We were designing this PDF editor having the idea of making it as easy to apply as it can be. That's the reason the actual procedure of typing in the cms 855a form will be simple accomplish the next steps:

Step 1: Select the orange button "Get Form Here" on the webpage.

Step 2: You can now manage your cms 855a form. Our multifunctional toolbar enables you to include, erase, improve, and highlight content material or perhaps undertake other commands.

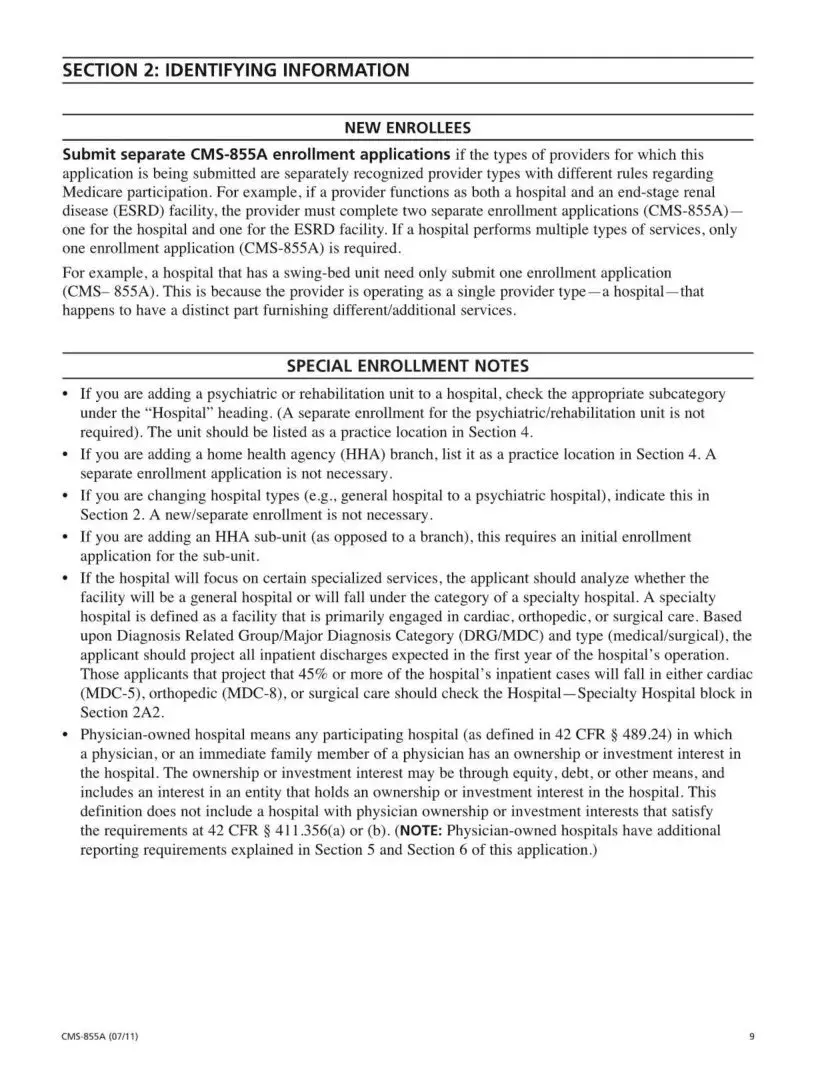

The PDF template you plan to fill in will include the next areas:

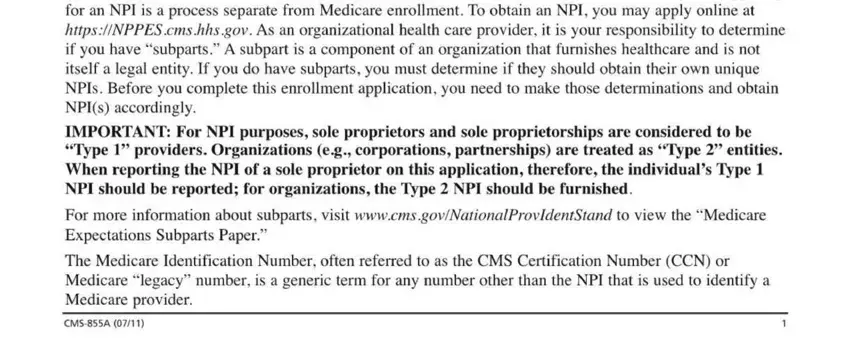

Within the section The National Provider Identifier enter the data that the platform demands you to do.

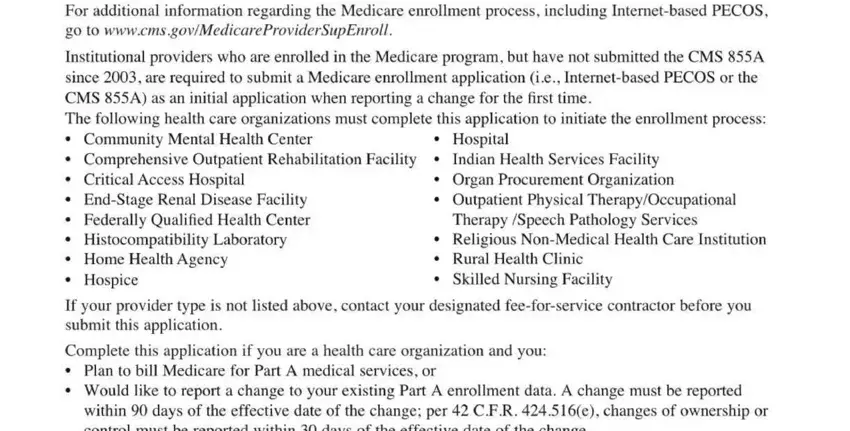

Put down the valuable particulars when you find yourself on the ADDITIONAL INFORMATION, For additional information, MAIL YOUR APPLICATION, and The Medicare fee, for, service area.

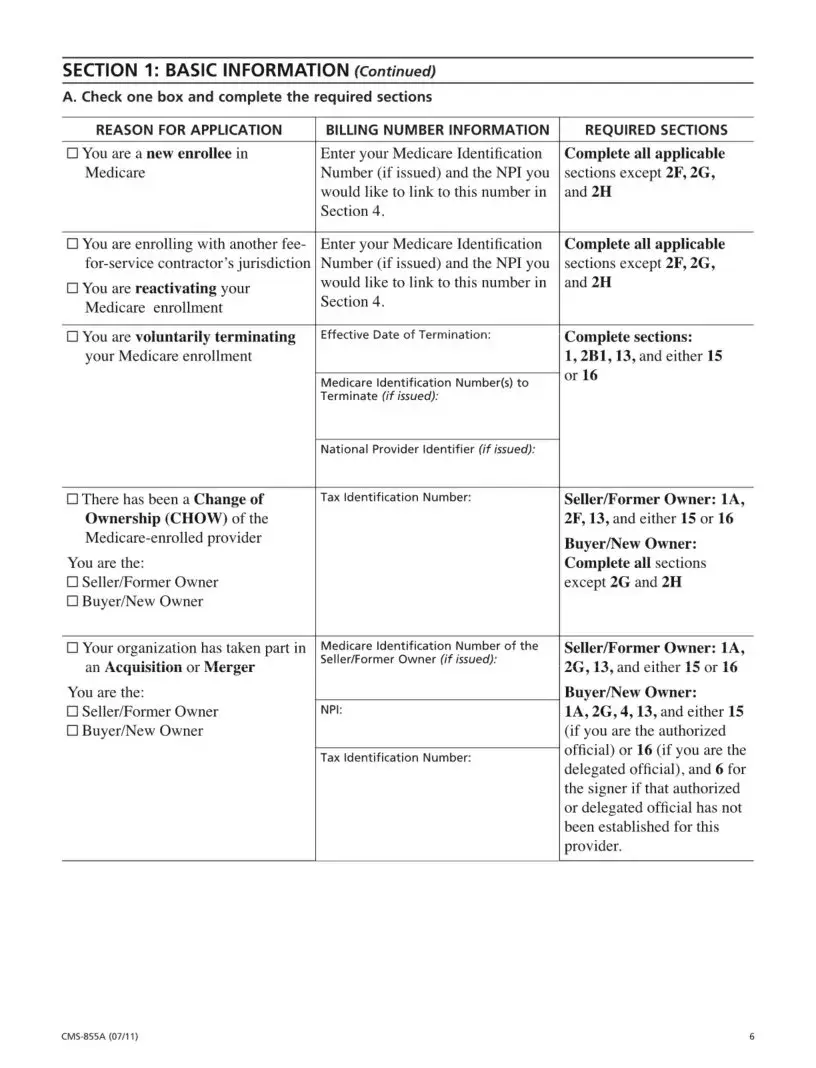

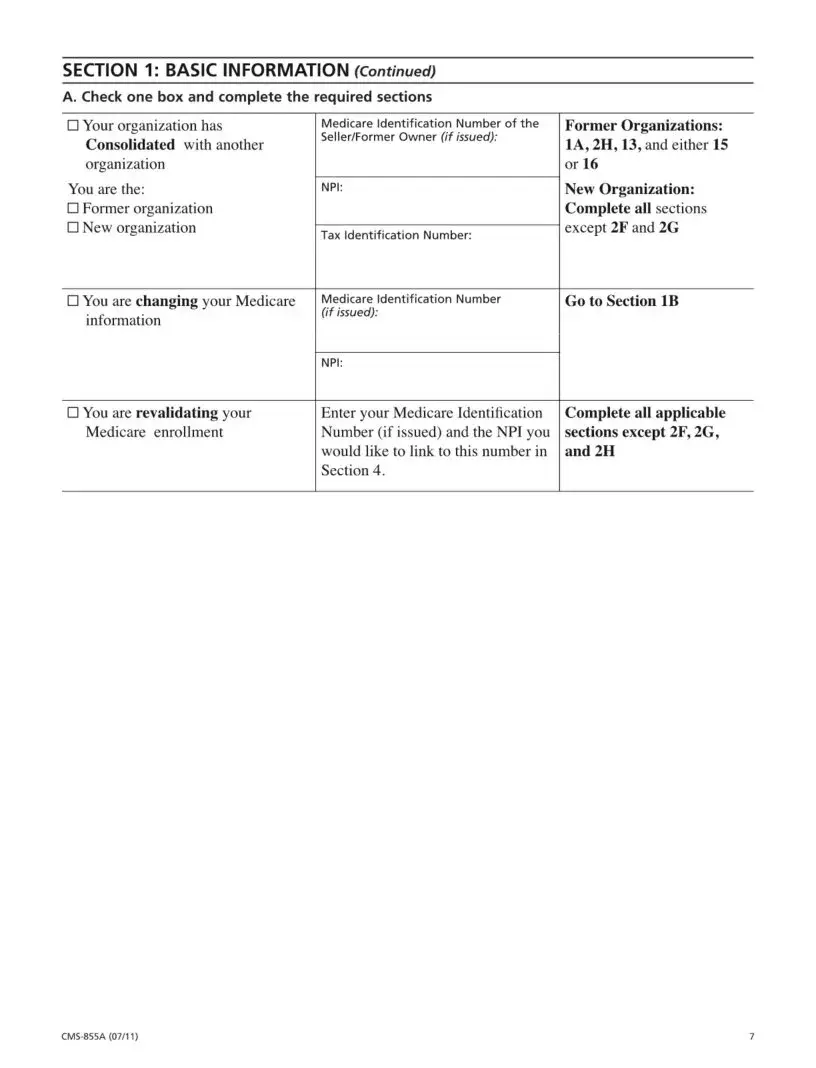

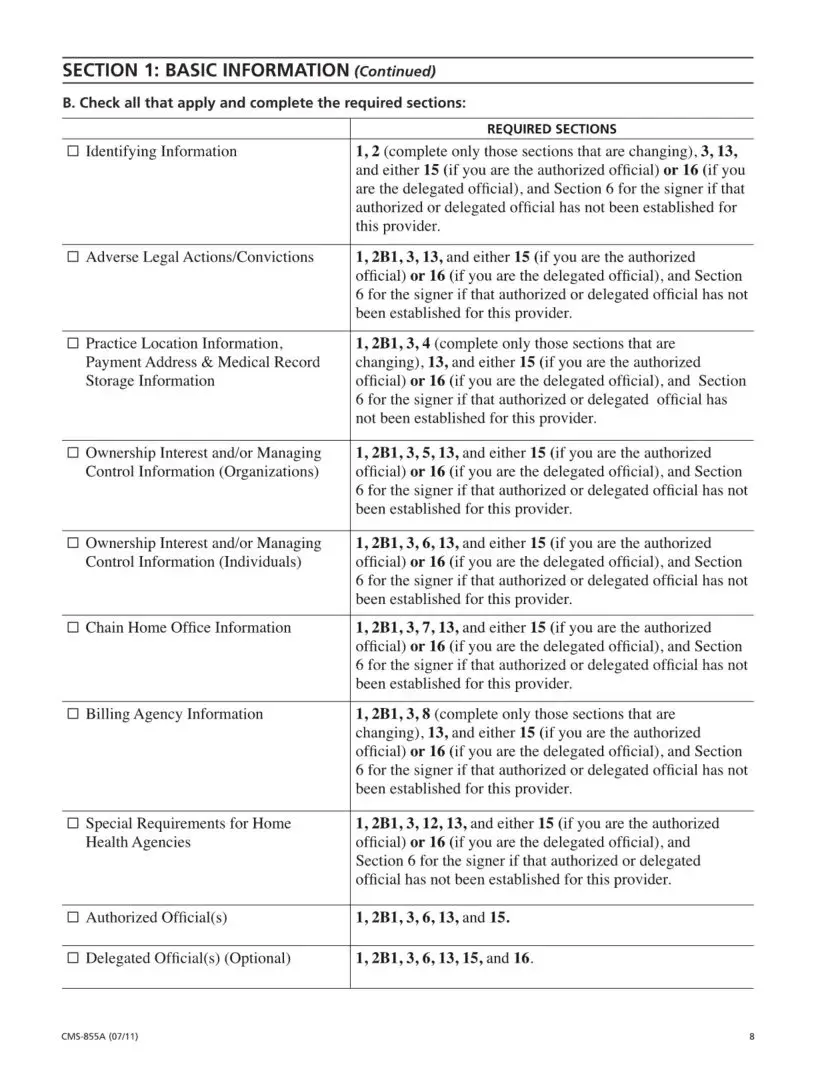

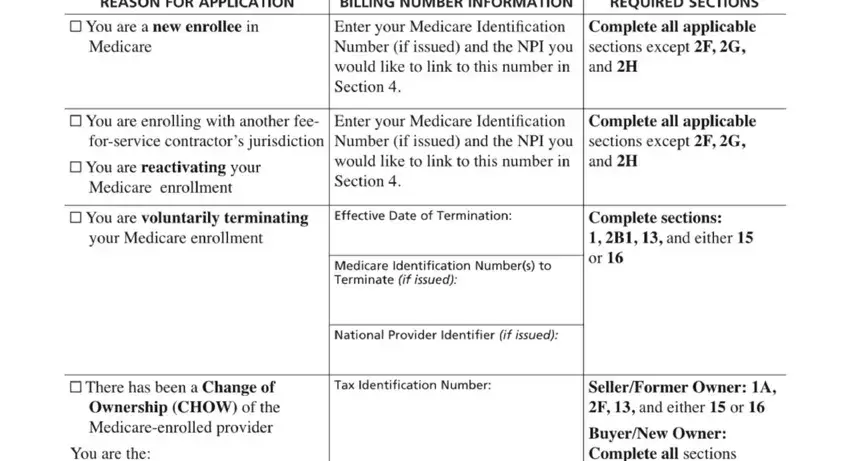

You need to place the rights and responsibilities of the sides within the BILLING NUMBER INFORMATION Enter, Enter your Medicare Identification, Effective Date of Termination:, Medicare Identification Number, s National Provider Identifier (if, Tax Identification Number:, REASON FOR APPLICATION, □ You are a new enrol, lee in, Medicare, □ You are enrolling with another, □ You are reactivating your, Medicare enrollment, □ You are voluntarily terminating, your Medicare enrollment, and □ There has been a Change of space.

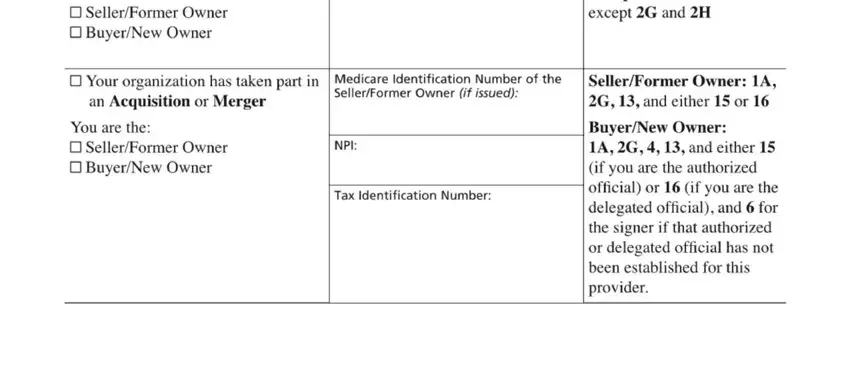

Finalize by reading the following areas and filling in the appropriate data: You are the: □ Seller, Former Owner, □ Your organization has taken part, an Acquisition or Merger, Medicare Identification Number of, You are the: □ Seller, Former Owner, NP, I Tax Identification Number:, Seller, Former Owner: 1, A and Seller, Former Owner: 1, A

Step 3: Choose the Done button to confirm that your finished form may be exported to every gadget you end up picking or delivered to an email you specify.

Step 4: Come up with as much as two or three copies of your file to remain away from any specific potential future troubles.