Any time you need to fill out statewide super hardship withdrawals, there's no need to install any sort of programs - simply make use of our online tool. The tool is constantly maintained by our team, getting awesome features and becoming greater. By taking some basic steps, you are able to start your PDF journey:

Step 1: Just click the "Get Form Button" at the top of this site to see our pdf editor. Here you will find all that is necessary to work with your file.

Step 2: With our handy PDF tool, it is possible to do more than just fill out blank form fields. Express yourself and make your forms seem sublime with customized textual content added in, or tweak the original input to excellence - all accompanied by the capability to add any graphics and sign the file off.

With regards to the blanks of this precise document, here's what you want to do:

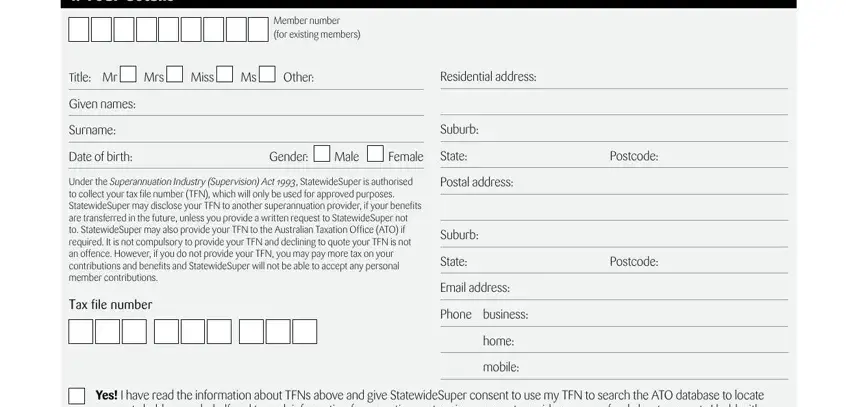

1. To start off, once completing the statewide super hardship withdrawals, start in the section containing following blanks:

2. Soon after the prior array of fields is completed, go to type in the suitable details in all these - Are you or have you ever been a, Yes, Dependants, List your financial dependants eg, Full Name, Full Name, Full Name, Full Name, Relationship, Relationship, Relationship, Relationship, Age, Age, and Age.

Be very careful when completing Yes and Full Name, since this is where many people make some mistakes.

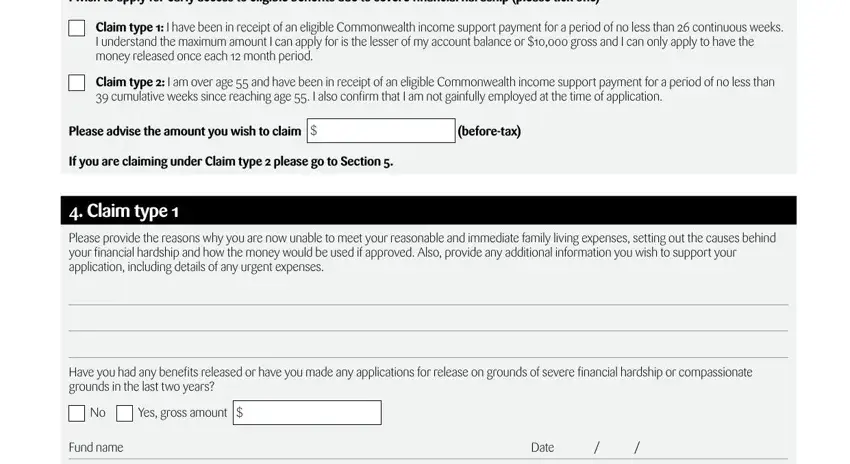

3. This third step will be hassle-free - complete all of the blanks in Claim details I wish to apply for, Claim type I have been in receipt, I understand the maximum amount I, Claim type I am over age and, cumulative weeks since reaching, Please advise the amount you wish, beforetax, If you are claiming under Claim, Claim type Please provide the, Have you had any benefits released, Yes gross amount, Fund name, and Date to conclude this segment.

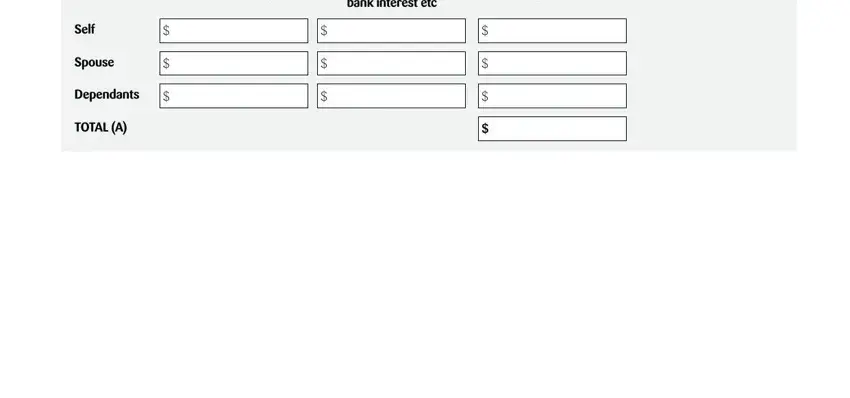

4. This next section requires some additional information. Ensure you complete all the necessary fields - Commonwealth income, bank interest etc, Total income, Self, Spouse, Dependants, and TOTAL A - to proceed further in your process!

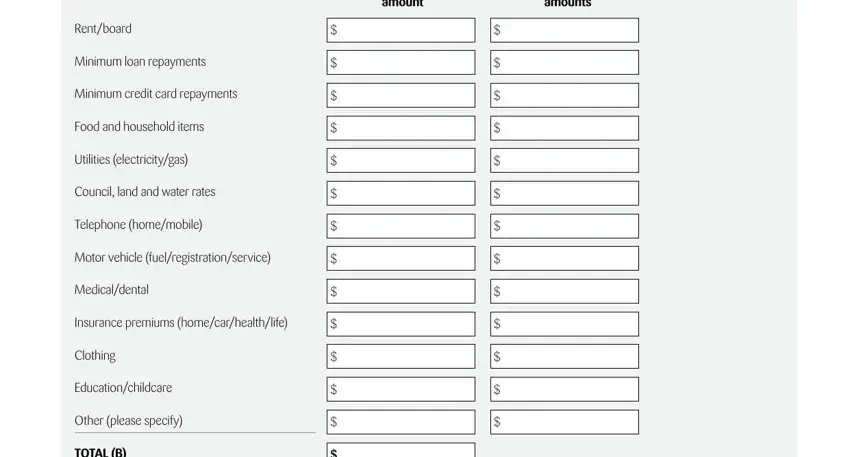

5. Since you approach the end of this document, there are actually a few extra requirements that need to be met. Specifically, Rentboard, Minimum loan repayments, Minimum credit card repayments, Food and household items, Utilities electricitygas, Council land and water rates, Telephone homemobile, Motor vehicle, Medicaldental, Insurance premiums, Clothing, Educationchildcare, Other please specify, TOTAL B, and amount must all be filled out.

Step 3: After you have glanced through the information in the file's blanks, simply click "Done" to finalize your FormsPal process. Join FormsPal right now and instantly get access to statewide super hardship withdrawals, ready for download. All alterations made by you are preserved , meaning you can edit the form at a later stage if needed. FormsPal guarantees your data confidentiality via a secure system that in no way saves or distributes any personal information involved in the process. Rest assured knowing your paperwork are kept confidential each time you use our editor!