Completing 3 s form is simple. Our team made our PDF software to make it simple to use and enable you to fill in any form online. Here are a few steps that you need to take:

Step 1: Choose the "Get Form Here" button.

Step 2: The form editing page is presently open. It's possible to add information or manage present content.

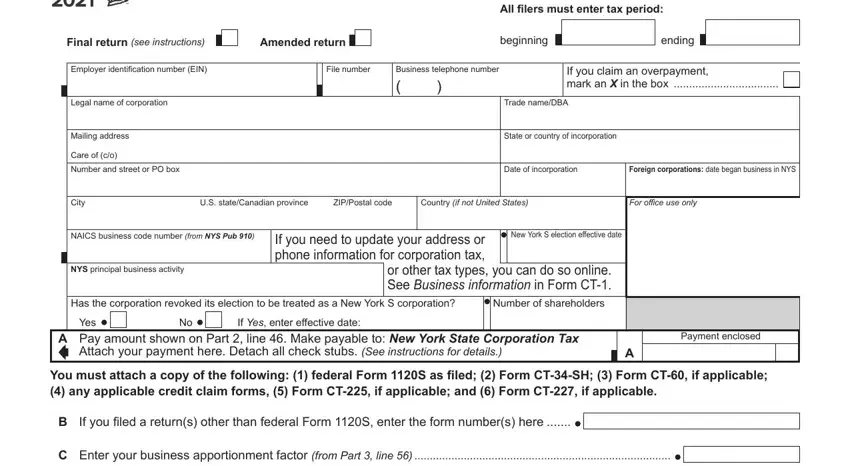

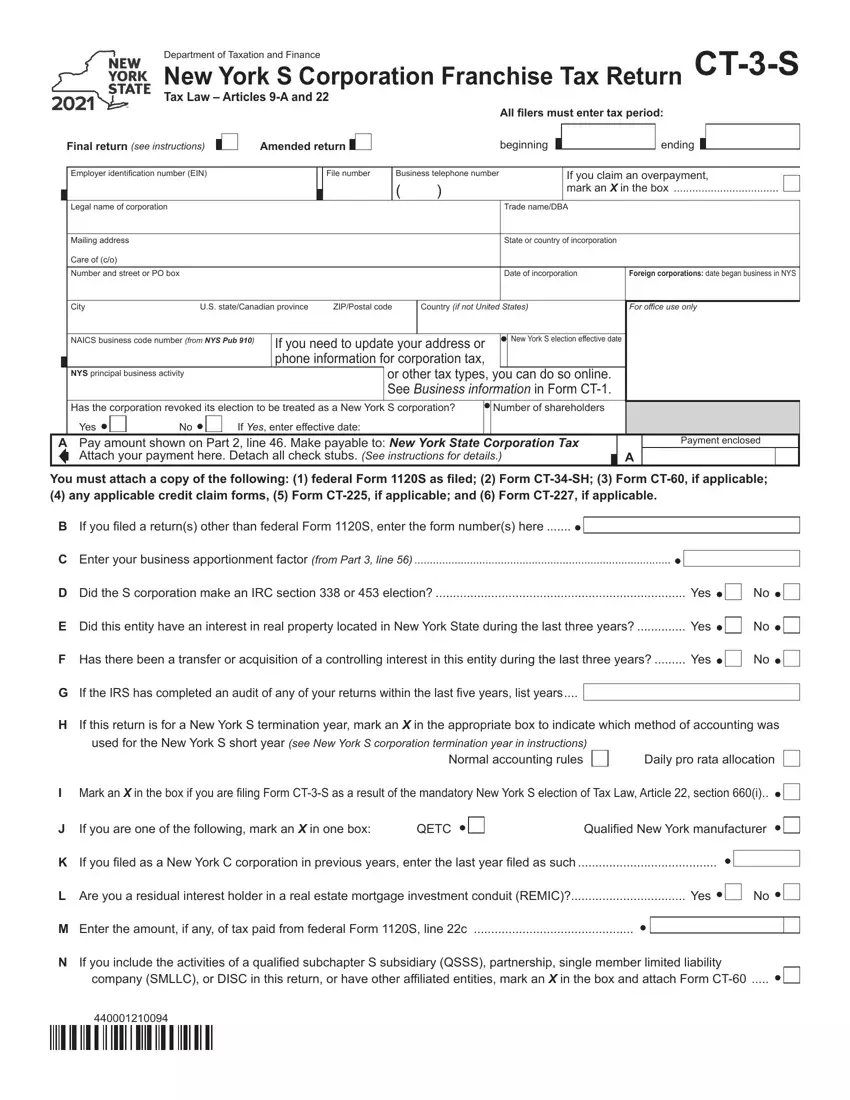

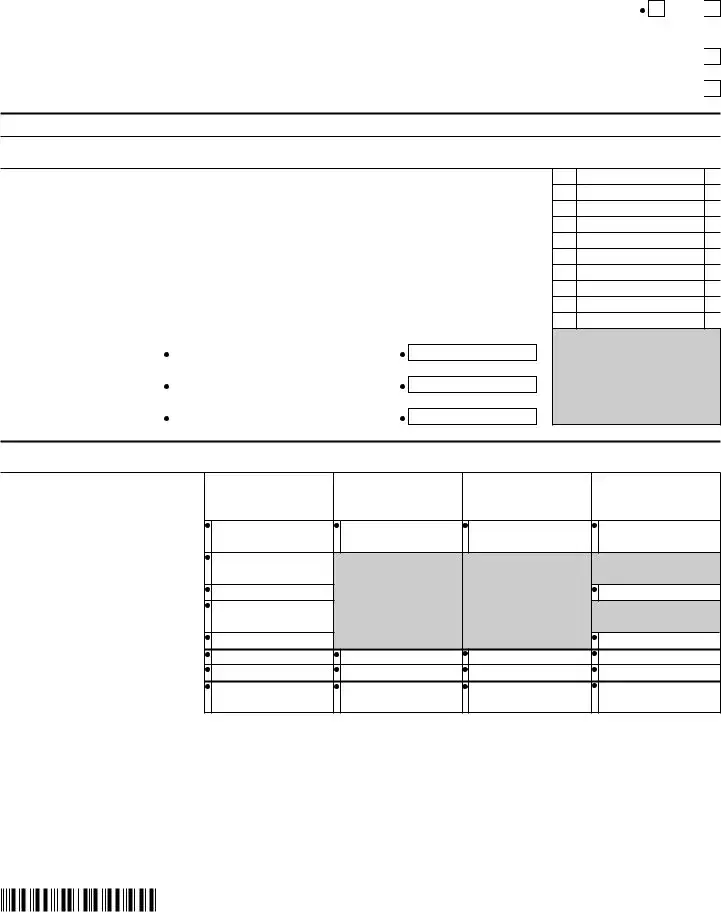

You'll need to type in the following data to be able to create the file:

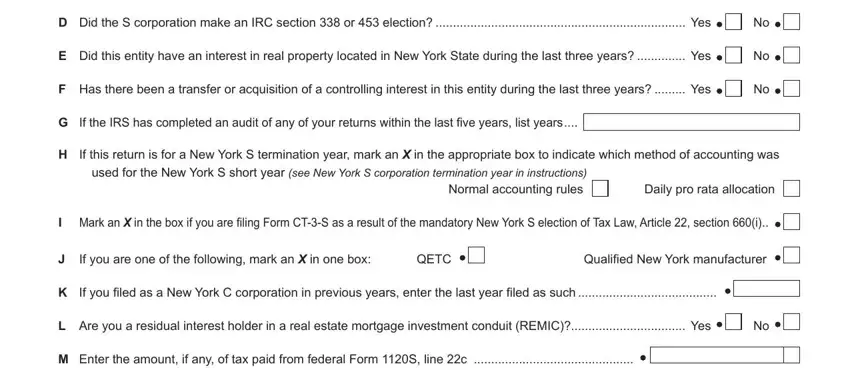

Type in the requested details in the space D Did the S corporation make an, E Did this entity have an interest, F Has there been a transfer or, If the IRS has completed an audit, If this return is for a New York S, Daily pro rata allocation, I Mark an X in the box if you are, If you are one of the following, QETC, Qualified New York manufacturer, If you filed as a New York C, L Are you a residual interest, and M Enter the amount if any of tax.

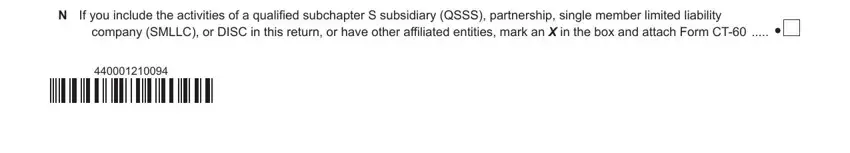

You need to write particular data within the space If you include the activities of a.

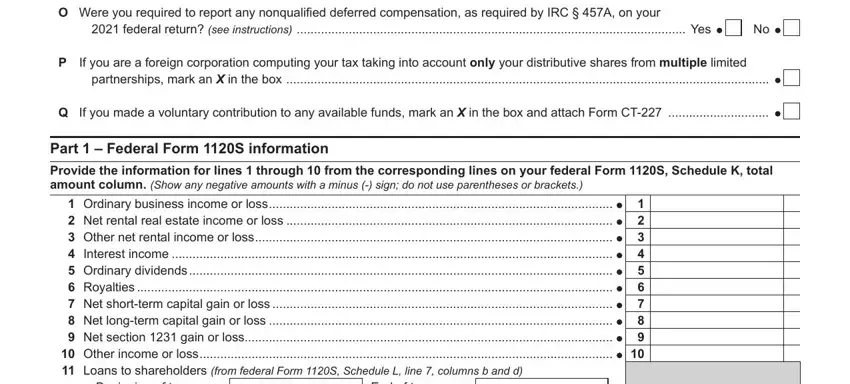

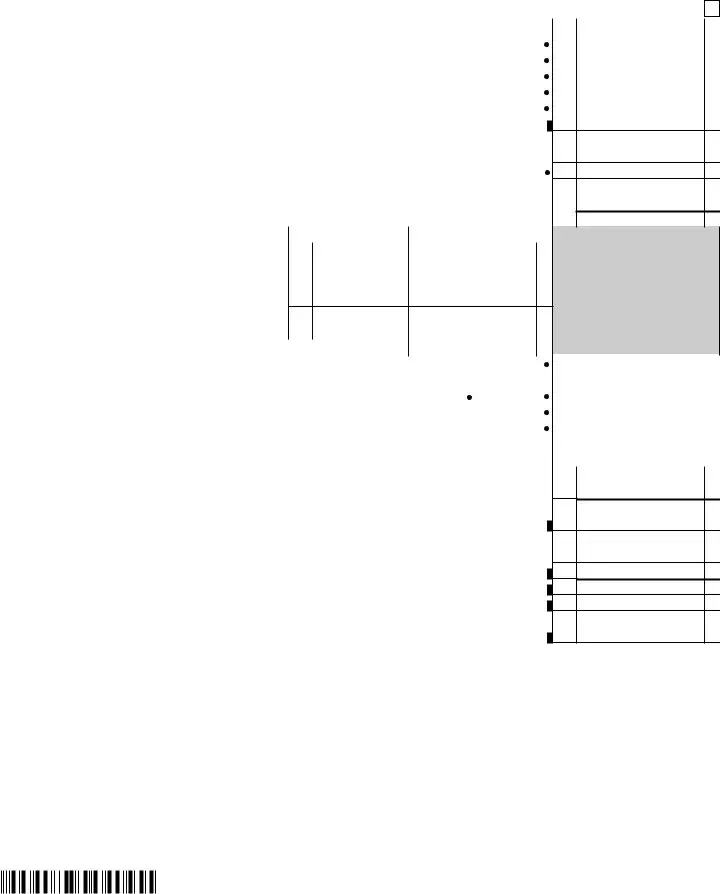

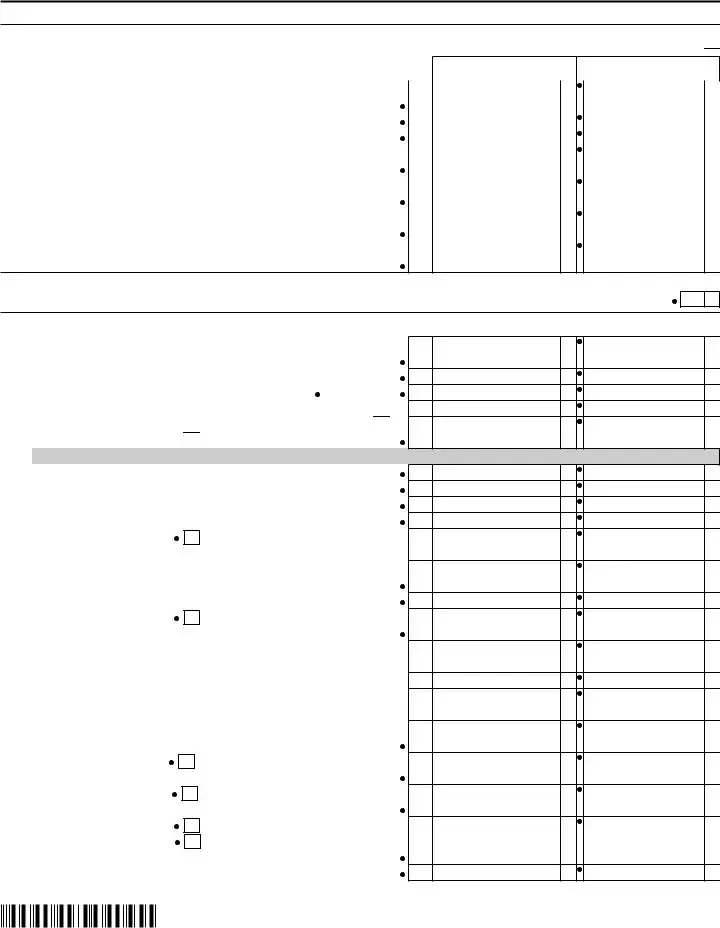

The O Were you required to report any, federal return see instructions, If you are a foreign corporation, If you made a voluntary, Part Federal Form S information, Provide the information for lines, Ordinary business income or loss, Beginning of tax year, and End of tax year field needs to be applied to list the rights or responsibilities of both sides.

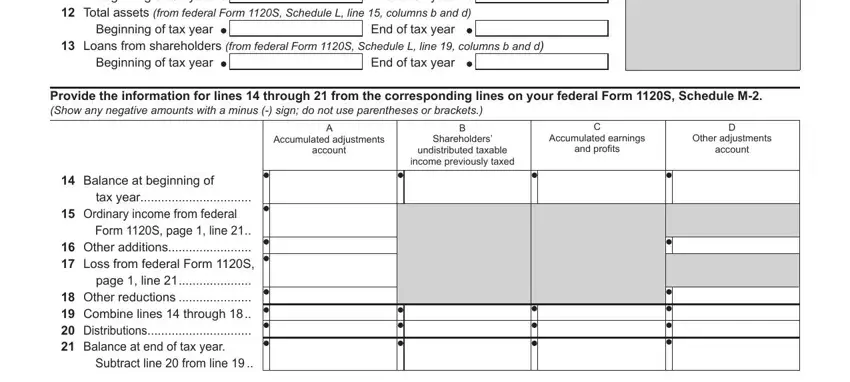

Finalize by reviewing the following areas and filling them out as needed: Beginning of tax year, End of tax year, Total assets from federal Form S, Beginning of tax year, End of tax year, Loans from shareholders from, Beginning of tax year, End of tax year, Provide the information for lines, A Accumulated adjustments account, B Shareholders undistributed, C Accumulated earnings and profits, D Other adjustments account, Balance at beginning of, and tax year.

Step 3: Select the "Done" button. Now you may transfer the PDF document to your device. Additionally, you can send it by email.

Step 4: To protect yourself from any sort of challenges in the long run, be sure to create minimally two or three copies of the file.

).

).