Once you open the online tool for PDF editing by FormsPal, you can easily complete or alter california ct nrp 2 right here. To make our tool better and more convenient to work with, we constantly work on new features, with our users' suggestions in mind. To get the process started, consider these basic steps:

Step 1: Simply press the "Get Form Button" above on this webpage to open our pdf file editing tool. This way, you'll find all that is needed to work with your document.

Step 2: This tool offers the capability to customize PDF files in many different ways. Modify it by writing any text, correct existing content, and include a signature - all close at hand!

With regards to the blank fields of this precise document, here is what you should do:

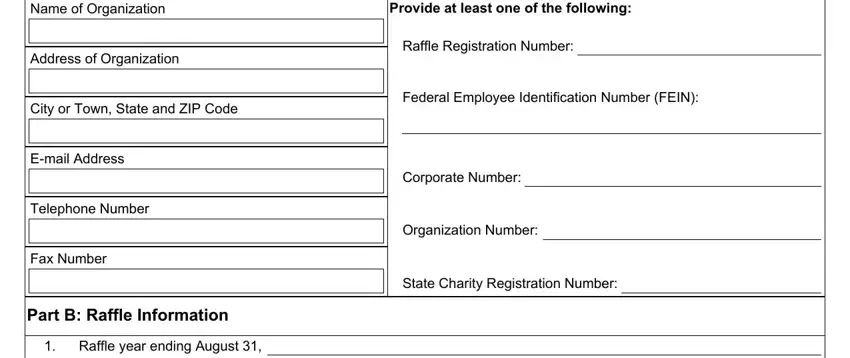

1. Whenever filling out the california ct nrp 2, be certain to incorporate all of the necessary blanks in the corresponding area. It will help to speed up the process, enabling your details to be processed without delay and accurately.

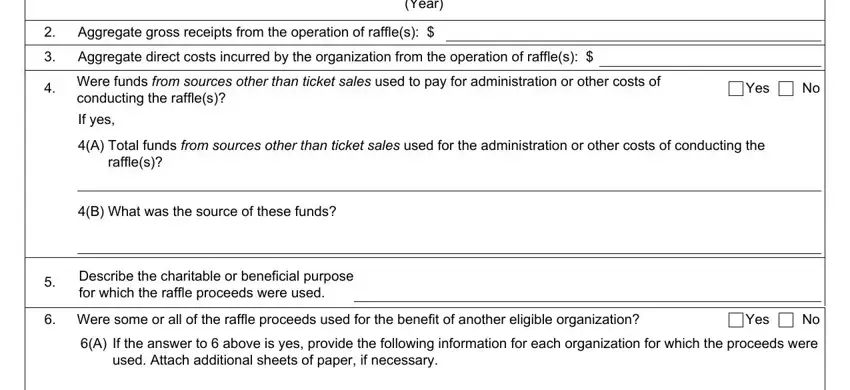

2. After the last array of fields is finished, you should include the necessary particulars in Aggregate gross receipts from the, Aggregate direct costs incurred by, Year, Were funds from sources other, conducting the raffles, Yes, If yes, A Total funds from sources other, raffles, B What was the source of these, Describe the charitable or, Were some or all of the raffle, Yes, A If the answer to above is yes, and used Attach additional sheets of in order to move on further.

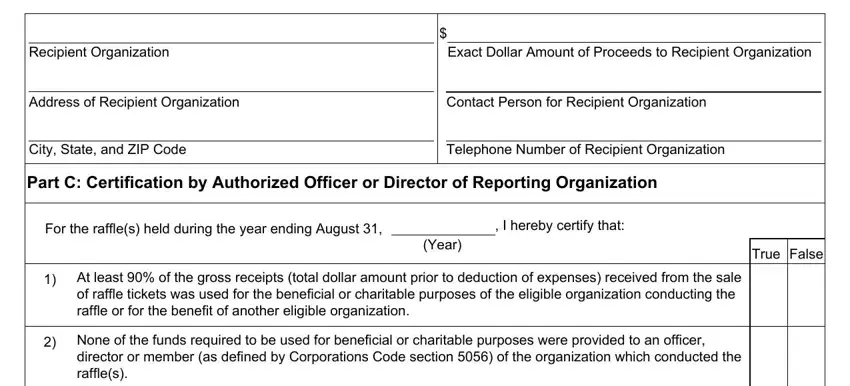

3. The following part focuses on Recipient Organization, Exact Dollar Amount of Proceeds to, Address of Recipient Organization, Contact Person for Recipient, City State and ZIP Code, Telephone Number of Recipient, Part C Certification by Authorized, For the raffles held during the, I hereby certify that, Year, True False, At least of the gross receipts, and None of the funds required to be - complete each one of these blank fields.

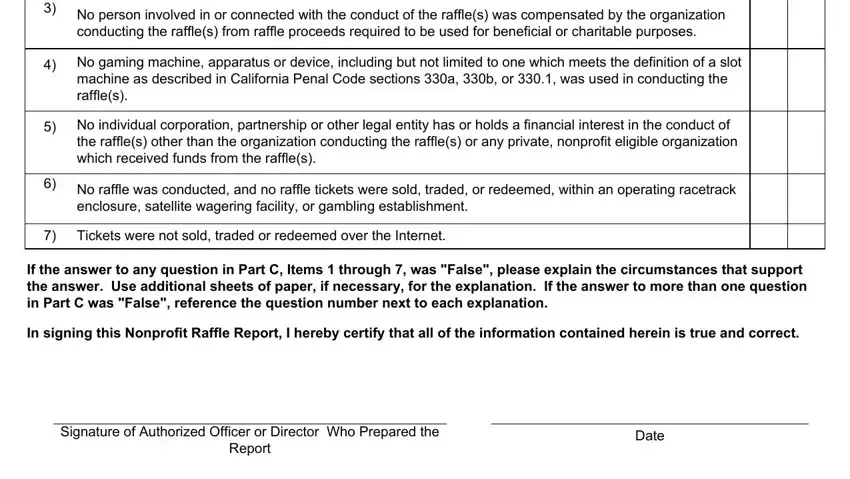

4. Completing No person involved in or connected, No gaming machine apparatus or, No individual corporation, No raffle was conducted and no, Tickets were not sold traded or, If the answer to any question in, In signing this Nonprofit Raffle, Signature of Authorized Officer or, Report, and Date is essential in this fourth form section - make sure to take the time and fill in each and every blank!

Concerning No raffle was conducted and no and Report, ensure you don't make any errors in this section. These two could be the most important fields in the PDF.

Step 3: Immediately after looking through your completed blanks, click "Done" and you're good to go! Get hold of the california ct nrp 2 when you sign up for a 7-day free trial. Easily access the pdf form inside your personal cabinet, together with any edits and changes automatically preserved! FormsPal provides secure form tools devoid of personal information recording or any sort of sharing. Feel at ease knowing that your details are safe here!