INSTRUCTIONS FOR REGISTRATION STATEMENT (COR-92) AND

ADDITIONAL DOCUMENTATION NEEDED FOR INITIAL REGISTRATION

Instructions for completing Initial Registration and form:

This form, along with several other documents listed later in these instructions, must be completed and filed in order to complete an initial registration with the Secretary of State so that an organization may solicit charitable contributions in the State of Maryland. This should be completed and filed prior to the beginning of any charitable solicitations in Maryland. There is no need to complete this form if this is for your annual update of registration. If the organization is filing an Annual Update of Registration, please complete the Annual Update of Registration form.

Print this form; complete it; and mail it along with the required documentation that is listed after the instructions for completing this form to:

Charitable Organization Division, Secretary of State, State House, Annapolis, MD 21401.

For questions about the form or documentation required to be submitted along with the form, please call us at 410-974- 5534 or email us.

You will receive a letter from this office in response to your filing of the annual update of registration documents unless you are filing an extension. If the annual update of registration filing is complete, you will receive your registration letter which will provide your next registration due date. If the annual update of registration filing is not complete, you will receive a letter requesting additional documentation (we may try to call or email you as well).

Directions for completion of this form, the Registration Statement for Charitable Organizations (COR-92):

1.If fee submitted, please enter amount of fee submitted along with this form. If you are unsure of your registration fee, please refer to the table at the end of the instructions for help in calculating your registration fee.

2.Enter the month in which the organization’s fiscal year ends.

3.Enter the organization’s EIN (Federal Tax Identification Number).

4.Enter the name of the charitable organization. This name should match the name on your IRS Tax Determination Letter and current version of your Articles of Incorporation. If the organization does business under any other names, please list them in the space provided.

5.Enter the mailing address and physical address of the charity. The mailing address is the address to which we will mail all correspondence for this charitable organization. The physical address should be the actual location at which the organization’s primary place of business can be located.

6.Enter the County in which the organization is located.

7.Enter the organization’s telephone number.

8.Enter the organization’s fax number.

9.Enter the organization’s email address. This should be an email address of someone who handles state registration issues for the organization.

10.Enter the names and addresses of any chapters, branches, or affiliates of this organization that are located in Maryland.

11.Enter the names and home or alternative business addresses of officers, including principal salaried executive officers for the organization. If attaching a separate list, please write “see attached list.” An officer is a person elected or appointed to manage the organization's daily operations. An officer that served at any time during the organization's tax year is deemed a current officer. The officers of an organization are determined by reference to its organizing document, bylaws, or resolutions of its governing body, or as otherwise designated consistent with state law, but, at a

minimum, include those officers required by applicable state law. Officers can include a president, vice-president, secretary, treasurer and, in some cases, a Board Chair. A principal salaried executive is a person who has ultimate responsibility for implementing the decisions of the governing body or for supervising the management, administration, or operation of the organization; for example, the organization's president, CEO, or executive director. It can also be a person who has ultimate responsibility for managing the organization's finances; for example, the organization's treasurer or chief financial officer. Reference directions for completing the IRS Form 990 for more detailed information.

12.Enter the names and home or alternative business addresses of persons who have final responsibility for the custody and final distribution of the contributions received by this organization.

13.Enter the purpose or purposes for which contributions are to be used. If the purpose is very long, please attach a separate page and write “see attached.” Please note that we have limited space to enter the purpose of the organization into our system. If the purpose is too long, we will use as many sentences as possible until space runs out. This purpose will be displayed on our website for people searching for information on your organization. You should try to keep this purpose to 25 words or less.

14.If your organization has contracts/fundraising agreements with a Professional Solicitor write “yes” into the appropriate field. If not, write “no” into the appropriate field. Do the same for Fund-raising counsel. You will only need to answer “yes” if the company solicits contributions on your behalf in Maryland or advises about a solicitation that will occur in Maryland. If you enter “yes” to either or both, attach a copy of the contract(s) and give the name and address each company with which a contract exists.

Also, answer yes or no to the two questions regarding potential conflicts of interest. If you answer “yes” to the question, you should provide details of why you answered “yes.” These details should include you involvement with the charity and your involvement with the company with which the charity does business including your influence in the decision-making processes for the charity and company.

15.Check one of the three boxes. If all taxes owed to the State of Maryland, a county in Maryland, or Baltimore City for the prior year have been paid you will want to check the first statement. If you did not owe any taxes to the State of Maryland, a county in Maryland, or Baltimore City, you will also want to check the first statement. You will only check the second statement if not all taxes due from the prior year have been paid to the State of Maryland, a county in Maryland, or Baltimore City or there is a dispute over taxes owed to State of Maryland, a county in Maryland, or Baltimore City from the prior year. If you have not paid all of your taxes due to the State of Maryland, or county in Maryland, or Baltimore City but they are not under dispute you will check the third statement.

16.Check the appropriate line to answer for whether or not your organization is affiliated with a Maryland State agency. “Organization affiliated with a State agency” means a charitable organization which engages in activities for the benefit of the State agency or to further the purposes of the State agency, or both, through the use of contributions solicited from the public. If the organization circles ‘yes’ it must list the names of the agencies with which it is affiliated. If it answers yes and it has raised more than $100,000 in charitable contributions, it must also submit an Agreed Upon Procedures Report along with the organization’s annual registration. See what is required in an Agreed Upon Procedures Report at this link: http://www.dsd.state.md.us/comar/getfile.aspx?file=01.02.04.20-1.htm.

17.By signing this form, you are certifying that you have attached all required forms from these instructions.

Affidavit section: Remember to sign the Registration Statement and Print the name of the person signing the document and their position within the charity. Also, note the date the document was signed.

Along with this form, you are required to submit the following documentation to complete the organization’s initial registration:

1. A current copy of the organization's articles of incorporation and/or other governing instruments (bylaws/charter).

2.A copy of the organization's IRS tax determination letter or other confirmation from the IRS showing the tax exempt status of the charitable organization. If the organization has applied for tax determination with the IRS, but it has not been granted, submit a copy of the IRS Form 1023.

3.A copy of a signed IRS Form 990 or 990 EZ. The Office of the Secretary of State's Form COF-85 may be filed in lieu of IRS Form 990 if you are exempt from IRS filing requirements or if filing the 990 N. If your IRS Form 990 is incomplete, please submit an approved IRS Form 8868, the IRS request for an extension of the Form 990 filing deadline.

4.A. If the organization's charitable contributions are at least $200,000, but are less than $500,000 a financial review performed by an independent certified public accountant.

OR

B. If the organization's charitable contributions are at least $500,000 an audit performed by an independent certified public accountant.

5.If the organization is a private foundation (as defined in COMAR 01.02.04.01L) that is affiliated with any Maryland State agency and raised more than $100,000, you must submit an Audit and Agreed Upon Procedures Report with the application.

6.The names and home or alternative business addresses of the board of directors. This is not the address of the charitable organization and not a post office box. Unless the home or alternative addresses are included in the IRS Form 990, please submit a separate list of home or alternative business addresses.

7.A copy of all contracts with professional solicitors or fund-raising counsel and all subcontracts or other contracts in furtherance of such an agreement under which solicitation is conducted in Maryland.

8.A check or money order made payable to the Secretary of State in payment of the registration fee. This fee is based on the organization’s level of charitable contributions. See below chart. Note: For purposes of determining the

annual registration fee and the audit or review requirements, charitable contributions are computed on each form as follows:

1.IRS Form 990: add lines 1(b), 1(c), 1(d), 1(f), 8(a), 9(a) on Part VIII (page 9). If the organization is a PTA, also add line 10(a).

2.IRS Form 990-EZ: add lines 1, 6(a), 6(b) on page 1. If the organization is a PTA, also add line 10(a)

3.COF-85: add lines 1, 6(a), 7(a) on page 1. If the organization is a PTA, also add 8(a)

Level of Charitable Contributions |

Annual Registration Fee |

|

|

Less Than $25,000 (see note below)* |

$0 |

|

|

At least $25,000 but less than $50,0001 |

$50 |

|

|

At least $50,001 but less than $75,001 |

$75 |

|

|

At least $75,001 but less than $100,001 |

$100 |

|

|

At least $100,001 but less than $500,001 |

$200 |

|

|

$500,001 and above |

$300 |

*A charitable organization that collects less than $25,000 in charitable contributions but uses the services of a Professional Solicitor is required to pay an annual fee of $50.

Registration Statement for Charitable Organizations (COR-92)

Office of the Secretary of State, State House, Annapolis MD 21401 Telephone: 410-974-5534

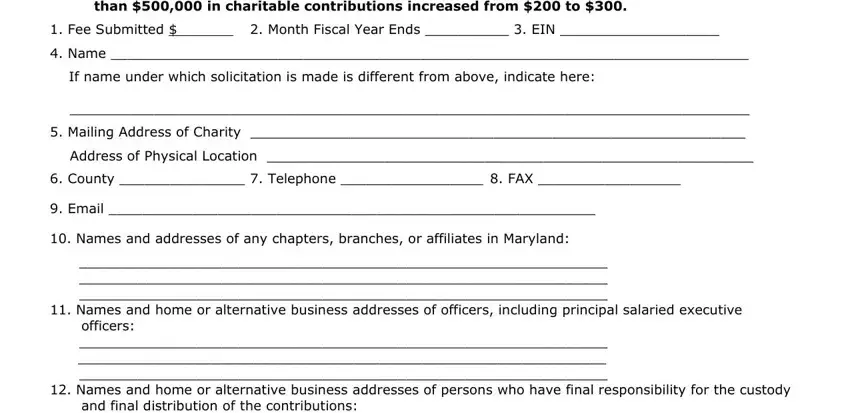

Effective October 1, 2014, the Annual Charity Registration Fee for non-profits receiving more

than $500,000 in charitable contributions increased from $200 to $300.

1. Fee Submitted $ |

2. Month Fiscal Year Ends __________ 3. EIN ___________________ |

|

|

|

4.Name ____________________________________________________________________________

If name under which solicitation is made is different from above, indicate here:

_________________________________________________________________________________

5.Mailing Address of Charity ___________________________________________________________

Address of Physical Location __________________________________________________________

6.County _______________ 7. Telephone _________________ 8. FAX _________________

9.Email __________________________________________________________

10.Names and addresses of any chapters, branches, or affiliates in Maryland:

_______________________________________________________________

_______________________________________________________________

_______________________________________________________________

11.Names and home or alternative business addresses of officers, including principal salaried executive officers:

_______________________________________________________________

_______________________________________________________________

_______________________________________________________________

12.Names and home or alternative business addresses of persons who have final responsibility for the custody and final distribution of the contributions:

_______________________________________________________________

_______________________________________________________________

_______________________________________________________________

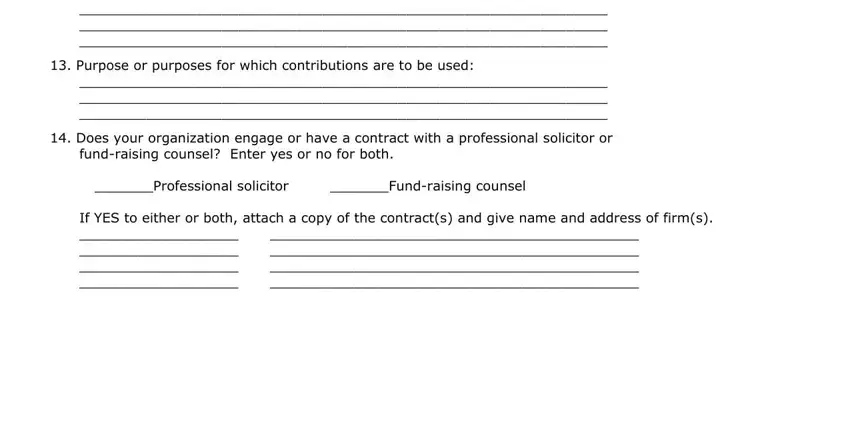

13.Purpose or purposes for which contributions are to be used:

_______________________________________________________________

_______________________________________________________________

_______________________________________________________________

14.Does your organization engage or have a contract with a professional solicitor or

fund-raising counsel? Enter yes or no for both.

_______Professional solicitor _______Fund-raising counsel

If YES to either or both, attach a copy of the contract(s) and give name and address of firm(s).

___________________ |

____________________________________________ |

___________________ |

____________________________________________ |

___________________ |

____________________________________________ |

___________________ |

____________________________________________ |

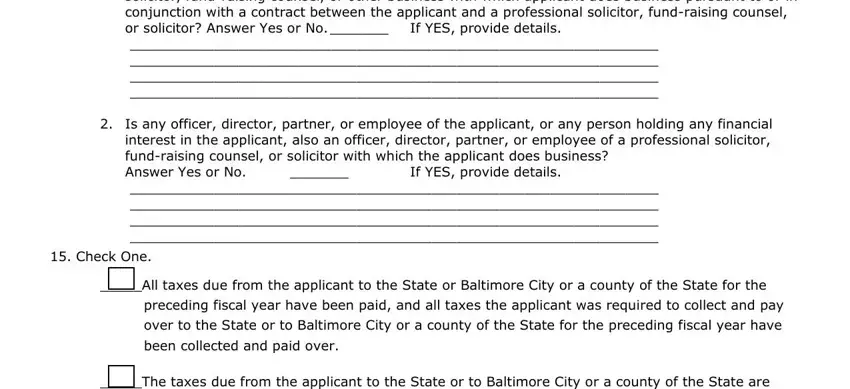

1.Does applicant or any officer, director, partner, or employee of applicant, or any person holding any financial interest in the applicant, have any interest in any mail house, cashiering, professional solicitor, fund-raising counsel, or other business with which applicant does business pursuant to or in

conjunction with a contract between the applicant and a professional solicitor, fund-raising counsel, or solicitor? Answer Yes or No._______ If YES, provide details.

_______________________________________________________________

_______________________________________________________________

_______________________________________________________________

_______________________________________________________________

2.Is any officer, director, partner, or employee of the applicant, or any person holding any financial interest in the applicant, also an officer, director, partner, or employee of a professional solicitor,

fund-raising counsel, or solicitor with which the applicant does business?

Answer Yes or No. _______ If YES, provide details.

_______________________________________________________________

_______________________________________________________________

_______________________________________________________________

_______________________________________________________________

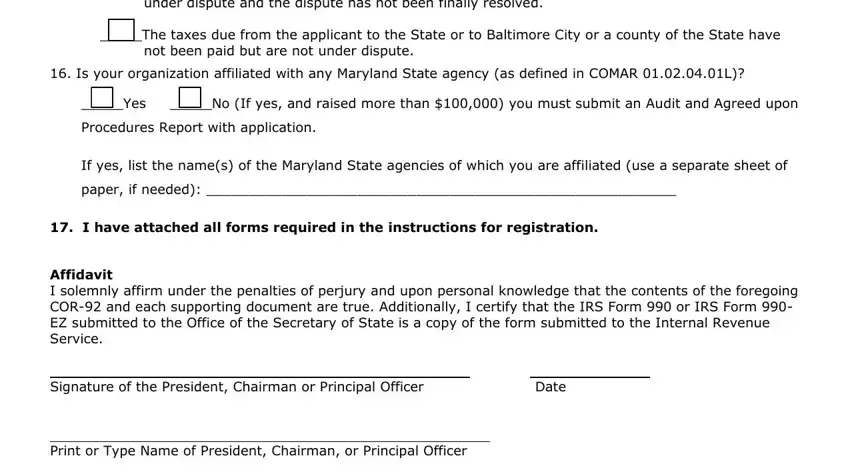

15. Check One.

_____All taxes due from the applicant to the State or Baltimore City or a county of the State for the

preceding fiscal year have been paid, and all taxes the applicant was required to collect and pay

over to the State or to Baltimore City or a county of the State for the preceding fiscal year have been collected and paid over.

_____The taxes due from the applicant to the State or to Baltimore City or a county of the State are

under dispute and the dispute has not been finally resolved.

_____The taxes due from the applicant to the State or to Baltimore City or a county of the State have

not been paid but are not under dispute.

16. Is your organization affiliated with any Maryland State agency (as defined in COMAR 01.02.04.01L)?

_____Yes _____No (If yes, and raised more than $100,000) you must submit an Audit and Agreed upon

Procedures Report with application.

If yes, list the name(s) of the Maryland State agencies of which you are affiliated (use a separate sheet of paper, if needed): ________________________________________________________

17. I have attached all forms required in the instructions for registration.

Affidavit

I solemnly affirm under the penalties of perjury and upon personal knowledge that the contents of the foregoing COR-92 and each supporting document are true. Additionally, I certify that the IRS Form 990 or IRS Form 990- EZ submitted to the Office of the Secretary of State is a copy of the form submitted to the Internal Revenue Service.

Signature of the President, Chairman or Principal Officer |

Date |

Print or Type Name of President, Chairman, or Principal Officer