city of carson business license can be filled out in no time. Simply try FormsPal PDF editing tool to finish the job fast. In order to make our editor better and easier to use, we consistently design new features, with our users' feedback in mind. Starting is simple! Everything you should do is stick to the following simple steps down below:

Step 1: First of all, open the editor by pressing the "Get Form Button" above on this webpage.

Step 2: As soon as you access the tool, there'll be the document all set to be filled out. Other than filling out various blank fields, you might also do several other things with the Document, that is adding your own words, editing the original text, inserting images, placing your signature to the PDF, and much more.

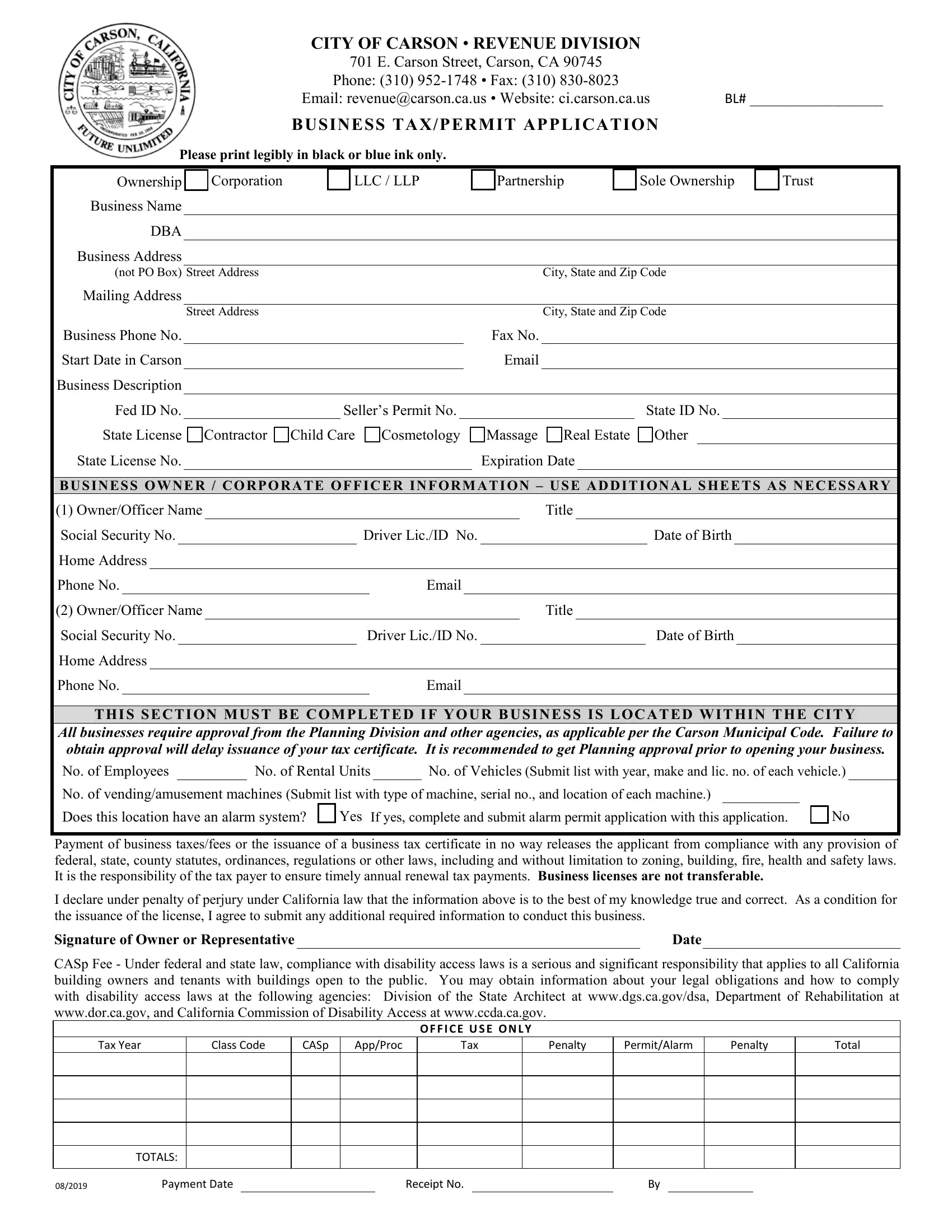

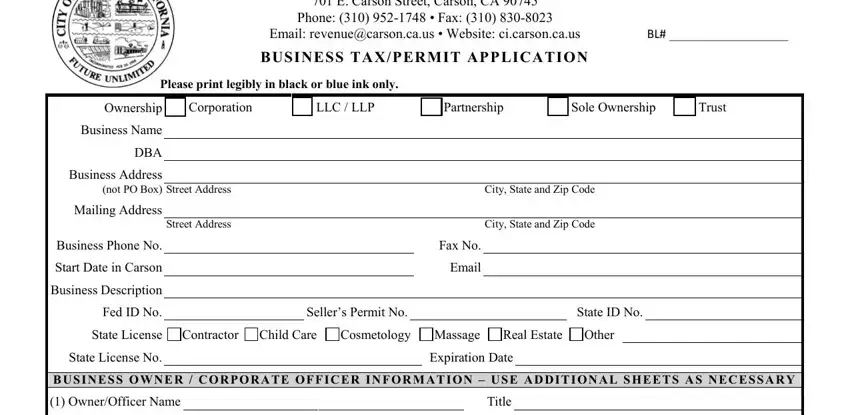

When it comes to fields of this particular document, this is what you need to know:

1. It's essential to fill out the city of carson business license accurately, therefore pay close attention when filling in the parts including all of these blanks:

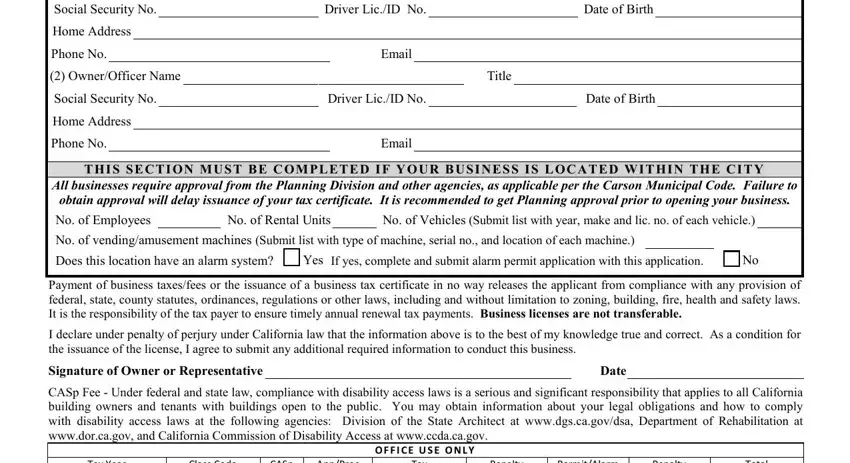

2. When the previous section is done, go on to type in the suitable information in all these - Social Security No, Home Address, Phone No, OwnerOfficer Name, Social Security No, Home Address, Phone No, Driver LicID No, Date of Birth, Email, Title, Driver LicID No, Date of Birth, Email, and T H I S S E C T I O N M U S T B E.

Be extremely attentive while completing Home Address and OwnerOfficer Name, as this is where many people make mistakes.

Step 3: Ensure that your details are right and then click "Done" to progress further. Download your city of carson business license the instant you subscribe to a free trial. Immediately get access to the document within your personal account page, together with any edits and changes being automatically kept! We don't share or sell any details you provide whenever working with forms at our website.