2020 112 form co can be completed very easily. Simply use FormsPal PDF tool to perform the job without delay. We at FormsPal are dedicated to providing you with the best possible experience with our tool by constantly presenting new functions and enhancements. With these updates, using our tool gets better than ever before! This is what you would want to do to get going:

Step 1: Hit the orange "Get Form" button above. It'll open up our editor so that you can start completing your form.

Step 2: The editor provides the ability to change PDF files in a range of ways. Transform it with your own text, adjust what's originally in the file, and include a signature - all readily available!

It is actually simple to complete the document following this detailed tutorial! Here is what you have to do:

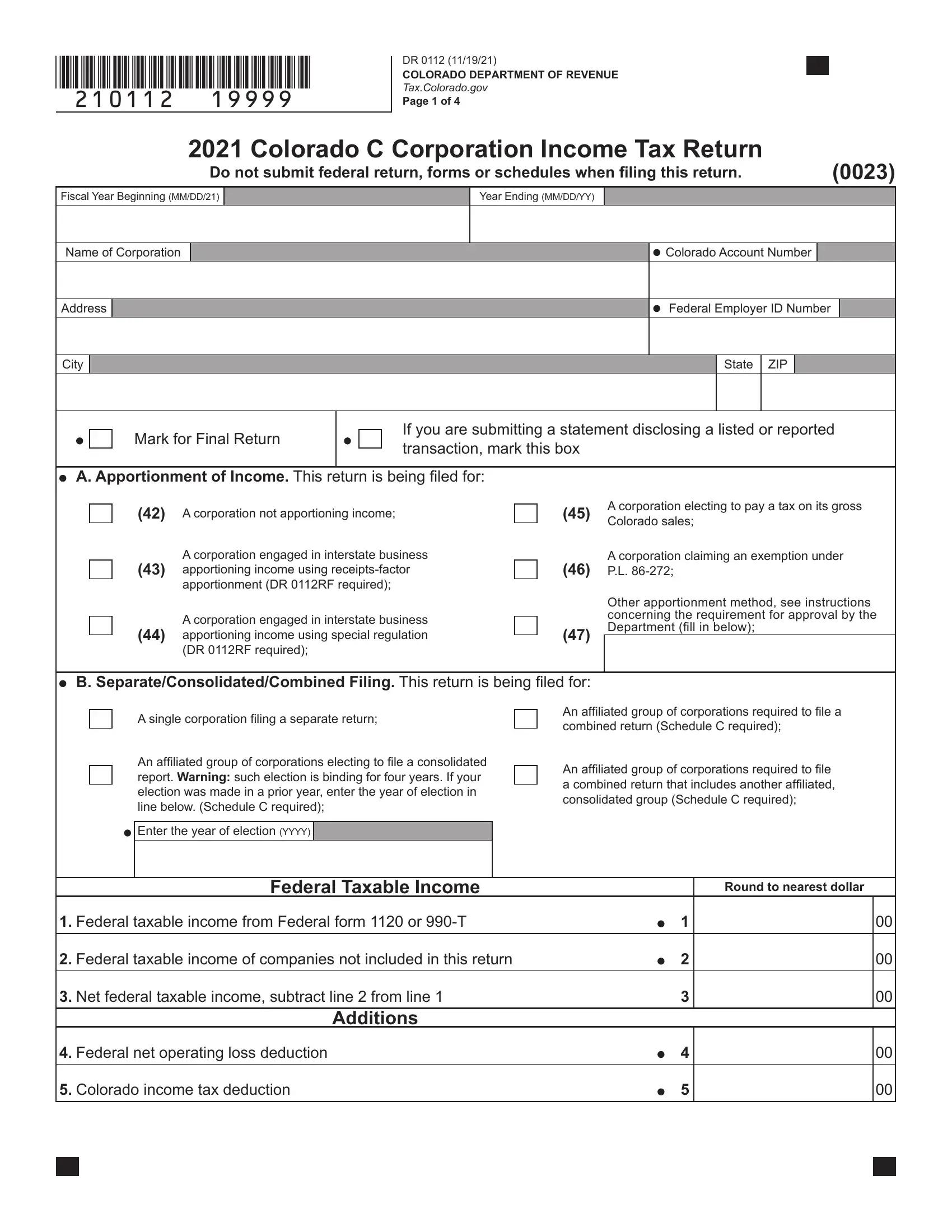

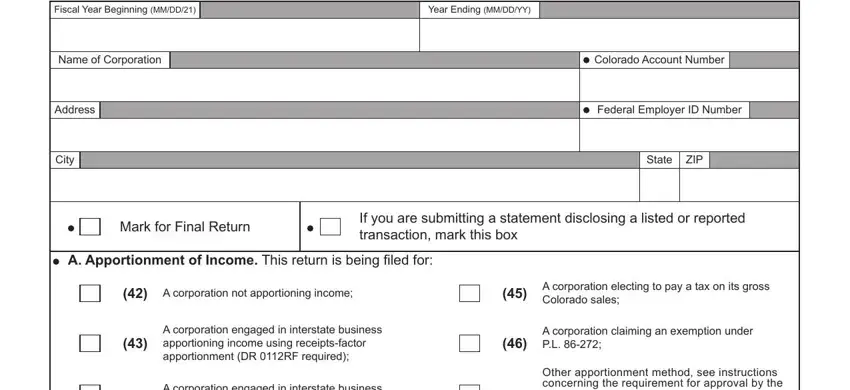

1. While filling out the 2020 112 form co, ensure to complete all necessary fields in the associated area. This will help facilitate the process, which allows your information to be handled quickly and correctly.

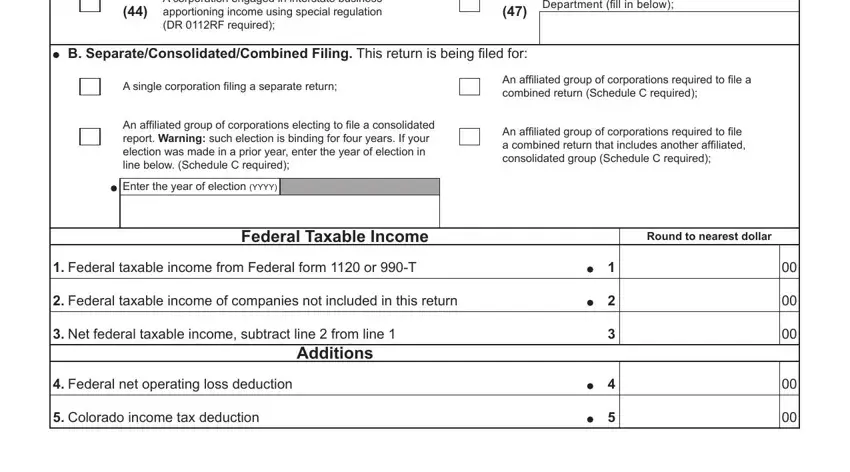

2. Once your current task is complete, take the next step – fill out all of these fields - A corporation engaged in, Other apportionment method see, B SeparateConsolidatedCombined, A single corporation filing a, An affiliated group of, Enter the year of election YYYY, An affiliated group of, An affiliated group of, Federal Taxable Income, Round to nearest dollar, Federal taxable income from, Federal taxable income of, Net federal taxable income, Additions, and Federal net operating loss with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

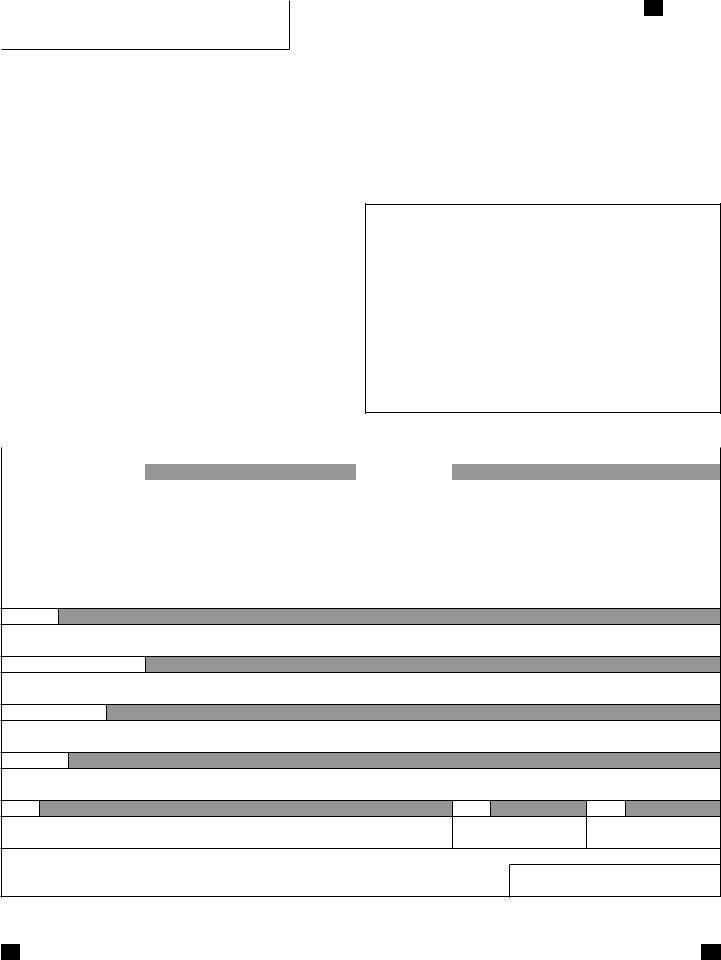

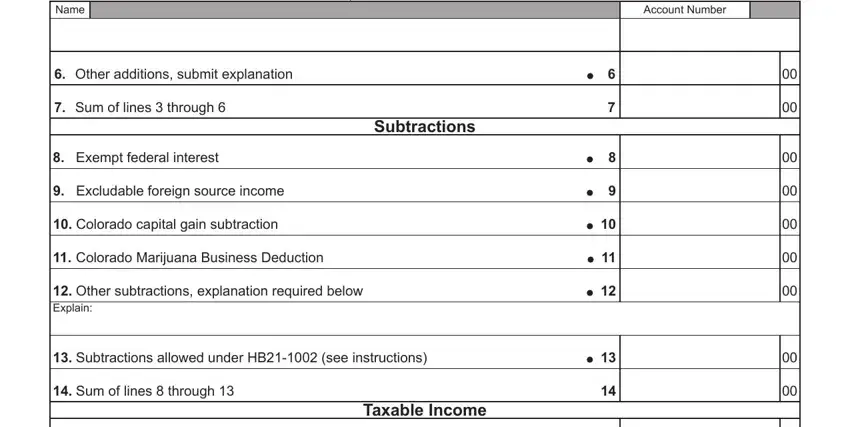

3. This next portion focuses on Name, Account Number, Subtractions, Other additions submit explanation, Sum of lines through, Exempt federal interest, Excludable foreign source income, Colorado capital gain subtraction, Colorado Marijuana Business, Other subtractions explanation, Subtractions allowed under HB see, Sum of lines through, and Taxable Income - type in these blank fields.

It's easy to make an error while filling out the Colorado capital gain subtraction, and so you'll want to reread it before you submit it.

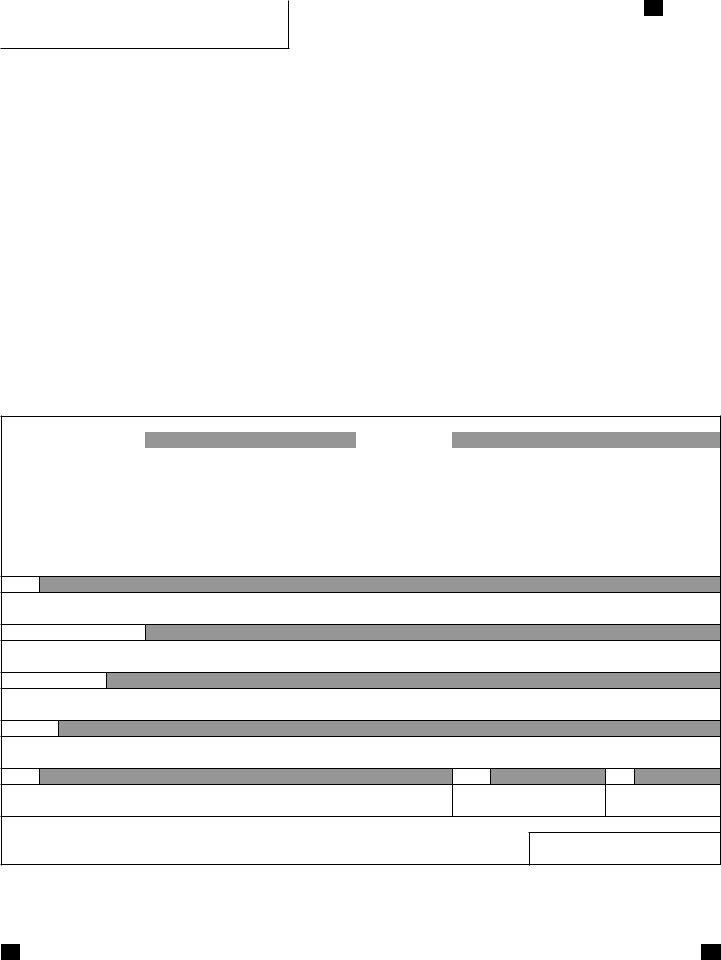

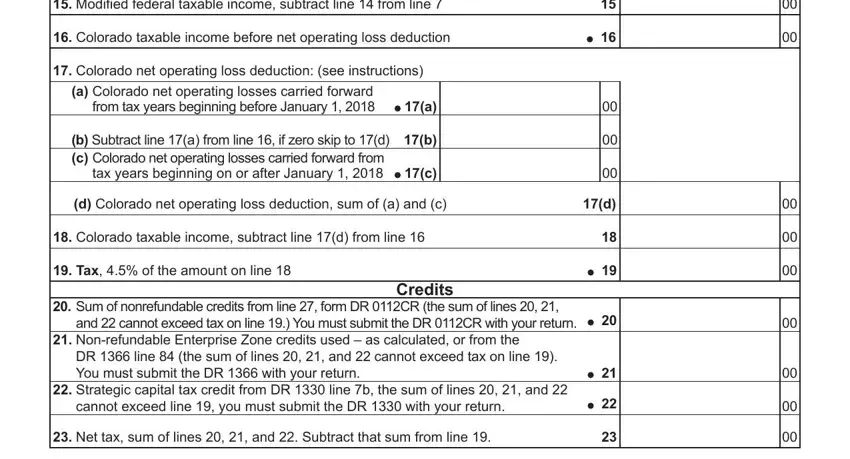

4. The subsequent section will require your details in the following parts: Modified federal taxable income, Colorado taxable income before, Colorado net operating loss, a Colorado net operating losses, b Subtract line a from line if, d Colorado net operating loss, Colorado taxable income subtract, Tax of the amount on line, Credits, Sum of nonrefundable credits from, and cannot exceed tax on line, Nonrefundable Enterprise Zone, DR line the sum of lines and, Strategic capital tax credit from, and cannot exceed line you must. Just be sure you fill out all of the requested details to go forward.

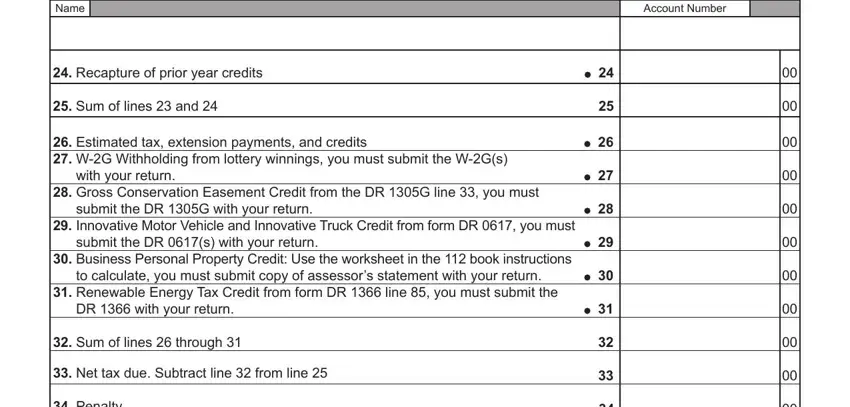

5. And finally, the following last subsection is what you will have to complete before closing the PDF. The blanks in this instance are the following: Name, Account Number, Recapture of prior year credits, Sum of lines and, Estimated tax extension payments, with your return, Gross Conservation Easement, submit the DR G with your return, Innovative Motor Vehicle and, submit the DR s with your return, Business Personal Property Credit, to calculate you must submit copy, Renewable Energy Tax Credit from, DR with your return, and Sum of lines through.

Step 3: Confirm that your details are right and click "Done" to complete the project. Go for a 7-day free trial account with us and gain instant access to 2020 112 form co - which you are able to then use as you would like from your personal cabinet. FormsPal ensures your data confidentiality via a secure system that in no way saves or distributes any kind of private data involved in the process. Be confident knowing your docs are kept safe when you use our services!