Are you looking for a way to get your child into a prestigious 1st grade program? Look no further! A recently released report by the New York Times breaks down the top 32 schools in the city – and how to get your child into them. According to the report, Studiosity, an online tutoring company, compiled data from admissions officers at some of the most competitive schools in New York City. The findings are based on SAT or ACT scores, grades, attendance records, essay contests and other measures of academic success. Get your child started on the right track today with one of these top-performing schools!

| Question | Answer |

|---|---|

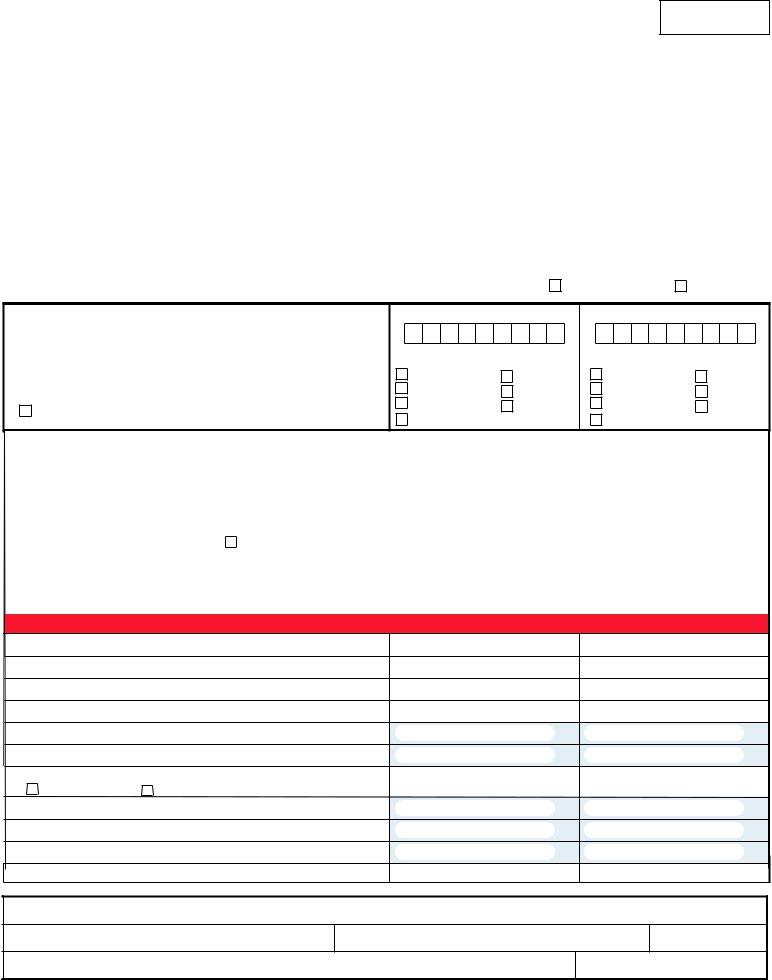

| Form Name | Clgs To 32 1 Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | Biglerville, YYYY, S-Corp, W-2s |

YORK ADAMS TAX BUREAU |

BUREAU COPY |

||

|

1405 N. Duke St., PO Box 15627 |

900 Biglerville Rd., PO Box 4374 |

TAXPAYER ANNUAL |

|

York, PA |

Gettysburg, PA 17325 |

LOCAL EARNED INCOME TAX RETURN |

|

Phone (717) |

Phone (717) |

|

|

|

|

|

|

|

|

|

You are entitled to receive a written explanation of your rights with regard to the audit, appeal, enforcement, refund and collection of local taxes by contacting your Tax Officer.

*If you have relocated during the tax year, please supply additional information.

Tax Year

DATESLIVINGATEACHADDRESS |

STREET ADDRESS (No PO Box, RD or RR) |

CITY OR POST OFFICE |

STATE |

ZIP |

||||

/ |

/ |

TO |

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

/ |

TO |

/ |

/ |

|

|

|

|

**If you need additional space - please attach separate sheet.

EXTENSION |

AMENDED RETURN |

DAYTIME PHONE NUMBER |

RESIDENT PSD CODE |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The calculations reported in the first column MUST pertain to the name printed

in the column, regardless of whether the husband or wife appears first.

Combining income is NOT permitted.

ONLY USE BLACK OR BLUE INK TO COMPLETE THIS FORM

Single |

|

Married, Filing Jointly |

|

Married, Filing Separately |

|

Final Return* |

Social Security #

If you had NO EARNED INCOME,

check the reason why:

disabled |

student |

deceased |

military |

homemaker |

retired |

unemployed |

|

Spouse’s Social Security #

If you had NO EARNED INCOME,

check the reason why:

disabled |

student |

deceased |

military |

homemaker |

retired |

unemployed |

|

1. |

Gross Compensation as Reported on |

.00 |

.00 |

|

|

|

|

2. |

Unreimbursed Employee Business Expenses. (Enclose PA Schedule UE) . . . . |

.00 |

.00 |

|

|

|

|

3. |

Other Taxable Earned Income * |

.00 |

.00 |

|

|

|

|

4. |

Total Taxable Earned Income (Add lines 1 through 3) |

.00 |

.00 |

|

|

|

|

5. |

Net Profit (Enclose PA Schedules*) |

.00 |

.00 |

|

|||

|

|

|

|

6. |

Net Loss (Enclose PA Schedules*) |

.00 |

.00 |

|

|

|

|

7. |

Total Taxable Net Profit (Subtract Line 6 from Line 5. If less than zero, enter zero) . . |

.00 |

.00 |

|

|

|

|

8. |

Total Taxable Earned Income and Net Profit (Add Lines 4 and 7) |

.00 |

.00 |

|

|

|

|

DO NOT ROUND AMOUNTS BELOW THIS LINE

9. Total Tax Liability |

(Line 8 multiplied by |

) |

10.Total Local Earned Income Tax Withheld as Reported on

12.Miscellaneous Tax Credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13. TOTAL PAYMENTS and CREDITS |

(Add lines 10 through 12) . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14.Refund

IF MORE THAN $1.00, enter amount

(or select option in 15) . . . . . . . .

15. Credit Taxpayer/Spouse (Amount of Line 13 you want as a credit to your account) |

|

Credit to next year |

Credit to spouse |

. . .

16. 17. 18. 19.

EARNED INCOME TAX BALANCE DUE (Line 9 minus |

||

Penalty after April 15* (multiply line 16 |

by |

) |

Interest after April 15* (multiply line 16 |

by |

) |

TOTAL PAYMENT DUE (Add Lines 16, 17, and 18) . . . . |

||

Line . . . . . . . . .

13) . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

*SEE INSTRUCTIONS

Under penalties of perjury, I (we) declare that I (we) have examined this information, including all accompanying

schedules and statements and to the best of my (our) belief, they are true, correct and complete.

YOUR SIGNATURE

SPOUSE’S SIGNATURE (If Filing Jointly)

DATE (MM/DD/YYYY)

PREPARER’S PRINTED NAME & SIGNATURE

PHONE NUMBER

SubChapter S Corporations Earnings

FOR AUDIT PURPOSES ONLY DO NOT LIST ON FRONT OF TAX FORM. PLEASE PROVIDE TOTAL BELOW:

LOCAL WORKSHEET (For Taxpayers Who Moved During the Year)

INCOME PRORATION (______________________________________________________________________)

Residence #1 – Complete Address

Employer # 1 ___________________________________

Local Income $ _______________ / 12 X _______________________ = ________________

Total Income |

# of months at this residence |

Prorated Income – Employer #1 |

Tax Withheld $ _______________ / 12 X _______________________ = ________________ |

||

Total Tax Withheld |

# of months at this residence |

Prorated Tax Withheld – Employer #1 |

Employer # 2 ___________________________________ |

|

|

Local Income $ _______________ / 12 X _______________________ = ________________ |

||

Total Income |

# of months at this residence |

Prorated Income – Employer #2 |

Tax Withheld $ _______________ / 12 X _______________________ = ________________ |

||

Total Tax Withheld |

# of months at this residence |

Prorated Tax Withheld – Employer #2 |

INCOME PRORATION (______________________________________________________________________) |

||

|

Residence #2 – Complete Address |

|

Employer # 1 ___________________________________ |

|

|

Local Income $ _______________ / 12 X _______________________ = ________________ |

||

Total Income |

# of months at this residence |

Prorated Income – Employer #1 |

Tax Withheld $ _______________ / 12 X _______________________ = ________________ |

||

Total Tax Withheld |

# of months at this residence |

Prorated Tax Withheld – Employer #1 |

Employer # 2 ___________________________________ |

|

|

Local Income $ _______________ / 12 X _______________________ = ________________ |

||

Total Income |

# of months at this residence |

Prorated Income – Employer #2 |

Tax Withheld $ _______________ / 12 X _______________________ = ________________ |

||

Total Tax Withheld |

# of months at this residence |

Prorated Tax Withheld – Employer #2 |

(See Instructions Line 10) |

Taxpayer A |

Taxpayer B |

EARNED INCOME actually taxed in other state or Philadelphia |

|

|

as shown on the state or Philadelphia tax return………………………………………………….. (1) __________ |

(1) __________ |

|

Local tax rate: 1% or as specified on the front of this form |

X __________ |

X __________ |

Multiply line (1) by tax rate………………………………………………………………….......... (2) __________ |

(2) __________ |

|

Tax Liability Paid to other state(s) |

(3) __________ |

(3) __________ |

PA Income Tax (line 1 x PA Income Tax rate for year being reported) |

(4) __________ |

(4) __________ |

CREDIT to be used against Local Tax (Line 3 minus line 4) |

(5) __________ |

(5) __________ |

On line 12 of page one of this return, enter the amount on line (5) or the amount on line (2) of worksheet, whichever is less. (If less than zero, enter zero).

Enclose a copy of the PA Return with Schedule G and the other state return when requesting credit for tax paid to a nonreciprocating state.

Enclose a copy of the Philadelphia Net Profits Return when requesting credit for Philadelphia net profits tax. Failure to supply the other PA return and Schedule G, the other state return, or a copy of the Philadelphia net profits return or the credit will be disallowed.

If claiming credit for Philadelphia Tax withheld from earnings within Philadelphia attach a copy of any