ct 400 mn form can be filled in in no time. Just make use of FormsPal PDF editing tool to finish the job in a timely fashion. The editor is consistently updated by us, getting useful features and becoming more convenient. Starting is effortless! All you need to do is adhere to these basic steps down below:

Step 1: Press the "Get Form" button at the top of this page to open our editor.

Step 2: This editor provides the ability to work with PDF forms in a variety of ways. Change it with customized text, correct what is already in the PDF, and include a signature - all when you need it!

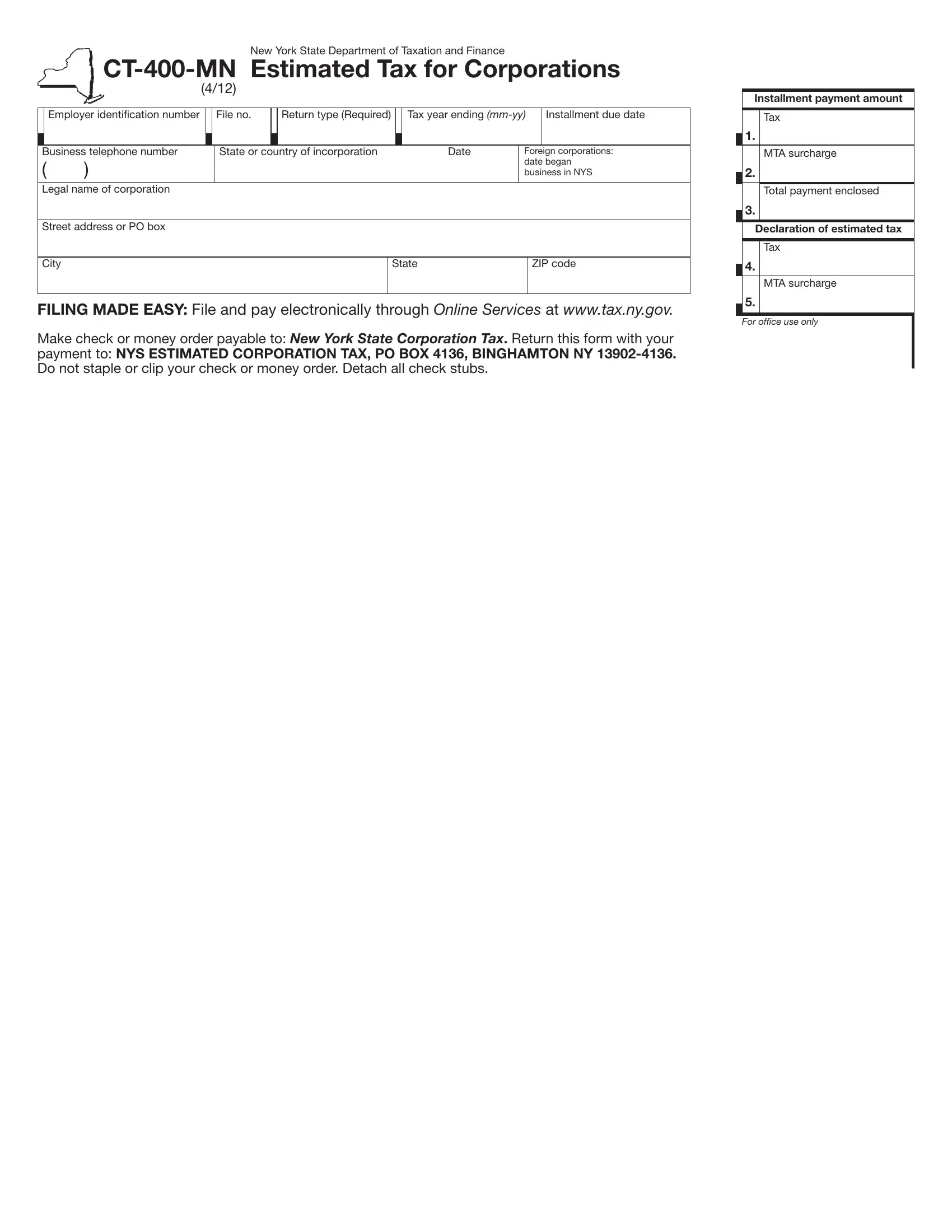

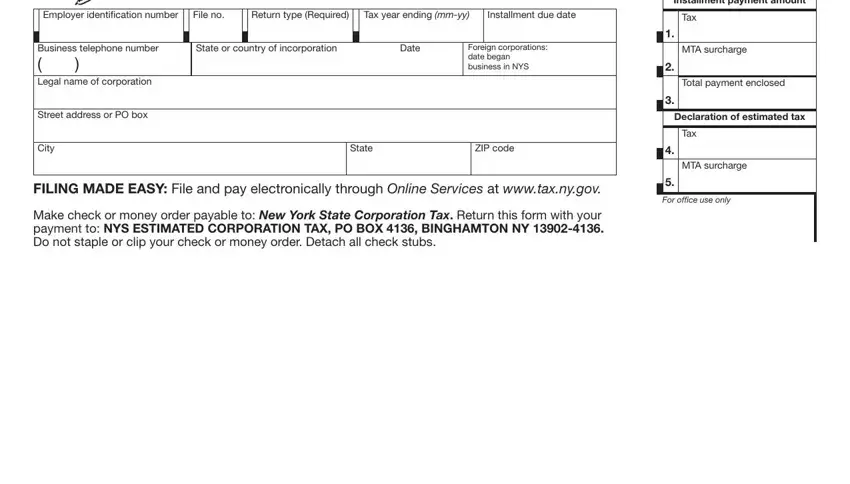

This PDF will require specific data to be filled in, therefore make sure to take whatever time to enter what is requested:

1. For starters, when filling out the ct 400 mn form, start with the area that features the next fields:

Step 3: Right after proofreading the fields, hit "Done" and you are all set! Download your ct 400 mn form after you register at FormsPal for a free trial. Instantly get access to the pdf document in your personal cabinet, along with any edits and adjustments being conveniently kept! At FormsPal.com, we aim to be certain that all of your information is kept secure.