Understanding the intricacies of corporate tax responsibilities in New York can be daunting, especially when it comes to ensuring compliance with the Department of Taxation and Finance's requirements. One pivotal document in this process is the CT-34-SH form, designed specifically for S Corporations operating within the state. This form, which must be attached to Form CT-3-S, meticulously details each shareholder's information, alongside a comprehensive breakdown of their New York State modifications, credits, and relevant adjustments. Spanning various sections, it covers shareholder modifications related to S corporation items, including New York State's franchise tax, federal depreciation deductions, and adjustments due to decoupling from the Internal Revenue Code. Additionally, the form delves into a range of tax credit opportunities available to corporations, such as START-UP NY tax credits, investment tax credits, and credits specially tailored toward environmental remediation, employment of persons with disabilities, and revitalization of historic properties. Beyond these, it outlines the parameters for reporting on agricultural incentives, innovative energy solutions, and real property tax credits, underlining the state's commitment to fostering economic growth across diverse sectors. Designed to ensure accurate tax reporting and facilitate the smooth administration of shareholder-related fiscal duties, the CT-34-SH form embodies the complex interplay between corporate activities and tax obligations in New York.

| Question | Answer |

|---|---|

| Form Name | Ct 34 Sh Form |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | Department of Taxation and Finance New York S Corporation ... |

Department of Taxation and Finance |

||

New York S Corporation |

||

|

||

Shareholders’ Information Schedule |

|

Legal name of corporation

Employer identification number (EIN)

Attach to Form

Schedule A – Shareholders’ New York State modifications and credits (Enter the total amount reported by the New York S corporation on each line. Each shareholder must include his or her pro rata share of these amounts on his or her personal income tax return.)

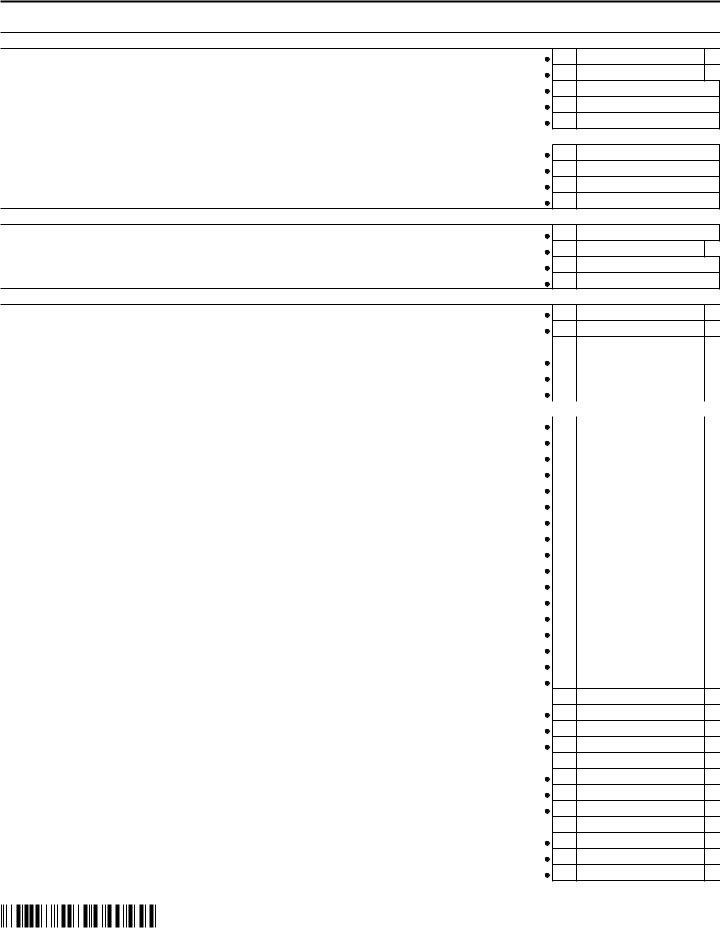

Part 1 – Total shareholder modifications related to S corporation items (see instructions)

|

1 |

New York State franchise tax imposed under Article |

1 |

|

|

Additions |

2 |

Federal depreciation deduction from Form |

2 |

|

|

|

3 |

Other additions (attach Form |

3 |

|

|

|

3a |

New York addition adjustments due to decoupling from the Internal Revenue |

|

|

|

|

|

Code (IRC) |

3a |

|

|

Subtractions |

4 |

Allowable New York depreciation from Form |

4 |

|

|

5 |

Other subtractions (attach Form |

5 |

|

|

|

|

|

|

|||

|

5a |

New York subtraction adjustments due to decoupling from the IRC |

5a |

|

|

Other items |

6 |

Additions to itemized deductions |

6 |

|

|

(attach explanation) |

7 |

Subtractions from itemized deductions |

7 |

|

|

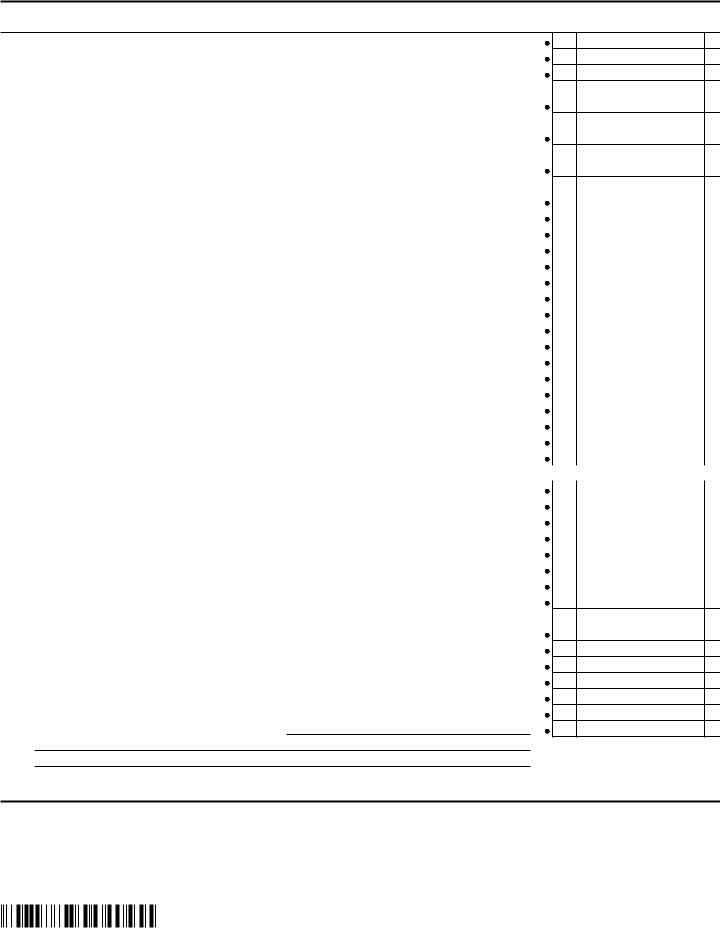

Part 2 – Total S corporation New York State credits and taxes on early dispositions (see instructions; attach applicable forms)

8 |

8 |

|

|

|

|

|

9 |

Year of the |

9 |

|

|

||

10 |

|

|

10 |

|

|

|

11 |

Recapture of |

|

|

11 |

|

|

12 |

|

|

12 |

|

|

|

13 |

|

|

13 |

|

|

|

14 |

14 |

|

15 |

15 |

|

16 |

Year of the |

|

|

obtain number from your partnership) |

16 |

17

|

partnership) |

17 |

|

|

18 |

18 |

|

|

|

Investment tax credits (see instructions) |

|

|

|

|

|

|

|

|

|

19 |

Investment tax credit and employment incentive credit (Form |

19 |

|

|

20 |

Investment tax credit on research and development property (Form |

20 |

|

|

21 |

|

|

|

|

22Tax on early dispositions – investment tax credit, retail enterprise tax credit,

|

historic barn credit, investment tax credit on research and development property, or investment |

|

|

|

|

tax credit for financial services industry (Form |

22 |

|

|

Empire zone (EZ) tax credits (see instructions) |

|

|

|

|

|

|

|

|

|

23 |

EZ investment tax credit (Form |

23 |

|

|

24 |

|

|

|

|

25 |

Recaptured tax credit – EZ investment tax credit or EZ investment tax credit for financial services |

|

|

|

|

industry (Form |

25 |

|

|

433001210094

Page 2 of 4

Part 2 – Total S corporation New York State credits and taxes on early dispositions (continued)

Qualified empire zone enterprise (QEZE) tax credits (see instructions) |

|

|

26 |

QEZE real property tax credit allowed (Form |

26 |

27 |

Net recapture of QEZE real property tax credit (Form |

27 |

28 |

QEZE tax reduction credit employment increase factor (Form |

28 |

29 |

QEZE tax reduction credit zone allocation factor (Form |

29 |

30 |

QEZE tax reduction credit benefit period factor (Form |

30 |

|

QEZE tax reduction credit factors from partnership (for multiple partnerships attach separate statement; see instructions) |

|

31 |

QEZE partnership EIN |

31 |

32 |

QEZE employment increase factor (obtain factor from your partnership) |

32 |

33 |

QEZE zone allocation factor (obtain factor from your partnership) |

33 |

34 |

QEZE benefit period factor (obtain factor from your partnership) |

34 |

Farmers’ school tax credit (see instructions) |

|

|

35 |

Total acres of qualified agricultural property |

35 |

36 |

Total amount of eligible school district property taxes paid |

36 |

37 |

Total acres of qualified agricultural property converted to nonqualified use |

37 |

38 |

Total acres of qualified conservation property |

38 |

Other credits (attach applicable forms) |

|

|

39 |

Recapture of alternative fuels credit (Form |

39 |

40 |

Credit for employment of persons with disabilities (Form |

40 |

41Rehabilitation of historic properties credit (Form

|

project number reporting) |

41 |

42 |

Recapture of rehabilitation of historic properties credit (Form |

42 |

43 |

Clean heating fuel credit (Form |

43 |

44 |

|

|

45 |

Empire State commercial production credit (Form |

45 |

46 |

Empire State film production credit for the current year (Form |

46 |

47 |

Empire State film production credit for the second year (Form |

47 |

48 |

Empire State film production credit for the third year (Form |

48 |

49 |

49 |

|

50 |

Credit for purchase of an automated external defibrillator (Form |

50 |

51 |

Empire State film |

51 |

52 |

Empire State film |

52 |

53 |

Empire State film |

53 |

54 |

Excelsior jobs tax credit component (Form |

54 |

55 |

Excelsior investment tax credit component (Form |

55 |

56 |

Excelsior research and development tax credit component (Form |

56 |

57 |

Excelsior real property tax credit component (Form |

57 |

57a |

Excelsior child care services tax credit component (Form |

57a |

58 |

Recapture of excelsior jobs program tax credit (Form |

58 |

59 |

Brownfield redevelopment tax credit site preparation credit component (Form |

59 |

60 |

Brownfield redevelopment tax credit tangible property credit component (Form |

60 |

61Brownfield redevelopment tax credit

62 |

Recapture of brownfield redevelopment tax credit (Form |

62 |

63 |

Brownfield redevelopment tax credit site preparation credit component (Form |

63 |

64 |

Brownfield redevelopment tax credit tangible property credit component (Form |

64 |

65Brownfield redevelopment tax credit

66 |

Recapture of brownfield redevelopment tax credit (Form |

66 |

67 |

Brownfield redevelopment tax credit site preparation credit component (Form |

67 |

68 |

Brownfield redevelopment tax credit tangible property credit component (Form |

68 |

69Brownfield redevelopment tax credit

70 |

Recapture of brownfield redevelopment tax credit (Form |

70 |

71 |

Remediated brownfield credit for real property taxes (Form |

71 |

72 |

Recapture of remediated brownfield credit for real property taxes (Form |

72 |

433002210094

Part 2 – Total S corporation New York State credits and taxes on early dispositions (continued)

73 |

Environmental remediation insurance credit (Form |

73 |

74 |

Recapture of environmental remediation insurance credit (Form |

74 |

75 |

Security officer training tax credit (attach Form |

75 |

76Economic transformation and facility redevelopment program jobs tax credit component

(Form |

76 |

77Economic transformation and facility redevelopment program investment tax credit component

(Form |

77 |

78Economic transformation and facility redevelopment program job training tax credit component

(Form |

78 |

79Economic transformation and facility redevelopment program real property tax credit component

|

|

(Form |

79 |

80 |

|

Recapture of economic transformation and facilities redevelopment program tax credit (Form |

80 |

81 |

|

Taxicabs and livery service vehicles accessible to persons with disabilities credit (Form |

81 |

82 |

|

QETC employment credit (Form |

82 |

83 |

|

QETC capital tax credit (Form |

83 |

84 |

|

Recapture of QETC capital tax credit (Form |

84 |

85 |

|

85 |

|

86 |

|

Recapture of |

86 |

87 |

|

Empire state jobs retention credit (Form |

87 |

88 |

|

Recapture of empire state jobs retention credit (Form |

88 |

89 |

|

New York youth jobs program credit (Form |

89 |

90 |

............................................................Alcoholic beverage production credit for beer (Form |

90 |

|

91 |

|

Alcoholic beverage production credit for cider (Form |

91 |

92 |

|

Alcoholic beverage production credit for wine (Form |

92 |

93 |

|

Alcoholic beverage production credit for liquor (Form |

93 |

94 |

|

Alternative fuels and electric vehicle recharging property credit (Form |

94 |

95 |

|

Recapture of alternative fuels and electric vehicle recharging property credit (Form |

95 |

96 |

|

|

|

97 |

|

Real property tax credit for manufacturers (Form |

97 |

98 |

|

Recapture of real property tax credit for manufacturers (Form |

98 |

99 |

|

Empire state musical and theatrical production credit (Form |

99 |

100 |

|

Hire a veteran credit (Form |

100 |

101 |

|

Workers with disabilities tax credit (Form |

101 |

102 |

|

Employee training incentive program tax credit (Form |

102 |

103 |

.................................................................................Farm workforce retention credit (Form |

103 |

|

104 |

|

Life sciences research and development tax credit (Form |

104 |

105Farm donations to food pantries credit (Form

|

informational reporting) |

105 |

106 |

Empire State apprenticeship tax credit (Form |

106 |

107 |

Recovery tax credit (Form |

107 |

108 |

108 |

|

109 |

New York City musical and theatrical production tax credit (Form |

109 |

110 |

Restaurant |

110 |

111 |

Other tax credits and recaptures (see instructions) |

111 |

(complete Schedule B on the last page)

433003210094

Page 4 of 4

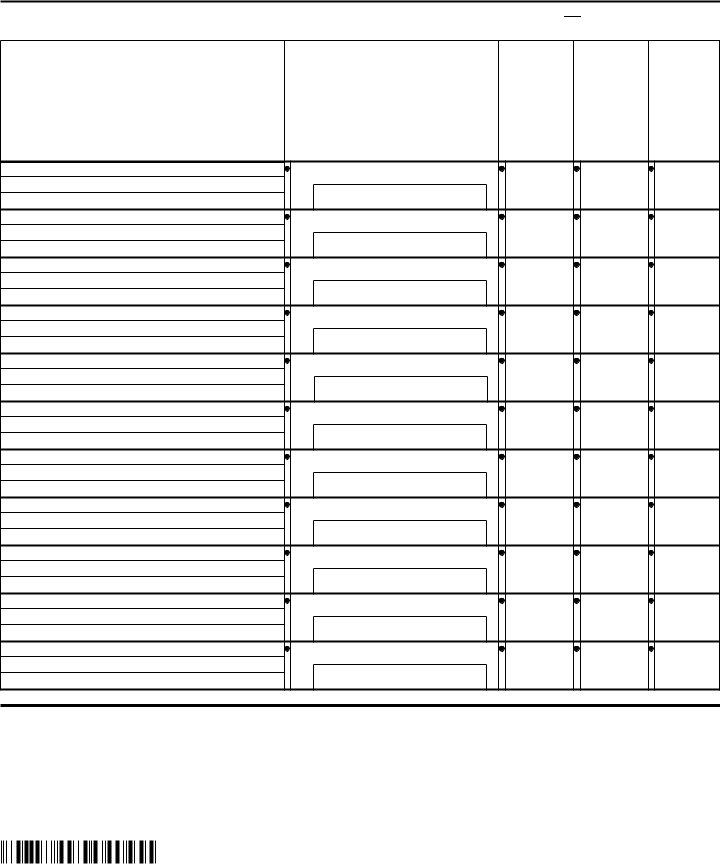

Schedule B – Shareholders’ identifying information (see instructions)

Photocopy Schedule B as needed. Attach all additional schedules to this form. Also mark an X in the box.

A |

B |

C |

D |

E |

For each shareholder, |

Identifying number |

Percentage |

Shareholder |

Shareholder |

enter last name, first name, middle initial on first line; |

(SSN or EIN) |

of ownership |

residency status |

entity status |

enter home address on second and third lines. |

|

|

(make only one entry) (make only one entry) |

|

(attach federal Schedule |

|

|

1 for New York State |

I for individual |

|

|

|

2 for New York City |

F for estate or trust |

|

|

|

3 for Yonkers |

E for exempt |

|

|

|

4 for NYS nonresident |

organization |

|

|

|

|

|

1 |

|

|

|

|

|

1 |

|

|

|

2 |

|

|

|

|

|

2 |

|

|

|

3 |

|

|

|

|

|

3 |

|

|

|

4 |

|

|

|

|

|

4 |

|

|

|

5 |

|

|

|

|

|

5 |

|

|

|

6 |

|

|

|

|

|

6 |

|

|

|

7 |

|

|

|

|

|

7 |

|

|

|

8 |

|

|

|

|

|

8 |

|

|

|

9 |

|

|

|

|

|

9 |

|

|

|

10 |

|

|

|

|

|

10 |

|

|

|

11 |

|

|

|

|

|

11 |

|

|

|

433004210094