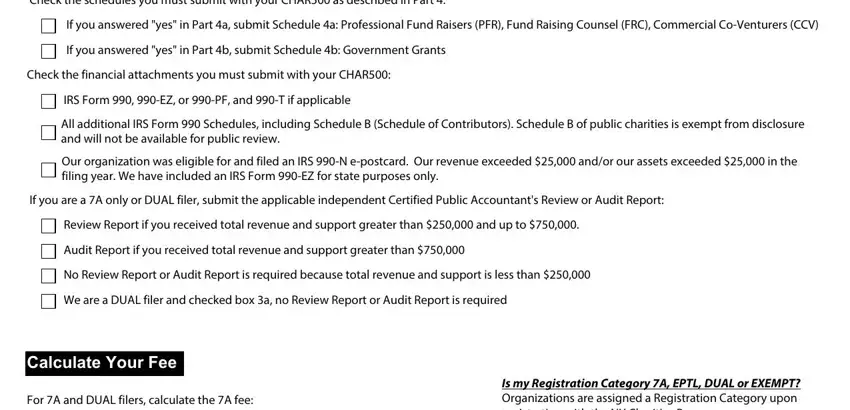

4. Completing Check the schedules you must, If you answered yes in Part a, If you answered yes in Part b, Check the financial attachments, IRS Form EZ or PF and T if, All additional IRS Form Schedules, Our organization was eligible for, If you are a A only or DUAL filer, Review Report if you received, Audit Report if you received total, No Review Report or Audit Report, We are a DUAL filer and checked, Calculate Your Fee, For A and DUAL filers calculate, and Is my Registration Category A EPTL is essential in this next stage - you should definitely be patient and fill out each blank!

It's easy to make errors while completing your All additional IRS Form Schedules, hence you'll want to take another look before you submit it.

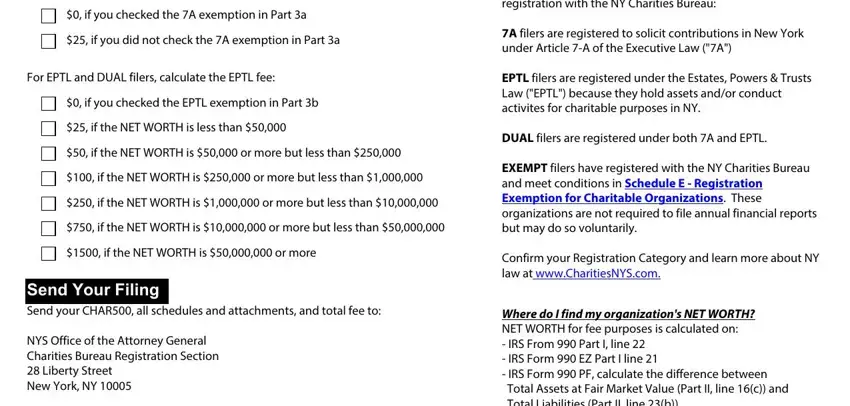

5. Lastly, this final portion is precisely what you should complete before submitting the form. The blank fields here are the following: if you checked the A exemption in, if you did not check the A, For EPTL and DUAL filers calculate, if you checked the EPTL exemption, if the NET WORTH is less than, if the NET WORTH is or more but, if the NET WORTH is or more but, if the NET WORTH is or more but, if the NET WORTH is or more but, if the NET WORTH is or more, Send Your Filing Send your CHAR, Is my Registration Category A EPTL, and Where do I find my organizations.

Step 3: Check all the details you have inserted in the blank fields and then hit the "Done" button. After creating afree trial account with us, you will be able to download char500 form 2020 or email it promptly. The PDF document will also be readily accessible from your personal cabinet with your each modification. We don't share any information you use while filling out forms at FormsPal.